Extended Until 2025: The Future Of Trump's 30% Tariffs On China

Table of Contents

The Impact of Extended Tariffs on US Businesses

The prolonged existence of Trump's 30% tariffs on China continues to significantly impact American businesses. The increased costs and supply chain disruptions are forcing companies to adapt or risk falling behind.

Increased Costs and Reduced Competitiveness

- Higher Prices for Consumers: The tariffs directly increase the cost of imported Chinese goods for US importers. These increased costs are often passed on to consumers in the form of higher prices, reducing purchasing power and potentially slowing economic growth. This is particularly noticeable in sectors like consumer electronics, clothing, and furniture.

- Reduced Competitiveness: US businesses that rely on imported Chinese components or finished goods face a significant disadvantage compared to their competitors. The added tariff costs make their products less competitive in both domestic and international markets. This impacts profitability and potentially threatens long-term sustainability.

- Industries Heavily Affected: Manufacturing, retail, and agricultural sectors have been particularly hard-hit by the tariffs. The increased costs of raw materials and finished products have squeezed profit margins and forced difficult choices about pricing, production, and employment.

- Potential Business Relocation and Job Losses: Faced with higher costs and reduced competitiveness, some US businesses may consider relocating their operations to other countries with lower import costs. This could lead to job losses in the US, further exacerbating economic concerns.

Supply Chain Disruptions and Delays

- Complicated Supply Chains: The tariffs have significantly complicated established supply chains, forcing businesses to navigate complex customs procedures and increased bureaucratic hurdles. This adds to the overall cost and time involved in importing goods.

- Increased Shipping Costs and Longer Delivery Times: The tariffs have led to increased shipping costs and longer delivery times, creating further challenges for businesses that rely on just-in-time inventory management systems. This uncertainty can disrupt production schedules and lead to lost sales opportunities.

- Alternative Sourcing Strategies: Many businesses are exploring alternative sourcing strategies, seeking suppliers in other countries. However, finding reliable alternatives with comparable quality and cost is a significant challenge. This process often requires substantial investment in research, negotiation, and logistical adjustments.

- Inventory Management and Production Schedules: The uncertainty caused by the tariffs makes inventory management extremely difficult. Businesses struggle to predict future demand and adjust their production schedules accordingly, leading to potential stockouts or overstocking.

The Geopolitical Implications of the Extended Tariffs

Trump's 30% tariffs on China have had profound geopolitical implications, significantly impacting US-China relations and the global economic landscape.

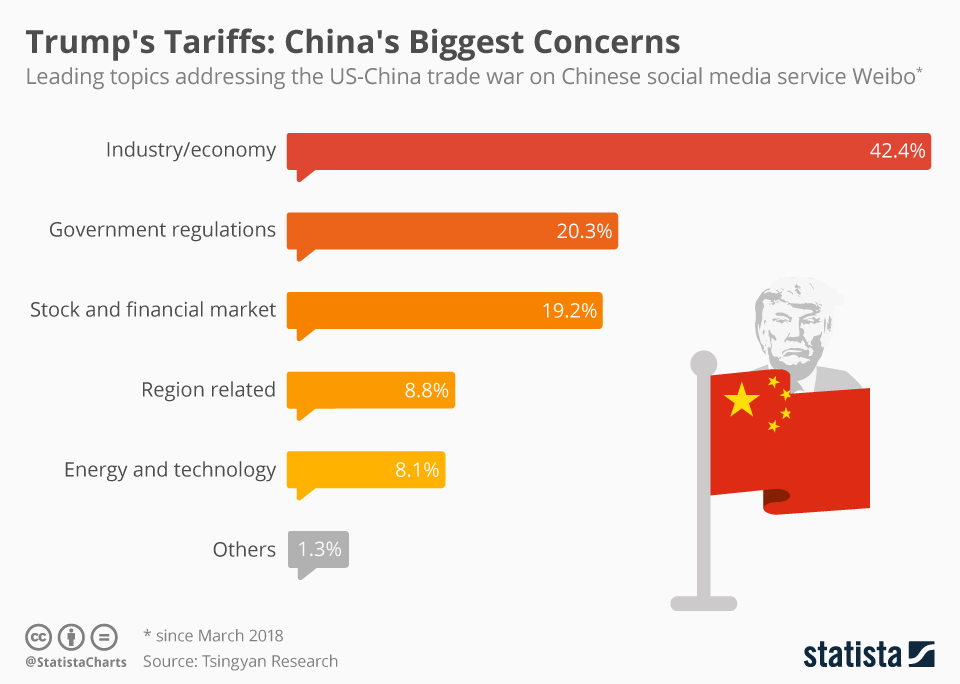

US-China Relations and Trade Tensions

- Ongoing Trade War: The tariffs are a central component of the ongoing trade war between the US and China, escalating tensions and creating a climate of uncertainty for businesses and investors.

- Geopolitical Leverage: The US has employed the tariffs as a tool to exert geopolitical leverage over China, aiming to address concerns about intellectual property theft, trade imbalances, and other economic issues.

- Retaliatory Measures from China: China has responded with its own retaliatory tariffs and trade restrictions, further intensifying the trade war and creating a negative feedback loop.

- Impact on Global Trade and International Relations: The trade dispute between the US and China has had a ripple effect on global trade, impacting international relations and creating uncertainty for businesses worldwide.

Impact on Global Markets and Economic Growth

- Ripple Effects on Global Economic Growth: The tariffs have negatively impacted global economic growth, creating uncertainty and reducing investor confidence.

- Inflation and Consumer Spending: The increased cost of goods has contributed to inflation, potentially reducing consumer spending and slowing economic growth.

- Investment Decisions and Market Volatility: The uncertainty surrounding the tariffs has increased market volatility and impacted investment decisions. Businesses are hesitant to commit to large-scale investments in the face of this unpredictability.

- Role of International Organizations: International organizations like the WTO have been actively involved in attempting to mitigate the negative effects of the tariffs, but their ability to influence the outcome remains limited.

Potential Future Scenarios and Mitigation Strategies

The future of Trump's 30% tariffs on China remains uncertain, requiring businesses and policymakers to consider various scenarios and develop effective mitigation strategies.

Negotiations and Trade Agreements

- Future Negotiations: The possibility of future negotiations between the US and China remains, with potential outcomes ranging from a complete removal of tariffs to further escalation.

- Trade Agreement or Tariff Reduction: The likelihood of a comprehensive trade agreement or significant tariff reduction remains uncertain, dependent on the political climate and the willingness of both sides to compromise.

- Roles of Stakeholders: Businesses, governments, and international organizations all play significant roles in influencing the outcome of these negotiations.

Adaptation Strategies for Businesses

- Diversification of Suppliers: Businesses should actively diversify their supply chains, reducing their reliance on any single country, including China.

- Cost-Cutting Measures: Implementing cost-cutting measures throughout the business can help offset the increased costs associated with the tariffs.

- Lobbying Efforts: Businesses can engage in lobbying efforts to advocate for policies that support their interests and mitigate the negative impacts of the tariffs.

- Innovative Solutions: Exploring innovative solutions, such as automation and technological advancements, can help enhance efficiency and reduce reliance on imported goods.

Conclusion

The extension of Trump's 30% tariffs on China until 2025 presents a complex and multifaceted challenge with far-reaching consequences. Understanding the impact on US businesses, the geopolitical implications, and potential future scenarios is crucial for navigating this uncertain environment. Businesses need to proactively develop adaptation strategies to mitigate the negative effects, while policymakers must work towards a more stable and predictable trade relationship. Staying informed about the developments surrounding Trump's 30% tariffs on China is essential for both businesses and consumers. Keep abreast of the latest news and analysis on this critical issue to make informed decisions and navigate the evolving landscape of US-China trade relations. Understanding the implications of Trump's 30% tariffs on China is crucial for long-term economic stability.

Featured Posts

-

The Face Of Metropolis Japan Contrasts And Comparisons Across Its Major Cities

May 18, 2025

The Face Of Metropolis Japan Contrasts And Comparisons Across Its Major Cities

May 18, 2025 -

Ohio Derailment Aftermath Lingering Toxic Chemicals In Buildings Raise Concerns

May 18, 2025

Ohio Derailment Aftermath Lingering Toxic Chemicals In Buildings Raise Concerns

May 18, 2025 -

Teylor Svift Rekordni Prodazhi Vinilovikh Plativok Za Ostannye Desyatilittya

May 18, 2025

Teylor Svift Rekordni Prodazhi Vinilovikh Plativok Za Ostannye Desyatilittya

May 18, 2025 -

Trumps Aerospace Legacy Assessing The Impact Of Ambitious Deals

May 18, 2025

Trumps Aerospace Legacy Assessing The Impact Of Ambitious Deals

May 18, 2025 -

The Uks Eurovision 2025 Act A History Of Controversy

May 18, 2025

The Uks Eurovision 2025 Act A History Of Controversy

May 18, 2025

Latest Posts

-

Only Fans And Beyond Amanda Bynes Recent Activities Revealed In Photos

May 18, 2025

Only Fans And Beyond Amanda Bynes Recent Activities Revealed In Photos

May 18, 2025 -

Easy A Airing Times Bbc Three Hd Tv Schedule

May 18, 2025

Easy A Airing Times Bbc Three Hd Tv Schedule

May 18, 2025 -

Amanda Bynes Joins Only Fans New Photos And Public Appearance

May 18, 2025

Amanda Bynes Joins Only Fans New Photos And Public Appearance

May 18, 2025 -

Your Guide To Watching Easy A On Bbc Three Hd

May 18, 2025

Your Guide To Watching Easy A On Bbc Three Hd

May 18, 2025 -

Amanda Bynes Post Only Fans Public Outing A Look At The Photos

May 18, 2025

Amanda Bynes Post Only Fans Public Outing A Look At The Photos

May 18, 2025