French CAC 40 Index: Weekly Summary - Down Slightly, But Stable Overall (March 7, 2025)

Table of Contents

The French CAC 40 Index experienced a slight dip this week, closing marginally lower than the previous week's finish. However, overall stability characterized the market, indicating a degree of resilience amidst ongoing global economic uncertainties. This article focuses on the French CAC 40 Index, a crucial barometer of the French and broader European economies. Our aim is to provide a concise weekly summary and analysis of its performance, highlighting key drivers and offering a cautious outlook for the coming week.

2. Main Points:

H2: Weekly Performance Overview of the French CAC 40

The French CAC 40 Index closed down 0.2% this week (March 7, 2025), a slight decrease compared to the previous week's 0.5% gain. While the week showed some volatility, with a notable intra-week swing, the overall trend remained relatively stable. Here are the key figures:

- Opening Value (Monday): 7,250.15

- Closing Value (Friday): 7,235.00

- Weekly High: 7,282.50

- Weekly Low: 7,200.80

- Trading Volume: Averaged 3.5 billion shares daily.

H2: Key Sectors Driving the CAC 40 Index Movement

This week's performance of the French CAC 40 Index was influenced by contrasting sector performances.

- Top Performers: The Energy sector showed robust gains, driven by a surge in global oil prices. French energy giants benefited significantly. The Luxury Goods sector also performed well, fueled by strong demand from Asian markets.

- Underperformers: The Technology sector experienced a slight correction, influenced by broader global tech stock trends and concerns over interest rate hikes. French banking stocks also showed some weakness, reflecting ongoing regulatory uncertainty.

Here's a breakdown of key sector performances:

- Energy: +1.5%

- Financials: -0.5%

- Technology: -0.8%

- Consumer Goods: +0.3%

H2: Impact of Global Economic Factors on the French CAC 40

Global economic factors played a significant role in shaping the French CAC 40's trajectory this week. Rising interest rates in the United States, concerns about inflation in Europe, and ongoing geopolitical tensions in Eastern Europe all contributed to investor uncertainty. These factors led to some profit-taking in certain sectors and a generally cautious investor sentiment.

- Rising Interest Rates: Increased borrowing costs negatively impacted some sectors.

- Geopolitical Uncertainty: Caused some investors to adopt a wait-and-see approach.

- Inflation Concerns: Dampened investor confidence and led to some market correction.

H2: Outlook for the French CAC 40 Index in the Coming Week

Predicting market movements is inherently challenging. However, based on the current trends and anticipated events, we foresee the French CAC 40 Index potentially moving within a narrow range next week. The release of key economic data, including French inflation figures and Eurozone manufacturing PMI, may significantly influence investor sentiment. The energy sector's performance will likely depend on oil price fluctuations. We maintain a cautiously optimistic outlook, but significant volatility remains a possibility.

3. Conclusion: Monitoring the French CAC 40 Index and Next Steps

This week's analysis reveals a French CAC 40 Index showing overall stability despite a minor dip. Key sectors like Energy performed strongly, while others, including Technology and Financials, faced challenges. Global economic uncertainties and interest rate hikes played a significant role. Monitoring the French CAC 40 Index is crucial for investors seeking exposure to the French and broader European markets. Stay informed about the fluctuations of the French CAC 40 Index by checking our weekly summaries! Check back next week for an updated summary and analysis. [Link to subscription service/relevant resource].

Featured Posts

-

Retail Sales Surge Pushes Back On Bank Of Canada Rate Cuts

May 25, 2025

Retail Sales Surge Pushes Back On Bank Of Canada Rate Cuts

May 25, 2025 -

Market Update Dow Joness Cautious Climb On Strong Pmi

May 25, 2025

Market Update Dow Joness Cautious Climb On Strong Pmi

May 25, 2025 -

L Epoque Tout Le Monde En Parle Ardisson Brise Le Silence Suite Aux Declarations De Baffie

May 25, 2025

L Epoque Tout Le Monde En Parle Ardisson Brise Le Silence Suite Aux Declarations De Baffie

May 25, 2025 -

Test Naskolko Khorosho Vy Znaete Roli Olega Basilashvili

May 25, 2025

Test Naskolko Khorosho Vy Znaete Roli Olega Basilashvili

May 25, 2025 -

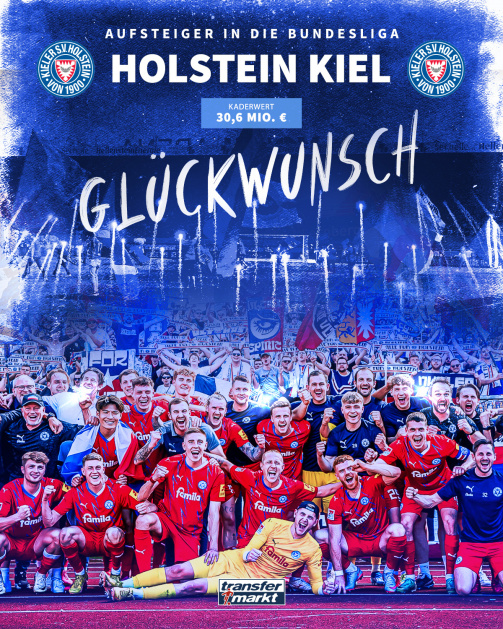

Hsv Im Hoehenflug Aufstieg In Die Bundesliga Perfekt Gemacht

May 25, 2025

Hsv Im Hoehenflug Aufstieg In Die Bundesliga Perfekt Gemacht

May 25, 2025