Finance Loans 101: Your Complete Guide To Applying For Loans

Table of Contents

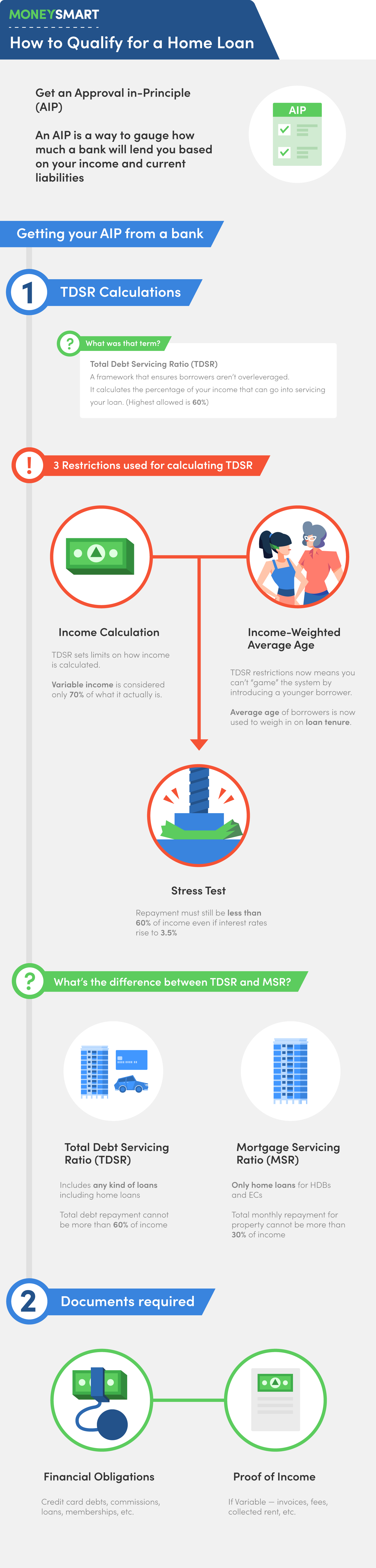

Understanding Different Types of Finance Loans

Finance loans come in various forms, each designed for specific purposes. Understanding these differences is crucial for choosing the right loan for your needs.

- Personal Loans: These are unsecured loans used for various purposes, from debt consolidation to home improvements. Example: Paying off high-interest credit card debt. Key Differences: Typically higher interest rates than secured loans, shorter repayment terms. Related keywords: personal loan interest rates, personal loan calculator.

- Auto Loans: Used to finance the purchase of a vehicle. Example: Buying a new or used car. Key Differences: Secured by the vehicle itself, lower interest rates than personal loans, longer repayment terms. Related keywords: auto loan financing, car loan interest rates.

- Mortgage Loans: Large loans used to purchase a home or other real estate. Example: Buying a house. Key Differences: Secured by the property, longest repayment terms (often 15-30 years), interest rates vary significantly. Related keywords: mortgage loan calculator, mortgage rates, home loan options.

- Student Loans: Help finance higher education costs. Example: Paying for college tuition and fees. Key Differences: Often government-backed, repayment begins after graduation, interest rates and repayment terms vary depending on the loan type. Related keywords: student loan repayment, federal student loans, private student loans.

- Business Loans: Used to fund business operations, expansion, or start-up costs. Example: Purchasing equipment for a small business. Key Differences: Eligibility criteria are stricter, interest rates vary depending on the business's creditworthiness and loan type. Related keywords: small business loan applications, SBA loans, business loan interest rates.

Assessing Your Financial Eligibility for a Loan

Before applying for a finance loan, assess your financial health to increase your chances of approval.

- Credit Score: Lenders heavily rely on your credit score to evaluate your creditworthiness. A higher credit score generally leads to better loan terms. Related keywords: credit score check, free credit report, how to improve credit score.

- Steps to Improve Credit Score: Pay bills on time, keep credit utilization low, maintain a diverse credit history.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI indicates a greater ability to repay a loan. Related keywords: debt to income ratio calculator, improve debt to income ratio.

- Calculating DTI: Divide your total monthly debt payments by your gross monthly income. A DTI below 36% is generally considered good for loan applications.

- Loan Pre-Approval: Getting pre-approved for a loan gives you a clearer understanding of your borrowing power and helps streamline the application process. Related keywords: loan pre-approval, pre-qualification for a loan.

The Loan Application Process: A Step-by-Step Guide

Applying for a finance loan involves several steps. Following these steps carefully will increase your chances of success.

- Researching Lenders: Compare different lenders based on interest rates, fees, and customer reviews. Related keywords: best loan lenders, compare loan offers.

- Completing Applications: Fill out the loan application form accurately and completely, providing all the necessary documentation. Related keywords: loan application form, online loan application.

- Necessary Documents: Proof of income (pay stubs, tax returns), identification (driver's license, passport), bank statements.

- Providing Documentation: Gather all required documents and submit them to the lender. Ensure all information is accurate and up-to-date. Related keywords: loan documentation, supporting documents for loan application.

Comparing Loan Offers and Choosing the Right Lender

Once you receive loan offers, carefully compare them before making a decision.

- Interest Rates & Fees: Compare Annual Percentage Rates (APRs), origination fees, and any other associated charges. Related keywords: loan interest rate comparison, loan fees, APR calculator.

- Repayment Terms: Consider the loan term's length and the corresponding monthly payments. Choose a repayment plan that fits your budget. Related keywords: loan repayment schedule, amortization schedule.

- Lender Reputation & Customer Service: Research the lender's reputation and read customer reviews to ensure they are trustworthy and provide good customer service. Related keywords: lender reviews, reputable lenders, best loan providers.

- Tips for Negotiating Better Loan Terms: Shop around for the best rates, negotiate fees, and leverage your credit score.

- Resources for Finding Reputable Lenders: Check with the Better Business Bureau, review online lender ratings and compare different loan offers.

Managing Your Loan Repayments Effectively

Once you secure a finance loan, effective repayment management is essential.

- Creating a Repayment Plan: Develop a budget that includes your loan payments to avoid missed payments. Related keywords: loan repayment schedule, budgeting for loans.

- Tips for Staying on Track: Set up autopay, use budgeting apps, and track your payments regularly.

- Consequences of Missed Payments: Missed payments can negatively impact your credit score and lead to additional fees or penalties. Related keywords: avoid loan default, late payment fees.

- Financial Assistance: If you face financial hardship, explore options like loan modification or debt management programs. Related keywords: debt management, debt consolidation, financial hardship assistance.

Conclusion: Making Informed Decisions with Finance Loans

Securing finance loans requires careful planning and understanding of the process. This guide provided a comprehensive overview, from identifying your loan needs and understanding different loan types to assessing your eligibility, applying for a loan, and managing repayments effectively. Remember to research lenders, compare loan offers, and choose a repayment plan that aligns with your financial capabilities. By following these steps, you can make informed decisions and confidently navigate the world of finance loans.

Ready to take control of your finances? Start exploring your finance loan options today! [Link to a reputable loan comparison website]

Featured Posts

-

Brewers Vs Diamondbacks Prediction Picks And Odds For Todays Mlb Game

May 28, 2025

Brewers Vs Diamondbacks Prediction Picks And Odds For Todays Mlb Game

May 28, 2025 -

The Kanye West Bianca Censori Union A Critical Examination Of Control

May 28, 2025

The Kanye West Bianca Censori Union A Critical Examination Of Control

May 28, 2025 -

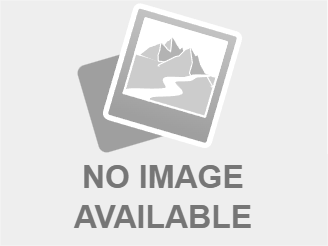

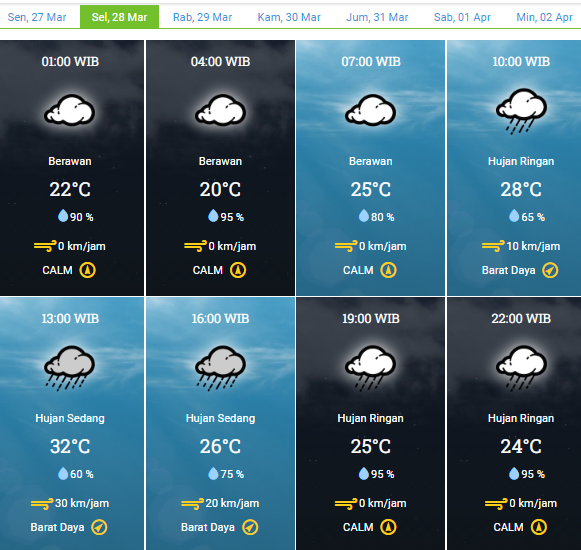

Cuaca Kaltim Hari Ini Update Terbaru Ikn Balikpapan Samarinda

May 28, 2025

Cuaca Kaltim Hari Ini Update Terbaru Ikn Balikpapan Samarinda

May 28, 2025 -

Hot Ones Hailee Steinfelds Kansas City Chiefs Shout Out

May 28, 2025

Hot Ones Hailee Steinfelds Kansas City Chiefs Shout Out

May 28, 2025 -

Cuaca Bandung 26 Maret 2024 Peringatan Hujan Dan Informasi Lengkap

May 28, 2025

Cuaca Bandung 26 Maret 2024 Peringatan Hujan Dan Informasi Lengkap

May 28, 2025

Latest Posts

-

Recours De L Etat Le Projet A69 Pourrait Reprendre Malgre Son Annulation

May 30, 2025

Recours De L Etat Le Projet A69 Pourrait Reprendre Malgre Son Annulation

May 30, 2025 -

Greve Sncf Imminente Le Ministre S Exprime Sur Le Chaos

May 30, 2025

Greve Sncf Imminente Le Ministre S Exprime Sur Le Chaos

May 30, 2025 -

Greve A La Sncf L Avis De Philippe Tabarot Sur Les Revendications Des Syndicats

May 30, 2025

Greve A La Sncf L Avis De Philippe Tabarot Sur Les Revendications Des Syndicats

May 30, 2025 -

An Insiders Guide To Paris Best Neighborhoods

May 30, 2025

An Insiders Guide To Paris Best Neighborhoods

May 30, 2025 -

Philippe Tabarot Conteste La Legitimite Des Revendications Lors De La Greve Sncf

May 30, 2025

Philippe Tabarot Conteste La Legitimite Des Revendications Lors De La Greve Sncf

May 30, 2025