Faster HMRC Call Resolution With Advanced Voice Recognition

Table of Contents

How Voice Recognition Improves HMRC Call Efficiency

Voice recognition technology significantly streamlines the initial call routing process for HMRC phone calls. Instead of navigating complex phone menus, callers can simply state their query, and the system can quickly identify their needs and direct them to the appropriate agent. This results in:

- Faster identification of caller needs: Voice recognition accurately interprets the caller's intent, immediately routing the call to the most relevant department or individual.

- Reduced need for manual data entry by agents: The system automatically captures key information from the caller's voice input, minimizing the time agents spend on data entry.

- Immediate access to relevant information based on voice input: The system can access relevant taxpayer information and documents based on the spoken query, ensuring agents have the necessary details at their fingertips.

- Improved accuracy in understanding complex queries: Advanced voice recognition algorithms are designed to understand nuanced language and complex tax queries, reducing misunderstandings.

This streamlined process leads to reduced call handling times. Studies show that voice recognition can reduce call handling times by up to 30%, freeing up agents to handle more calls and improve overall service levels. This increased efficiency also contributes to improved agent satisfaction, reducing workload-related stress and boosting morale.

Enhanced Accuracy and Reduced Errors with Voice Recognition for HMRC

Human error is inevitable, but voice recognition minimizes misunderstandings and errors in data collection during HMRC phone calls. By accurately capturing and interpreting information directly from the caller's voice, the system significantly reduces the risk of misinterpretations. This leads to:

- Improved accuracy in capturing taxpayer information: Crucial details like National Insurance numbers, tax reference numbers, and financial figures are captured accurately, eliminating manual entry errors.

- Minimized data entry errors: The automated process significantly reduces the likelihood of human errors during data input, ensuring data integrity and accuracy.

- Reduced chances of misinterpretation of queries: The system's ability to understand complex queries minimizes the chances of misinterpretations, ensuring accurate responses and solutions.

- Increased compliance and accuracy in tax processing: Accurate data capture translates directly into increased compliance and accuracy in the processing of tax information.

This improved accuracy benefits both the taxpayer and HMRC. Taxpayers experience smoother interactions and fewer delays, while HMRC benefits from improved data quality and reduced processing errors.

Improved Taxpayer Experience with Faster HMRC Call Resolution

The most significant impact of voice recognition on HMRC phone calls is the improved taxpayer experience. Faster resolution translates directly into:

- Reduced call waiting times: Callers are connected to the right agent quickly, minimizing frustrating hold times.

- Faster resolution of tax queries: The accurate information gathering and streamlined process facilitate quicker resolutions to taxpayers' issues.

- Increased taxpayer satisfaction: Faster, more efficient service leads to significantly higher levels of taxpayer satisfaction.

- Improved accessibility for individuals with disabilities: Voice recognition can improve accessibility for individuals with visual or auditory impairments, ensuring equal access to HMRC services.

Faster resolution of tax queries builds taxpayer confidence and trust in HMRC, fostering a more positive and productive relationship between the tax authority and its constituents.

The Future of HMRC Call Centres: Embracing Advanced Voice Recognition Technology

Voice recognition technology is constantly evolving. Future advancements will further enhance its capabilities and integration with HMRC services. We can expect:

- Integration with other HMRC systems for seamless data access: Seamless data access across various systems will further streamline the process.

- Potential for multilingual support: Expanding multilingual support will cater to the diverse population of the UK.

- Use of AI to anticipate taxpayer needs and provide proactive solutions: AI-powered systems could proactively address common issues and provide tailored assistance.

- Increased scalability to handle higher call volumes: Advanced systems can handle significantly higher call volumes, ensuring efficient service even during peak periods.

Investing in advanced voice recognition technology represents a significant step towards modernizing HMRC call centres and ensuring efficient, accurate, and user-friendly services for all taxpayers.

Conclusion: Achieving Faster HMRC Call Resolution through Advanced Voice Recognition

The benefits of integrating advanced voice recognition into HMRC phone calls are clear: faster call resolution, improved accuracy, and an enhanced taxpayer experience. This technology significantly improves HMRC's operational efficiency while simultaneously boosting taxpayer satisfaction. By embracing advanced voice recognition, HMRC can modernize its service delivery, ensuring a more efficient and positive experience for all involved. Learn more about how advanced voice recognition can revolutionize your HMRC call handling. Contact us today for a consultation!

Featured Posts

-

Incendio Na Tijuca Pais E Ex Alunos Em Alerta Apos Incendio Em Escola

May 20, 2025

Incendio Na Tijuca Pais E Ex Alunos Em Alerta Apos Incendio Em Escola

May 20, 2025 -

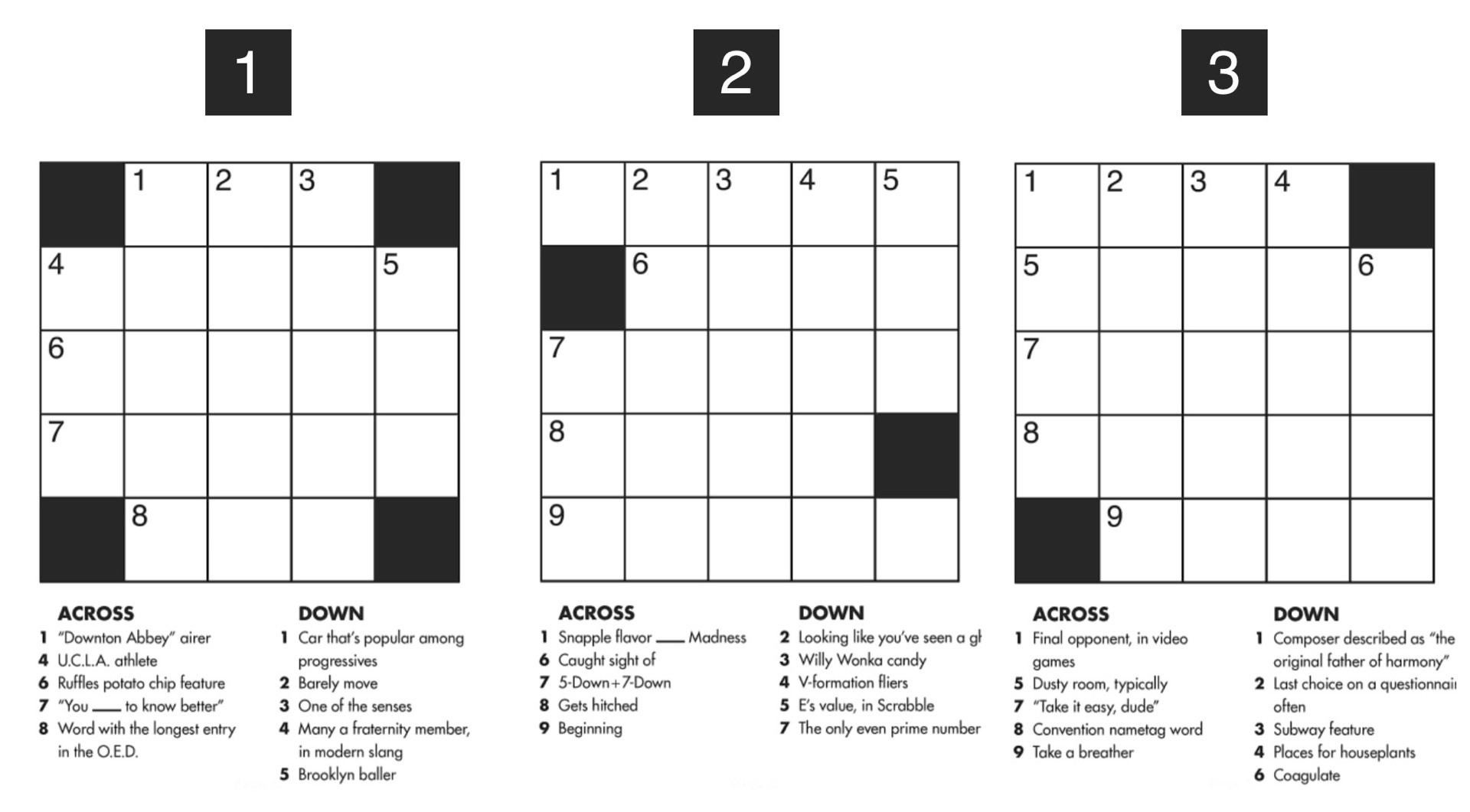

Todays Nyt Mini Crossword Answers February 25th

May 20, 2025

Todays Nyt Mini Crossword Answers February 25th

May 20, 2025 -

Cassidy Hutchinsons Planned Memoir Insights From A Key Jan 6 Witness

May 20, 2025

Cassidy Hutchinsons Planned Memoir Insights From A Key Jan 6 Witness

May 20, 2025 -

Jose Mourinhos Tactical Masterclass Analyzing Tadic And Dzeko

May 20, 2025

Jose Mourinhos Tactical Masterclass Analyzing Tadic And Dzeko

May 20, 2025 -

Solve The Nyt Mini Crossword April 13 Answers

May 20, 2025

Solve The Nyt Mini Crossword April 13 Answers

May 20, 2025