Federal Debt Crisis: Implications For Homebuyers

Table of Contents

Rising Interest Rates and Their Impact on Mortgage Affordability

The Federal Debt Crisis significantly impacts mortgage affordability, primarily through rising interest rates. The Federal Reserve, tasked with controlling inflation, often raises interest rates as a response to a growing national debt and subsequent inflation. This directly affects the cost of borrowing money, including mortgages.

The Federal Reserve's Response to Inflation

- Inflationary pressures: When the national debt increases, it can fuel inflation, eroding the purchasing power of the dollar. The Federal Reserve combats this by increasing the federal funds rate, the target rate banks charge each other for overnight loans.

- Ripple effect on mortgage rates: This increase ripples through the financial system, leading to higher mortgage rates offered by lenders. A prime rate increase directly influences the rates available to consumers.

- Impact on monthly payments: Even a small percentage increase in the interest rate can significantly impact monthly mortgage payments. For example, a 1% increase on a $300,000, 30-year mortgage can add hundreds of dollars to the monthly payment.

[Insert relevant graph or chart showing the historical relationship between federal debt and mortgage rates here]

Reduced Purchasing Power

Higher mortgage rates directly reduce the purchasing power of homebuyers. With less money available to put towards a down payment and higher monthly payments, potential homebuyers find themselves qualified for significantly smaller mortgages.

- Smaller home budgets: Higher rates mean less house for the same monthly payment amount, forcing buyers to compromise on size, location, or amenities.

- Increased competition: Reduced affordability can lead to increased competition among buyers for a limited supply of homes, potentially driving up prices even further.

- Impact on housing inventory: A challenging market can result in less new construction as builders hesitate to enter a market with reduced demand.

Government Intervention and its Influence on the Housing Market

Government intervention plays a crucial role in influencing the housing market, but the Federal Debt Crisis limits its effectiveness.

Potential Government Programs and Their Limitations

The government offers several programs to support homeownership, including FHA loans and VA loans. However, the Federal Debt Crisis puts a strain on government resources.

- Reduced funding: Existing programs may face reduced funding, leading to stricter eligibility criteria or longer wait times.

- Program changes: Changes to eligibility requirements or loan limits can make it more challenging for certain demographics to access these crucial programs.

- Political challenges: Securing funding for new housing initiatives becomes increasingly difficult during times of high national debt, often leading to political gridlock and delayed action.

Impact of Fiscal Policy on Housing Supply and Demand

Government spending on infrastructure projects—roads, utilities, and public transportation—directly impacts housing supply and demand.

- Construction costs: Government spending on infrastructure can impact the cost of new home construction, potentially increasing or decreasing the price of housing.

- Housing availability: Government investment in infrastructure development in new areas can lead to increased housing supply, whereas spending cuts can hinder new construction and reduce availability.

- Indirect effects: Government cutbacks on other social programs can indirectly influence housing affordability by impacting household incomes and the ability to secure a mortgage.

Uncertainty and Market Volatility

The uncertainty surrounding the Federal Debt Crisis significantly impacts investor sentiment and market volatility within the housing sector.

Investor Sentiment and Housing Market Fluctuations

The perceived risk associated with a worsening debt crisis can influence investor confidence in the housing market.

- Market fluctuations: Uncertainty creates volatility in home prices, making it challenging to predict future market trends.

- Mortgage availability: Lenders may tighten lending standards, making it harder for prospective homebuyers to secure a mortgage.

- Price instability: Investors pulling out of the market can lead to significant price drops in certain areas, adding further uncertainty.

Long-Term Implications for Homeownership

The long-term implications of the Federal Debt Crisis on homeownership are substantial, potentially impacting future generations' ability to own homes.

- Increased difficulty in obtaining financing: The combination of higher interest rates, stricter lending standards, and reduced government support could make it substantially more difficult to obtain a mortgage.

- Potential for a housing market crash: In a worst-case scenario, a prolonged period of uncertainty could result in a significant decline in home values.

- Responsible home buying: Prospective homebuyers need to be cautious, thoroughly assess their financial situation, and seek professional advice before making any significant decisions.

Conclusion

The Federal Debt Crisis presents significant challenges for prospective homebuyers. Rising interest rates, reduced government support, and market uncertainty all contribute to a more difficult environment for achieving homeownership. Understanding the impact of the national debt on mortgage rates, housing affordability, and government programs is crucial for making informed decisions. Don't let the Federal Debt Crisis derail your homeownership dreams; plan wisely and stay informed. Carefully consider your financial situation, research current mortgage rates and market conditions, and seek expert advice before making major home buying decisions in the context of the current Federal Debt Crisis. Navigate the Federal Debt Crisis and find your dream home with informed decision-making.

Featured Posts

-

The Future Of Libraries Navigating Funding Challenges

May 19, 2025

The Future Of Libraries Navigating Funding Challenges

May 19, 2025 -

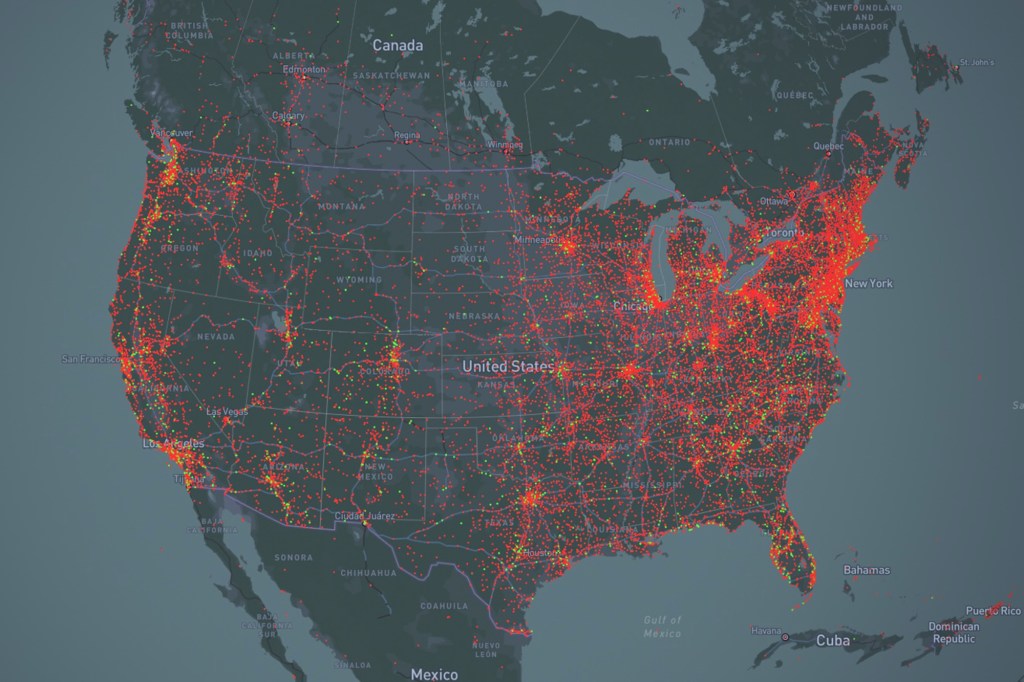

New Business Hotspots Across The Country An Interactive Map And Analysis

May 19, 2025

New Business Hotspots Across The Country An Interactive Map And Analysis

May 19, 2025 -

Rescate Y Transformacion En Cortes Quienes Compiten Por La Diputacion

May 19, 2025

Rescate Y Transformacion En Cortes Quienes Compiten Por La Diputacion

May 19, 2025 -

Cannes 2025 Kristen Stewarts Chic White Satin Suit For Directorial Premiere

May 19, 2025

Cannes 2025 Kristen Stewarts Chic White Satin Suit For Directorial Premiere

May 19, 2025 -

Cohep Monitorea Las Elecciones Asegurando Un Proceso Justo

May 19, 2025

Cohep Monitorea Las Elecciones Asegurando Un Proceso Justo

May 19, 2025