Falling Retail Sales: Pressure Mounts On Bank Of Canada To Cut Rates

Table of Contents

The Severity of Falling Retail Sales

Recent Data and Trends

The latest retail sales data paints a concerning picture for the Canadian economy. Statistics Canada recently reported a significant drop in retail sales for [Month, Year], marking a [Percentage]% decrease compared to [Previous Month/Year]. This decline represents a substantial slowdown compared to the previous period's [Previous Percentage]% growth. This isn't isolated to one sector; various retail segments are experiencing significant headwinds.

- Clothing Sales: A [Percentage]% decrease in clothing sales was observed in [Month, Year], indicating weakened consumer confidence in non-essential purchases.

- Automobile Sales: The automotive sector also witnessed a sharp decline of [Percentage]% in [Month, Year], reflecting the impact of higher interest rates on borrowing for large purchases.

- Furniture and Appliance Sales: Similar declines were seen in the furniture and appliance sector, with a [Percentage]% drop in [Month, Year], further emphasizing the weakening consumer spending.

These figures are alarming and signal a potential broader economic slowdown.

Geographical Impact

The impact of falling retail sales isn't uniform across Canada. While the national picture is concerning, some regions are experiencing more significant declines than others.

- Ontario: Ontario, Canada's most populous province, experienced a [Percentage]% drop in retail sales, impacting major urban centers like Toronto and Ottawa.

- British Columbia: British Columbia also witnessed a notable decrease of [Percentage]%, potentially linked to the cooling housing market in Vancouver and surrounding areas.

- Atlantic Canada: The Atlantic provinces, while showing a smaller percentage decline, still reflect the overall trend of weakening consumer spending.

The regional variations highlight the need for targeted policy responses to address the uneven impact of falling retail sales across the country.

Consumer Confidence and Spending

The decline in retail sales is directly linked to weakening consumer confidence. Surveys such as the Conference Board of Canada's Consumer Confidence Index have shown a consistent downward trend in recent months. This reduced confidence translates into decreased discretionary spending.

- Consumer Confidence Index: The Consumer Confidence Index fell to [Number] in [Month, Year], indicating a significant drop in consumer optimism and willingness to spend.

- Household Debt: Rising household debt levels, fueled by increased borrowing costs, further contribute to reduced spending capacity.

- Savings Rates: While some consumers might have increased their savings rate, this is often a reactive measure to economic uncertainty rather than a sign of strong economic health.

The correlation between falling consumer confidence and falling retail sales underscores the urgent need for policy intervention.

Factors Contributing to Falling Retail Sales

High Interest Rates

The Bank of Canada's aggressive interest rate hikes to combat inflation have significantly impacted consumer spending and borrowing. Higher interest rates increase the cost of borrowing for mortgages, car loans, and credit card debt, directly reducing disposable income.

- Mortgage Rates: Increased mortgage rates have led to reduced affordability for homebuyers, impacting the housing market and related spending.

- Auto Loan Rates: Higher auto loan rates have dampened demand for new and used vehicles, contributing to the decline in automobile sales.

- Credit Card Debt: The rising cost of credit card debt puts further pressure on household budgets, limiting discretionary spending.

The impact of higher interest rates on consumer spending is a primary driver of falling retail sales.

Inflationary Pressures

Persistent inflationary pressures continue to erode purchasing power, forcing consumers to curtail their spending. The rising cost of essential goods and services significantly impacts household budgets.

- Grocery Prices: Food prices have seen significant increases, forcing consumers to reduce spending on other items.

- Energy Costs: Increased energy costs, including gasoline and heating, further reduce disposable income.

- Housing Costs: High housing costs, both for rent and ownership, put considerable strain on household finances.

Inflation's persistent impact on consumer purchasing power is a major contributor to the ongoing decline in retail sales.

Global Economic Slowdown

The global economic slowdown is also playing a role in falling retail sales in Canada. Concerns about a potential recession, supply chain disruptions, and geopolitical instability all contribute to economic uncertainty.

- Global Recession Fears: Concerns about a global recession are impacting investor confidence and consumer sentiment, leading to reduced spending.

- Supply Chain Disruptions: Ongoing supply chain disruptions continue to impact the availability and cost of goods, adding to inflationary pressures.

- Geopolitical Instability: Geopolitical instability, particularly the war in Ukraine, contributes to global economic uncertainty, impacting investment and consumer confidence.

The global economic climate is exacerbating the challenges facing the Canadian economy and contributing to the decline in retail sales.

Pressure on the Bank of Canada to Act

Potential for Interest Rate Cuts

Given the severity of falling retail sales, pressure is mounting on the Bank of Canada to consider cutting interest rates. Economists and market analysts are divided on the likelihood and timing of such a move.

- Bank of Canada Statements: Recent statements from Bank of Canada officials suggest a cautious approach, weighing the risks of inflation against the need to support economic growth.

- Economist Predictions: Some economists predict an interest rate cut in [Timeframe], while others believe the Bank of Canada will remain on hold until [Timeframe].

- Market Forecasts: Market forecasts reflect a degree of uncertainty, with varying predictions on the future direction of interest rates.

The decision on whether to cut interest rates will depend on the Bank of Canada's assessment of the overall economic situation.

Economic Risks of Rate Cuts

Cutting interest rates, while potentially stimulating economic activity, also carries significant risks. Premature rate cuts could reignite inflationary pressures or create asset bubbles.

- Inflationary Risks: Lowering interest rates could exacerbate inflationary pressures, making it more difficult to achieve the Bank of Canada's inflation target.

- Asset Bubbles: Reduced interest rates could fuel asset bubbles in the housing market or other sectors, leading to financial instability.

- Currency Depreciation: Interest rate cuts could lead to a depreciation of the Canadian dollar, impacting import costs and potentially fueling inflation further.

The Bank of Canada must carefully weigh the potential benefits and risks of any interest rate cuts.

Alternative Monetary Policy Options

The Bank of Canada may consider alternative monetary policy options beyond interest rate cuts to address falling retail sales.

- Quantitative Easing: Quantitative easing, a form of monetary stimulus, could be considered to inject liquidity into the market.

- Targeted Fiscal Stimulus: The government might implement fiscal measures to stimulate economic growth, such as tax cuts or infrastructure spending.

- Communication Strategy: Clear and effective communication about the Bank of Canada's policy intentions is crucial to maintaining confidence and stability in the market.

The Bank of Canada will likely use a combination of tools and strategies to address the current economic challenges.

Conclusion

The decline in retail sales presents a serious challenge to the Canadian economy, putting significant pressure on the Bank of Canada to respond. While an interest rate cut might stimulate economic activity and counter falling retail sales, it also carries considerable risks. Understanding the complex interplay between falling retail sales, high interest rates, inflation, and global economic uncertainty is crucial. Continued monitoring of these economic indicators, and particularly the Bank of Canada's policy decisions, is essential for navigating this complex economic landscape. Stay informed about developments in falling retail sales and the Bank of Canada's response to effectively manage your personal finances and investments.

Featured Posts

-

Accessibility And Affordability Examining The Impact Of Over The Counter Birth Control Post Roe

Apr 28, 2025

Accessibility And Affordability Examining The Impact Of Over The Counter Birth Control Post Roe

Apr 28, 2025 -

Ev Mandate Backlash Car Dealerships Renew Resistance

Apr 28, 2025

Ev Mandate Backlash Car Dealerships Renew Resistance

Apr 28, 2025 -

Discover Abu Dhabi 10 Gb Sim Card And 15 Attraction Discount

Apr 28, 2025

Discover Abu Dhabi 10 Gb Sim Card And 15 Attraction Discount

Apr 28, 2025 -

Minnesota Twins Secure 6 3 Win Against New York Mets

Apr 28, 2025

Minnesota Twins Secure 6 3 Win Against New York Mets

Apr 28, 2025 -

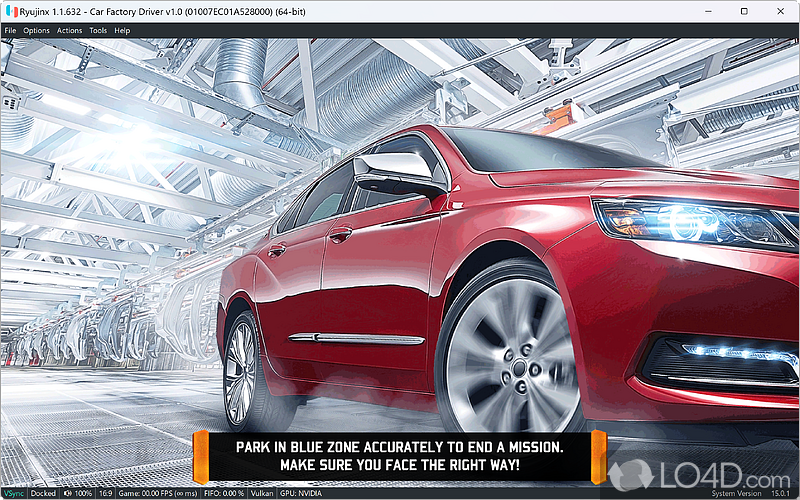

Ryujinx Emulator Development Halted Nintendos Impact

Apr 28, 2025

Ryujinx Emulator Development Halted Nintendos Impact

Apr 28, 2025

Latest Posts

-

The Impact Of Michael Kays Remarks On Juan Sotos Bat

May 11, 2025

The Impact Of Michael Kays Remarks On Juan Sotos Bat

May 11, 2025 -

Analyzing Juan Sotos Recent Success After Michael Kays Comments

May 11, 2025

Analyzing Juan Sotos Recent Success After Michael Kays Comments

May 11, 2025 -

Juan Sotos Post Kay Interview Performance Coincidence Or Causation

May 11, 2025

Juan Sotos Post Kay Interview Performance Coincidence Or Causation

May 11, 2025 -

Are Jazz Chisholm Jr S Stats Beating Aaron Judges This Season

May 11, 2025

Are Jazz Chisholm Jr S Stats Beating Aaron Judges This Season

May 11, 2025 -

Early Season Mlb Powerhouse Chisholms Numbers Compared To Judges

May 11, 2025

Early Season Mlb Powerhouse Chisholms Numbers Compared To Judges

May 11, 2025