Finance Minister's Meeting With Deutsche Bank Executives: Key Discussion Points

Table of Contents

Strengthening Financial Stability in Germany and Beyond

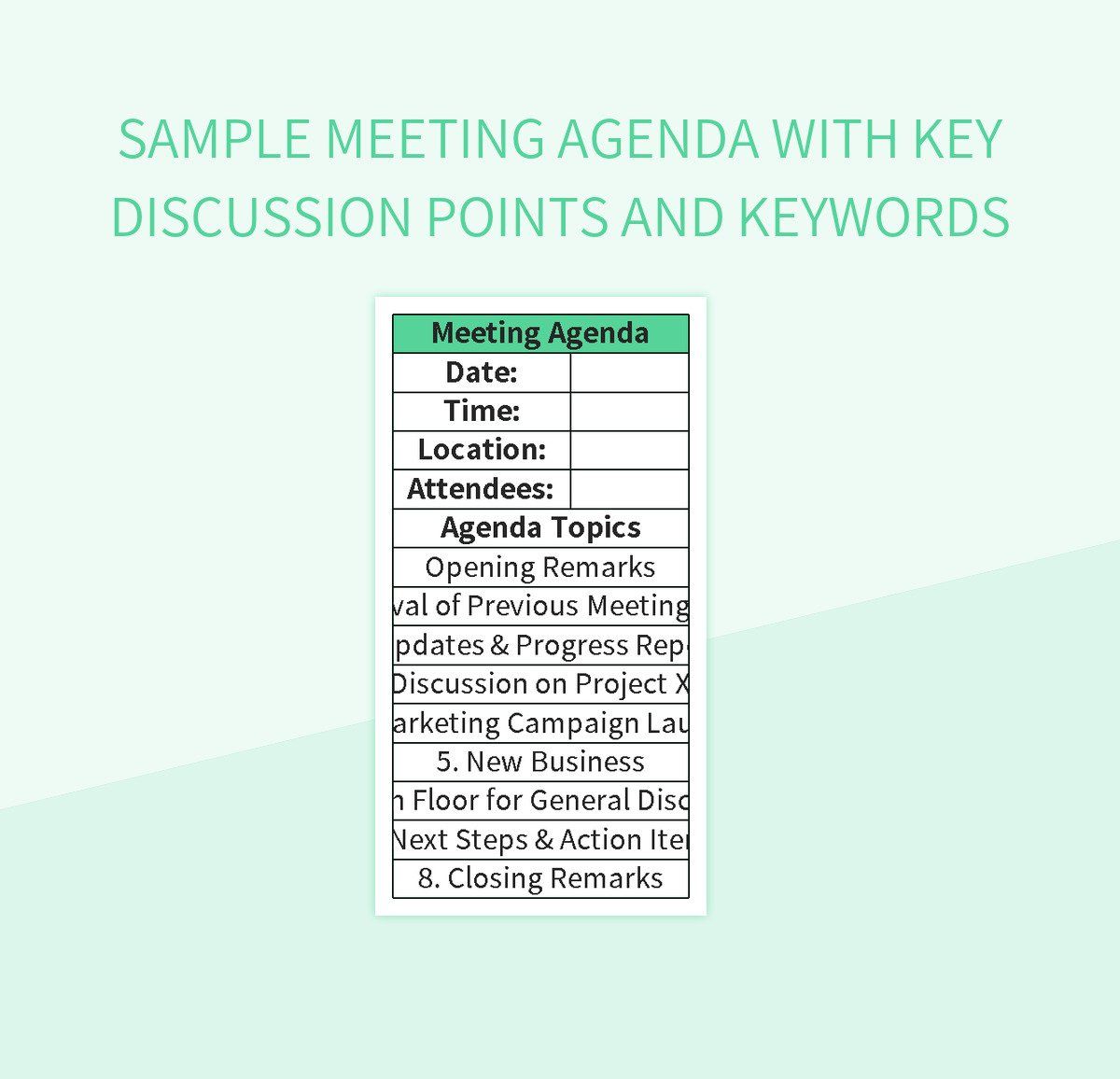

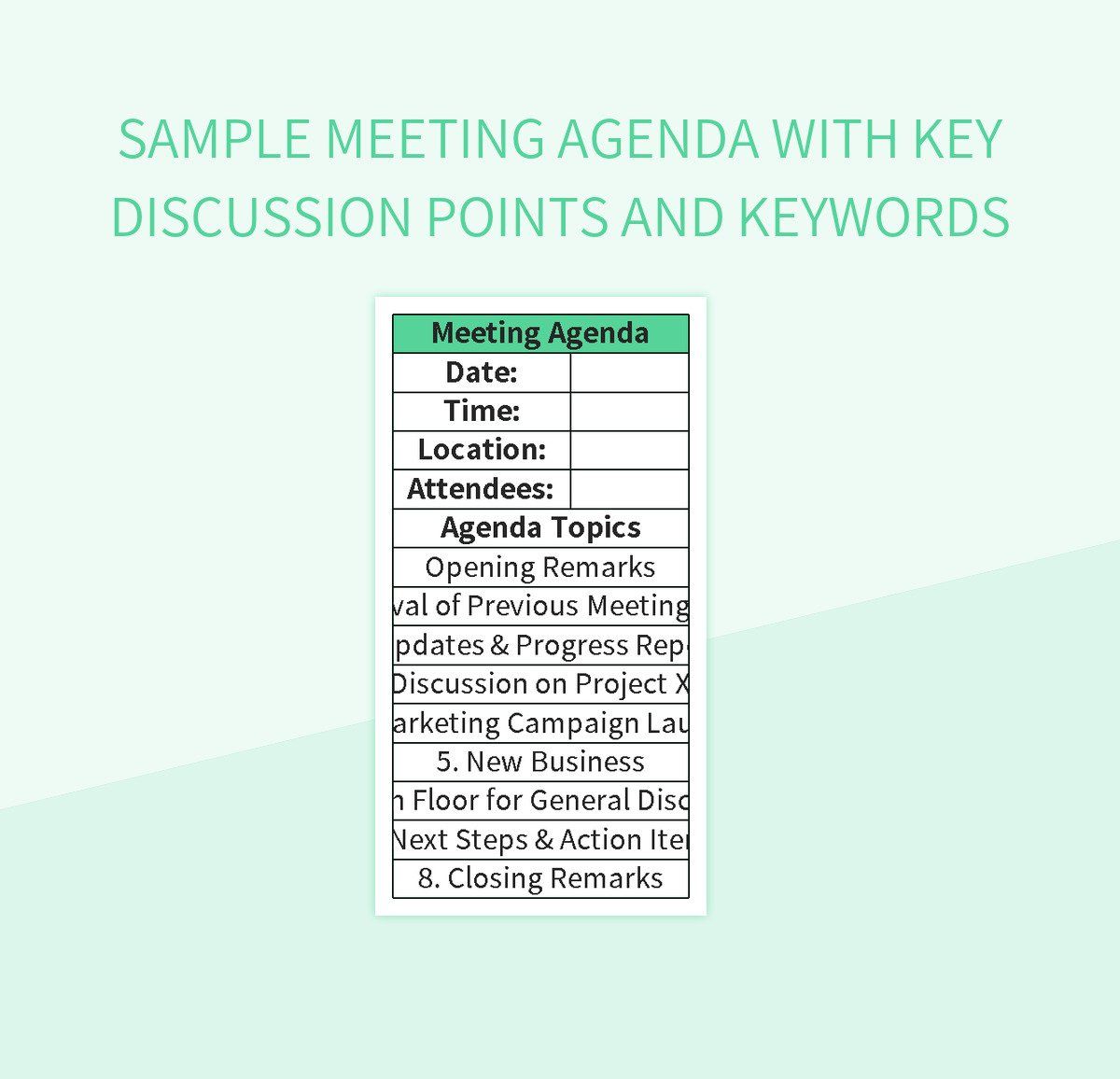

The meeting placed significant emphasis on bolstering financial stability within Germany and mitigating potential risks to the broader European and global economies. Keywords such as financial stability, risk management, and banking regulations dominated the conversation. Key aspects discussed included:

-

Enhanced Risk Management Practices: The discussions explored strengthening risk management practices not only within Deutsche Bank but across the entire German banking sector. This involved a comprehensive review of existing frameworks and the implementation of advanced risk assessment models to proactively identify and manage potential threats. Improved internal controls and stricter oversight were key themes.

-

Regulatory Reforms for Enhanced Stability: The Finance Minister and Deutsche Bank executives explored potential regulatory reforms designed to enhance financial stability and prevent future crises. This included discussions on capital adequacy requirements, stress testing methodologies, and the potential need for stricter oversight of systemically important financial institutions.

-

Navigating Global Economic Uncertainties: The impact of global economic uncertainties, including geopolitical risks and inflationary pressures, on Germany's financial system was a central focus. Strategies to mitigate these external shocks and maintain the resilience of the German economy were debated.

-

Mitigating Systemic Risk: A significant portion of the meeting addressed the crucial need to mitigate systemic risk. This involved enhanced cooperation between the government and financial institutions, including mechanisms for information sharing and coordinated responses to potential crises.

Boosting Economic Growth Through Strategic Investment

Stimulating economic growth through targeted investment was another key discussion point. The conversation centered around economic growth, investment strategies, infrastructure projects, and public-private partnerships. Specific areas addressed included:

-

Investment Opportunities for Growth: The meeting explored various investment opportunities designed to stimulate economic growth in Germany, focusing on sectors with high growth potential and job creation capacity. This included renewable energy, digital infrastructure, and advanced manufacturing.

-

Public-Private Partnerships: Discussions focused on leveraging public-private partnerships (PPPs) to finance large-scale infrastructure projects. The aim was to attract private sector capital while ensuring alignment with national economic priorities.

-

Incentivizing Private Sector Investment: The Finance Minister and Deutsche Bank executives discussed incentives and policies to encourage greater private sector investment in key industries. Tax breaks, streamlined regulatory processes, and targeted subsidies were among the options explored.

-

Attracting Foreign Direct Investment: Strategies to attract foreign direct investment (FDI) and enhance Germany's global competitiveness were also discussed. This included improving the business environment, simplifying investment procedures, and promoting Germany as an attractive investment destination.

The Role of Deutsche Bank in National Economic Development

Deutsche Bank's role in supporting national economic objectives was explicitly addressed. This section focused on keywords like Deutsche Bank, national economic development, corporate social responsibility, sustainable finance, and ESG investing. Key discussion points included:

-

Supporting National Economic Goals: The meeting explored how Deutsche Bank can actively contribute to achieving national economic goals, including sustainable development and inclusive growth.

-

Sustainable Finance and ESG Investing: The commitment of Deutsche Bank to sustainable finance and Environmental, Social, and Governance (ESG) investing was a central theme. Discussions focused on aligning the bank's investment strategies with national sustainability priorities.

-

Corporate Social Responsibility Initiatives: The bank's corporate social responsibility (CSR) initiatives and their contribution to the overall well-being of German society were evaluated.

-

Future Collaboration: The meeting explored opportunities for future collaborations between the government and Deutsche Bank to support national economic development goals.

Addressing Regulatory Challenges and Reforms

The meeting also addressed the evolving regulatory landscape and the challenges faced by financial institutions. Key terms included regulatory reforms, financial regulations, compliance, anti-money laundering, and fintech regulation. Significant discussion revolved around:

-

Navigating Evolving Regulations: The challenges related to compliance with constantly evolving financial regulations were openly discussed. This involved streamlining compliance processes and ensuring sufficient resources are allocated to meet regulatory requirements.

-

Combating Financial Crime: Strengthening anti-money laundering (AML) measures and combating financial crime were high on the agenda. This included enhancing due diligence procedures, improving information sharing, and strengthening international cooperation.

-

Adapting to Fintech Innovation: The rapid growth of fintech and digital banking necessitated discussions on adapting regulations to foster innovation while mitigating associated risks. Finding a balance between promoting innovation and maintaining financial stability was paramount.

-

Improving Regulatory Clarity and Efficiency: The meeting addressed the need for clearer and more efficient regulatory processes to reduce burdens on businesses and encourage innovation.

Conclusion

The meeting between the Finance Minister and Deutsche Bank executives covered vital aspects of financial stability, economic growth, and regulatory reform. Discussions focused on strengthening risk management, boosting investment, and adapting to evolving regulatory landscapes. The outcome will significantly shape Germany's financial future and its role in the global economy. The emphasis on collaboration between the government and private sector suggests a proactive approach to addressing economic challenges and securing Germany's continued prosperity.

Call to Action: Stay informed about the implications of this crucial Finance Minister's meeting with Deutsche Bank executives. Follow our updates for further analysis of the key discussion points and their potential impact on the German and global financial systems. For more in-depth analysis on the Finance Minister's meeting with Deutsche Bank executives, subscribe to our newsletter.

Featured Posts

-

Illegal Vehicle Registrations The Drain On Virginias Revenue From Maryland Drivers

May 30, 2025

Illegal Vehicle Registrations The Drain On Virginias Revenue From Maryland Drivers

May 30, 2025 -

Odiado Tenista Argentino Confiesa Marcelo Rios Un Dios Del Tenis

May 30, 2025

Odiado Tenista Argentino Confiesa Marcelo Rios Un Dios Del Tenis

May 30, 2025 -

Is Bruno Fernandes Leaving Manchester United For Al Hilal

May 30, 2025

Is Bruno Fernandes Leaving Manchester United For Al Hilal

May 30, 2025 -

Ekstrennoe Preduprezhdenie Mada Ekstremalnye Pogodnye Usloviya V Izraile

May 30, 2025

Ekstrennoe Preduprezhdenie Mada Ekstremalnye Pogodnye Usloviya V Izraile

May 30, 2025 -

Province Expands Advanced Care Paramedic Services In Rural And Northern Manitoba

May 30, 2025

Province Expands Advanced Care Paramedic Services In Rural And Northern Manitoba

May 30, 2025