Euronext Amsterdam Stocks Jump 8% Following Trump Tariff Decision

Table of Contents

Understanding the Trump Tariff Decision and its Global Impact

The significant shift in Euronext Amsterdam stocks can be directly linked to the Trump administration's 2018 decision to impose tariffs on steel and aluminum imports. This decision, impacting a broad range of industries reliant on these materials, created significant global economic uncertainty. The 25% tariff on steel and 10% on aluminum significantly impacted manufacturing and construction sectors worldwide. The decision was met with immediate backlash, triggering retaliatory tariffs from the European Union, China, and other affected countries. This escalation created a complex web of trade disputes that continue to shape global markets.

- Specific details of the tariff: A 25% tariff on steel imports and a 10% tariff on aluminum imports from numerous countries, including EU members.

- Related trade agreements: The decision challenged existing trade agreements like the World Trade Organization (WTO) rules and sparked renegotiations of various bilateral trade pacts.

- Key players involved: The United States, the European Union, China, Canada, and Mexico were major players impacted by this decision and subsequent retaliatory measures.

Euronext Amsterdam's Response: Why the 8% Jump?

While seemingly counterintuitive, the 8% surge in Euronext Amsterdam stocks following the initial tariff announcement stemmed from a complex interplay of factors. One explanation lies in the market's anticipation of a potential positive outcome from the subsequent trade negotiations. Investors may have speculated that the EU's retaliatory measures would ultimately lead to a renegotiation of trade terms favorable to European companies. Furthermore, certain sectors within Euronext Amsterdam might have benefited indirectly from the disruption of global supply chains. The technology sector, for instance, may have seen increased demand due to shifts in manufacturing and sourcing.

- Analysis of winning and losing sectors: While some sectors undoubtedly suffered, others, like technology and certain niche manufacturing areas, potentially benefited from shifting global supply chains.

- Specific companies: Identifying specific companies that experienced substantial gains requires detailed market data analysis, but reports suggested several firms in the technology and sustainable energy sectors outperformed the overall market.

- Stock market data and charts: (Insert relevant charts and graphs showing the stock market performance of Euronext Amsterdam during this period.)

Analyzing Investor Sentiment and Future Predictions

The announcement of the tariffs initially caused significant uncertainty, reflected in a period of market volatility. However, the subsequent 8% jump suggests a shift towards increased confidence, driven perhaps by the expectation of advantageous trade negotiations or a faster-than-anticipated adaptation to the new trade landscape.

- Expert opinions: Many financial analysts predicted a recovery, citing the resilience of the European economy and its capacity to adapt to shifting global dynamics. (Insert quotes from reputable financial analysts.)

- Related news articles and reports: (Include links to relevant news articles and market reports.)

- Short-term and long-term predictions: The short-term outlook remained uncertain, but longer-term predictions suggested a potential for growth, contingent on effective adaptation to the new trade environment and successful trade negotiations.

Conclusion: Navigating the Euronext Amsterdam Market After the Trump Tariff Decision

The 8% jump in Euronext Amsterdam stocks following the Trump tariff decision highlights the complex and often unpredictable nature of global markets. This event underscores the importance of understanding how global events, such as trade wars and tariff decisions, impact specific markets like Euronext Amsterdam. The reasons behind this surge are multifaceted, ranging from anticipated trade negotiations to sector-specific adaptations. Navigating this complex landscape requires vigilance and informed decision-making.

To make informed investment decisions, it is crucial to continuously monitor Euronext Amsterdam stocks and stay updated on global trade developments. Analyze Euronext Amsterdam investments carefully, considering both short-term volatility and long-term growth potential. By staying informed and adapting to market shifts, investors can better navigate the complexities of the Euronext Amsterdam stock market and make sound investment choices. For further resources, you can consult leading financial news sites and investment platforms.

Featured Posts

-

Effetto Dazi Sulle Importazioni Di Abbigliamento Negli Usa

May 24, 2025

Effetto Dazi Sulle Importazioni Di Abbigliamento Negli Usa

May 24, 2025 -

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025 -

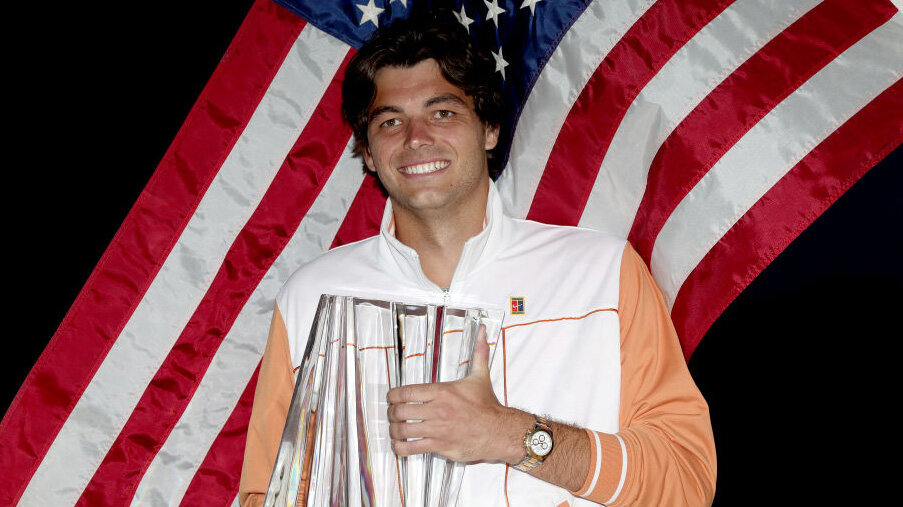

Draper Claims First Atp Masters 1000 Title At Indian Wells

May 24, 2025

Draper Claims First Atp Masters 1000 Title At Indian Wells

May 24, 2025 -

40 Svadeb Na Kharkovschine Pochemu Pary Vybrali Datu Data Foto

May 24, 2025

40 Svadeb Na Kharkovschine Pochemu Pary Vybrali Datu Data Foto

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Markt Draai

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Markt Draai

May 24, 2025

Latest Posts

-

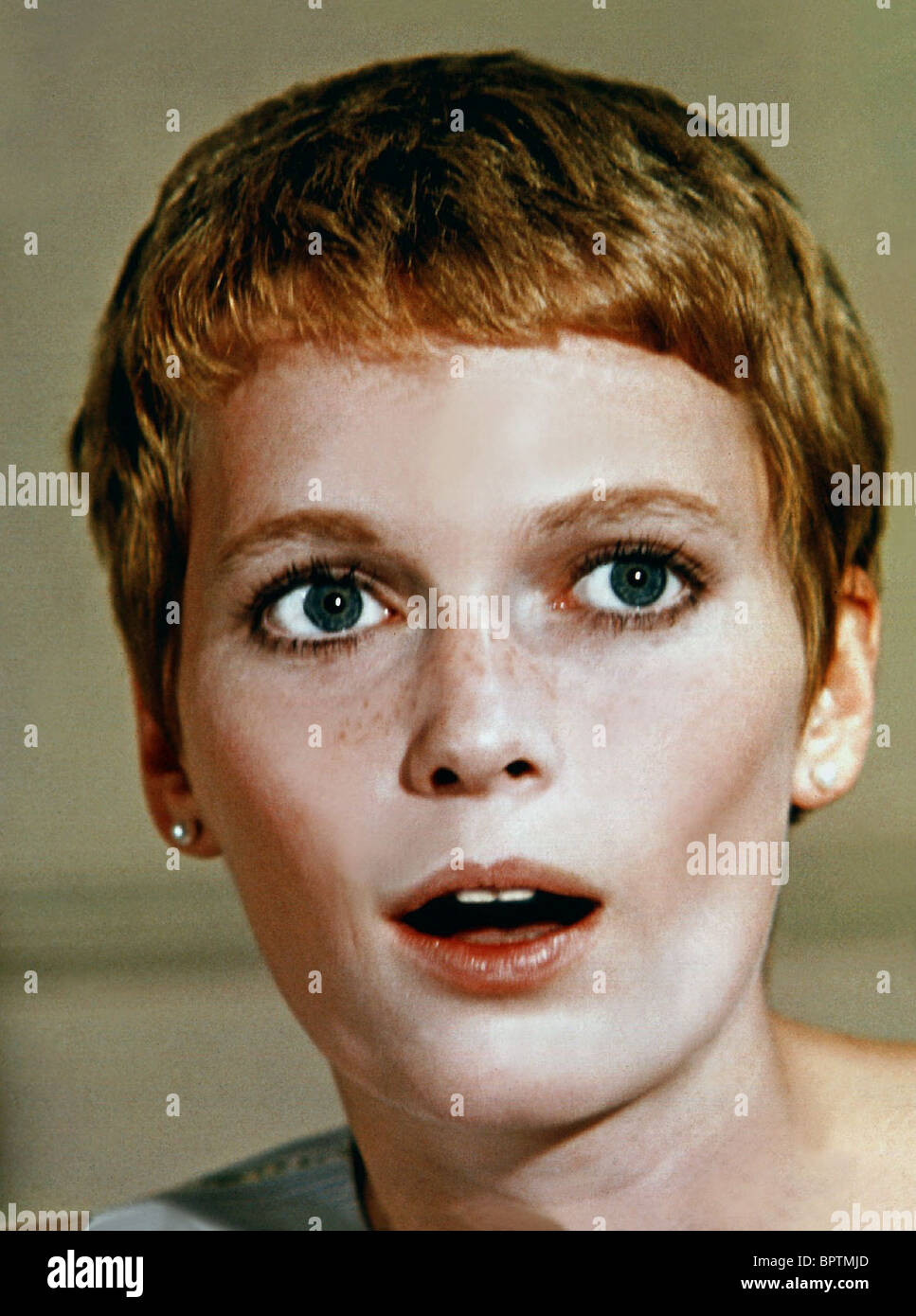

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025