Exclusive: Travel Tech Firm Navan Prepares For US Initial Public Offering

Table of Contents

Navan's Journey to IPO: A History of Growth and Innovation

Navan's path to an IPO is a story of strategic acquisitions, technological innovation, and consistent market expansion. Understanding this journey helps illustrate the company's readiness for a public listing.

-

Early beginnings and initial funding rounds: Navan's origins trace back to [insert founding year and brief description of initial vision]. Early funding rounds provided the crucial capital to build the foundation of the company's technology and service offerings.

-

Key acquisitions and mergers that expanded their service offerings: Strategic acquisitions like [mention key acquisitions and explain how they broadened Navan's capabilities] significantly enhanced their travel management platform and market reach.

-

Significant partnerships formed: Collaborations with [mention key partners] have strengthened Navan's ecosystem and broadened its access to customers and resources.

-

Growth in market share and customer base: Consistent growth in market share demonstrates Navan’s ability to attract and retain customers. Their current client portfolio spans various industry sectors, showcasing the platform’s versatility and value proposition.

-

Technological advancements and innovations in the travel booking space: Navan’s commitment to innovation is evidenced by continuous improvements in its user interface, the introduction of cutting-edge features such as [mention key features], and its data-driven approach to travel management.

Navan's Competitive Advantages in the Travel Tech Market

Navan differentiates itself through a combination of superior technology, comprehensive solutions, and a strong focus on customer relationships.

-

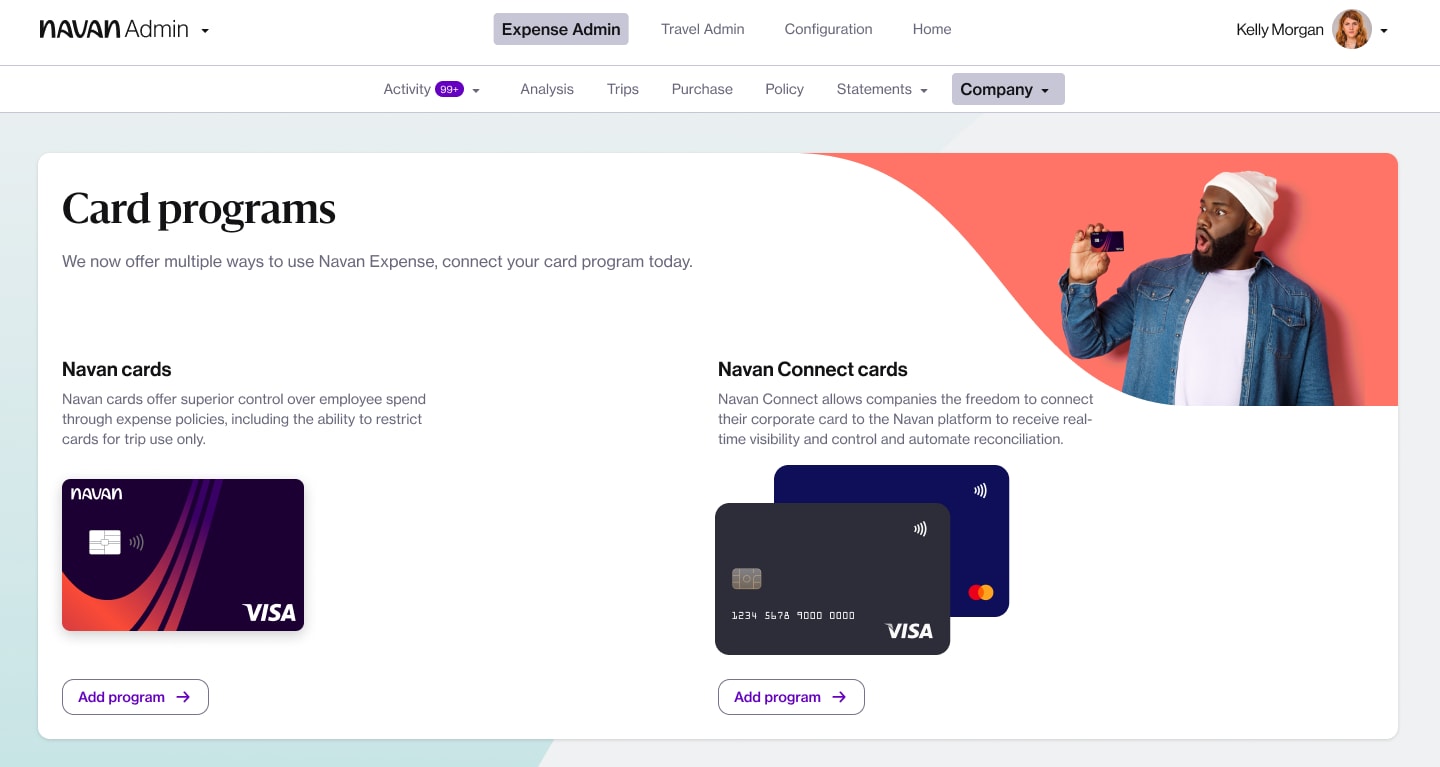

Superior technology and user experience (UX): Navan's platform boasts a user-friendly interface, intuitive design, and seamless integration with other business tools, providing a superior user experience compared to competitors.

-

Comprehensive travel management solutions: Unlike many competitors, Navan offers a complete suite of travel management tools, encompassing booking, expense management, policy compliance, and reporting, simplifying the travel process for businesses.

-

Data-driven insights and analytics for corporate travel: Navan leverages data analytics to provide businesses with valuable insights into their travel spending, enabling better budgeting, optimized travel strategies, and enhanced cost control.

-

Focus on sustainability and responsible travel: In an increasingly environmentally conscious world, Navan’s emphasis on sustainable travel options, carbon offsetting, and responsible sourcing sets it apart from its competitors and aligns with the values of many modern corporations.

-

Strong customer relationships and brand loyalty: Navan’s commitment to excellent customer service and ongoing support fosters strong relationships and cultivates brand loyalty, leading to high customer retention rates.

Compared to competitors like SAP Concur and TripActions, Navan stands out due to its superior user experience, comprehensive solution set, and strong focus on data-driven insights and sustainability. While Concur might have broader market reach, Navan’s agility and advanced technology offer a compelling alternative. TripActions, known for its consumer-like interface, lacks the depth of enterprise-grade features offered by Navan.

Financial Projections and Market Valuation for Navan's IPO

While specific financial details are confidential until the IPO filing, industry analysts predict strong performance for Navan.

-

Revenue growth projections: Analysts project significant revenue growth for Navan based on its current market share and projected expansion. [Include specific figures if available, or cite analyst predictions].

-

Profitability and margins: Navan's efficient operations and scalable business model indicate strong profitability potential. [Include projections or ranges if available].

-

Estimated IPO valuation: The anticipated valuation for Navan's IPO is expected to be in the [range] based on comparable companies and current market conditions.

-

Potential investor interest: Given the strong growth trajectory and the increasing demand for comprehensive travel management solutions, considerable investor interest is expected.

-

Market conditions and their impact on the IPO: The overall market conditions, particularly within the technology sector, will play a role in determining the final valuation and the success of the IPO.

Potential Impacts of Navan's IPO on the Travel Tech Industry

Navan’s IPO is poised to have a significant impact on the travel tech industry landscape.

-

Increased competition and innovation within the industry: The IPO will likely spark increased competition, pushing other players to innovate and enhance their offerings to stay ahead.

-

Potential for consolidation and further acquisitions: Navan's increased capital after the IPO could lead to further acquisitions within the travel tech sector, consolidating the market and potentially leading to larger, more integrated solutions.

-

Impact on investment in the travel tech sector: A successful IPO will likely attract further investment into the travel tech space, fueling innovation and growth within the sector.

-

Changes to pricing strategies and service offerings: The entry of a new major player into the public market may influence pricing strategies and service offerings across the board.

-

Increased focus on technology and data-driven solutions: Navan's success highlights the importance of technology and data-driven solutions in the travel management industry, influencing other companies to adopt similar strategies.

Conclusion: The Navan IPO and the Future of Business Travel

Navan's upcoming US Initial Public Offering represents a significant event for the travel tech industry. The company's innovative technology, strong market position, and robust financial projections suggest a successful IPO. This event will likely reshape the competitive landscape and drive further investment in the sector. Stay tuned for updates as we continue to follow Navan's progress towards its public listing and its impact on the future of business travel. Learn more about the innovative world of travel technology and the potential of Navan's IPO by following our coverage and exploring related resources on the topic of travel technology company IPOs.

Featured Posts

-

The Judd Sisters A Docuseries Exploring Family History And Challenges

May 14, 2025

The Judd Sisters A Docuseries Exploring Family History And Challenges

May 14, 2025 -

Sanremo Il 12 Aprile Marzia Taruffi Presenta Il Suo Nuovo Libro Il Destino Del Primo Figlio

May 14, 2025

Sanremo Il 12 Aprile Marzia Taruffi Presenta Il Suo Nuovo Libro Il Destino Del Primo Figlio

May 14, 2025 -

Lack Of Impact Why Sinners Fox Logo Lacks The Power Of Federers Rf

May 14, 2025

Lack Of Impact Why Sinners Fox Logo Lacks The Power Of Federers Rf

May 14, 2025 -

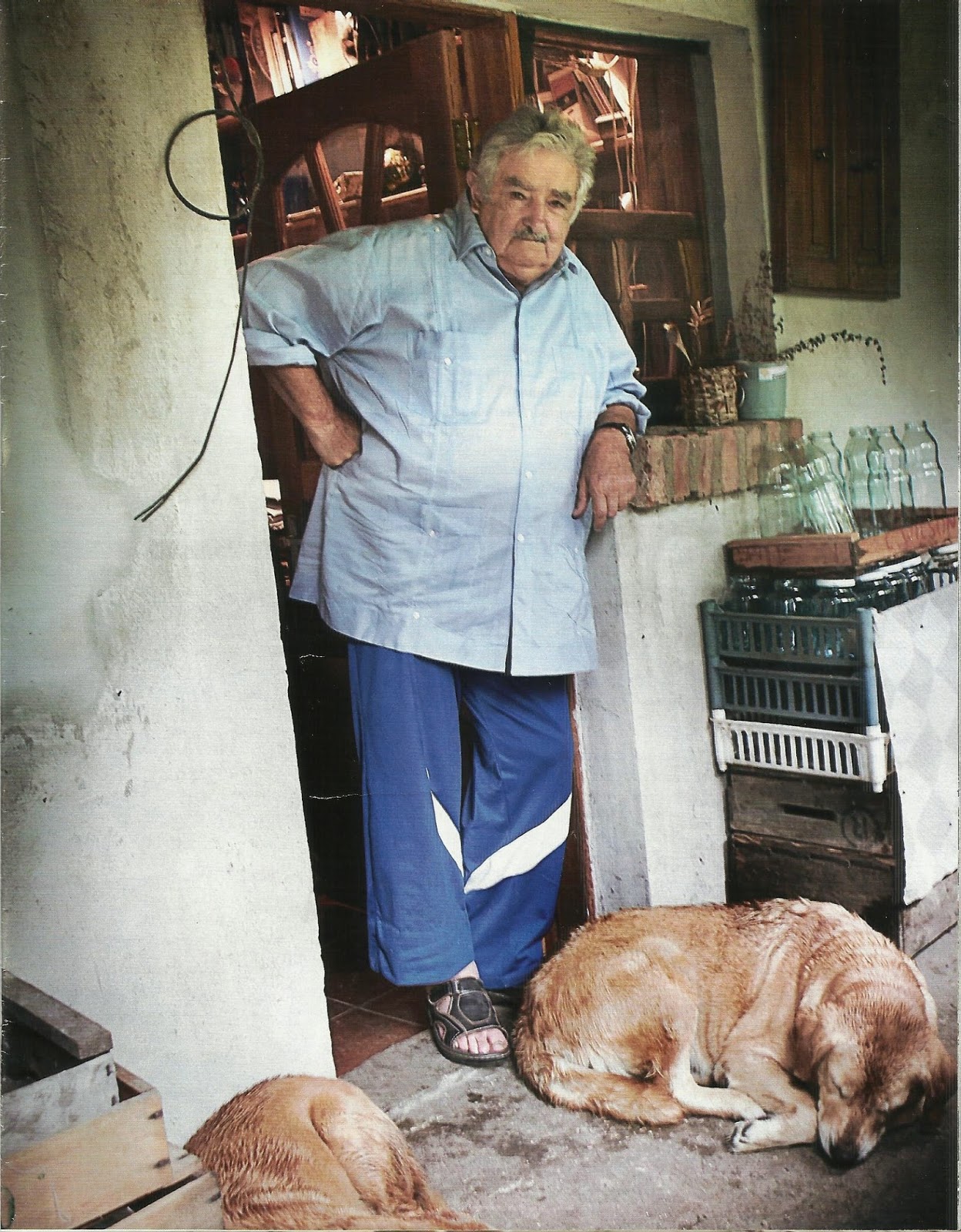

Jose Mujica 1935 2024 El Presidente Que Cambio Uruguay

May 14, 2025

Jose Mujica 1935 2024 El Presidente Que Cambio Uruguay

May 14, 2025 -

Koliko Je Dokovic Daleko Od Federerove Velicine

May 14, 2025

Koliko Je Dokovic Daleko Od Federerove Velicine

May 14, 2025