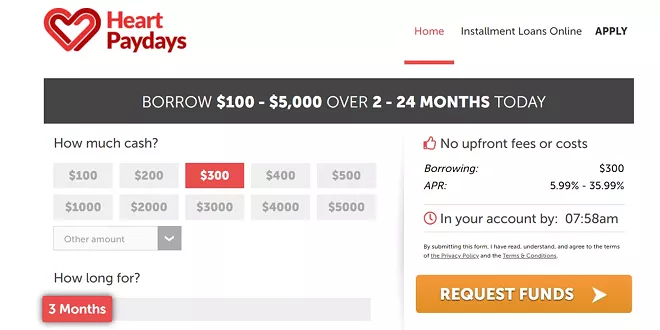

Find The Best Direct Payday Loan With Guaranteed Approval Despite Bad Credit

Table of Contents

Understanding Direct Payday Loans and Guaranteed Approval

Direct payday loans connect you directly with a lender, eliminating the need for intermediaries like brokers. This often translates to faster funding and a simplified application process. The convenience of a direct payday loan is a significant advantage for those facing urgent financial needs. However, the term "guaranteed approval," frequently used in advertising, requires clarification. While lenders may advertise guaranteed approval for payday loans, it's crucial to understand that approval is still contingent upon meeting specific eligibility criteria. This means your application will still undergo a review process.

- Faster funding: Direct payday loans typically offer faster funding compared to traditional loans or loans processed through brokers.

- Direct lender interaction: Dealing directly with the lender streamlines communication and simplifies the process.

- Simplified application process: The application process for a direct payday loan is often quicker and less complex than traditional loan applications.

- Higher interest rates: The "guaranteed approval" aspect often comes with a higher interest rate to compensate for the increased risk associated with lending to individuals with less-than-perfect credit.

Factors Affecting Your Approval Chances for a Payday Loan

Several factors influence your chances of approval for a direct payday loan, even with bad credit. While your credit score is a significant factor, lenders also consider other aspects of your financial situation. Understanding these factors is crucial for increasing your chances of securing a loan.

- Regular income verification: Lenders need proof of consistent income to assess your ability to repay the loan. This usually involves providing pay stubs or bank statements.

- Employment stability: A stable employment history demonstrates your ability to consistently generate income to cover loan repayments.

- Debt-to-income ratio: Lenders evaluate your debt compared to your income to determine your ability to manage additional debt. A high debt-to-income ratio can reduce your chances of approval.

- Current banking information: Providing accurate and current banking details is essential for the loan disbursement and repayment process.

- Age and residency requirements: Most lenders have minimum age and residency requirements that must be met to be eligible for a payday loan.

Finding Reputable Direct Payday Lenders

Navigating the payday loan landscape requires caution to avoid scams and predatory lenders. Thorough research is essential to ensure you choose a legitimate and trustworthy lender.

- Check online reviews and ratings: Look for independent reviews and ratings from previous borrowers to gauge the lender's reputation and customer service.

- Verify licensing and registration: Confirm that the lender is licensed and registered with the relevant authorities in your state or region.

- Look for transparent fee structures and interest rates: Avoid lenders who are vague about fees and interest rates. Transparency is a key indicator of a reputable lender.

- Beware of lenders promising unrealistic terms: Be wary of lenders who promise incredibly easy approval or unrealistically low interest rates – these are often red flags.

- Read the fine print carefully: Before signing any agreement, carefully read all the terms and conditions to understand the complete implications of the loan.

Tips for Improving Your Chances of Approval

Even with a poor credit history, you can improve your chances of approval for a direct payday loan. By taking proactive steps, you can present a stronger application.

- Improve your credit score: While difficult in the short term, consistently paying off existing debts and using credit responsibly can improve your credit score over time, which benefits future loan applications.

- Provide accurate and complete information: Accuracy in your application is crucial. Inaccurate information can lead to rejection or delays.

- Borrow only what you need: Borrow only the amount you need and can realistically repay to avoid getting into further debt.

- Consider a co-signer: If possible, having a co-signer with good credit can significantly increase your chances of approval.

Alternatives to Direct Payday Loans

Payday loans, while convenient, often come with high interest rates. Exploring alternative options might offer more favorable terms depending on your circumstances.

- Personal loans: Personal loans often have lower interest rates than payday loans, but they may require a better credit score.

- Credit unions: Credit unions sometimes offer smaller loans with more lenient terms than traditional banks.

- Negotiating with creditors: Contacting creditors to negotiate payment extensions or reduced payments can provide temporary financial relief.

- Credit counseling services: Credit counseling services can help you manage your debt and develop a budget to avoid future financial difficulties.

Conclusion

Securing a direct payday loan with guaranteed approval despite bad credit requires careful consideration and research. By understanding the factors influencing approval, choosing reputable lenders, and exploring alternative solutions, you can navigate the process effectively. Remember to always borrow responsibly and only take out what you can afford to repay. Don't hesitate to explore your options for a direct payday loan and find the best solution for your immediate financial needs. Start your search for the best direct payday loan today!

Featured Posts

-

Ajaxs Title Push Feyenoord And Psvs Race For Second

May 28, 2025

Ajaxs Title Push Feyenoord And Psvs Race For Second

May 28, 2025 -

Prakiraan Cuaca Bandung Besok 26 Maret Antisipasi Hujan Di Jawa Barat

May 28, 2025

Prakiraan Cuaca Bandung Besok 26 Maret Antisipasi Hujan Di Jawa Barat

May 28, 2025 -

The Many Crews Of One Piece A Character Analysis

May 28, 2025

The Many Crews Of One Piece A Character Analysis

May 28, 2025 -

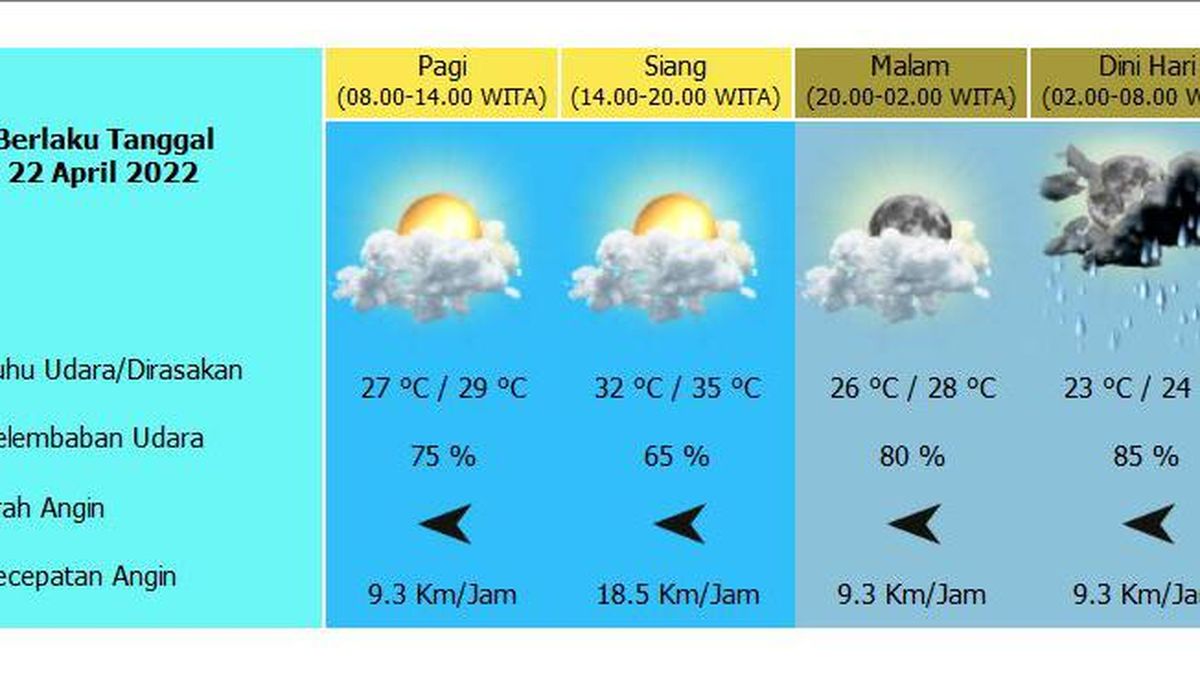

Info Cuaca Denpasar And Bali Untuk Besok

May 28, 2025

Info Cuaca Denpasar And Bali Untuk Besok

May 28, 2025 -

The 99th Minute And Nine Lost Points Ajaxs Season Defining Collapse

May 28, 2025

The 99th Minute And Nine Lost Points Ajaxs Season Defining Collapse

May 28, 2025

Latest Posts

-

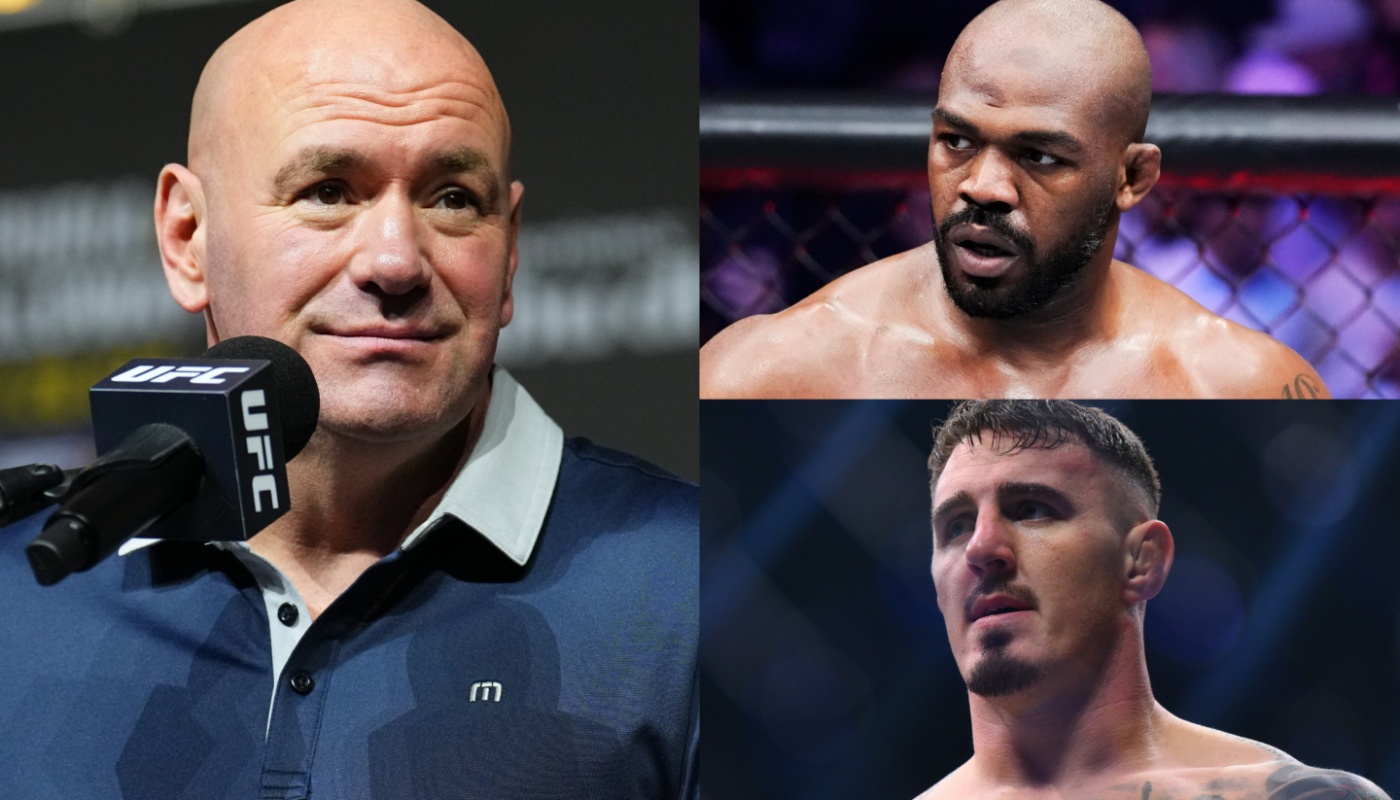

Alexander Gustafsson Weighs In Jon Jones And The Tom Aspinall Threat

May 30, 2025

Alexander Gustafsson Weighs In Jon Jones And The Tom Aspinall Threat

May 30, 2025 -

The Dark Side Of Roland Garros How Opponents Experience Abuse

May 30, 2025

The Dark Side Of Roland Garros How Opponents Experience Abuse

May 30, 2025 -

Ufc Heavyweights Anger At Jon Jones Comeback

May 30, 2025

Ufc Heavyweights Anger At Jon Jones Comeback

May 30, 2025 -

Jon Jones Vs Tom Aspinall Gustafssons Take On The Fight And The Dangers Involved

May 30, 2025

Jon Jones Vs Tom Aspinall Gustafssons Take On The Fight And The Dangers Involved

May 30, 2025 -

French Open Opponents Face Abuse Insults Whistling And More

May 30, 2025

French Open Opponents Face Abuse Insults Whistling And More

May 30, 2025