Evaluating Palantir Stock: A Current Market Perspective

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's business model revolves around providing sophisticated data analytics platforms to both government and commercial clients. Understanding these distinct revenue streams is crucial for evaluating Palantir stock.

Government Contracts

Government contracts form a significant portion of Palantir's revenue and profitability. The stability of these contracts is a key factor influencing investor sentiment towards Palantir stock. However, reliance on government contracts also presents risks.

- Revenue Breakdown: Palantir's government revenue comes from various agencies, including intelligence, defense, and other governmental departments. The specific breakdown varies year to year, but this sector consistently contributes a substantial portion of the company's total revenue.

- Contract Duration and Renewal: The duration of government contracts is a critical consideration. While some contracts are multi-year, the renewal process introduces uncertainty. Analyzing the success rate of contract renewals is essential for assessing the long-term stability of Palantir's government revenue streams.

- Geopolitical Risks and Competition: Geopolitical events can significantly influence government spending on data analytics. Moreover, Palantir faces competition from other established players in the government contracting space. This competition necessitates constant innovation and adaptation to maintain its market share.

Commercial Growth

Palantir's expansion into the commercial sector is crucial for its long-term growth and diversification. Success in this area is a key indicator of the future health of Palantir stock.

- Key Commercial Clients and Case Studies: Palantir has secured partnerships with significant players across various sectors, including finance and healthcare. Examining successful case studies demonstrating the value proposition of Palantir's platform for these clients is crucial for understanding its commercial traction.

- Market Share and Penetration: Assessing Palantir's market share within specific commercial sectors provides insights into its competitive position. Analyzing its market penetration strategies and the potential for further growth within these sectors is essential for projecting future revenue.

- Competitive Landscape: The commercial data analytics market is highly competitive. Analyzing Palantir's competitive advantages, such as its unique technology and established client base, helps understand its potential for sustained growth in this sector.

Profitability and Financial Performance

A comprehensive evaluation of Palantir stock requires a thorough review of its financial performance. This includes analyzing its revenue growth, operating margins, and cash flow.

- Key Financial Ratios: Examining key ratios such as the Price-to-Earnings (P/E) ratio, revenue growth rate, and operating margin provides insights into the company's financial health and valuation. Comparing these ratios to industry peers helps gauge Palantir's relative performance.

- Path to Profitability: Palantir's historical financial statements reveal its progress towards profitability. Understanding the company's strategy for achieving and maintaining profitability is vital for long-term investment decisions concerning Palantir stock.

- Earnings Projections: Analyzing future earnings projections from financial analysts provides context for evaluating the potential return on investment for Palantir stock. These projections, however, should be viewed with caution, considering inherent uncertainties.

Market Valuation and Investor Sentiment

Understanding the market's valuation of Palantir stock and prevailing investor sentiment is critical for making informed investment decisions.

Stock Price Performance

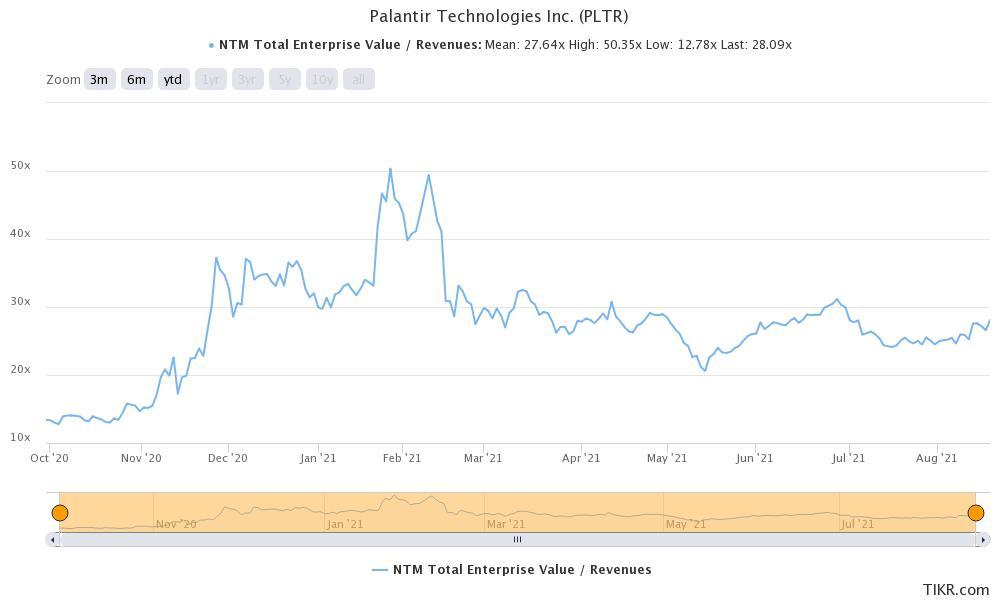

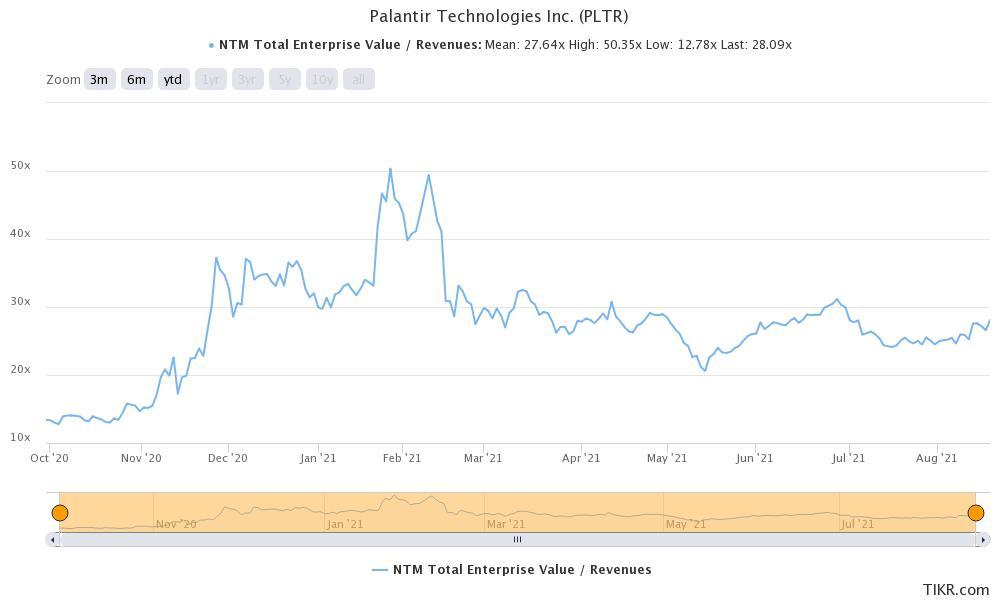

Palantir's stock price has experienced significant volatility since its IPO. Analyzing historical stock price performance reveals key factors driving this volatility.

- Stock Price Movement Chart: A visual representation of Palantir's stock price movement over time highlights periods of significant gains and losses, providing context for understanding investor behavior.

- Influencing Events: Earnings announcements, new partnerships, technological advancements, and geopolitical events can significantly impact Palantir's stock price. Understanding the interplay of these events is crucial for predicting future price movements.

Analyst Ratings and Price Targets

Analyst ratings and price targets offer a glimpse into the collective opinion of financial professionals regarding Palantir stock.

- Summary of Ratings: Consolidating ratings from various investment banks provides a general consensus on Palantir's future prospects.

- Price Target Range: The range of price targets reflects the diversity of opinions among analysts, indicating the uncertainty surrounding future stock price movements.

Risk Assessment

Investing in Palantir stock carries inherent risks. A thorough risk assessment is crucial before making any investment decisions.

- Competition: Intense competition in the data analytics market poses a significant risk to Palantir's market share and profitability.

- Regulatory Changes: Changes in government regulations, particularly in data privacy and security, can impact Palantir's operations and revenue streams.

- Reliance on Government Contracts: Heavy reliance on government contracts introduces geopolitical and budgetary risks, affecting the stability of Palantir's revenue.

Future Growth Prospects and Potential

Palantir's future growth potential depends on its ability to innovate, expand into new markets, and maintain its competitive edge.

Innovation and Product Development

Palantir's ongoing investments in research and development are crucial for its long-term competitiveness.

- New Products and Features: Analyzing Palantir's pipeline of new products and features provides insights into its innovation capacity and potential for future growth.

- Competitive Advantage: Assessing the competitive advantage of Palantir's technology and its ability to address evolving market needs is crucial for evaluating its long-term prospects.

Expansion into New Markets

Expanding into new geographic regions or market segments presents opportunities for significant revenue growth.

- Potential Target Markets: Identifying potential target markets where Palantir's technology can create value is crucial for assessing its future growth trajectory.

- Market Entry Strategies: Analyzing Palantir's market entry strategies and their effectiveness in new markets helps understand its potential for success in these expansions.

Long-Term Investment Thesis

The long-term investment thesis for Palantir stock is based on its ability to deliver on its growth plans and maintain its competitive advantage.

- Future Stock Price Scenarios: Considering different scenarios for future stock price performance, based on varying levels of success in executing its growth strategy, is crucial for informed investment decisions.

- Long-Term Growth Potential: Ultimately, evaluating the long-term growth potential of Palantir stock depends on its ability to successfully navigate the risks and capitalize on the opportunities within its market.

Conclusion

Evaluating Palantir stock requires a comprehensive understanding of its business model, financial performance, market position, and future growth prospects. While the company presents exciting opportunities, inherent risks must be carefully considered. The analysis highlights Palantir's strong position in the government sector and its ambition to expand its commercial footprint. However, competition, regulatory changes, and reliance on government contracts all present potential challenges. While evaluating Palantir stock requires careful consideration of its inherent risks and market dynamics, understanding its business model and future growth prospects is crucial for informed investment decisions. Continue your research and make your own assessment of Palantir stock.

Featured Posts

-

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Community Heroes

May 09, 2025

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Community Heroes

May 09, 2025 -

Navigate The Private Credit Boom 5 Dos And Don Ts

May 09, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts

May 09, 2025 -

Aeroport Permi Zaderzhki Reysov I Otmeny Iz Za Silnogo Snegopada

May 09, 2025

Aeroport Permi Zaderzhki Reysov I Otmeny Iz Za Silnogo Snegopada

May 09, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Premiere

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Premiere

May 09, 2025 -

Bayern Munich Vs Inter Milan Champions League Clash Preview

May 09, 2025

Bayern Munich Vs Inter Milan Champions League Clash Preview

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025