Finding Your Real Safe Bet: A Practical Approach To Investment

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific investment vehicles, it's crucial to understand your risk tolerance. This determines how much fluctuation you're comfortable with in your investment value. A clear understanding of your risk profile is the cornerstone of any successful investment strategy.

Assessing Your Financial Situation

Before jumping into any investment, honestly evaluate your current financial standing. This involves a realistic assessment of your assets and liabilities.

- Current savings: How much money do you currently have saved?

- Debts: What outstanding debts do you have (credit cards, loans, mortgages)?

- Monthly expenses: What are your regular monthly expenses (housing, food, transportation)?

- Emergency fund: Do you have 3-6 months' worth of living expenses saved in an easily accessible account? This is crucial before considering any investment.

- Long-term financial goals: What are your long-term financial goals (retirement, children's education, a down payment on a house)?

Having an emergency fund is paramount. It acts as a safety net, protecting you from unexpected expenses and preventing you from needing to liquidate investments prematurely. Different individuals have different risk profiles:

- Conservative: Prefers minimal risk and accepts lower returns.

- Moderate: Balances risk and return, accepting some fluctuation for potentially higher gains.

- Aggressive: Willing to take on higher risk for potentially significant returns.

Defining Your Investment Goals

What are you hoping to achieve with your investments? Clearly defining your investment goals—both short-term and long-term—is essential for selecting appropriate investments.

- Short-term goals: These might include saving for a down payment on a house, a new car, or a vacation. Short-term investments generally involve lower risk.

- Long-term goals: These are typically larger goals like retirement planning or funding your children's education. Long-term investments often allow for higher risk tolerance.

Your investment timeline significantly impacts your investment choices. Short-term goals necessitate low-risk, liquid investments, while long-term goals provide more flexibility to consider investments with higher growth potential, even if they carry more risk.

Exploring Low-Risk Investment Options

Several investment options are considered relatively safe, offering a balance between capital preservation and returns.

High-Yield Savings Accounts and Money Market Accounts

These accounts offer FDIC insurance (in the US) up to $250,000 per depositor, per insured bank, providing a safety net for your principal. While returns are modest compared to other investment vehicles, they offer liquidity and stability.

- FDIC insurance: Protects your deposits from bank failure.

- Interest rates: Rates vary depending on the financial institution and economic conditions.

- Accessibility: Funds are readily accessible.

- Liquidity: You can withdraw your money quickly without penalty.

Shop around to compare interest rates offered by different banks and credit unions. Interest rates fluctuate based on prevailing economic conditions.

Certificates of Deposit (CDs)

CDs offer fixed interest rates for a specific term (e.g., 6 months, 1 year, 5 years). This provides predictable returns, but you'll face penalties for early withdrawal.

- Fixed interest rates: Provides certainty regarding your return.

- Term lengths: Vary widely, allowing you to tailor your investment to your timeline.

- Penalties for early withdrawal: Penalties are applied if you withdraw funds before the maturity date.

- CD laddering strategy: Investing in CDs with different maturity dates to minimize risk and maximize returns.

CD laddering spreads your risk by staggering maturities. As one CD matures, you reinvest the proceeds into a new CD with a longer term.

Government Bonds and Treasury Bills

Government bonds, issued by the U.S. Treasury (or equivalent government agencies in other countries), are considered among the safest investments due to their backing by the government.

- Low risk: The backing of the government minimizes the risk of default.

- Stable returns: While returns aren't exceptionally high, they provide consistent income.

- Different maturities: Bonds are available with varying maturity dates (short-term, medium-term, long-term).

- Tax implications: Interest earned on government bonds may be subject to federal income tax, and possibly state and local taxes, depending on your location.

Different types of government bonds (Treasury bills, notes, bonds) have varying maturities and risk profiles.

Real Estate Investment Trusts (REITs)

REITs are companies that own or finance income-producing real estate. They offer diversification and potentially higher returns compared to other low-risk options, but carry some inherent market risk.

- Diversification benefits: Investing in REITs diversifies your portfolio beyond traditional stocks and bonds.

- Potential for income generation: Many REITs pay dividends, providing a regular income stream.

- Market volatility: REIT prices can fluctuate based on market conditions and interest rates.

- Management fees: REITs charge management fees, which can impact your overall returns.

Thorough research is crucial before investing in REITs. Understand the specific properties, management team, and financial health of each REIT.

Diversification: The Cornerstone of a Safe Investment Strategy

Diversification is crucial for mitigating risk and building a secure investment portfolio. It involves spreading your investments across different asset classes, reducing your reliance on any single investment's performance.

Spreading Your Investments Across Asset Classes

Don't put all your eggs in one basket. Diversify across stocks, bonds, real estate, and other asset classes to minimize the impact of poor performance in any single area.

- Asset allocation: Carefully determine the proportion of your portfolio allocated to each asset class based on your risk tolerance and financial goals.

- Portfolio diversification: Aim for a mix of investments to balance risk and reward.

- Risk mitigation: Diversification reduces the overall risk of your investment portfolio.

For example, a balanced portfolio might include a mix of stocks, bonds, and real estate, with the proportion adjusted based on your individual risk tolerance.

Regular Portfolio Review and Rebalancing

Market conditions change constantly. Regularly review and rebalance your portfolio to maintain your desired asset allocation.

- Frequency of review: Review your portfolio at least annually, or more frequently if market conditions are volatile.

- Rebalancing strategies: Rebalancing involves selling some assets that have performed well and buying assets that have underperformed to restore your target asset allocation.

- Professional financial advice: Seek professional guidance if you need assistance managing a complex portfolio.

Regular rebalancing helps you take advantage of market fluctuations and maintain a balanced approach to risk management.

Conclusion

Finding your real safe bet involves a careful assessment of your financial situation, risk tolerance, and investment goals. By exploring low-risk investment options like high-yield savings accounts, CDs, government bonds, and diversifying your portfolio across various asset classes, you can build a secure foundation for your financial future. Remember, while eliminating all risk is impossible, a well-planned and diversified investment strategy can significantly reduce it. Start planning your safe investment strategy today and take control of your financial security. Don't hesitate to seek advice from a qualified financial advisor to help you find the real safe bet for your individual circumstances.

Featured Posts

-

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025

Senate Democrats Accusation Pam Bondi And Hidden Epstein Records

May 10, 2025 -

Exclusive Judge Jeanine Pirro Opens Up About Her Greatest Fears And Love

May 10, 2025

Exclusive Judge Jeanine Pirro Opens Up About Her Greatest Fears And Love

May 10, 2025 -

Jazz Cash K Trade Partnership Opening Up Stock Markets To All

May 10, 2025

Jazz Cash K Trade Partnership Opening Up Stock Markets To All

May 10, 2025 -

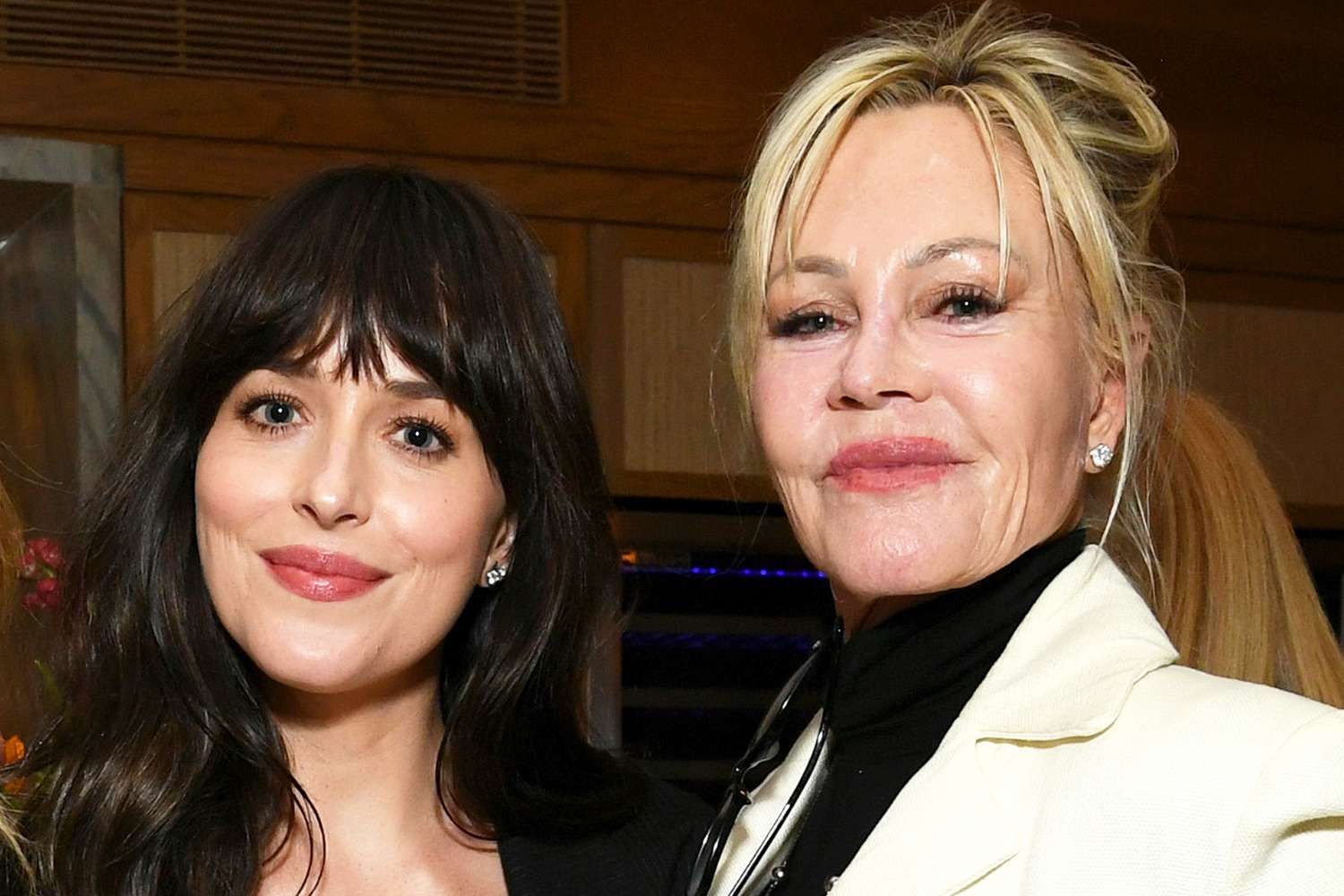

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 10, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 10, 2025 -

Zolotaya Malina 2023 Dakota Dzhonson Sredi Nominantov Na Khudshuyu Rol

May 10, 2025

Zolotaya Malina 2023 Dakota Dzhonson Sredi Nominantov Na Khudshuyu Rol

May 10, 2025