ETFs For The Self-Driving Uber Revolution: A Potential Investment

Table of Contents

Understanding the Self-Driving Car Market and its Growth Potential

The self-driving car market is poised for explosive growth, driven by significant technological advancements and a burgeoning demand for more efficient and safer transportation solutions. This revolution is not just about autonomous vehicles; it's about reshaping entire industries, from logistics and ride-sharing to urban planning.

The Technological Advancements Fueling the Revolution:

The rapid progress in artificial intelligence (AI), sensor technology, and advanced mapping systems is the engine behind the self-driving car revolution. Key players like Waymo, Cruise, and Tesla (with Autopilot) are pushing the boundaries of what's possible.

- Sensor Technology Breakthroughs: Significant leaps in lidar (light detection and ranging), radar, and computer vision are enabling vehicles to perceive their surroundings with unprecedented accuracy. These advancements allow autonomous vehicles to navigate complex environments, identify obstacles, and make crucial driving decisions in real-time.

- Sophisticated Machine Learning Algorithms: The increasing sophistication of machine learning algorithms is crucial for autonomous driving systems. These algorithms allow vehicles to learn from vast amounts of data, improving their decision-making capabilities and adapting to various driving situations. The continuous learning aspect of these systems ensures that autonomous vehicles become safer and more efficient over time.

The Economic Impact of Autonomous Vehicles:

The implications of autonomous vehicles extend far beyond the automotive industry. The economic impact is projected to be substantial, affecting various sectors and creating new opportunities.

- Cost Savings in Logistics and Transportation: Autonomous trucks and delivery vehicles promise significant cost reductions for logistics companies by reducing labor costs, improving fuel efficiency, and increasing operational efficiency.

- New Job Creation: The autonomous vehicle industry is creating a plethora of new jobs in areas like software development, AI engineering, sensor technology, and infrastructure development.

- Impact on Urban Planning and Infrastructure: The widespread adoption of self-driving cars will require changes to urban planning and infrastructure, including the development of smart city initiatives and the optimization of transportation networks. This presents both challenges and opportunities for urban development.

Identifying Relevant ETFs for Investment

Investing in the self-driving car revolution doesn't require investing directly in individual companies. ETFs provide diversified exposure to the various sectors benefiting from this technological transformation.

Tech ETFs with Exposure to Autonomous Vehicle Companies:

Several technology-focused ETFs hold shares in companies integral to the development and deployment of self-driving technology. These include companies developing crucial software, hardware components, and AI solutions.

- Examples: Look for ETFs with significant holdings in companies like NVIDIA (NVDA – known for its powerful GPUs crucial for AI processing), Mobileye (now part of Intel – a leader in autonomous driving systems), and other key suppliers to the automotive industry. Many broad technology ETFs will offer some exposure, but more specialized ETFs focusing on robotics or AI might offer a more concentrated approach. Always check the ETF's holdings to confirm its alignment with your investment goals.

Transportation and Logistics ETFs:

The transportation and logistics sector stands to be significantly disrupted and improved by the adoption of autonomous vehicles. ETFs focusing on this sector offer another avenue for exposure to the self-driving car revolution.

- Examples: Consider ETFs focusing on trucking companies, delivery services (like those using drones or autonomous delivery robots), or ride-sharing platforms. The potential for increased efficiency and dramatically lower operating costs in these sectors is substantial, making these ETFs attractive investment vehicles. Remember to check the specific holdings of any ETF before investing to ensure it aligns with your risk tolerance and investment strategy.

Risk Assessment and Diversification Strategies

While the self-driving car revolution holds immense potential, it's crucial to acknowledge the inherent risks associated with investing in emerging technologies.

Understanding the Risks Associated with Investing in Emerging Technologies:

Investing in a rapidly evolving field like autonomous vehicles carries significant risks:

- Technological Setbacks: Unforeseen technological challenges could delay the widespread adoption of self-driving technology, impacting the performance of related ETFs.

- Regulatory Hurdles: The regulatory landscape surrounding autonomous vehicles is still developing, and changes in regulations could significantly impact the industry.

- Market Volatility: The autonomous vehicle sector, like any emerging technology, is subject to significant market volatility.

The Importance of Diversification in Your Investment Portfolio:

Diversification is paramount to mitigate risk. Don't put all your eggs in one basket:

- Diversify Across ETFs: Spread investments across different ETFs within the autonomous vehicle space, focusing on various aspects of the technology or related industries.

- Beyond Autonomous Vehicles: Diversify your overall portfolio beyond autonomous vehicle ETFs. Include other asset classes like stocks, bonds, and real estate to reduce risk and enhance overall portfolio performance. A well-balanced portfolio approach is crucial for long-term investment success.

Conclusion

Investing in the self-driving Uber revolution through ETFs offers the potential for significant returns, but it's crucial to understand the associated risks. By carefully selecting ETFs that align with your investment strategy and employing effective diversification strategies, you can participate in this transformative technological shift while mitigating potential losses. Remember that thorough due diligence and possibly consulting a financial advisor are essential steps before making any investment decisions. Consider exploring various ETFs focused on self-driving technology, autonomous vehicles, and related sectors. Start your research today and find the best ETFs for your investment strategy within the exciting world of the self-driving car revolution. Remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions related to self-driving car ETFs.

Featured Posts

-

Reddits New Policy Addressing Upvotes On Violent Content

May 17, 2025

Reddits New Policy Addressing Upvotes On Violent Content

May 17, 2025 -

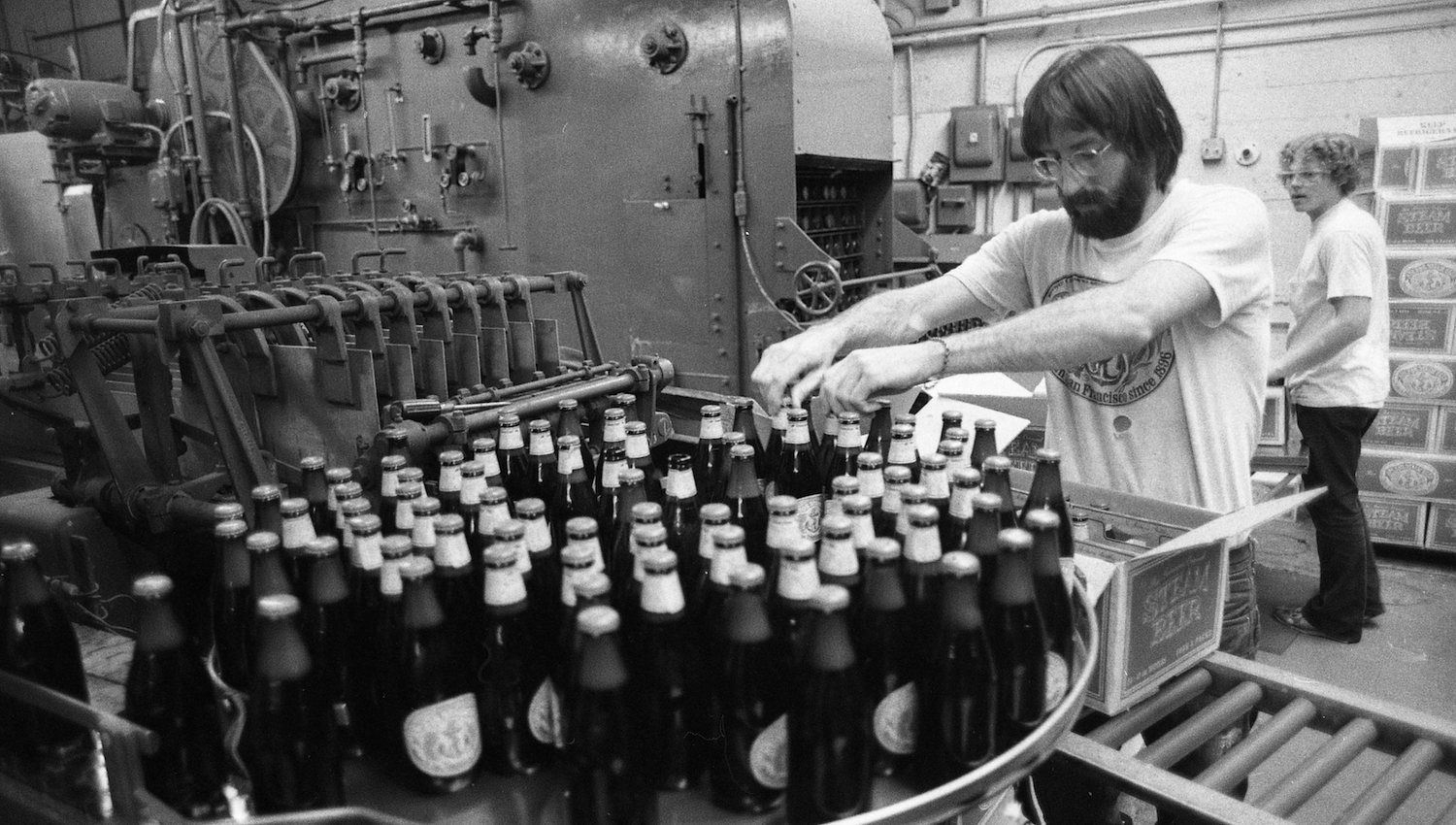

127 Year Old Anchor Brewing Company To Close Its Doors

May 17, 2025

127 Year Old Anchor Brewing Company To Close Its Doors

May 17, 2025 -

Descongelaran Cuentas Koriun Recuperacion Del Capital Para Inversionistas

May 17, 2025

Descongelaran Cuentas Koriun Recuperacion Del Capital Para Inversionistas

May 17, 2025 -

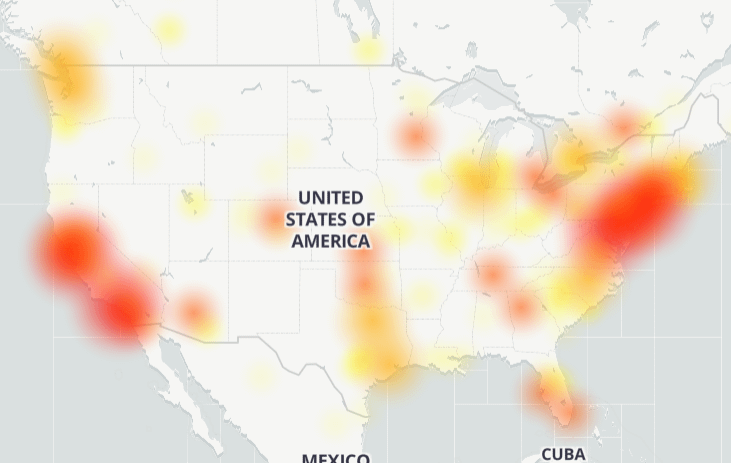

Psa Major Reddit Outage Updates And Solutions

May 17, 2025

Psa Major Reddit Outage Updates And Solutions

May 17, 2025 -

Will Severance Return For A Third Season Lehighvalleylive Com Update

May 17, 2025

Will Severance Return For A Third Season Lehighvalleylive Com Update

May 17, 2025