Federal Student Loan Refinancing: A Comprehensive Guide

Table of Contents

Understanding Federal Student Loan Refinancing

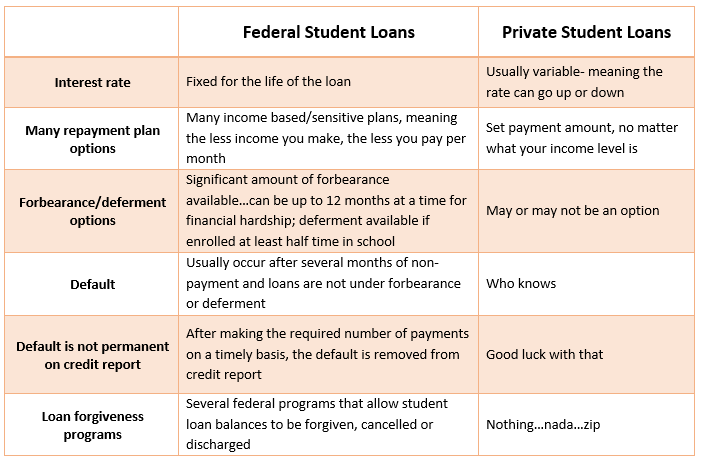

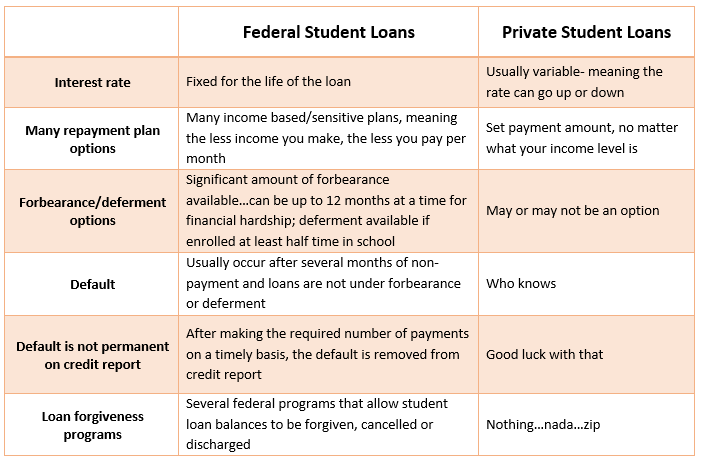

Before diving into refinancing, it's crucial to understand the difference between federal and private student loans. Federal student loans are offered by the government and often come with benefits like income-driven repayment plans and potential loan forgiveness programs. Private student loans, on the other hand, are offered by banks and credit unions and typically don't offer the same government protections.

Federal student loan refinancing involves replacing your existing federal student loans with a new private loan from a private lender. This process consolidates your multiple loans into a single, new loan with potentially more favorable terms.

Key Benefits of Federal Student Loan Refinancing:

- Reduced monthly payments: Lowering your monthly payment can significantly improve your cash flow.

- Lower overall interest paid: Refinancing to a lower interest rate can save you thousands of dollars over the life of the loan.

- Simplified repayment: Managing one loan instead of several simplifies your financial life.

- Potential for a shorter repayment period: Paying off your loan faster can lead to substantial savings.

Eligibility Requirements for Federal Student Loan Refinancing

Lenders have specific eligibility requirements for federal student loan refinancing. Meeting these requirements is essential for a successful application.

- Credit Score: Most lenders require a good to excellent credit score (typically 680 or higher). A higher credit score often translates to better interest rates.

- Income and Debt-to-Income Ratio: Lenders assess your income and debt-to-income ratio (DTI) to determine your ability to repay the loan. A lower DTI generally improves your chances of approval.

- Stable Employment History: Demonstrating a stable employment history, showing consistent income over time, is crucial for demonstrating your ability to repay the loan.

Key Requirements:

- Minimum credit score: Typically 680-700 or higher, but this varies by lender.

- Acceptable debt-to-income ratios: Generally below 43%, but again, lender specific.

- Required documentation: This usually includes proof of income (tax returns, pay stubs), employment history, and details of your existing federal student loans.

Choosing the Right Federal Student Loan Refinancing Lender

Choosing the right lender is crucial for securing the best possible terms for your federal student loan refinancing. Don't rush the process!

Compare lenders based on several factors:

- Interest rates: Compare fixed vs. variable interest rates offered by various lenders. Fixed rates offer predictability, while variable rates can fluctuate.

- Fees: Pay close attention to origination fees, prepayment penalties, and any other associated fees. These fees can significantly impact the overall cost.

- Customer service: Read online reviews and check customer satisfaction ratings to gauge the lender's reputation and responsiveness.

Factors to Consider:

- Compare interest rates from multiple lenders: Shop around and don't settle for the first offer you receive.

- Check for origination fees and prepayment penalties: These can add significant costs to your loan.

- Read online reviews and compare customer satisfaction ratings: Understand the lender's reputation before making a decision.

Understanding Interest Rates and Fees

Interest rates are a critical factor influencing the overall cost of refinancing. Fixed interest rates remain constant throughout the loan term, while variable rates fluctuate based on market conditions. Fees can include origination fees (charged upfront), prepayment penalties (charged if you pay off the loan early), and late payment fees. Carefully calculate the total cost of refinancing, considering both interest and fees, before making a decision.

The Application Process for Federal Student Loan Refinancing

The application process typically involves these steps:

- Gather necessary documents: Collect your tax returns, pay stubs, and details of your existing federal student loans.

- Complete the online application: Most lenders offer online applications for convenience.

- Provide required documentation: Submit all the necessary documentation to support your application.

- Wait for approval and loan disbursement: Once approved, the lender will disburse the funds, and your existing loans will be paid off.

Potential Downsides of Federal Student Loan Refinancing

While refinancing can offer significant benefits, it's essential to be aware of potential downsides:

- Loss of federal student loan benefits: Refinancing typically means you lose access to income-driven repayment plans and federal loan forgiveness programs.

- Potential for higher interest rates: If your credit score isn't strong, you might end up with a higher interest rate than anticipated.

- Unexpected fees: Hidden or unexpected fees can impact your overall savings.

Careful consideration of these drawbacks is crucial before proceeding with refinancing.

Conclusion

Federal student loan refinancing can be a powerful tool for managing your student loan debt, potentially leading to lower monthly payments and significant long-term savings. However, it's essential to carefully weigh the benefits against potential drawbacks, such as the loss of federal student loan benefits. Researching and comparing lenders, understanding eligibility requirements, and carefully evaluating interest rates and fees are crucial steps in making an informed decision. Ready to explore your options for federal student loan refinancing and potentially save thousands? Start comparing lenders today and take control of your student loan debt!

Featured Posts

-

Gwendoline Christie From Game Of Thrones To Severance Embracing The Challenge

May 17, 2025

Gwendoline Christie From Game Of Thrones To Severance Embracing The Challenge

May 17, 2025 -

Reddit Experiencing Widespread Outage Thousands Affected

May 17, 2025

Reddit Experiencing Widespread Outage Thousands Affected

May 17, 2025 -

Ralph Lauren Fall 2025 Riser Collection Details And Runway Highlights

May 17, 2025

Ralph Lauren Fall 2025 Riser Collection Details And Runway Highlights

May 17, 2025 -

Severance Ben Stillers Lumon Industries Compared To Apple

May 17, 2025

Severance Ben Stillers Lumon Industries Compared To Apple

May 17, 2025 -

Is Reddit Experiencing An Outage Right Now

May 17, 2025

Is Reddit Experiencing An Outage Right Now

May 17, 2025