Falling Iron Ore Prices: The Implications Of China's Steel Production Cuts

Table of Contents

China's Reduced Steel Production: The Driving Force

Several factors contribute to the decrease in China's steel production, significantly impacting global iron ore prices.

Government Regulations and Environmental Concerns

China's government has implemented stringent policies to curb carbon emissions and improve environmental standards. These initiatives are aimed at achieving the country's ambitious climate goals.

- Stricter Emission Limits: New regulations place tighter limits on greenhouse gas emissions from steel mills, forcing them to reduce production or invest heavily in cleaner technologies.

- Production Quotas: The government has imposed production quotas on steel mills in certain regions, limiting their overall output.

- Increased Scrutiny on Illegal Production: Crackdowns on illegal and polluting steel mills further contribute to the reduced overall output.

These policies have directly impacted steel mills, forcing many to reduce operations or even shut down entirely, leading to a decreased demand for iron ore, the primary raw material in steel production.

Weakening Domestic Demand

A slowdown in China's construction and infrastructure sectors has significantly reduced the demand for steel.

- Reduced Infrastructure Projects: The government's focus on deleveraging and controlling debt has led to a decrease in large-scale infrastructure projects, reducing the need for steel.

- Real Estate Market Slowdown: The struggling real estate sector, a major consumer of steel, further contributes to decreased demand. The impact of Evergrande's collapse is still being felt across the market.

- Shifting Economic Priorities: China's economic focus is increasingly shifting towards higher-value manufacturing and services, decreasing reliance on heavy industry and thus, steel consumption.

Increased Efficiency and Technological Advancements

Improvements in steel production technology are enabling higher output with less raw material.

- Optimized Production Processes: Steel mills are adopting more efficient processes that minimize waste and optimize resource utilization.

- Technological Advancements: New technologies allow for higher-quality steel production using less iron ore per ton of steel.

- Recycling Initiatives: Increased focus on steel recycling reduces the reliance on newly mined iron ore.

This increased efficiency means that less iron ore is needed to produce the same amount of steel, leading to decreased demand and consequently, lower prices.

The Ripple Effect: Implications for Global Iron Ore Markets

The reduction in Chinese steel production has created a significant ripple effect across global iron ore markets.

Price Volatility and Market Instability

The relationship between supply and demand dictates iron ore prices. With reduced demand from China, a surplus of iron ore has emerged, leading to price volatility and instability.

- Supply Outstrips Demand: The reduced demand from China has created a global oversupply of iron ore, driving prices down.

- Impact on Mining Companies: Mining companies, particularly in Australia and Brazil, are facing reduced revenues and profitability due to lower iron ore prices.

- Market Speculation: Speculation in the iron ore market further exacerbates price fluctuations, creating uncertainty for all stakeholders.

Impact on Iron Ore Producing Countries

Major iron ore exporters like Australia and Brazil are feeling the impact of falling prices.

- Economic Slowdown: Reduced iron ore exports lead to decreased revenues and potential economic slowdowns in these countries.

- Job Losses: Mining companies may be forced to reduce their workforce, leading to job losses in the affected regions.

- Government Response: Governments are exploring various mitigation strategies, including diversification of economies and support packages for affected industries.

Opportunities for Strategic Players

Despite the challenges, falling iron ore prices create opportunities for strategic players.

- Asset Acquisition: Companies can acquire valuable iron ore assets at lower prices, strengthening their market position in the long term.

- Mergers and Acquisitions: Consolidation in the iron ore industry is likely, with larger companies potentially acquiring smaller ones.

Looking Ahead: Predictions and Future Trends

Forecasting iron ore prices is challenging, but several factors will influence future price movements.

Forecasting Iron Ore Prices

Predicting short-term iron ore prices is difficult given the current market volatility. However, long-term predictions depend heavily on:

- Global Economic Recovery: A strong global economic recovery could boost demand for steel and, consequently, iron ore.

- Changes in Chinese Policy: Changes in Chinese government policies regarding steel production and environmental regulations will significantly impact demand.

- Technological Innovations: Further advancements in steel production technology might influence iron ore consumption in the future.

The Role of Sustainable Steel Production

The shift towards sustainable steel production practices will play a crucial role in shaping future iron ore demand.

- Green Steel Initiatives: The increasing focus on reducing carbon emissions in steel production will drive innovation and potentially alter the demand for iron ore.

- Technological Advancements: New technologies focused on sustainable steel production may impact future demand for iron ore, potentially increasing it if alternative raw materials are less efficient.

Conclusion: Understanding the Dynamics of Falling Iron Ore Prices

The decline in iron ore prices is fundamentally linked to the significant reduction in China's steel production, driven by government regulations, weakening domestic demand, and increased production efficiency. This has created volatility in global markets, impacting mining companies and economies worldwide. Understanding these dynamics is crucial for navigating the complexities of the iron ore market. To stay informed about the ongoing developments, continue researching the implications of falling iron ore prices and China's steel production, and consult reliable market analysis resources for the latest updates.

Featured Posts

-

Brekelmans India Strategie Behoud Van Samenwerking

May 09, 2025

Brekelmans India Strategie Behoud Van Samenwerking

May 09, 2025 -

St Albert Dinner Theatres New Production A Fast Flying Farce

May 09, 2025

St Albert Dinner Theatres New Production A Fast Flying Farce

May 09, 2025 -

Decoding The Nyt Strands April 9 2025 Puzzle A Step By Step Guide

May 09, 2025

Decoding The Nyt Strands April 9 2025 Puzzle A Step By Step Guide

May 09, 2025 -

Palantir Stock In 2025 Assessing The Investment Opportunity After A 40 Increase

May 09, 2025

Palantir Stock In 2025 Assessing The Investment Opportunity After A 40 Increase

May 09, 2025 -

Analysis Alpine Bosss Comments On Doohan In F1

May 09, 2025

Analysis Alpine Bosss Comments On Doohan In F1

May 09, 2025

Latest Posts

-

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025 -

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025 -

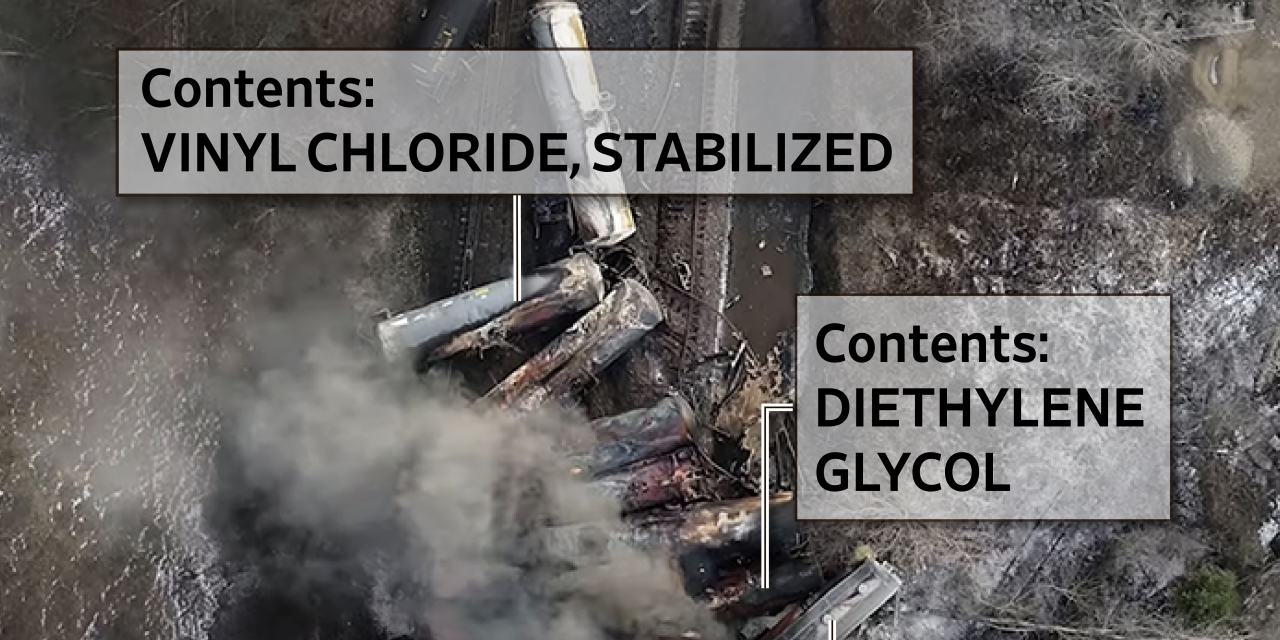

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025