Federal Reserve Pauses Rate Hikes: Weighing Inflation And Economic Slowdown

Table of Contents

Inflation Remains a Key Concern

Despite previous rate hikes aimed at cooling the economy, inflation remains a persistent concern. While the rate of inflation has shown some signs of easing, it still significantly exceeds the Federal Reserve's target of 2%. This stubborn persistence highlights the complexity of the current economic landscape and the challenges faced by the central bank. Core inflation, which excludes volatile food and energy prices, also remains elevated, indicating broader price pressures across the economy.

The persistence of inflation can be attributed to several factors, including supply chain disruptions, robust consumer demand, and the lingering effects of fiscal stimulus. Understanding the components of core inflation is crucial. For example, the housing sector continues to contribute significantly to inflation due to high rental costs and home prices. Similarly, energy prices, though more volatile, can significantly impact the overall inflation rate.

Previous rate hikes have shown some impact, but the lag effect of monetary policy means the full effect of these increases may not be felt for several months. The Federal Reserve is carefully monitoring the data to assess the effectiveness of its past actions.

- Current CPI (Consumer Price Index): [Insert latest CPI figure and source]

- Current PCE (Personal Consumption Expenditures) Index: [Insert latest PCE figure and source]

- Significant Inflation Contributors: Housing, energy, and [mention other key sectors] are driving inflation.

- Lag Effects: The full impact of previous rate hikes on inflation may take 6-18 months to fully materialize.

Economic Slowdown – A Looming Threat

The Federal Reserve's decision to pause rate hikes also reflects growing concerns about a potential economic slowdown. Several indicators point towards a weakening economy. GDP growth has slowed, unemployment claims have risen in recent months, and consumer spending, a key driver of economic growth, shows signs of softening.

High interest rates, while intended to curb inflation, can negatively impact business investment and consumer confidence. Increased borrowing costs make it more expensive for businesses to expand and for consumers to make large purchases like homes and cars. This dampening effect can trigger a vicious cycle, leading to reduced economic activity and potentially a recession. The severity of a potential recession remains uncertain, but the possibility cannot be ignored.

- Recent GDP Growth: [Insert recent GDP growth figures and source]

- Unemployment Claims: [Insert latest unemployment claim numbers and source]

- Consumer Sentiment Index: [Insert recent consumer sentiment index and source]

- Housing Market Impact: High interest rates are already significantly impacting the housing market, leading to a decrease in sales and home prices.

The Fed's Balancing Act: Data Dependency and Future Rate Hikes

The Federal Reserve's decision-making process is characterized by "data dependency," meaning the central bank closely monitors a range of economic indicators before making policy decisions. This approach allows for flexibility and adjustments based on evolving economic conditions. The Fed will be meticulously scrutinizing inflation reports, employment data, consumer spending figures, and other key economic metrics to assess the overall health of the economy.

Future rate hikes remain a possibility, contingent on the trajectory of economic data. If inflation proves more persistent than anticipated, the Fed may resume raising interest rates to bring inflation back down to its target level. Conversely, if the economy weakens significantly, the Fed may choose to maintain the pause or even consider rate cuts to stimulate economic growth. This careful balancing act presents a complex challenge for the Federal Reserve.

- Upcoming Economic Data Releases: [List key upcoming economic data release dates]

- Potential Scenarios for Future Interest Rates: [Discuss potential scenarios, e.g., further hikes, pause, rate cuts]

- Risks of Further Rate Hikes: Risks include exacerbating a recession and harming economic growth.

- Risks of Pausing Rate Hikes: Risks include allowing inflation to become entrenched and requiring even more aggressive action in the future.

Conclusion: Understanding the Implications of the Federal Reserve's Pause

The Federal Reserve's pause on rate hikes reflects a delicate balancing act between controlling inflation and preventing a significant economic downturn. The central bank's decision emphasizes the importance of monitoring economic data closely. The long-term effects of this pause on various sectors of the economy, from housing to consumer spending, will be significant and need careful observation. The implications will ripple through the economy and investors should be prepared.

To make informed financial decisions, stay informed about future Federal Reserve pronouncements and related economic developments. This includes regularly reviewing economic data releases and analyzing expert commentary. Understanding the intricacies of "Federal Reserve pauses rate hikes" and their potential impact is crucial for both personal finance and investment strategies. Consider exploring resources like the Federal Reserve's website and reputable financial news outlets for ongoing updates.

Featured Posts

-

Racist Attack Family Left Devastated

May 09, 2025

Racist Attack Family Left Devastated

May 09, 2025 -

Expensive Babysitter Leads To Even Pricier Daycare One Mans Story

May 09, 2025

Expensive Babysitter Leads To Even Pricier Daycare One Mans Story

May 09, 2025 -

Williams F1 Teams Statement On Doohan As Colapinto Rumors Intensify

May 09, 2025

Williams F1 Teams Statement On Doohan As Colapinto Rumors Intensify

May 09, 2025 -

Ba Nguyen Thi A Thua Nhan Hanh Vi Bao Hanh Tre O Tien Giang

May 09, 2025

Ba Nguyen Thi A Thua Nhan Hanh Vi Bao Hanh Tre O Tien Giang

May 09, 2025 -

Materialist Premiere Dakota Johnsons Star Studded Family Support

May 09, 2025

Materialist Premiere Dakota Johnsons Star Studded Family Support

May 09, 2025

Latest Posts

-

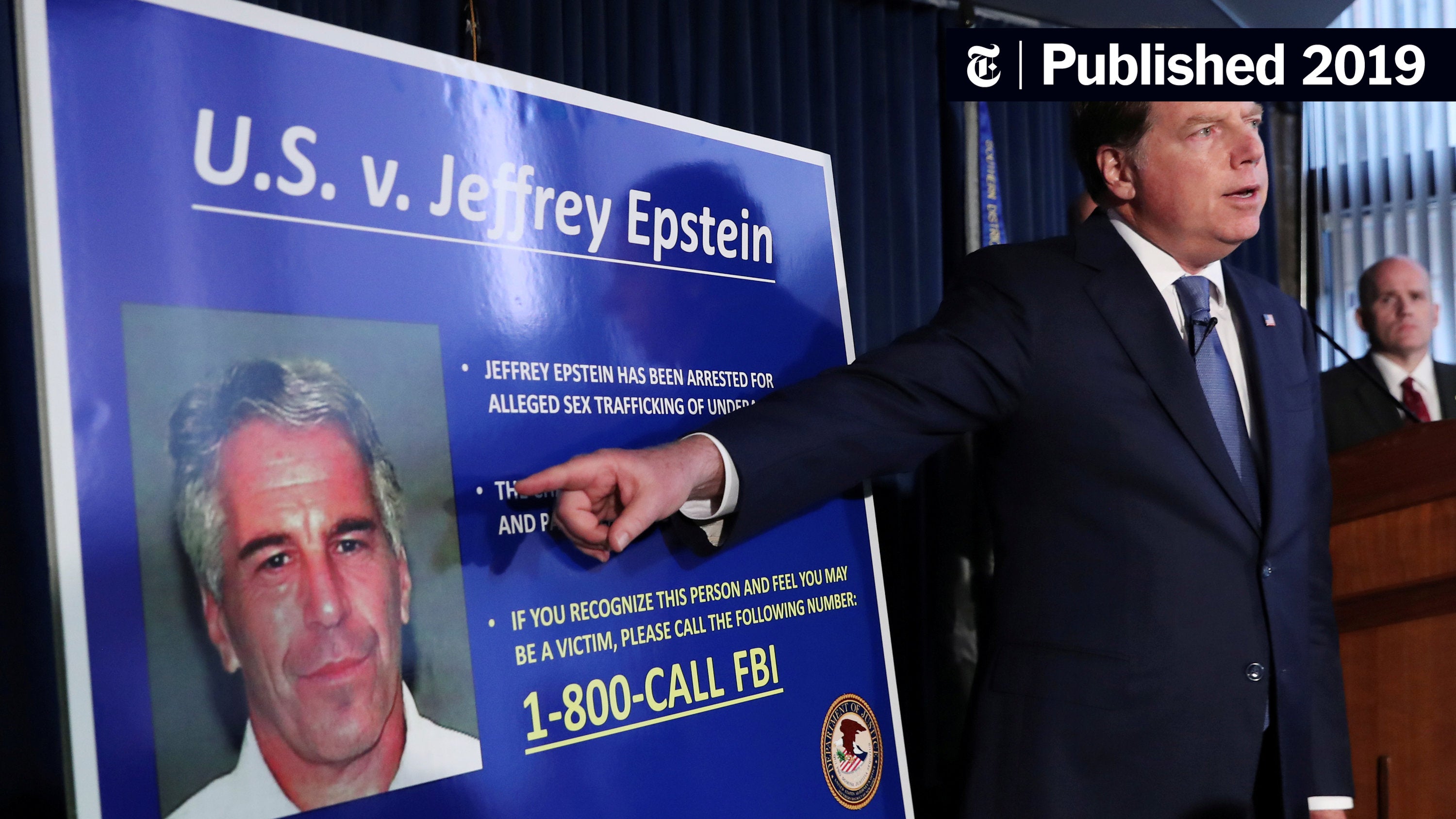

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025 -

Focusing On The Bigger Picture Why The Us Attorney Generals Fox News Appearances Matter

May 10, 2025

Focusing On The Bigger Picture Why The Us Attorney Generals Fox News Appearances Matter

May 10, 2025 -

The Us Attorney General And Fox News A Question Of Priorities

May 10, 2025

The Us Attorney General And Fox News A Question Of Priorities

May 10, 2025 -

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025 -

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025