Frankfurt Stock Market Report: DAX Suffers Losses

Table of Contents

Geopolitical Instability Weighs on DAX Performance

The ongoing geopolitical instability, particularly the war in Ukraine and its impact on energy prices and global inflation, continues to exert downward pressure on the DAX. The uncertainty surrounding the conflict's duration and its broader economic consequences creates a risk-averse environment, leading investors to reduce their exposure to equities. This geopolitical risk is a major factor influencing the current market volatility.

- Rising energy costs: Soaring energy costs are impacting German businesses, increasing production expenses and squeezing profit margins. This, in turn, affects consumer confidence and spending.

- Energy supply uncertainty: The ongoing conflict creates significant uncertainty regarding the future of energy supplies in Europe, leading to price volatility and impacting business planning.

- Global inflation surge: The war in Ukraine has exacerbated global inflation, impacting consumer spending and corporate profits. This inflationary pressure is a key driver of the current economic downturn.

- Currency market volatility: Increased volatility in currency markets is affecting export-oriented German companies, making it harder to predict revenues and impacting their competitiveness.

Inflation and Interest Rate Hikes Dampen Investor Sentiment

Persistent high inflation and the subsequent aggressive interest rate hikes by the European Central Bank (ECB) are significantly impacting investor sentiment. Higher interest rates increase borrowing costs for businesses, slowing down economic growth and potentially reducing corporate earnings. This monetary policy tightening is a significant factor contributing to the DAX's decline.

- ECB's monetary policy: The ECB's commitment to combating inflation through rate hikes is impacting market confidence. Investors are assessing the potential impact of these measures on economic growth.

- Impact on business investment: Higher interest rates make borrowing more expensive for businesses, potentially reducing investment in expansion and innovation.

- Recessionary concerns: Concerns about a potential economic recession in the Eurozone are weighing heavily on investor sentiment, leading to a sell-off in equities.

- Future ECB decisions: The market is closely watching future ECB monetary policy decisions and their potential impact on the DAX and the broader European economy.

Specific Sectoral Weaknesses Contributing to DAX Decline

The decline in the DAX isn't uniform across all sectors. Specific sectors have experienced particularly steep losses, dragging down the overall index performance. Understanding these sectoral weaknesses is crucial for a complete analysis of the DAX's current situation.

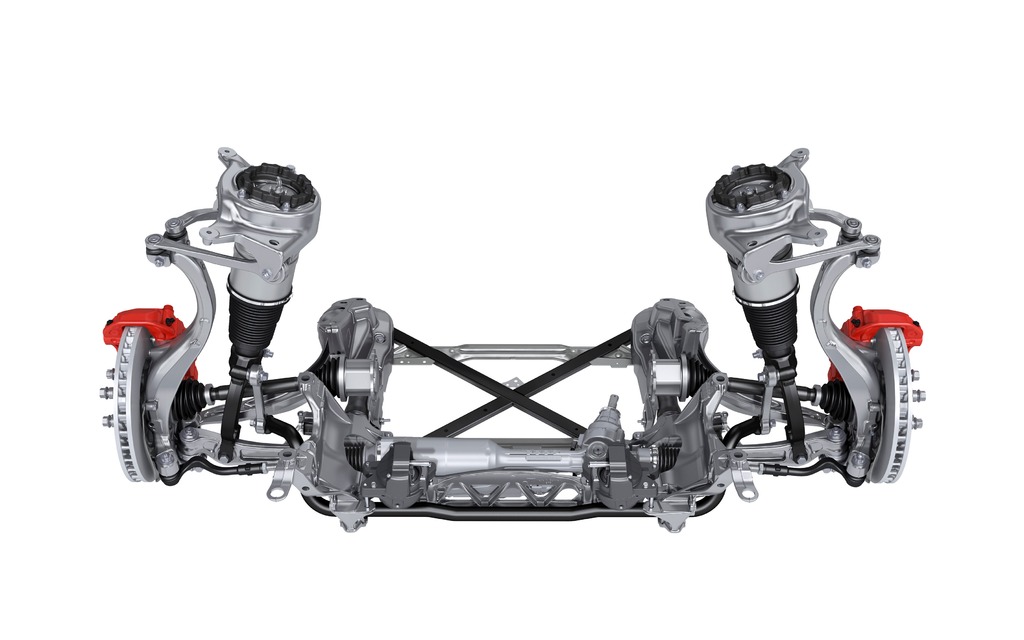

- Automotive Industry struggles: The automotive industry is facing significant challenges due to supply chain disruptions, the ongoing semiconductor shortage, and slowing global demand.

- Technology sector correction: The technology sector is experiencing a global correction, with many tech stocks experiencing significant price declines. This is impacting the performance of German technology companies listed on the DAX.

- Financial sector concerns: The financial sector is also facing headwinds due to rising interest rates and concerns about potential loan defaults.

- Company-specific performance: Individual DAX companies are experiencing varying levels of success, reflecting the diverse challenges within their respective sectors.

Technical Analysis of the DAX's Recent Performance

A technical analysis of the DAX chart reveals key support and resistance levels, offering insights into potential future price movements. Examining chart patterns and trading signals can aid in understanding the short-term trajectory of the index. Identifying these technical indicators can help investors make informed trading decisions. Analyzing key chart patterns, such as head and shoulders or double tops/bottoms, can provide valuable insights into potential trend reversals. Support and resistance levels provide crucial information about potential price ceilings and floors.

Conclusion

The Frankfurt Stock Market's recent losses, reflected in the significant decline of the DAX, are a result of several interconnected factors including geopolitical uncertainty, persistent inflation, and subsequent interest rate hikes. Specific sectorial weaknesses further exacerbated the decline. While the short-term outlook remains uncertain, understanding these contributing elements is crucial for investors to navigate this volatile market effectively. Stay informed by regularly checking our Frankfurt Stock Market Report for updates on the DAX and other key indicators to make informed investment decisions. Continuously monitor the DAX Index and related news for a comprehensive view of the German stock market's performance. Understanding the nuances of the DAX and the Frankfurt Stock Market is key to successful investing.

Featured Posts

-

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav And Its Importance

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav And Its Importance

May 24, 2025 -

Peredbachennya Konchiti Vurst Khto Peremozhe Na Yevrobachenni 2025 Unian

May 24, 2025

Peredbachennya Konchiti Vurst Khto Peremozhe Na Yevrobachenni 2025 Unian

May 24, 2025 -

How To Get Bbc Big Weekend 2025 Sefton Park Tickets A Complete Guide

May 24, 2025

How To Get Bbc Big Weekend 2025 Sefton Park Tickets A Complete Guide

May 24, 2025 -

March 18 2025 New York Times Connections Puzzle 646 Solutions

May 24, 2025

March 18 2025 New York Times Connections Puzzle 646 Solutions

May 24, 2025

Latest Posts

-

Bangladesh Businesses In Europe A Collaborative Path To Success

May 24, 2025

Bangladesh Businesses In Europe A Collaborative Path To Success

May 24, 2025 -

Ces Unveiled Europe Les Dernieres Innovations Technologiques Devoilees A Amsterdam

May 24, 2025

Ces Unveiled Europe Les Dernieres Innovations Technologiques Devoilees A Amsterdam

May 24, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Quelles Technologies Attendent Les Visiteurs

May 24, 2025

Amsterdam Accueille Le Ces Unveiled Europe Quelles Technologies Attendent Les Visiteurs

May 24, 2025 -

Retour Du Ces Unveiled En Europe Les Innovations A Decouvrir A Amsterdam

May 24, 2025

Retour Du Ces Unveiled En Europe Les Innovations A Decouvrir A Amsterdam

May 24, 2025 -

Ces Unveiled Revient A Amsterdam Nouveautes Technologiques Europeennes

May 24, 2025

Ces Unveiled Revient A Amsterdam Nouveautes Technologiques Europeennes

May 24, 2025