Euro Futures Trading On Swissquote Bank: A Market Update

Table of Contents

Understanding Euro Futures Contracts on Swissquote

Euro futures contracts are derivative instruments that allow traders to buy or sell a specific amount of Euros at a predetermined price on a future date. This provides a powerful tool for hedging against currency risk or speculating on the Euro's price movements. Trading Euro futures offers several key benefits: leverage, hedging capabilities, and the ability to profit from both rising and falling prices. Swissquote Bank provides a secure and efficient platform to access this market.

Contract Specifications

Euro futures contracts on Swissquote typically follow standardized specifications:

- Contract Size: Usually €125,000 (or equivalent in other currencies).

- Trading Hours: Generally follow the trading hours of major European and global exchanges, providing ample trading opportunities.

- Expiry Dates: Contracts have specific expiry dates, requiring traders to either close their positions before expiry or take delivery/settlement of Euros. A range of expiry dates are offered, providing flexibility.

Margin Requirements and Leverage

Trading futures involves leverage, meaning you only need to deposit a percentage of the contract's value as margin. Swissquote's margin requirements for Euro futures vary based on factors such as account type and market volatility. For example, a trader might need to deposit only 5% of the contract value as margin, significantly amplifying potential profits (but also losses). It’s crucial to understand the risks associated with leverage.

-

Example: With a €125,000 contract and a 5% margin requirement, you'd only need €6,250 to open a position.

-

Key Advantages of using Swissquote for Euro Futures Trading:

- Competitive pricing and tight spreads.

- Advanced trading platform with robust charting tools.

- Reliable and fast order execution.

- Access to real-time market data and analytics.

- Excellent customer support.

Swissquote's Trading Platform for Euro Futures

Swissquote's advanced trading platform provides traders with a comprehensive suite of tools and resources for effective Euro futures trading. The platform is user-friendly, even for beginners, while offering sophisticated features for experienced traders.

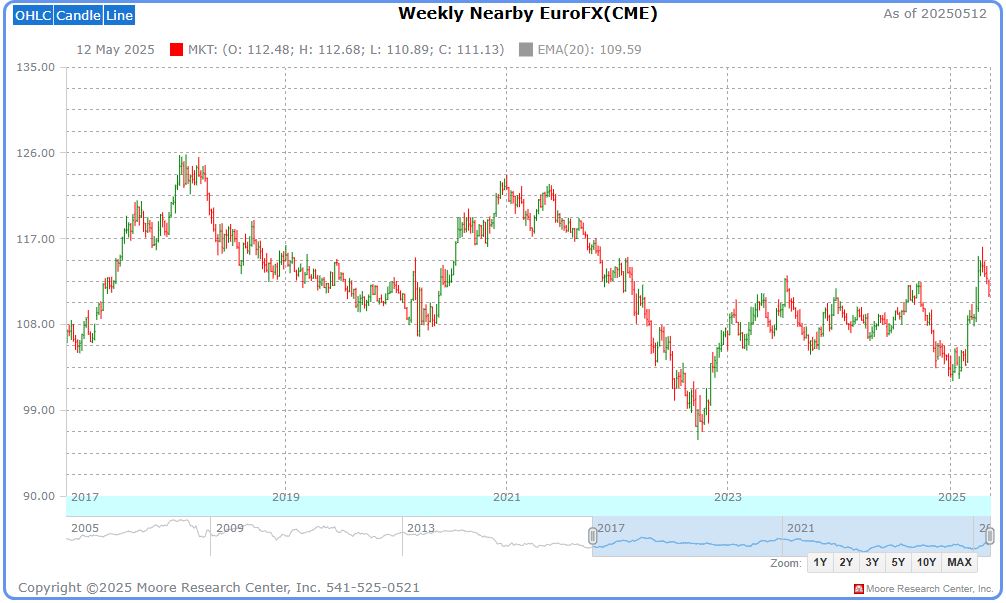

Advanced Charting and Technical Analysis

The platform boasts a wide array of charting tools, including various chart types (candlestick, bar, line), technical indicators (moving averages, RSI, MACD), and drawing tools. Traders can use technical analysis to identify potential trading opportunities based on price patterns and historical data.

Order Types and Execution

Swissquote offers a range of order types, including:

- Market Orders: Executed immediately at the best available price.

- Limit Orders: Executed only when the price reaches a specified level.

- Stop Orders: Triggered when the price moves beyond a certain level, often used to limit potential losses.

Swissquote utilizes advanced order execution algorithms to ensure efficient and reliable trade execution.

- Key Features of Swissquote's Platform:

- Customizable dashboards for personalized trading experience.

- Real-time market alerts and notifications.

- Mobile accessibility for trading on the go.

- Secure and regulated trading environment.

Analyzing the Current Euro Futures Market

The Euro's value is influenced by a complex interplay of economic and geopolitical factors. Analyzing these elements is crucial for successful Euro futures trading.

Key Economic Indicators to Watch

Several key economic indicators significantly impact Euro futures prices:

- Inflation rates: Higher-than-expected inflation can weaken the Euro.

- GDP growth: Strong GDP growth generally supports a stronger Euro.

- Unemployment rates: Low unemployment rates usually boost the Euro.

- Interest rate decisions by the European Central Bank (ECB): ECB policy changes directly affect the Euro's value.

Geopolitical Risks and their Impact

Geopolitical events, such as political instability within the Eurozone or international conflicts, can significantly influence the Euro's price and consequently, Euro futures contracts.

- Examples of Recent Events Influencing Euro Futures: Recent energy crises, geopolitical tensions, and unexpected policy announcements from the ECB have all played a role in shaping the Euro's volatility and futures prices.

Risk Management Strategies for Euro Futures Trading

Effective risk management is paramount in futures trading. Never invest more than you can afford to lose.

Position Sizing and Stop-Loss Orders

Determining the appropriate position size is crucial. This should be based on your account capital and risk tolerance. Stop-loss orders automatically close a position when the price reaches a predefined level, limiting potential losses.

Diversification and Hedging

Diversifying your portfolio across different assets and using hedging strategies can mitigate risks. Hedging involves taking offsetting positions to reduce exposure to price movements.

- Risk Management Techniques for Euro Futures Trading on Swissquote:

- Utilizing stop-loss and limit orders.

- Diversifying across different asset classes.

- Employing hedging strategies.

- Monitoring market conditions closely.

- Using Swissquote's risk management tools and resources.

Conclusion

Euro Futures Trading on Swissquote Bank provides a powerful platform for navigating the volatile Euro market. Swissquote offers a user-friendly, feature-rich trading platform with competitive pricing, allowing traders of all levels to participate. Understanding the factors influencing the Euro, implementing robust risk management strategies, and leveraging Swissquote's advanced tools are key to successful Euro futures trading. Begin your Euro futures trading journey with Swissquote and explore the exciting opportunities available in this dynamic market. Learn more about Euro futures trading opportunities at Swissquote [link to Swissquote's website].

Featured Posts

-

Ufc Vegas 106 Headliner Pros Analyze Morales Impressive Victory

May 19, 2025

Ufc Vegas 106 Headliner Pros Analyze Morales Impressive Victory

May 19, 2025 -

Spring Budget 2024 Analysis Of Public Discontent And Government Plans

May 19, 2025

Spring Budget 2024 Analysis Of Public Discontent And Government Plans

May 19, 2025 -

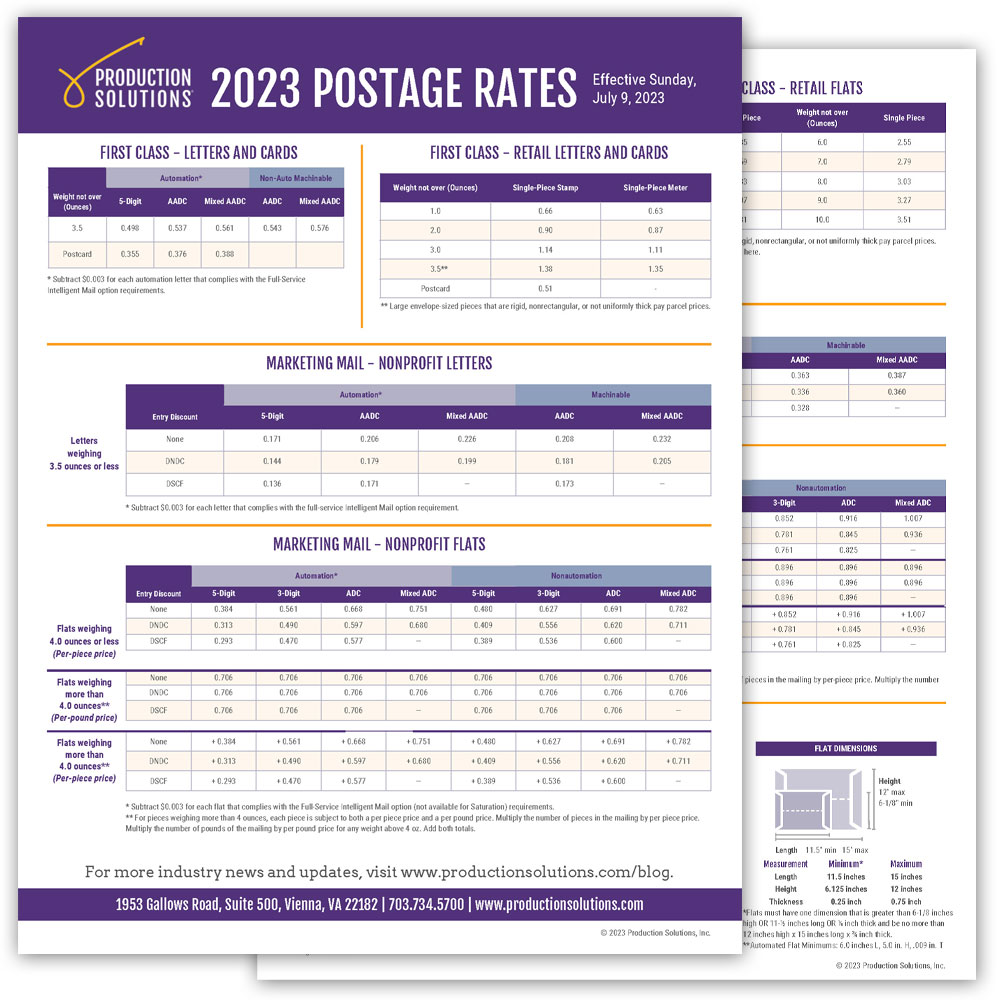

Royal Mail Price Hikes Exact Stamp Costs Rising April 7th

May 19, 2025

Royal Mail Price Hikes Exact Stamp Costs Rising April 7th

May 19, 2025 -

North Carolina Tar Heels Athletic Events Recap March 3 9

May 19, 2025

North Carolina Tar Heels Athletic Events Recap March 3 9

May 19, 2025 -

Gilbert Burns Losses To Chimaev Della Maddalena And Muhammad Not His Biggest Concern

May 19, 2025

Gilbert Burns Losses To Chimaev Della Maddalena And Muhammad Not His Biggest Concern

May 19, 2025