EU To Phase Out Russian Gas: Spot Market In Focus

Table of Contents

The Decline of Long-Term Contracts and the Rise of Spot Trading

Historically, the EU relied heavily on long-term contracts with Russia for its natural gas supply. These agreements provided a degree of predictability, albeit at the cost of price flexibility. However, the geopolitical shift has spurred a dramatic move towards shorter-term, spot market transactions. This transition introduces increased price volatility, as spot gas prices fluctuate based on real-time supply and demand dynamics.

- Decreased reliance on predictable, long-term gas supply agreements: The shift away from long-term contracts means less certainty about future gas supplies.

- Increased exposure to fluctuating spot gas prices: Businesses and consumers face greater risk of price spikes and potential economic instability.

- Higher risk but also higher potential for profit for buyers and sellers: The volatile nature of the spot market creates opportunities for those adept at navigating price fluctuations.

- Growing importance of market liquidity and efficient trading platforms: Efficient and transparent trading platforms are essential for managing risk and ensuring fair pricing in this dynamic market. The need for robust infrastructure supporting spot gas trading is more critical than ever.

The increased volatility in spot gas prices presents both challenges and opportunities for market participants. Sophisticated risk management strategies and advanced analytics are becoming increasingly important to navigate this new reality.

Diversification of Gas Supply Sources – Beyond Russia

To mitigate the risks associated with reliance on a single supplier, the EU is actively pursuing a strategy of gas supply diversification. This involves securing gas from multiple sources and via various delivery methods, reducing dependence on Russian gas. This diversification strategy is crucial for enhancing energy independence and bolstering energy security.

- Increased LNG terminal capacity in EU member states: Significant investments are being made to expand LNG import infrastructure, allowing for greater flexibility in sourcing gas globally.

- Strengthening partnerships with LNG exporting countries (e.g., US, Qatar): The EU is forging stronger ties with major LNG producers to secure reliable and diverse gas supplies.

- Exploring alternative pipeline gas suppliers (e.g., Norway): The EU is strengthening existing relationships and forging new ones with countries that can provide pipeline gas.

- Investing in renewable energy sources to decrease overall gas demand: A long-term strategy involves reducing reliance on natural gas altogether by investing heavily in renewables like wind, solar, and hydropower.

This multi-pronged approach aims to create a more resilient and secure energy system for Europe, less susceptible to geopolitical shocks.

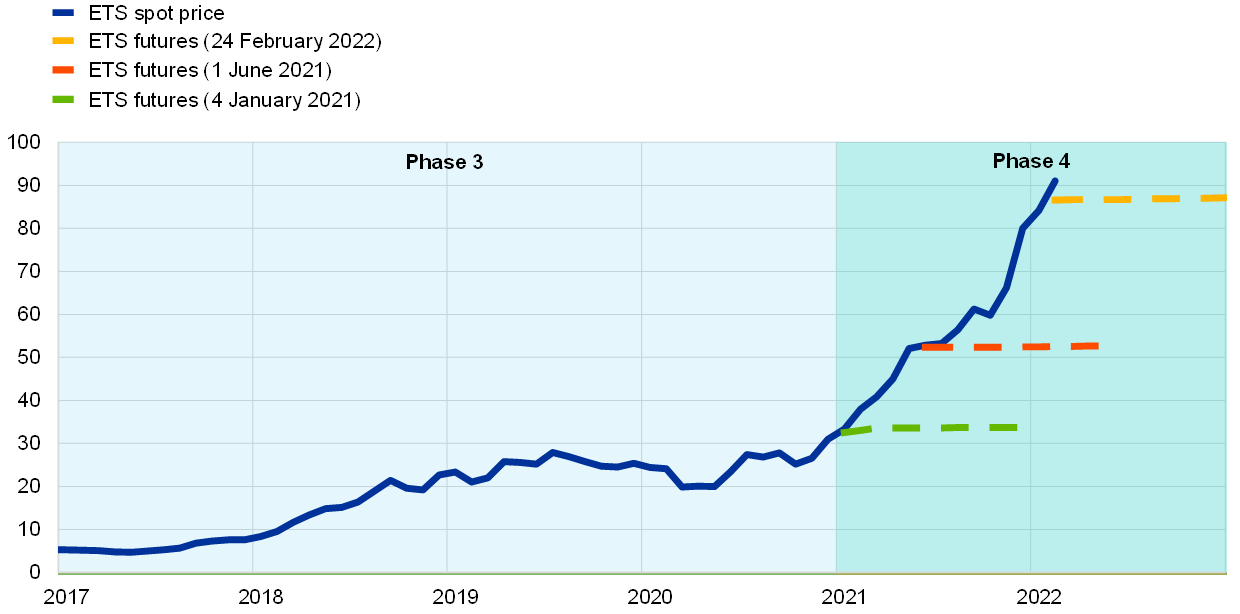

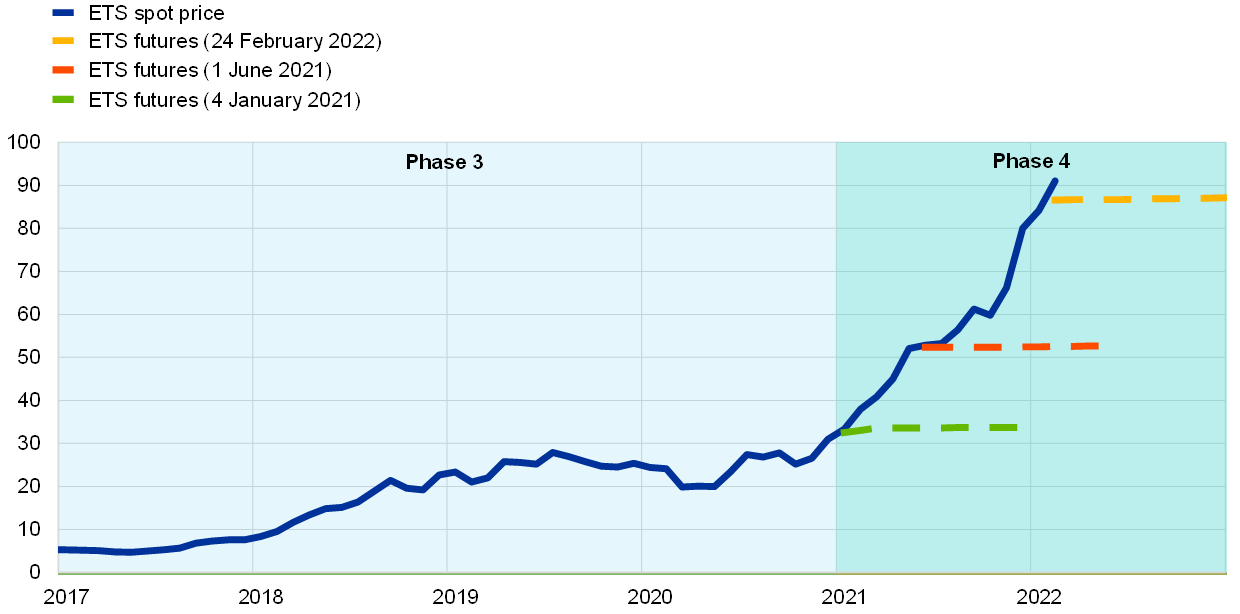

The Impact on Gas Prices and Consumer Costs

The transition to a spot market for gas has undeniably impacted gas prices and, consequently, consumer costs. The increased volatility in spot gas prices can lead to significant price swings, impacting both businesses and households. This volatility introduces challenges for consumers, potentially exacerbating inflation and reducing energy affordability.

- Increased price volatility leading to potential price spikes: Rapid price fluctuations create uncertainty and can strain household budgets.

- Government measures to mitigate the impact on consumers: Governments are implementing various measures, such as price caps and subsidies, to cushion the impact on consumers.

- Potential for increased inflation driven by higher energy costs: Rising energy prices contribute to broader inflationary pressures across the economy.

- The need for transparent and efficient energy markets to avoid price manipulation: Transparent and regulated markets are crucial to prevent price manipulation and ensure fair pricing.

The Role of Technology and Data Analytics in the Spot Market

The complexities of the spot gas market necessitate the adoption of advanced technologies and data analytics. Sophisticated software solutions and analytical tools are crucial for effective price forecasting, risk management, and optimized trading strategies.

- Gas trading platforms: Advanced platforms facilitate efficient trading and price discovery.

- Data analytics: Real-time data analysis helps identify market trends and optimize trading decisions.

- Price forecasting: Predictive modeling helps anticipate price movements and manage risk.

- Risk management: Sophisticated tools mitigate price volatility and protect against losses.

- Energy trading software: Specialized software streamlines trading processes and enhances efficiency.

Conclusion

The EU's phasing out of Russian gas has fundamentally reshaped the European energy landscape, placing the spot gas market at the forefront of energy security discussions. This transition brings significant challenges, including price volatility and the need for vastly diversified supply sources. However, it also presents opportunities for innovation, diversification, and increased energy independence. The development and implementation of robust, transparent, and technologically advanced markets is paramount to ensure the stability and security of the EU’s energy future.

Understanding the dynamics of the spot gas market is crucial for navigating this new energy era. Stay informed about the latest developments and strategies for navigating the evolving landscape of the EU's transition away from Russian gas and the increasingly important spot gas market. Learn more about spot gas price forecasting and effective gas supply diversification strategies to ensure your business is prepared for the future.

Featured Posts

-

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025 -

Understanding The Crucial Role Of Middle Management In Todays Workplace

Apr 24, 2025

Understanding The Crucial Role Of Middle Management In Todays Workplace

Apr 24, 2025 -

Increased Tornado Risk During Peak Season The Impact Of Trumps Cuts

Apr 24, 2025

Increased Tornado Risk During Peak Season The Impact Of Trumps Cuts

Apr 24, 2025 -

Sharks And Tragedy The Mystery Of The Missing Swimmer At An Israeli Beach

Apr 24, 2025

Sharks And Tragedy The Mystery Of The Missing Swimmer At An Israeli Beach

Apr 24, 2025 -

William Watson On The Liberal Party Platform Analysis And Voting Advice

Apr 24, 2025

William Watson On The Liberal Party Platform Analysis And Voting Advice

Apr 24, 2025