Fremantle Reports 5.6% Q1 Revenue Decline: Buyer Budget Cuts Take Toll

Table of Contents

Detailed Breakdown of Fremantle's Q1 Revenue Decline

Specific Figures and Comparisons

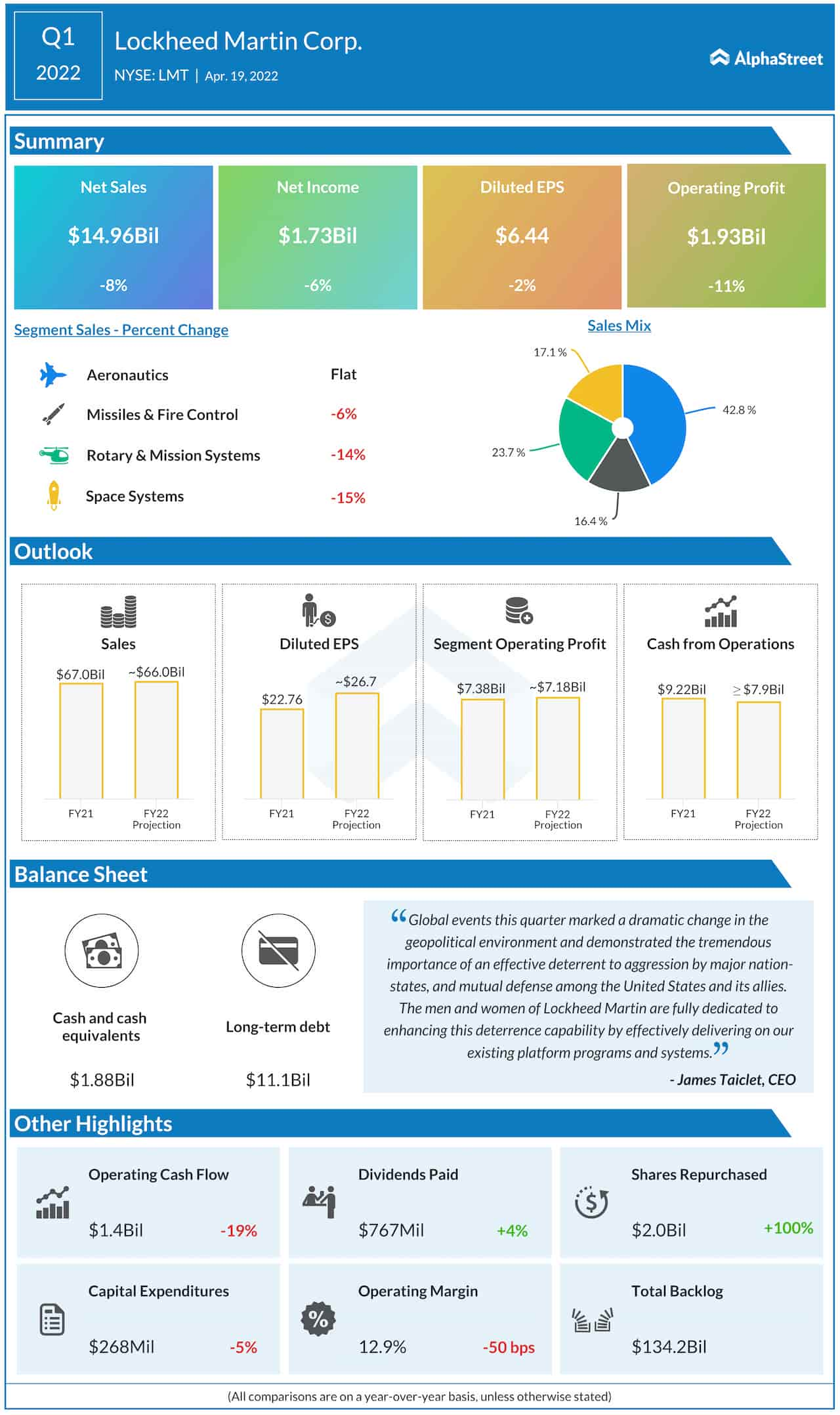

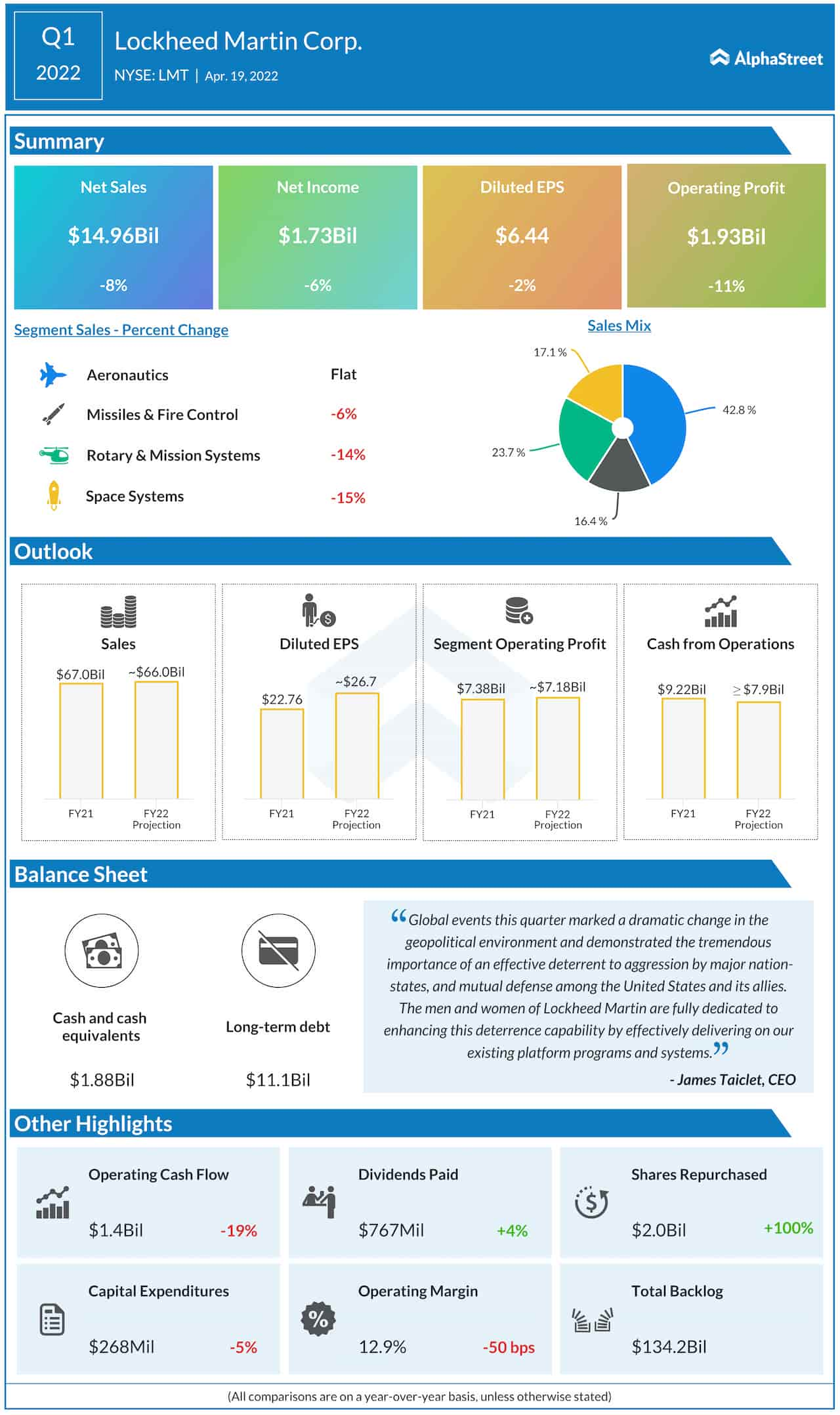

Fremantle's Q1 revenue decline of 5.6% represents a substantial setback compared to the previous year's performance. While precise figures weren't publicly released in their entirety, the announcement confirmed a marked decrease. This represents a significant departure from previous quarters which showed more robust growth. A visual representation (graph or chart, if available from Fremantle's official report) would further illustrate this decline.

- Year-over-year comparison: Show a clear percentage decrease from Q1 of the previous year.

- Quarterly comparison: Demonstrate the trend across recent quarters, highlighting the shift from previous growth to the current decline.

- Breakdown by region (if available): Analyzing regional performance would offer insights into the geographical distribution of the revenue decline. Was it concentrated in certain markets, or more widespread?

- Comparison to industry averages: Benchmarking Fremantle's performance against other major entertainment production companies can offer a broader perspective on the industry-wide impact of budget cuts.

Impact of Buyer Budget Cuts on Fremantle's Production Pipeline

Delayed or Cancelled Projects

The primary driver of Fremantle's Q1 revenue decline is attributed to significant buyer budget cuts impacting their production pipeline. Several projects have faced delays or outright cancellation as a direct result of these financial constraints. This disruption affects various production types, from high-profile TV series to feature films.

- Examples of affected projects: Mention specific projects (if publicly available) to illustrate the impact.

- Types of productions: Specify the types of content affected (e.g., scripted drama, reality TV, documentaries, film).

- Geographic locations of impacted projects: Highlighting locations reveals the global reach of these budget cuts and their consequences. Did certain regions suffer more than others?

Fremantle's Response to the Revenue Decline and Budgetary Challenges

Cost-Cutting Measures

In response to the revenue decline, Fremantle has implemented several cost-cutting measures to mitigate the impact and stabilize its financial position. These actions are common during periods of economic uncertainty within the entertainment industry.

- Examples of cost-cutting measures: This might include workforce reductions, streamlining operational processes, and renegotiating contracts.

- Strategies for efficiency improvements: The company likely focused on optimizing production workflows and exploring new technologies to enhance efficiency and reduce overhead.

Strategic Initiatives for Future Growth

Despite the challenges, Fremantle is actively pursuing strategic initiatives to drive future growth and navigate the challenging market conditions.

- New projects in development: Highlighting new projects showcases Fremantle's commitment to adapting and continuing to deliver content.

- Expansion into new markets: Exploring new international markets can diversify revenue streams and reduce reliance on affected regions.

- Partnerships with other companies: Collaborations can bring new resources, technologies, and creative talent to the company, bolstering their production capabilities.

Broader Implications for the Global Entertainment Industry

Industry-Wide Trends

Fremantle's experience reflects a broader trend within the global entertainment industry. Buyer budget cuts are impacting numerous production companies, leading to project delays, cancellations, and overall uncertainty.

- Impact on other production companies: The trend is not isolated to Fremantle, emphasizing its widespread impact.

- Effects on talent: Job security for actors, writers, directors, and crew members is threatened by project cancellations.

- Changes in content creation strategies: The industry may see a shift towards lower-budget productions or a greater emphasis on cost-effective formats.

Conclusion

Fremantle's 5.6% Q1 revenue decline clearly demonstrates the significant impact of buyer budget cuts on the global entertainment production landscape. The company's response, incorporating cost-cutting measures and strategic initiatives, highlights the need for adaptability and innovation in this evolving market. The broader implications extend across the entire industry, affecting both production companies and creative talent. Staying informed about Fremantle’s ongoing performance and the future of entertainment production is crucial. Stay informed about Fremantle's ongoing performance and the future of entertainment production by following [link to relevant resource, e.g., Fremantle's investor relations page].

Featured Posts

-

A Hell Of A Run The Ftv Live Perspective

May 20, 2025

A Hell Of A Run The Ftv Live Perspective

May 20, 2025 -

Napad Na Detsu U Bi Kh Tadi Kritiku E Shmita

May 20, 2025

Napad Na Detsu U Bi Kh Tadi Kritiku E Shmita

May 20, 2025 -

Wayne Gretzky Trump Tariffs And Canadian Statehood Examining The Controversy

May 20, 2025

Wayne Gretzky Trump Tariffs And Canadian Statehood Examining The Controversy

May 20, 2025 -

Fa Cup Rashfords Brace Propels Manchester United Past Preston

May 20, 2025

Fa Cup Rashfords Brace Propels Manchester United Past Preston

May 20, 2025 -

Enquete Sur Des Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Maurice

May 20, 2025

Enquete Sur Des Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Maurice

May 20, 2025