Federal Debt: A Direct Threat To Your Mortgage?

Table of Contents

How Federal Debt Impacts Interest Rates

The relationship between federal debt and interest rates is complex but undeniable. Understanding this connection is crucial for anyone considering buying a home or refinancing their mortgage.

The Relationship Between Debt and Inflation

Increased government borrowing to finance the national debt often leads to inflation. When the government borrows heavily, it increases the demand for money, driving up prices across the economy. To combat this inflation, the Federal Reserve (the central bank of the US) typically raises interest rates.

- Mechanics of Inflation: Increased money supply chases a limited amount of goods and services, resulting in higher prices. This reduces the purchasing power of each dollar.

- Past Examples: Historically, periods of significant increases in federal debt have often been followed by periods of higher inflation and subsequent interest rate hikes by the Federal Reserve. The 1970s and early 1980s offer a stark example of this correlation.

- Impact on Mortgage Payments: Inflation erodes the purchasing power of your income, making it harder to afford your mortgage payments even if the nominal amount stays the same. A rise in interest rates further exacerbates this problem.

Direct Impact on Mortgage Rates

Rising interest rates, a direct consequence of managing inflation driven by increased federal debt, translate directly into higher mortgage rates. This makes borrowing money to buy a home more expensive.

- Impact of Small Increases: Even a seemingly small increase in interest rates can significantly impact your monthly mortgage payment over the life of the loan. For example, a 0.5% increase on a $300,000, 30-year mortgage can add hundreds of dollars to your monthly payment.

- Impact on First-Time Homebuyers: Higher mortgage rates disproportionately affect first-time homebuyers who often have less savings for a down payment and rely more heavily on financing.

- Refinancing Implications: Homeowners looking to refinance their mortgages will also face higher interest rates, potentially increasing their monthly payments or lengthening their loan terms.

The Influence of Federal Debt on Economic Stability

High levels of federal debt can create significant economic uncertainty, impacting the housing market and mortgage lending in several ways.

Economic Uncertainty and Mortgage Lending

Economic uncertainty, often a byproduct of high federal debt, makes lenders more risk-averse. This translates into tighter lending standards and potentially higher interest rates for borrowers.

- Risk-Averse Lenders: Lenders become more cautious during times of economic uncertainty, leading to stricter credit requirements, higher down payment requirements, and potentially a reduction in the availability of mortgage products.

- Mortgage Approvals and Interest Rates: This heightened risk aversion can result in fewer mortgage approvals and higher interest rates for those who do qualify, making homeownership less accessible.

- Impact on the Housing Market: Reduced affordability and decreased lending can lead to a slowdown in the housing market, potentially impacting home values.

Government Intervention and Mortgage Markets

Government interventions aimed at addressing high federal debt can have both positive and negative consequences for the mortgage market.

- Bailouts and Stimulus Packages: Government bailouts or stimulus packages designed to stabilize the economy can indirectly affect mortgage markets by impacting interest rates or influencing lender behavior. These interventions may temporarily alleviate some pressures but can also create long-term financial risks.

- Potential Impacts: Government intervention may lead to artificially low interest rates in the short term, but this could lead to future inflation and subsequent rate hikes.

- Unintended Consequences: While intended to stabilize the economy, government interventions can also lead to unintended consequences, including increased national debt and potential long-term instability.

Protecting Yourself from the Impacts of Federal Debt

While you can't control the national debt, you can control your financial response to it.

Financial Planning Strategies

Proactive financial planning is crucial to mitigate the risks posed by rising federal debt and its impact on your mortgage.

- Budgeting: Creating and sticking to a realistic budget is paramount. This allows you to save for a larger down payment and manage your monthly expenses effectively.

- Larger Down Payment: A larger down payment reduces the amount you need to borrow, lowering your monthly payments and making your mortgage less susceptible to interest rate fluctuations.

- Fixed-Rate Mortgage: Opting for a fixed-rate mortgage locks in your interest rate for the duration of the loan, protecting you from future interest rate increases.

- Diversify Investments: Diversifying your investments can help mitigate the risks associated with economic instability.

Monitoring Economic Indicators

Staying informed about key economic indicators is crucial for making informed financial decisions.

- Inflation Rate: Monitor inflation rates to gauge the potential for future interest rate hikes.

- Interest Rate Projections: Pay attention to interest rate projections from the Federal Reserve and other financial institutions.

- Government Debt Levels: Stay informed about the growth of federal debt and its potential impact on the economy.

- Reputable Sources: Use reputable sources such as the Federal Reserve, the Bureau of Economic Analysis, and respected financial news outlets to track these indicators.

Conclusion

The relationship between federal debt, interest rates, and mortgage affordability is undeniable. Rising federal debt creates economic uncertainty, potentially leading to higher inflation, increased interest rates, and tighter lending standards. This directly impacts your ability to secure a mortgage and manage your existing one. However, by implementing proactive financial planning strategies and diligently monitoring economic indicators, you can minimize the risks and protect your financial well-being. Don't let rising federal debt jeopardize your mortgage. Take proactive steps to protect your financial well-being today! Learn more about managing your mortgage in the face of rising federal debt and explore strategies for financial stability.

Featured Posts

-

Final Destination 6 How Bloodline Changes The Films Formula

May 19, 2025

Final Destination 6 How Bloodline Changes The Films Formula

May 19, 2025 -

Hopkins Honors Paige Bueckers With One Day Name Change On May 16th

May 19, 2025

Hopkins Honors Paige Bueckers With One Day Name Change On May 16th

May 19, 2025 -

Final Destination Bloodlines Does This Sequel Deliver

May 19, 2025

Final Destination Bloodlines Does This Sequel Deliver

May 19, 2025 -

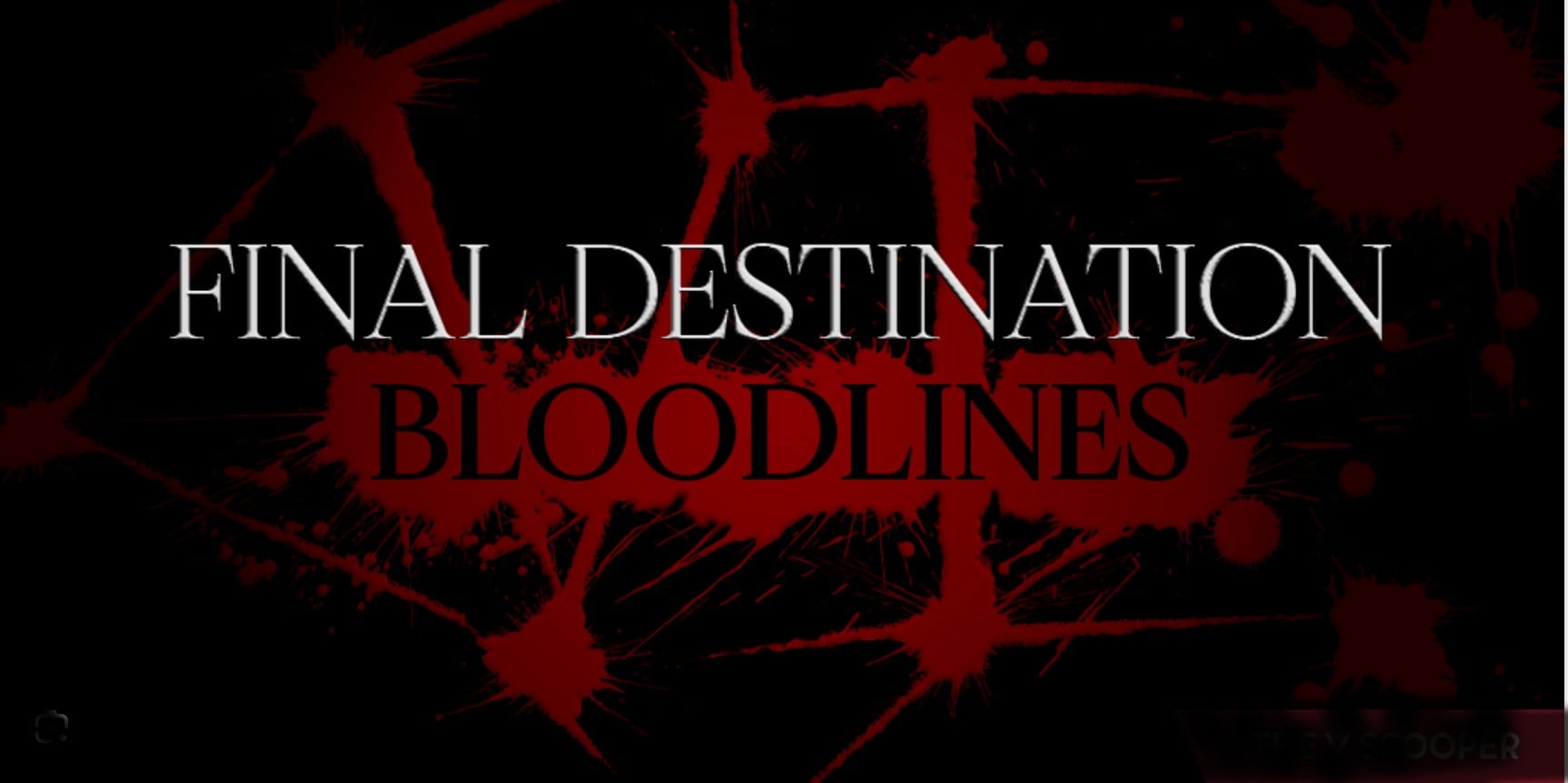

Meta Faces Ftc Defense In Antitrust Case

May 19, 2025

Meta Faces Ftc Defense In Antitrust Case

May 19, 2025 -

Controversia Rixi Moncada Y Cossette Lopez En Choque De Posturas

May 19, 2025

Controversia Rixi Moncada Y Cossette Lopez En Choque De Posturas

May 19, 2025