EUR/USD: Lagarde's Renewed Focus On Strengthening The Euro's International Presence

Table of Contents

H2: Lagarde's Strategy for Enhancing the Euro's International Role

Lagarde's ambition to bolster the euro's global standing is evident in her recent speeches and the ECB's strategic initiatives. Her strategy involves a multifaceted approach leveraging monetary policy tools to promote the euro's use in international transactions and enhance its perceived value in global financial markets. The ECB is actively working to increase the euro's appeal as a reserve currency, aiming to reduce the dollar's dominance.

The ECB's efforts include:

- Increased efforts to encourage the use of the euro in international trade settlements. This involves diplomatic engagement with key trading partners to facilitate euro-denominated transactions.

- Promoting the euro as a reserve currency through bilateral agreements. This aims to encourage central banks and other institutions to hold larger reserves of euros.

- Strengthening the ECB’s communication strategies to enhance the Euro’s perception in global markets. Clear and consistent communication is crucial to build trust and confidence in the euro.

- Exploring the role of a digital euro in international payments. A digital euro could potentially streamline cross-border transactions and increase the euro's attractiveness.

These initiatives reflect a broader ECB strategy focusing on the internationalization of the euro, a long-term project aiming to reduce reliance on the US dollar in global finance. The success of this strategy depends on various geopolitical and economic factors, which we explore below.

H2: The Impact of Geopolitical Factors on the EUR/USD Exchange Rate

Geopolitical risks significantly impact the EUR/USD exchange rate. The ongoing war in Ukraine and the resulting energy crisis have created considerable volatility. The conflict has disrupted supply chains, fueled inflation across the Eurozone, and dampened economic growth, putting downward pressure on the euro. Furthermore, sanctions imposed on Russia and subsequent counter-sanctions have created uncertainty and affected trade and capital flows, directly influencing the EUR/USD exchange rate.

Key factors include:

- The effect of the energy crisis on the Eurozone economy and its impact on the EUR/USD. High energy prices reduce consumer spending and business investment, weakening the euro.

- The role of the conflict in Ukraine in influencing investor sentiment towards the euro. Geopolitical uncertainty often leads to risk aversion, prompting investors to move towards safer haven assets like the US dollar.

- Analysis of the impact of sanctions on trade and capital flows affecting the EUR/USD. Sanctions can disrupt trade relationships and limit capital flows, impacting currency values.

These factors highlight the intricate relationship between global events and the EUR/USD exchange rate, reminding us that monetary policy alone cannot fully control currency fluctuations.

H2: Analyzing the Effectiveness of Lagarde's Policies on the EUR/USD

Assessing the effectiveness of Lagarde's policies on the EUR/USD requires a nuanced analysis. While her initiatives aim to strengthen the euro's long-term position, their immediate impact on the exchange rate is complex and influenced by numerous external factors. The market's reaction to Lagarde's pronouncements is a crucial indicator, showing how effectively her communication strategy builds confidence in the euro. However, achieving a significant shift in the global currency landscape is a long-term endeavor.

Key considerations include:

- Short-term and long-term effects of the ECB's policies on the EUR/USD. While short-term effects might be less pronounced, long-term structural changes are the ultimate goal.

- Assessment of market responses to Lagarde's pronouncements on the euro's international role. Market reactions gauge the credibility and effectiveness of Lagarde's communication strategy.

- Consideration of alternative strategies for boosting the euro's international standing. Other factors, such as structural economic reforms within the Eurozone, are also vital to strengthening the euro's global standing.

Ultimately, the success of Lagarde's strategy depends on a convergence of monetary policy effectiveness, global economic stability, and geopolitical calm.

H2: Opportunities and Risks for Investors in the EUR/USD Market

The current EUR/USD market dynamics present both opportunities and risks for investors. The volatility caused by geopolitical events and the ECB's policy responses create potential for significant price swings. However, prudent risk management is crucial. Investors need to carefully consider their risk tolerance and investment horizon when making decisions in this dynamic market.

Key considerations for investors:

- Strategies for capitalizing on potential fluctuations in the EUR/USD. Both short-term trading and long-term investment strategies can be employed, depending on market conditions and risk appetite.

- Risk mitigation techniques for navigating uncertainty in the forex market. Diversification and hedging strategies are essential for mitigating potential losses.

- Advice for investors regarding long-term and short-term positions in the EUR/USD. A long-term outlook may favor investors who believe in the long-term strengthening of the euro, while short-term traders may profit from short-term volatility.

Careful analysis and a well-defined investment strategy are essential for navigating this complex market.

3. Conclusion

Christine Lagarde's efforts to enhance the euro's international presence are a significant factor shaping the EUR/USD exchange rate. While geopolitical uncertainties and economic challenges continue to exert influence, Lagarde’s initiatives, including promoting the euro in international transactions and exploring the digital euro's potential, are crucial for the euro's long-term health. The effectiveness of these strategies will depend on various factors, including market response, economic growth within the Eurozone, and the evolution of global geopolitical events. Investors must carefully assess these factors and adopt appropriate risk management strategies when navigating the dynamic EUR/USD market. Stay informed about the evolving EUR/USD exchange rate and the ECB's monetary policy decisions by following expert analysis and market updates. Understanding the dynamics of the EUR/USD, and specifically Lagarde's influence, is crucial for effective investment strategies in the foreign exchange market. Monitor the EUR/USD closely to capitalize on emerging opportunities.

Featured Posts

-

Open Ai Unveils Streamlined Voice Assistant Creation Tools

May 28, 2025

Open Ai Unveils Streamlined Voice Assistant Creation Tools

May 28, 2025 -

Nl West Showdown Dodgers And Padres Start Unbeaten

May 28, 2025

Nl West Showdown Dodgers And Padres Start Unbeaten

May 28, 2025 -

Alcaraz Soaring Swiatek Faltering Ahead Of Roland Garros

May 28, 2025

Alcaraz Soaring Swiatek Faltering Ahead Of Roland Garros

May 28, 2025 -

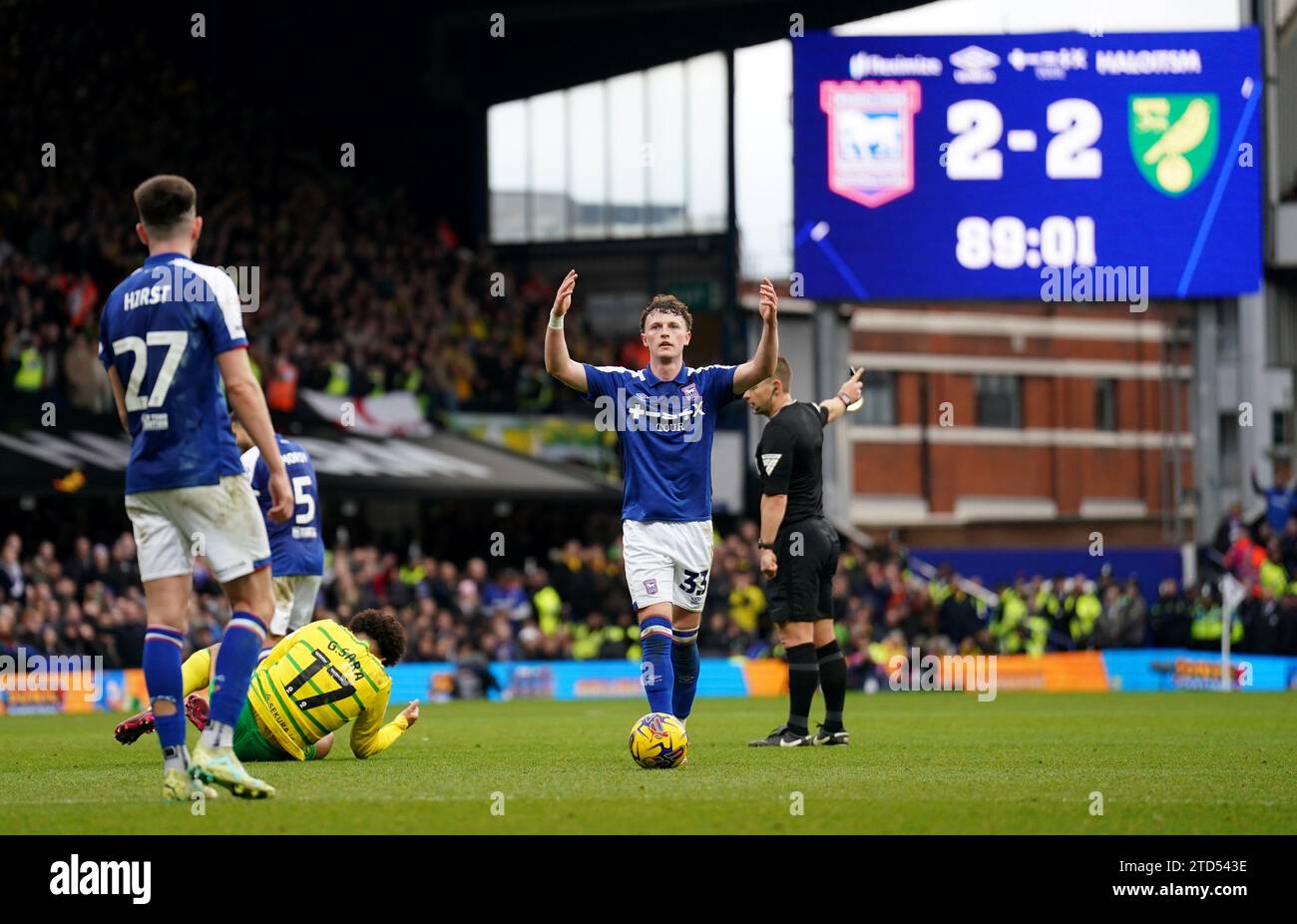

Championship Survival Nathan Broadhead Heroics Secure Ipswich Win Against Bournemouth

May 28, 2025

Championship Survival Nathan Broadhead Heroics Secure Ipswich Win Against Bournemouth

May 28, 2025 -

Pacers Vs Hawks Game Time Tv Channel And Live Stream Info March 8th

May 28, 2025

Pacers Vs Hawks Game Time Tv Channel And Live Stream Info March 8th

May 28, 2025

Latest Posts

-

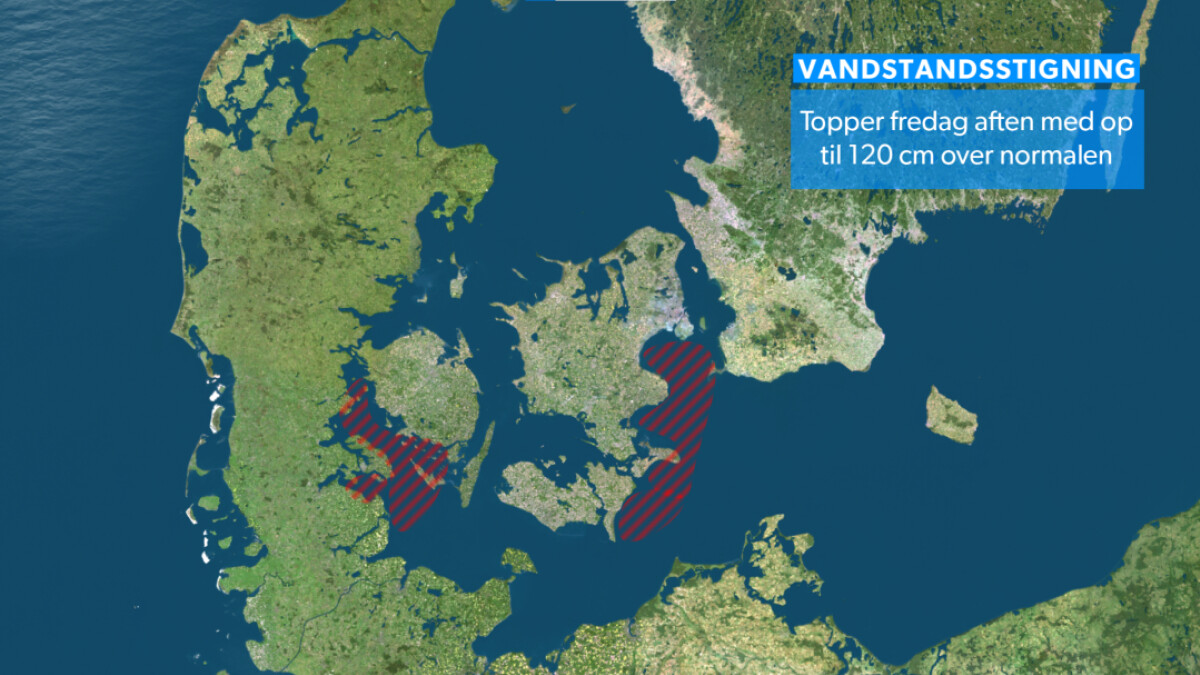

Holder Vejret Spaendingen Stiger Vil Danmark Blive Afvist

May 30, 2025

Holder Vejret Spaendingen Stiger Vil Danmark Blive Afvist

May 30, 2025 -

Moet Anderlecht Een Aantrekkelijk Bod Accepteren

May 30, 2025

Moet Anderlecht Een Aantrekkelijk Bod Accepteren

May 30, 2025 -

Danmark Portugal Noglefakta Og Spilforudsigelser

May 30, 2025

Danmark Portugal Noglefakta Og Spilforudsigelser

May 30, 2025 -

Danmarks Fremtid Holder Vejret Og En Mulig Afvisning

May 30, 2025

Danmarks Fremtid Holder Vejret Og En Mulig Afvisning

May 30, 2025 -

Anderlecht En Lucratieve Aanbiedingen Een Analyse

May 30, 2025

Anderlecht En Lucratieve Aanbiedingen Een Analyse

May 30, 2025