Foot Locker's Q4 2024 Earnings: Analyzing The Lace Up Plan Progress

Table of Contents

Key Financial Performance Indicators

This section will dissect Foot Locker's Q4 2024 financial performance, focusing on key indicators to assess the health and direction of the business.

Revenue Analysis

Analyzing Foot Locker's revenue is crucial for understanding the success of the "Lace Up" plan. We'll compare Q4 2024 figures to Q4 2023 and initial projections, examining growth or decline across various product categories.

- Specific revenue numbers: (Placeholder – actual numbers will be inserted post-earnings release). For example, total revenue might be reported as $X billion, compared to $Y billion in Q4 2023, representing a Z% change.

- Year-over-year growth: We will analyze percentage changes in revenue year-over-year, highlighting key growth drivers and areas of concern. For instance, a strong performance in basketball shoes could indicate success in a key category.

- Product category performance: We'll examine the performance of individual product categories like basketball shoes, running shoes, and apparel. This granular analysis will reveal category-specific strengths and weaknesses. For example, a decline in running shoe sales may prompt a deeper investigation into market trends and competitive pressures. Understanding the performance of each category is critical to judging the overall success of the Foot Locker revenue streams.

Profitability and Margins

Profitability is paramount, and this section will examine Foot Locker's gross profit margins, operating income, and net income to understand the efficiency of its operations.

- Specific profit margin percentages: (Placeholder – actual numbers will be inserted post-earnings release). For example, a gross profit margin of X% compared to Y% in Q4 2023 reveals trends in cost management and pricing strategies.

- Comparison to previous quarters and years: We'll analyze the trends in profitability over time, identifying any significant shifts and their underlying causes.

- Explanation for changes in profitability: Factors like inventory management efficiency, supply chain optimization, and pricing strategies will be discussed to explain changes in profitability. For example, improved supply chain efficiency might lead to higher operating income. This provides valuable insights into the effectiveness of Foot Locker's operational strategies and the impact on their bottom line.

Stock Market Reaction

The stock market's reaction to Foot Locker's Q4 earnings announcement provides valuable insight into investor sentiment and the company's future valuation.

- Stock price changes pre and post-announcement: We will track the fluctuations in Foot Locker's stock price before and after the earnings announcement. A significant positive or negative change reflects the market's assessment of the results.

- Analyst ratings: Post-earnings, we'll analyze ratings and comments from financial analysts to gain a broader perspective on investor sentiment.

- Investor commentary: We'll review investor comments and news articles to gauge overall market reaction and understand the key drivers behind the stock price movement. This section will offer an understanding of how the market interprets the announced Foot Locker revenue and the implications for future growth.

Assessment of the "Lace Up" Plan's Progress

Foot Locker's "Lace Up" plan is central to its future. This section assesses its progress based on specific initiatives.

Key Initiatives and Their Impact

The "Lace Up" plan encompasses several strategic initiatives. This analysis will evaluate their impact on the company's financial performance.

- Specific examples of initiatives: This could include digital transformation initiatives, new market expansions, or strategic partnerships with major brands. For example, improved e-commerce capabilities could increase online sales.

- Metrics demonstrating success or failure: We will use key performance indicators (KPIs) to assess the success of each initiative. Increased website traffic, enhanced customer engagement, and expanded market share are some potential metrics.

- Analysis of their contribution to overall financial performance: We'll quantify the contribution of each initiative to Foot Locker's overall revenue and profitability. A successful initiative will show a positive impact on the company's financial performance. Analyzing this data is essential for assessing the effectiveness of the Lace Up plan in driving revenue growth and improved profitability.

Challenges and Opportunities

No strategic plan is without challenges. This section identifies hurdles and explores potential future opportunities.

- Challenges related to competition, economic conditions, or internal factors: We will examine potential challenges, such as increased competition from online retailers or economic downturns affecting consumer spending. Internal challenges, like supply chain disruptions, may also affect performance.

- Potential future strategies to overcome these challenges and capitalize on opportunities: We'll discuss strategies Foot Locker can implement to address challenges and leverage new opportunities for growth. For example, investments in advanced technology and innovative marketing strategies might help overcome competitive pressures.

Conclusion

Foot Locker's Q4 2024 earnings will provide crucial insights into the effectiveness of the "Lace Up" plan. This analysis will assess the key financial indicators, evaluating both successes and areas needing improvement. The overall performance will be judged not only by the numbers themselves but also by the strategic direction they point towards. Understanding Foot Locker's revenue streams, profit margins, and stock market response will be key in deciphering the overall success of the initiative.

To stay informed about Foot Locker's ongoing performance and the evolution of the "Lace Up" plan, subscribe to the company's investor relations updates or follow financial news related to Foot Locker's Q4 2024 earnings and the ongoing impact of their "Lace Up" strategy for sustained growth in the athletic footwear market. Regular monitoring of Foot Locker's financial performance is crucial to understanding the long-term impact of the "Lace Up" plan and its contribution to the overall success of the company in the competitive athletic footwear market.

Featured Posts

-

Womens Increased Alcohol Consumption A Growing Concern For Doctors

May 15, 2025

Womens Increased Alcohol Consumption A Growing Concern For Doctors

May 15, 2025 -

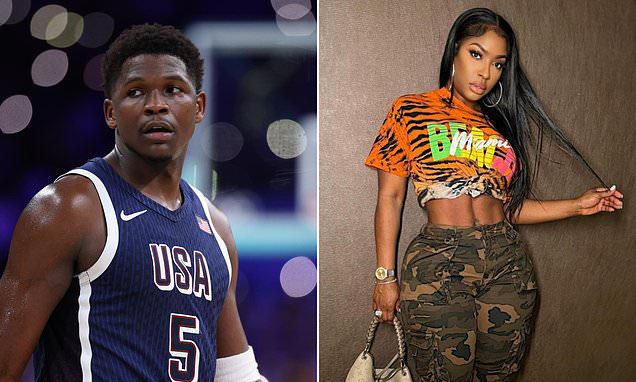

Ayesha Howard And Anthony Edwards A New Chapter In Co Parenting

May 15, 2025

Ayesha Howard And Anthony Edwards A New Chapter In Co Parenting

May 15, 2025 -

Celtics Vs Pistons Expert Prediction And Analysis

May 15, 2025

Celtics Vs Pistons Expert Prediction And Analysis

May 15, 2025 -

Andors First Look Everything Fans Have Been Waiting For

May 15, 2025

Andors First Look Everything Fans Have Been Waiting For

May 15, 2025 -

Toronto Maple Leafs Vs Nashville Predators March 22nd Game Picks

May 15, 2025

Toronto Maple Leafs Vs Nashville Predators March 22nd Game Picks

May 15, 2025