Fed's Rate Hike Pause: A Different Approach To Global Central Banks

Table of Contents

<p>The Federal Reserve's recent pause on interest rate hikes marks a significant divergence from the strategies employed by many global central banks. While numerous countries continue aggressive tightening measures to combat inflation, the Fed's decision reflects a unique assessment of the US economic landscape. This article will explore the reasons behind the Fed's pause and compare its approach to other central banking strategies worldwide, examining the implications of this divergent path on global markets and the long-term economic outlook.</p>

<h2>The Rationale Behind the Fed's Pause</h2>

<h3>Assessing the Impact of Previous Hikes</h3>

<p>The lagged effects of interest rate increases are substantial. It takes time for monetary policy changes to fully permeate the economy and impact inflation and economic growth. The Fed's pause acknowledges this lag, allowing time to fully assess the impact of previous rate hikes.</p>

<ul> <li><strong>Evidence of slowing inflation:</strong> While inflation remains above the Fed's target, recent data shows a clear deceleration in the rate of price increases.</li> <li><strong>Potential for recession:</strong> Aggressive rate hikes increase the risk of triggering a recession, a consequence the Fed is carefully weighing.</li> <li><strong>Labor market dynamics:</strong> Although the unemployment rate remains low, there are signs of softening in the labor market, suggesting potential future impacts on inflation.</li> </ul>

<p>Analyzing data on inflation rates (like the Consumer Price Index – CPI), unemployment figures (as reported by the Bureau of Labor Statistics – BLS), and GDP growth provides crucial evidence supporting the Fed's decision. The recent slowing of inflation, coupled with concerns about potential economic contraction, contributed significantly to the pause.</p>

<h3>Data-Driven Decision Making</h3>

<p>The Fed's monetary policy is fundamentally data-driven. The central bank meticulously analyzes a wide range of economic indicators to inform its decisions.</p>

<ul> <li><strong>Importance of core inflation:</strong> The Fed pays close attention to core inflation (excluding volatile food and energy prices) as a more accurate measure of underlying inflationary pressures.</li> <li><strong>Employment reports:</strong> Data on employment levels, wage growth, and labor participation are critical indicators of economic health and inflationary pressures.</li> <li><strong>Consumer confidence indices:</strong> Consumer sentiment and spending patterns provide valuable insights into the overall economic climate.</li> </ul>

<p>The Fed interprets this data using sophisticated econometric models and expert judgment to project future economic trends and fine-tune its monetary policy strategy. This data-driven approach underpins its decision to pause rate hikes, allowing for further analysis before committing to further tightening.</p>

<h2>Global Central Bank Strategies: A Comparative Analysis</h2>

<h3>European Central Bank (ECB)</h3>

<p>In contrast to the Fed's pause, the European Central Bank (ECB) has continued its aggressive interest rate hikes. The Eurozone faces stubbornly high inflation, necessitating a more forceful response.</p>

<ul> <li><strong>Inflation levels in the Eurozone:</strong> Inflation in the Eurozone remains significantly higher than the ECB's target, driving its continued tightening.</li> <li><strong>ECB's inflation target:</strong> The ECB's commitment to its price stability mandate necessitates sustained efforts to bring inflation down to its target level.</li> <li><strong>Potential economic challenges:</strong> The ECB faces the difficult task of balancing inflation control with the risk of slowing economic growth and potentially triggering a recession.</li> </ul>

<p>The contrasting economic landscapes of the US and the Eurozone, particularly differences in energy dependence and supply chain disruptions, explain the divergence in central bank responses. The Eurozone's higher inflation rate necessitates a more assertive monetary policy response.</p>

<h3>Bank of England (BOE)</h3>

<p>The Bank of England (BOE) also faces unique challenges influencing its interest rate strategy. The UK's post-Brexit economic landscape, coupled with an ongoing energy crisis, complicates its monetary policy decisions.</p>

<ul> <li><strong>UK inflation rates:</strong> High inflation in the UK necessitates rate hikes, but the severity of the energy crisis necessitates a cautious approach.</li> <li><strong>Brexit's economic impact:</strong> The economic consequences of Brexit continue to impact the UK's economic performance and influence monetary policy.</li> <li><strong>Energy crisis:</strong> The energy crisis significantly contributes to inflationary pressures in the UK, presenting a major challenge for the BOE.</li> </ul>

<p>The BOE's approach reflects a delicate balancing act between controlling inflation and supporting economic growth in the face of significant external shocks. The unique challenges faced by the UK economy necessitate a distinct monetary policy approach compared to the US or the Eurozone.</p>

<h3>Other Global Central Banks</h3>

<p>Other major central banks around the globe have adopted diverse strategies, reflecting the unique economic circumstances in each region. For example, the Bank of Japan maintains an extremely accommodative monetary policy, while the Reserve Bank of Australia and the Bank of Canada have adopted intermediate approaches.</p>

<ul> <li><strong>Japan:</strong> Maintaining a highly accommodative monetary policy.</li> <li><strong>Canada:</strong> A more measured approach to rate hikes than the ECB or BOE.</li> <li><strong>Australia:</strong> Similar to Canada, exhibiting a cautious approach to rate adjustments.</li> </ul>

<p>These diverse responses highlight the global heterogeneity in economic conditions and the tailored approach required by central banks worldwide in managing inflation and promoting economic growth.</p>

<h2>Potential Implications of the Divergent Approaches</h2>

<h3>Impact on Global Markets</h3>

<p>The differing monetary policies pursued by global central banks significantly impact global financial markets. These variations create volatility and uncertainty, influencing currency exchange rates and investment flows.</p>

<ul> <li><strong>Potential for currency fluctuations:</strong> Differing interest rate policies lead to fluctuations in exchange rates, potentially affecting international trade and investment.</li> <li><strong>Impact on international trade:</strong> Changes in exchange rates resulting from divergent monetary policies can influence the competitiveness of exports and imports.</li> <li><strong>Effects on global financial markets:</strong> The overall uncertainty created by these differing policies can lead to increased market volatility and risk aversion.</li> </ul>

<p>Investors must carefully consider the implications of these divergent monetary policies when making investment decisions. The potential for currency fluctuations and increased market volatility necessitates a nuanced approach to portfolio management.</p>

<h3>Long-Term Economic Outlook</h3>

<p>The long-term economic consequences of these varied strategies are complex and uncertain. The Fed's pause could lead to sustained economic growth, but it also carries the risk of allowing inflation to become entrenched or triggering a delayed recession.</p>

<ul> <li><strong>Sustained economic growth:</strong> The pause could support continued economic expansion by avoiding a sharp economic contraction.</li> <li><strong>Potential for recession:</strong> If inflation proves more persistent than anticipated, the Fed may need to resume rate hikes, increasing the risk of a recession.</li> <li><strong>Inflation control:</strong> The success of the Fed's strategy will hinge on its ability to control inflation without sacrificing economic growth.</li> </ul>

<p>The future trajectory of the global economy will depend significantly on the effectiveness of these diverse monetary policy approaches. Further analysis and monitoring of economic indicators are crucial to understanding the long-term consequences.</p>

<h2>Conclusion</h2>

<p>The Fed's decision to pause interest rate hikes represents a significant departure from the strategies adopted by many global central banks. This divergence reflects differing economic conditions and priorities, with each central bank navigating a unique set of challenges. The long-term implications of these contrasting approaches remain to be seen, impacting global markets and the future trajectory of the global economy. The interplay between inflation, economic growth, and the varied responses of central banks around the world will continue to shape the global economic landscape in the coming years.</p>

<p><strong>Call to Action:</strong> Understanding the intricacies of the Fed's rate hike pause and its global context is crucial for informed decision-making. Stay informed about the evolving landscape of global monetary policy and the future implications of the Fed's approach to the Fed rate hike pause. Further research into the implications of these differing strategies is essential for investors, policymakers, and anyone interested in the future of the global economy.</p>

Featured Posts

-

Your Guide To The Nl Federal Election Candidates

May 09, 2025

Your Guide To The Nl Federal Election Candidates

May 09, 2025 -

Find Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025

Find Live Music And Events In Lake Charles This Easter Weekend

May 09, 2025 -

Stock Market Live Sensex And Nifty Gains Key Movers Today

May 09, 2025

Stock Market Live Sensex And Nifty Gains Key Movers Today

May 09, 2025 -

Britannian Kuninkaallinen Perimysjaerjestys Ajankohtainen Lista

May 09, 2025

Britannian Kuninkaallinen Perimysjaerjestys Ajankohtainen Lista

May 09, 2025 -

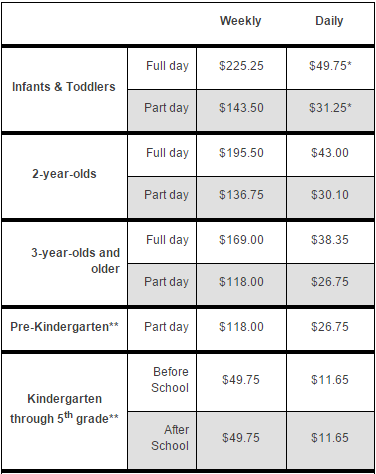

Expensive Babysitter Costs A Man Even More In Daycare Fees

May 09, 2025

Expensive Babysitter Costs A Man Even More In Daycare Fees

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025