Evaluating The Damage: Trump's Trade Offensive And US Financial Strength

Table of Contents

The Tariffs and Their Immediate Impact

Trump's trade policies were characterized by the widespread implementation of tariffs, primarily targeting steel and aluminum imports globally, and a significant focus on goods originating from China. These "tariff impact" measures, intended as tools of economic leverage, immediately disrupted various sectors of the US economy. The "trade war consequences" were felt most acutely in industries like agriculture and manufacturing. Farmers, for example, faced retaliatory tariffs from China on key exports like soybeans, leading to significant financial losses. Similarly, manufacturers dealing with imported steel and aluminum saw increased production costs, impacting competitiveness and potentially leading to job losses.

- Increased prices for consumers: Tariffs directly increased the cost of imported goods, leading to higher prices for consumers across a range of products.

- Job losses in certain sectors: While some sectors benefited, others, particularly those reliant on imports or facing retaliatory tariffs, experienced job losses and economic hardship.

- Retaliatory tariffs from other countries: The US's aggressive tariff policies triggered retaliatory measures from trading partners, escalating the trade war and further harming American businesses.

- Short-term disruption to supply chains: The imposition of tariffs created uncertainty and disruption within global supply chains, impacting businesses' ability to source materials and produce goods efficiently. The "economic repercussions" rippled through the global marketplace.

Long-Term Effects on US Financial Strength

The long-term economic impact of Trump's trade war is a complex issue. While some argue that it strengthened certain domestic industries, others point to its negative effects on key economic indicators. Concerns remain about the lasting impact on US financial stability and the nation's long-term economic prospects.

- Shift in global trade relationships: Trump's policies significantly altered global trade relationships, creating new alliances and tensions. The long-term consequences of these shifts are still unfolding.

- Potential for decreased competitiveness: Increased production costs due to tariffs potentially reduced the competitiveness of US businesses in the global market.

- Increased uncertainty for businesses: The fluctuating trade landscape created significant uncertainty for businesses, making long-term planning and investment more challenging.

- Impact on consumer confidence: The higher prices resulting from tariffs likely negatively affected consumer confidence, potentially slowing down overall economic growth. The impact on the "trade deficit" remains a contentious area of debate, with differing economic analyses offering contrasting conclusions. This uncertainty also affected the value of the US dollar and foreign investment.

Assessing the Success or Failure of the Trade Offensive

Whether Trump's trade policies achieved their stated goals is a matter of ongoing debate. Analyzing the "trade policy effectiveness" requires considering various perspectives. Supporters point to renegotiated trade deals as evidence of success, arguing that they secured better terms for the US. However, critics highlight the increased costs for consumers, the job losses in certain sectors, and the overall negative impact on global trade relations as evidence of the trade offensive's failure. A neutral analysis needs to weigh the pros and cons, considering the complex interplay of economic factors. A key question remains concerning the true effectiveness of "economic nationalism" in a globalized world. The "trade war outcome" wasn't simply a win or a loss; it was a multifaceted shift in global dynamics.

Comparative Analysis: Other Nations' Responses to Trump's Trade Policies

Understanding the full impact of Trump's trade policies requires examining the responses of other nations. China, for instance, implemented retaliatory tariffs, significantly impacting US agricultural exports. The EU also responded with countermeasures, affecting various sectors of the US economy. Analyzing the "global trade response" reveals a complex web of economic interactions and the ripple effect of protectionist policies. The study of "international trade relations" during this period provides crucial insights into the dynamics of global commerce.

- China's retaliatory tariffs and their impact: China's response significantly impacted US agricultural exports, causing substantial economic hardship for American farmers.

- The EU's response and its consequences: The EU's response further complicated the global trade landscape, adding to the uncertainty and disruption felt by businesses worldwide.

- The broader impact on global trade patterns: Trump's policies and the subsequent reactions led to significant shifts in global trade patterns, potentially creating long-term changes in the international economic order. This highlights the interconnectedness of the global economy and the "economic retaliation" which can follow protectionist measures.

Conclusion: Evaluating the Damage: Trump's Trade Offensive and its Lasting Impact on US Financial Strength

In conclusion, Trump's trade offensive had both short-term and long-term effects on US financial strength. While some sectors may have experienced short-term gains, the overall impact involved increased consumer prices, job losses in specific industries, and a significant disruption to global supply chains. The long-term consequences, including potential damage to US competitiveness and shifts in global trade relationships, continue to be debated and analyzed. The arguments for and against the success of the trade offensive remain complex and contested. The "damage" inflicted by the trade offensive is likely to have lasting implications, and further research and discussion are needed to fully understand its lasting effects on the US economy and global trade. We must continue to critically examine the impact of protectionist trade policies on US economic strength and the broader global trade implications to inform future economic strategies. Further research into Trump’s trade policies and their consequences is crucial for developing informed perspectives on US economic strength and international trade.

Featured Posts

-

Analyzing The Economic Costs Of Trumps Policies

Apr 22, 2025

Analyzing The Economic Costs Of Trumps Policies

Apr 22, 2025 -

After Easter Truce Russia Returns To Full Scale Fighting In Ukraine

Apr 22, 2025

After Easter Truce Russia Returns To Full Scale Fighting In Ukraine

Apr 22, 2025 -

The Shifting Sands Trumps Trade Wars And Americas Financial Future

Apr 22, 2025

The Shifting Sands Trumps Trade Wars And Americas Financial Future

Apr 22, 2025 -

Remembering Pope Francis A Life Dedicated To Service

Apr 22, 2025

Remembering Pope Francis A Life Dedicated To Service

Apr 22, 2025 -

Land Your Dream Private Credit Role 5 Crucial Dos And Don Ts

Apr 22, 2025

Land Your Dream Private Credit Role 5 Crucial Dos And Don Ts

Apr 22, 2025

Latest Posts

-

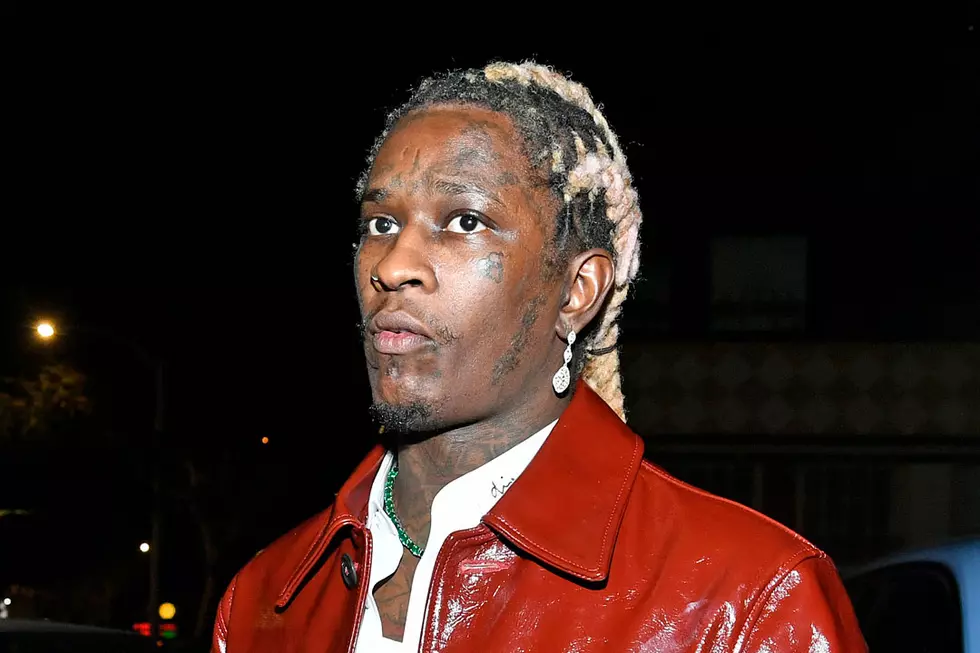

Uy Scuti Release Date Young Thug Offers Clues On New Album

May 10, 2025

Uy Scuti Release Date Young Thug Offers Clues On New Album

May 10, 2025 -

Young Thugs Uy Scuti Release Date Teased

May 10, 2025

Young Thugs Uy Scuti Release Date Teased

May 10, 2025 -

Young Thugs Uy Scuti Album Expected Release Date And Tracklist Rumors

May 10, 2025

Young Thugs Uy Scuti Album Expected Release Date And Tracklist Rumors

May 10, 2025 -

Young Thugs Uy Scuti Release Date Hints And Fan Reactions

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Fan Reactions

May 10, 2025 -

The Beyonce Effect Cowboy Carter Streams Double After Tour Kickoff

May 10, 2025

The Beyonce Effect Cowboy Carter Streams Double After Tour Kickoff

May 10, 2025