Euronext Amsterdam Stock Market Reacts To Trump's Tariff Decision: +8%

Table of Contents

Understanding the Initial Market Reaction

The news of the Trump administration's decision on tariffs concerning steel and aluminum imports sent immediate shockwaves through global markets. However, the Euronext Amsterdam Stock Market reacted in a surprisingly positive manner, experiencing an initial jump of +8%. This unexpected surge was observed within the first hour of the announcement, indicating a swift and significant market response.

- Percentage Change: The Euronext Amsterdam AMX index showed an 8.2% increase within the first trading hour following the announcement.

- Specific Stock Movements: While the overall index saw significant gains, specific sectors, like technology and energy, outperformed others. Further analysis of individual stock performance would be necessary to fully understand this nuanced response.

- Trading Volume: Trading volume on the Euronext Amsterdam Stock Market also experienced a considerable increase, indicating heightened investor activity and engagement.

- Key Observations:

- Biggest Gains: Technology and energy sectors saw disproportionately large gains.

- Comparison with Other Markets: In contrast to the Euronext Amsterdam's positive reaction, other European markets showed more muted or even negative responses. For example, the London Stock Exchange experienced a more modest increase, and the Frankfurt Stock Exchange saw a slight decline.

- Analyst Quotes: Initial analyst sentiment expressed surprise at the positive reaction, speculating on various underlying causes.

Factors Contributing to the Positive 8% Surge

The positive 8% surge in the Euronext Amsterdam Stock Market was unexpected, given the generally negative sentiment surrounding the tariff decision. Several contributing factors might explain this counterintuitive reaction:

- Unexpected Positive Economic Indicators: Prior to the tariff announcement, positive economic data, such as stronger-than-expected GDP growth or reduced unemployment figures, could have created a positive market sentiment that buffered the impact of the tariff news.

- Market Anticipation of Further Policy Changes: The market may have anticipated further policy adjustments from the Trump administration, potentially offsetting the negative effects of the initial tariff decision. Investors might have viewed this as a starting point for negotiation rather than a final decision.

- Investor Confidence in Specific Sectors: The increased performance of certain sectors, like technology, suggests strong investor confidence in the long-term prospects of those specific industries within the Euronext Amsterdam Stock Market, mitigating any negative impacts from the tariffs.

- Potential for Increased Competitiveness: Some believe the tariffs could lead to increased competitiveness for certain Dutch businesses, particularly those operating in sectors less directly affected by the steel and aluminum tariffs.

These factors, acting in concert, may have generated the unexpected positive outcome observed in the Euronext Amsterdam Stock Market.

Long-Term Implications for the Euronext Amsterdam Stock Market

While the initial reaction was positive, the long-term implications of the tariff decision on the Euronext Amsterdam Stock Market remain uncertain.

-

Potential Risks:

- Future Tariff Adjustments: Further adjustments or escalations of tariffs could negatively impact the market.

- Changes in Investor Behavior: Increased uncertainty could lead to decreased investor confidence.

- Impact on Trade Relations: Strained trade relations could negatively affect Dutch businesses that rely on international trade.

- Effect on Specific Companies: Companies heavily reliant on imported steel or aluminum could experience challenges.

-

Potential Opportunities:

- Increased Domestic Production: The tariffs might encourage domestic production, potentially benefiting certain companies listed on Euronext Amsterdam.

- Innovation and Diversification: Businesses may be incentivized to innovate and diversify their supply chains.

-

Long-Term Outlook: The long-term impact will depend on various evolving factors, including the overall global economic climate, further policy decisions by the Trump administration, and the capacity of Dutch businesses to adapt to the changing trade landscape.

Comparing the Euronext Amsterdam Response with Other Markets

The Euronext Amsterdam Stock Market's +8% surge stands in contrast to the reaction in other major markets.

- Euronext Amsterdam vs. London Stock Exchange: The LSE showed a more moderate increase, reflecting a less optimistic outlook among UK investors.

- Euronext Amsterdam vs. Frankfurt Stock Exchange: The Frankfurt Stock Exchange recorded a slight decline, highlighting the varied impacts of the tariff decision across different European economies.

- Euronext Amsterdam vs. Other Relevant Markets: A broader comparison with global indices like the Dow Jones or the NASDAQ would reveal further differences in market sentiment and reactions.

This divergence in market response underscores the unique factors influencing the Euronext Amsterdam Stock Market and the importance of analyzing market dynamics on a case-by-case basis.

Conclusion: Euronext Amsterdam Stock Market's Resiliency and Future Outlook

The +8% surge in the Euronext Amsterdam Stock Market following the Trump tariff decision was a surprising, yet significant, event. While the initial reaction was positive, influenced by a confluence of factors including pre-existing positive economic indicators and potentially optimistic anticipation of future policy adjustments, the long-term implications remain uncertain and depend heavily on future developments in both domestic and international economic and political landscapes. Understanding the Euronext Amsterdam Stock Market's nuanced response to global events is crucial for investors. To stay updated on the latest analysis and predictions regarding the Euronext Amsterdam Stock Market and its response to future global events, subscribe to our newsletter! Stay informed about the dynamic Euronext Amsterdam Stock Market and its future trajectory.

Featured Posts

-

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 25, 2025

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 25, 2025 -

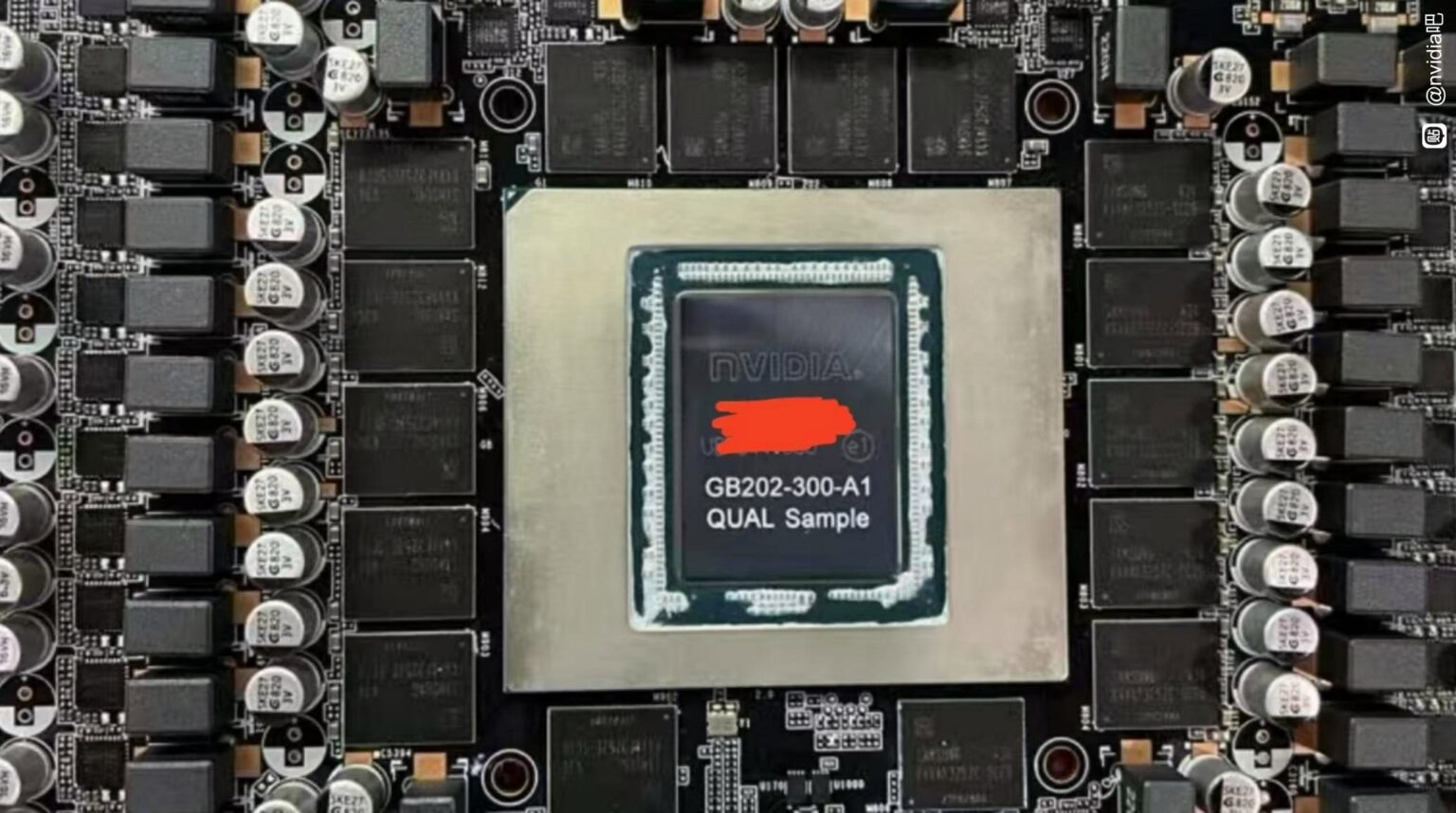

Rtx 5060 A Deeper Dive Into The Controversy Surrounding Nvidias Latest Gpu

May 25, 2025

Rtx 5060 A Deeper Dive Into The Controversy Surrounding Nvidias Latest Gpu

May 25, 2025 -

Washington D C S Black Lives Matter Plaza A Historical Analysis

May 25, 2025

Washington D C S Black Lives Matter Plaza A Historical Analysis

May 25, 2025 -

They Came From Afar Found Love In Dc Then Tragedy Struck

May 25, 2025

They Came From Afar Found Love In Dc Then Tragedy Struck

May 25, 2025 -

Ftc Probes Open Ais Chat Gpt Data Privacy And Algorithmic Bias Concerns

May 25, 2025

Ftc Probes Open Ais Chat Gpt Data Privacy And Algorithmic Bias Concerns

May 25, 2025