Federal Debt's Growing Impact On The Housing Market And Mortgages

Table of Contents

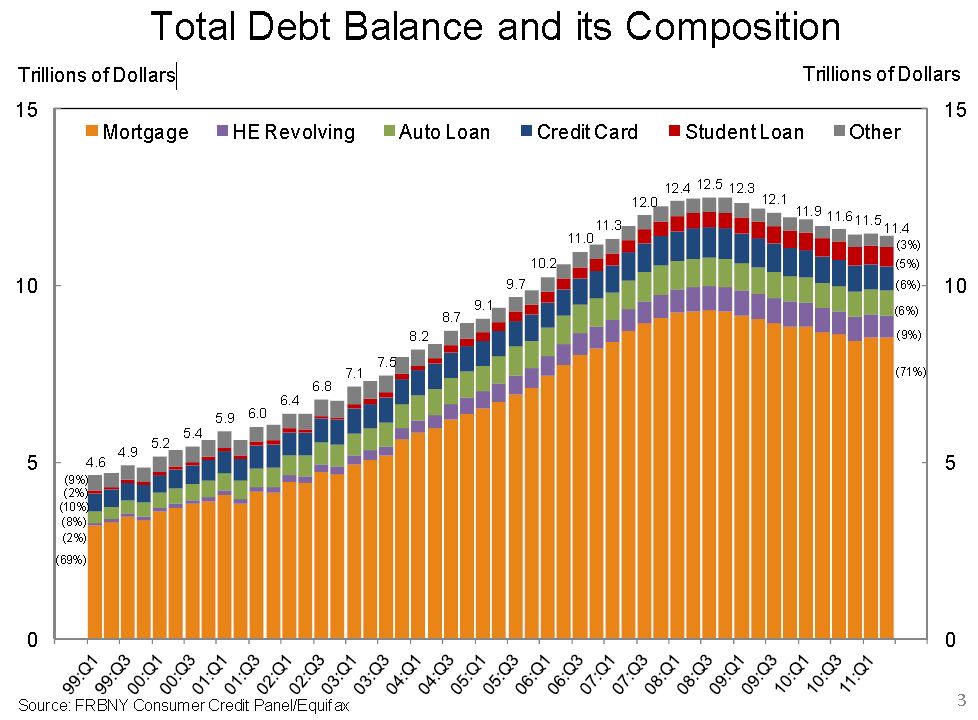

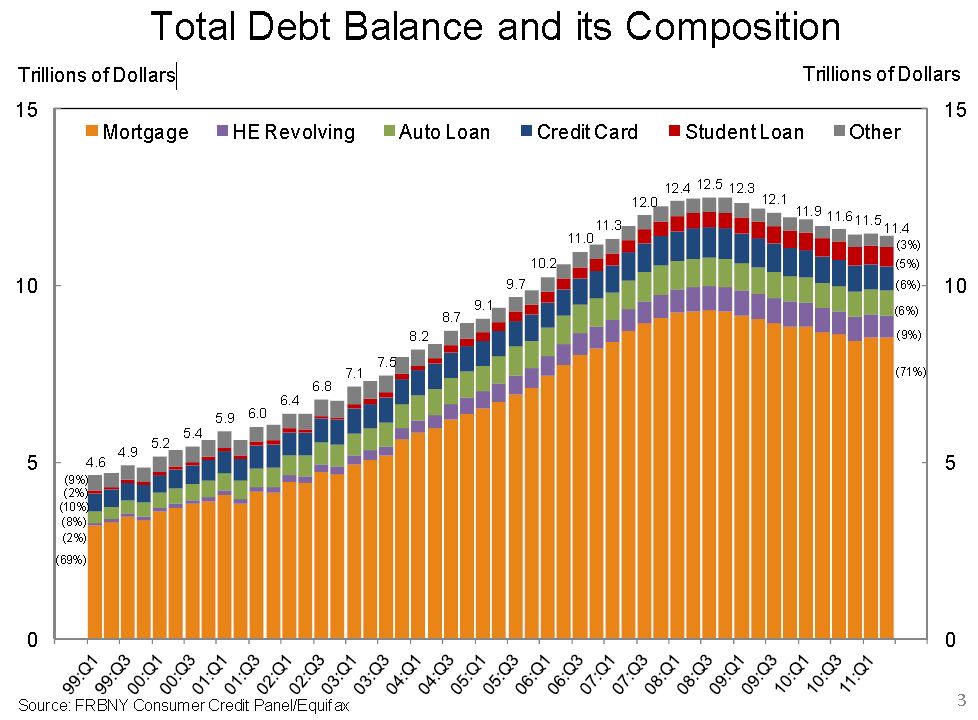

The Link Between Federal Debt and Interest Rates

How Government Borrowing Impacts Rates

Increased government borrowing significantly impacts interest rates, including those for mortgages. When the government needs to borrow money to finance its deficit, it issues Treasury bonds. This increased demand for loanable funds pushes up interest rates across the board.

- Increased competition for capital: Government borrowing competes with private sector borrowing for available funds, driving up the cost of borrowing for everyone.

- Impact on the 10-year Treasury yield: The yield on the 10-year Treasury bond is a benchmark for many other interest rates, including mortgages. A rise in the 10-year yield typically leads to higher mortgage rates.

- The role of the Federal Reserve: The Federal Reserve's monetary policy plays a crucial role. While the Fed can try to mitigate the impact, its actions are often influenced by the overall level of government debt and inflation.

Rising Mortgage Rates and Affordability

Higher interest rates translate directly into higher monthly mortgage payments. This makes homeownership less affordable, particularly for first-time homebuyers with limited savings.

- Calculation examples: A small increase in interest rates, even 0.5%, can significantly increase monthly payments over the life of a 30-year mortgage. This can mean the difference between qualifying for a loan and being priced out of the market.

- The effect on first-time homebuyers: First-time homebuyers are often the most vulnerable to rising mortgage rates, as they typically have less disposable income and smaller down payments.

- Geographical variations in impact: The impact of rising mortgage rates can vary geographically depending on local market conditions and housing prices. Areas with already high housing costs are particularly affected.

Inflation's Role in the Housing Market

Federal Debt and Inflationary Pressures

Increased government spending, often financed through borrowing, can contribute to inflationary pressures. When the money supply grows faster than the economy's ability to produce goods and services, prices rise.

- The quantity theory of money: This economic theory posits a direct relationship between the money supply and the price level. Increased government borrowing can lead to an expansion of the money supply, fueling inflation.

- The impact of inflation on home prices: Inflation increases the cost of building materials and labor, driving up home prices. This makes homes less affordable, even if mortgage rates remain relatively low.

- The Federal Reserve's response to inflation: The Federal Reserve often responds to high inflation by raising interest rates, which can further exacerbate the affordability challenges in the housing market.

Impact of Inflation on Home Prices and Mortgage Demand

Inflation significantly impacts both home prices and the overall demand for mortgages. As prices rise, affordability decreases, potentially leading to a slowdown in demand.

- Increased construction costs: Inflation increases the cost of building new homes, leading to higher prices for both new and existing homes.

- Changes in buyer behavior: High inflation can make buyers more cautious, leading to decreased demand and potentially a correction in the housing market.

- Potential for a housing market correction: If inflation persists and interest rates rise significantly, the housing market could experience a correction, with prices potentially declining.

Investor Confidence and Market Volatility

The Impact of High Debt on Investor Sentiment

Concerns about high federal debt can negatively impact investor confidence in the housing market. Investors may become hesitant to invest in real estate, fearing potential future economic instability.

- Reduced investment in real estate: Uncertainty about the future can lead to decreased investment in real estate development and construction.

- Potential for capital flight: Investors might seek safer investment opportunities outside the housing market, potentially reducing liquidity and increasing volatility.

- Effect on mortgage-backed securities: High levels of federal debt can increase the risk associated with mortgage-backed securities, potentially leading to lower prices and reduced demand.

Market Volatility and Uncertainty

Uncertainty surrounding the national debt contributes to increased volatility in the housing market. This makes it harder for both buyers and sellers to make informed decisions.

- Potential for price fluctuations: Market uncertainty can lead to significant price fluctuations, making it difficult to predict future housing values.

- Increased risk for lenders and borrowers: Increased volatility makes it riskier for lenders to provide mortgages and for borrowers to take on debt.

- The impact on long-term planning: The uncertainty surrounding the national debt makes long-term financial planning more challenging, especially for those considering purchasing a home.

Conclusion

Rising federal debt has a significant and far-reaching impact on the housing market and mortgages. It leads to higher interest rates, increased inflation, reduced investor confidence, and ultimately impacts housing affordability and mortgage accessibility. Understanding the federal debt's impact on housing market and mortgages is crucial for navigating the complexities of homeownership in the current economic climate. Stay informed about economic trends and plan wisely for your future homeownership goals. Consult government websites like the Treasury Department and the Federal Reserve, and seek advice from financial experts to better understand the complexities of federal debt and its implications for your personal finances.

Featured Posts

-

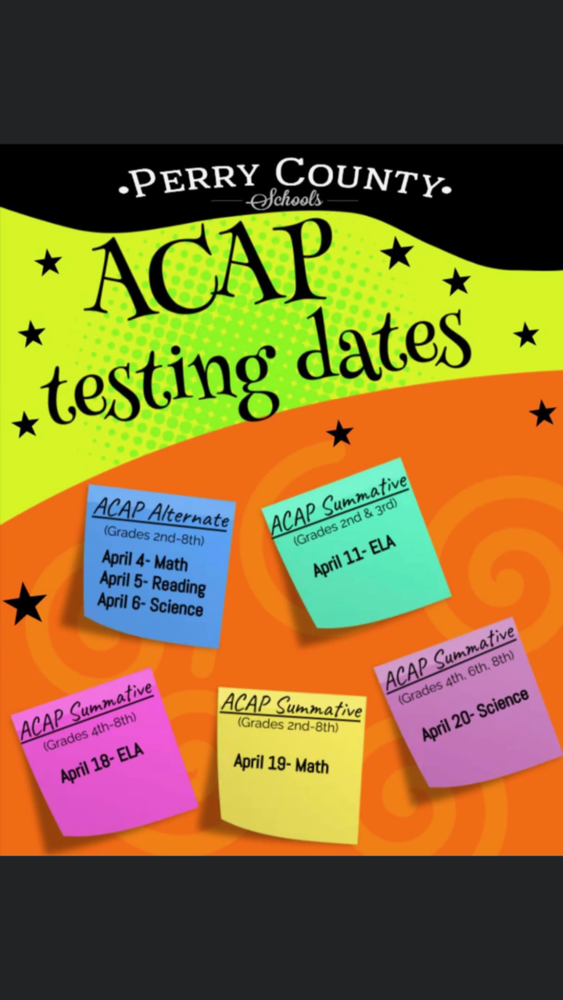

Addressing Budgetary Concerns In Perry County Schools The Role Of Enrollment Trends

May 19, 2025

Addressing Budgetary Concerns In Perry County Schools The Role Of Enrollment Trends

May 19, 2025 -

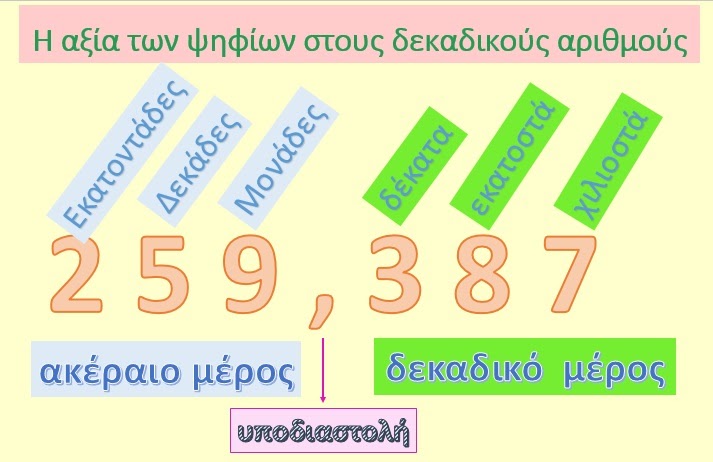

O Kateynasmos Sto Kypriako Mia Analysi Tis T Hesis Toy L Tzoymi

May 19, 2025

O Kateynasmos Sto Kypriako Mia Analysi Tis T Hesis Toy L Tzoymi

May 19, 2025 -

Achieve Chateau Style Easy Diy Projects For Every Home

May 19, 2025

Achieve Chateau Style Easy Diy Projects For Every Home

May 19, 2025 -

Florida State University Shooting Details Emerge About Victims Family Background

May 19, 2025

Florida State University Shooting Details Emerge About Victims Family Background

May 19, 2025 -

Eurovision 2025 United Kingdoms 19th Place Finish Analyzed

May 19, 2025

Eurovision 2025 United Kingdoms 19th Place Finish Analyzed

May 19, 2025