From $TRUMP Short To White House Dinner: One Trader's Story

Table of Contents

The Initial $TRUMP Short Position

The trader, let's call him Alex, based his initial $TRUMP short position on a thorough – albeit ultimately flawed – risk assessment. His analysis pointed to several perceived weaknesses in Donald Trump's campaign: his controversial statements, concerns about his policy proposals, and a generally negative market sentiment surrounding his candidacy. Short selling, a strategy that profits from a decline in asset value, seemed like a logical bet.

- Market Indicators: Alex closely followed pre-election polls showing a tight race, focusing on shifts in public opinion and their potential impact on market indices.

- Policy Assessment: He analyzed Trump's proposed trade policies, infrastructure plans, and tax reforms, concluding that their implementation could negatively affect certain sectors.

- Risk Tolerance and Commitment: Alex carefully calculated his risk tolerance and committed a significant portion of his portfolio to the short position, acknowledging the potential for substantial losses. This was high-stakes political trading at its finest.

The Unexpected Market Shift and Re-evaluation

Election night brought a seismic shock. Against many predictions, Donald Trump won the presidency. The markets reacted with immediate and dramatic volatility. The initial response was a sharp sell-off, but then, surprisingly, a significant rebound. Alex found himself facing a crisis.

- Market Reactions: The Dow Jones Industrial Average experienced a significant drop initially, followed by an unexpected surge in the days that followed. Currency fluctuations were also dramatic.

- Emotional Response and Analytical Approach: Initially surprised and concerned, Alex quickly shifted to a methodical, analytical approach, re-evaluating his investment strategy based on the new political reality.

- Strategic Adjustments: Faced with mounting losses, Alex decided to cover a portion of his short position, but held on to some, betting on a possible market correction.

From Financial Risk to White House Dinner

The post-election period proved to be a turning point. Alex, leveraging his understanding of the newly emerging market dynamics, made strategic investments in sectors that benefited from the Trump administration’s policies. His understanding of political risk transformed into a significant advantage. This success, combined with astute networking, led to unexpected opportunities.

- Post-Election Investment Decisions: He strategically invested in infrastructure-related companies and other sectors poised for growth under the new administration.

- The Role of Networking: His sharp market analysis combined with his participation in industry events and his growing network within the financial world opened doors to a variety of business opportunities.

- The White House Dinner: Through a combination of financial success and strategic networking, Alex eventually found himself invited to a White House dinner, a remarkable contrast to his initial $TRUMP short position.

Conclusion: Lessons Learned from a $TRUMP Trade

Alex's journey from a $TRUMP short to a White House dinner is a testament to the unpredictable nature of political trading and the importance of adaptability. This high-stakes gamble showcased the need for thorough risk management, a capacity to re-evaluate strategies in the face of unforeseen circumstances, and the significance of networking. While the initial $TRUMP short was a risky move, the subsequent adaptation and strategic investment highlighted the power of understanding political and market dynamics. The story also underscores that successful investing often involves more than just financial acumen; it can also involve navigating complex social and political landscapes.

Want to learn more about navigating the complexities of political trading and developing winning strategies? Explore [link to relevant resource]. Remember, $TRUMP trading, or any form of political trading, carries inherent risks. Always conduct thorough research and understand the implications before making any investment decisions.

Featured Posts

-

Arcane Exploring Jinxs Death And The Shows Ending

May 29, 2025

Arcane Exploring Jinxs Death And The Shows Ending

May 29, 2025 -

O Morello Ton Rage Against The Machine Kai I Kontra Toy Me Ton Tramp

May 29, 2025

O Morello Ton Rage Against The Machine Kai I Kontra Toy Me Ton Tramp

May 29, 2025 -

Probopass Ex Pokemon Tcg Pocket Deck Construction And Gameplay

May 29, 2025

Probopass Ex Pokemon Tcg Pocket Deck Construction And Gameplay

May 29, 2025 -

Taylor Deardens Parents Who Are They

May 29, 2025

Taylor Deardens Parents Who Are They

May 29, 2025 -

Mir Y Marini En Cota Ambicion Y Oportunidad En El Moto Gp De Austin

May 29, 2025

Mir Y Marini En Cota Ambicion Y Oportunidad En El Moto Gp De Austin

May 29, 2025

Latest Posts

-

Isabelle Autissier Collaboration Exploration Et Leadership

May 31, 2025

Isabelle Autissier Collaboration Exploration Et Leadership

May 31, 2025 -

Arnarulunguaq Une Pionniere Inuit Et Son Heritage

May 31, 2025

Arnarulunguaq Une Pionniere Inuit Et Son Heritage

May 31, 2025 -

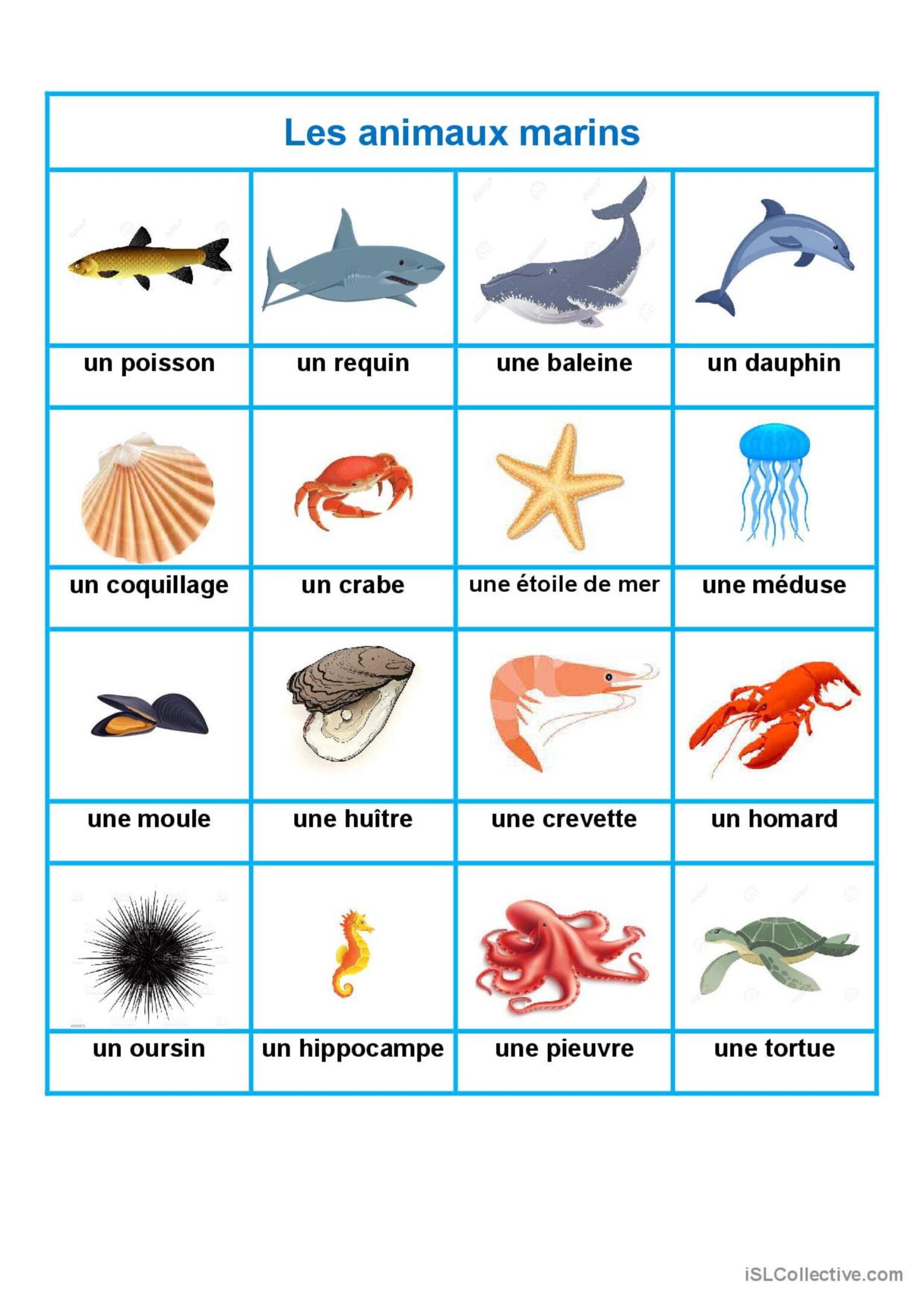

Planifier Votre Journee En Mer Un Guide Pour Les Marins

May 31, 2025

Planifier Votre Journee En Mer Un Guide Pour Les Marins

May 31, 2025 -

Un Jour En Mer Experiences Et Activites Nautiques

May 31, 2025

Un Jour En Mer Experiences Et Activites Nautiques

May 31, 2025 -

Critique De Soudain Seuls Que Reserve Ce Film Diffuse Ce Soir A La Tele

May 31, 2025

Critique De Soudain Seuls Que Reserve Ce Film Diffuse Ce Soir A La Tele

May 31, 2025