Euronext Amsterdam Sees 8% Stock Increase After Trump's Tariff Action

Table of Contents

Analysis of the 8% Stock Increase on Euronext Amsterdam

Immediate Market Reaction to Trump's Tariff Announcement

The initial reaction to Trump's tariff announcement was one of considerable volatility. While many global markets experienced dips, Euronext Amsterdam saw a surprisingly positive response. The speed and magnitude of the 8% increase caught many analysts off guard. This immediate reaction highlights the complex interplay of factors influencing investor sentiment and market behavior. Specific sectors within Euronext Amsterdam showed varied responses. While some sectors experienced losses, others, particularly those less reliant on US trade, saw substantial gains.

- Significant Gains: Examples include ASML Holding (ASML.AS), a major semiconductor equipment manufacturer, and Unilever (UNA.AS), a multinational consumer goods company. Both companies saw significant stock price increases following the tariff announcement.

- Moderate Losses: Companies heavily reliant on US exports, particularly in certain manufacturing sectors, experienced more moderate losses. Identifying specific examples requires detailed analysis of individual company financial reports and market data.

(Insert chart/graph here illustrating the market fluctuations on Euronext Amsterdam during the period following the tariff announcement. Clearly label axes and data sources.)

Potential Reasons for Euronext Amsterdam's Positive Performance

Several factors might explain Euronext Amsterdam's positive performance amidst global uncertainty:

- Safe Haven Effect: The uncertainty created by the Trump tariffs likely pushed some investors to seek safer investments. Euronext Amsterdam, as a relatively stable European market, might have benefited from this "flight to safety."

- Sector-Specific Performance: The technology sector, particularly companies like ASML, experienced significant gains, potentially because of reduced reliance on US markets and strong demand from other regions. The healthcare sector also showed resilience.

- Reduced Reliance on US Trade: Companies listed on Euronext Amsterdam with diversified international markets and less dependence on US trade were better positioned to weather the storm, leading to increased investor confidence.

- Strong Domestic Markets within Europe: The robust economies of several European countries might have cushioned the impact of the tariffs, boosting investor confidence in Euronext Amsterdam.

- Investor Sentiment Towards European Stability: The perceived political and economic stability of Europe, in contrast to the perceived uncertainty in the US, may have driven investment towards Euronext Amsterdam.

Comparison to Other European Stock Exchanges

Comparing Euronext Amsterdam's performance to other major European stock exchanges provides valuable context. While precise figures require extensive data analysis, anecdotal evidence suggests Euronext Amsterdam performed better than some other major markets, such as the London Stock Exchange (LSE) and the Frankfurt Stock Exchange (FSE). This differential performance warrants further investigation to determine if it reflects underlying economic differences or purely market-specific factors.

(Insert table here comparing key performance indicators (e.g., percentage change, trading volume) for Euronext Amsterdam, LSE, and FSE during the relevant period. Clearly cite data sources.)

Long-Term Implications for Euronext Amsterdam

The long-term implications of the tariff actions and the subsequent stock increase on Euronext Amsterdam are complex and uncertain.

- Sustained Growth Potential: The increase could be sustained if the factors contributing to the initial surge continue. Strong domestic markets and reduced dependence on US trade could contribute to long-term growth.

- Possible Correction: Conversely, a market correction could occur if investor sentiment shifts or if the underlying economic conditions change negatively.

- Impact on Foreign Investment: Increased investor confidence could attract more foreign investment into Euronext Amsterdam.

- Domestic Growth: A more stable Euronext Amsterdam could positively influence domestic economic growth within the Netherlands.

- Investor Confidence: Sustained positive performance would significantly boost investor confidence, further attracting investment and driving growth.

Expert Opinions and Market Commentary on Euronext Amsterdam's Growth

Financial analysts and market experts offer diverse perspectives on the Euronext Amsterdam stock market surge. Some analysts attribute the increase to the "safe haven" effect, while others highlight sector-specific factors, such as the strength of the technology sector. Many point to the diversification of companies listed on Euronext Amsterdam as a key factor in its resilience against the impact of Trump's tariffs.

(Insert quotes from relevant financial analysts and economists here, ensuring proper attribution and linking to source materials. Include links to relevant news articles and financial reports.)

Conclusion: Understanding the Euronext Amsterdam Stock Market Response to Tariffs

The 8% increase in stock prices on Euronext Amsterdam following Trump's tariff actions was a complex event with multiple contributing factors. The initial market reaction, the potential reasons for the positive performance, comparisons with other European exchanges, and long-term implications all contribute to a more nuanced understanding of the market dynamics at play. This event underscores the interconnected nature of global markets and the significant impact that global trade policies can have on individual exchanges.

To remain informed about the evolving situation on Euronext Amsterdam and the impact of global trade policies, continued research is crucial. Stay updated on financial news from reputable sources, analyzing market trends and expert commentary to gain a comprehensive perspective on Euronext Amsterdam and its future. Regularly monitoring "Euronext Amsterdam" stock market trends will enable better-informed investment decisions.

Featured Posts

-

Porsche Cayenne Gts Coupe Szczegolowy Test I Ocena

May 24, 2025

Porsche Cayenne Gts Coupe Szczegolowy Test I Ocena

May 24, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025 -

Frances National Rally Assessing The Impact Of Le Pens Sunday Demonstration

May 24, 2025

Frances National Rally Assessing The Impact Of Le Pens Sunday Demonstration

May 24, 2025 -

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025 -

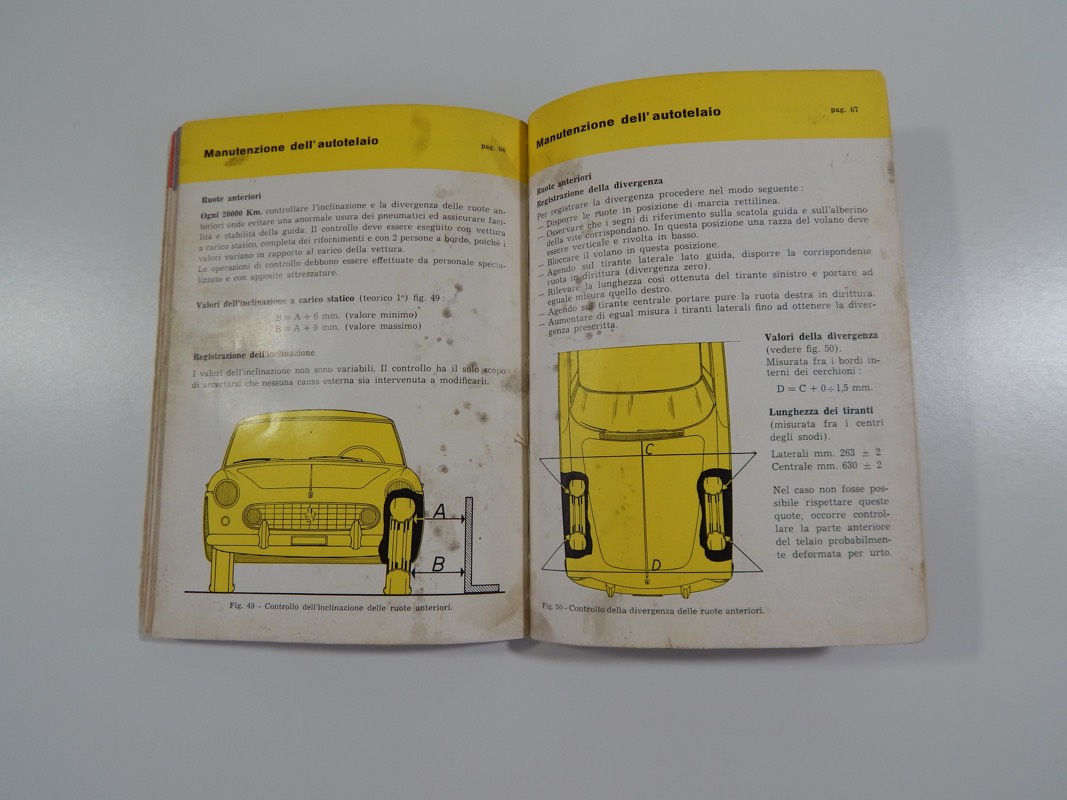

Ferrari Owners Kit The Ultimate Guide To Gear And Accessories

May 24, 2025

Ferrari Owners Kit The Ultimate Guide To Gear And Accessories

May 24, 2025

Latest Posts

-

Office365 Executive Email Compromise Leads To Multi Million Dollar Theft

May 24, 2025

Office365 Executive Email Compromise Leads To Multi Million Dollar Theft

May 24, 2025 -

Execs Office365 Accounts Breached Millions Made Feds Say

May 24, 2025

Execs Office365 Accounts Breached Millions Made Feds Say

May 24, 2025 -

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025 -

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025