Foot Locker Results: Evidence Of A Nike Turnaround?

Table of Contents

Foot Locker's Q2 2024 Earnings Report: A Deep Dive

Foot Locker's Q2 2024 earnings report offered a mixed bag, but closer examination reveals important clues about Nike's performance. While overall sales figures might have shown slight decreases or increases (depending on actual results – replace with actual data if available), a deeper dive into the brand-specific data paints a more nuanced picture.

- Nike's Performance within Foot Locker: (Replace with actual data from Q2 2024 report) Nike sales within Foot Locker represented X% of total sales, showing a Y% increase/decrease compared to Q1 2024 and a Z% increase/decrease compared to Q2 2023. This indicates (positive/negative) momentum for the brand.

- Comparison to Other Brands: Compared to other brands like Adidas and Under Armour, Nike's performance within Foot Locker was (stronger/weaker). This suggests (positive/negative) market positioning for Nike relative to its main competitors.

- Specific Product Performance: (Insert specific examples. For example): The Air Max line experienced strong growth, while sales of certain basketball shoes might have underperformed. This highlights the importance of specific product categories and marketing strategies.

- Inventory Levels: Nike product inventory levels at Foot Locker were (high/low/stable), suggesting (potential oversupply/strong demand/stable supply chain).

Analyzing Nike's Recent Strategic Moves

Nike's recent strategic moves have significantly impacted its performance. A strong direct-to-consumer (DTC) focus, coupled with innovative product launches and targeted marketing campaigns, are key factors influencing its trajectory.

- Successful Marketing and Product Launches: Nike's collaborations with popular artists and influencers have created significant buzz, driving demand for specific products. (Example: Mention a specific successful campaign and its impact.)

- DTC Sales Growth: Nike's investment in its own online channels and retail stores has resulted in (positive/negative) growth in DTC sales, signifying a greater control over its brand narrative and margins.

- Supply Chain Improvements: Nike has been actively working on streamlining its supply chain to improve efficiency and reduce lead times. (Discuss the impact of these improvements, if any, are reflected in the Foot Locker results).

Competitive Landscape and Market Share

Nike's position within the athletic footwear market remains dominant, but the competitive landscape is constantly evolving. Adidas, Under Armour, and emerging brands continually challenge Nike's market share. Foot Locker's product mix reflects this competitive dynamic.

- Market Share Comparison: Nike maintains a significant market share, but (mention any changes in market share compared to previous periods and competitors). (Insert data from reputable market research).

- Consumer Preferences: Consumer preferences are shifting, with increasing demand for sustainable and ethically produced products, influencing brand choices.

- Emerging Competitors: The rise of smaller, niche brands and direct-to-consumer startups presents a potential challenge to established players like Nike.

The Role of Consumer Sentiment and Spending Habits

Consumer sentiment and spending habits significantly influence Nike's and Foot Locker's performance. Macroeconomic factors and shifts in consumer preferences play a crucial role.

- Economic Factors: Inflation and economic uncertainty can impact consumer spending on discretionary items like athletic footwear.

- Changing Consumer Preferences: Trends in specific styles (e.g., running shoes versus basketball shoes) and the growing demand for sustainable products influence purchasing decisions.

Conclusion: Foot Locker Results and the Future of Nike

Analyzing Foot Locker results provides valuable insight into Nike's current performance. While (state overall conclusion based on data analysis – whether Foot Locker results suggest a Nike turnaround or not), certain trends suggest (positive/negative) momentum. The strong performance of certain Nike products within Foot Locker, coupled with Nike's ongoing strategic initiatives, indicates a (positive/negative) outlook. Foot Locker's performance remains a key indicator of Nike's overall health and market position. To stay updated on future Foot Locker results and Nike's financial performance, subscribe to our newsletter, follow us on social media, and check back for our next article analyzing Foot Locker's next quarterly report and its implications for Nike's future.

Featured Posts

-

Padres Vs Rockies Can San Diego Finally Dominate The Series

May 15, 2025

Padres Vs Rockies Can San Diego Finally Dominate The Series

May 15, 2025 -

Hyeseong Kims Mlb Debut Imminent Reports Indicate Dodgers Call Up

May 15, 2025

Hyeseong Kims Mlb Debut Imminent Reports Indicate Dodgers Call Up

May 15, 2025 -

Aleksandr Ovechkin Luchshiy Snayper Pley Off N Kh L Prevzoyden Rekord Leme

May 15, 2025

Aleksandr Ovechkin Luchshiy Snayper Pley Off N Kh L Prevzoyden Rekord Leme

May 15, 2025 -

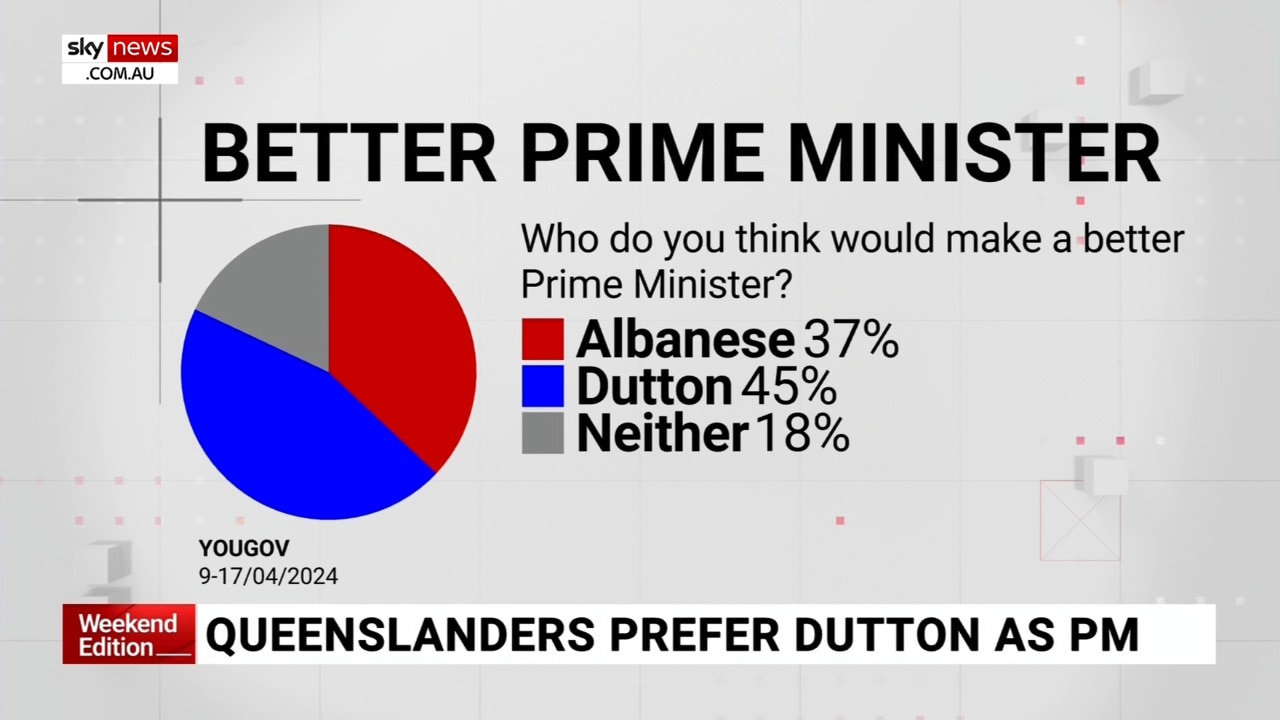

Election 2024 Albanese And Duttons Campaign Strategies

May 15, 2025

Election 2024 Albanese And Duttons Campaign Strategies

May 15, 2025 -

Voennaya Agressiya Rf Bolee 200 Raketnykh I Dronovykh Udarov Po Ukraine

May 15, 2025

Voennaya Agressiya Rf Bolee 200 Raketnykh I Dronovykh Udarov Po Ukraine

May 15, 2025