FTC Appeals Activision Blizzard Acquisition: What's Next For Microsoft?

Table of Contents

The Federal Trade Commission's (FTC) appeal of a judge's decision to allow Microsoft's acquisition of Activision Blizzard has sent shockwaves through the gaming industry. This landmark case raises crucial questions about the future of gaming mergers and acquisitions, and more specifically, what this means for Microsoft's ambitions in the gaming market. This article delves into the complexities of the appeal, exploring potential outcomes and their ramifications for Microsoft's gaming strategy and the broader tech landscape.

The FTC's Arguments Against the Acquisition

Concerns about Competition

The FTC's primary argument centers on the potential for reduced competition within the gaming market. The acquisition of Activision Blizzard, a major player with hugely popular franchises like Call of Duty, World of Warcraft, and Candy Crush, by Microsoft, already a significant force in gaming through Xbox and its Game Pass subscription service, raises serious concerns. The FTC argues this merger would stifle competition, leading to less choice and potentially higher prices for gamers.

- Market Dominance: The combined entity would control a substantial market share, potentially creating a monopoly or oligopoly in certain gaming sectors. This could lead to less innovation and less incentive for Microsoft to compete fairly.

- Reduced Consumer Choice: The FTC worries that key Activision Blizzard titles, particularly Call of Duty, could become exclusive to Xbox consoles or the Game Pass service, limiting access for players on competing platforms like PlayStation. This could significantly impact the competitive landscape and consumer choice.

- Anti-Competitive Practices: The FTC suggests the merger could create opportunities for Microsoft to engage in anti-competitive behavior, such as predatory pricing or leveraging its market power to harm rivals. Statistics regarding market share held by Microsoft and Activision Blizzard before and after the potential merger would significantly support this claim. For example, a combined market share exceeding a certain threshold could trigger antitrust concerns.

Potential for Future Anti-Competitive Behavior

Beyond the immediate concerns about Call of Duty and other Activision Blizzard titles, the FTC's appeal sets a broader precedent. A successful appeal could signal a stricter approach to mergers and acquisitions within the tech industry as a whole. This could affect future deals, potentially slowing down innovation and consolidation in the sector.

- Impact on Tech Sector: The outcome of this case could significantly impact future mergers and acquisitions in the tech industry, setting a precedent for regulators in other countries as well. This will increase scrutiny of future tech acquisitions.

- Chilling Effect on Innovation: Uncertainty around regulatory approvals might discourage future mergers and acquisitions, potentially hindering innovation as companies are less likely to pursue potentially beneficial but risky collaborations.

- Examples of Affected Mergers: The success or failure of this appeal could influence the regulatory review of other large tech mergers, including those in the cloud computing, social media, or streaming sectors. The outcome will significantly impact how future mergers are reviewed and regulated.

Microsoft's Defense of the Acquisition

Arguments for Pro-Competitive Effects

Microsoft counters the FTC's arguments by emphasizing the benefits for consumers. The company maintains that the acquisition will expand access to games, benefitting gamers through increased content and broader availability.

- Multi-Platform Releases: Microsoft has committed to releasing key Activision Blizzard titles across multiple platforms, including PlayStation, ensuring continued access for a wider player base.

- Game Pass Expansion: The inclusion of Activision Blizzard's catalog within Xbox Game Pass would broaden its appeal, offering significant value to subscribers. The increase in the value proposition makes it a stronger competitor to other subscription services.

- Increased Competition: Microsoft argues that the acquisition will actually increase competition by strengthening its position against other gaming giants like Sony and Nintendo. Strengthening their position enables them to compete more effectively in the long run. Statements made by Microsoft executives supporting these points would strengthen this argument.

Addressing FTC Concerns

Microsoft has attempted to mitigate the FTC's concerns, primarily focusing on Call of Duty. To address the concerns of reduced competition and anti-competitive behavior they have offered concessions.

- Long-Term Licensing Agreements: Microsoft has offered long-term licensing agreements to ensure Call of Duty remains available on PlayStation consoles, even after the acquisition. The length and terms of these agreements would be crucial to evaluating their effectiveness.

- Other Concessions: In addition to the Call of Duty agreements, Microsoft may have offered other concessions, such as commitments regarding pricing or platform access for other Activision Blizzard titles. The details of these would be critical for evaluation.

- Effectiveness of Concessions: The effectiveness of these concessions in alleviating the FTC's concerns remains a critical point of contention. The FTC’s response and argument would determine the effectiveness and whether these concessions are sufficient.

Potential Outcomes of the Appeal

FTC Victory

An FTC victory could have significant consequences. The most drastic outcome would be a complete blocking of the merger, effectively ending Microsoft's acquisition attempt.

- Blocked Merger: A successful appeal could result in the complete blocking of the Microsoft-Activision Blizzard merger, forcing Microsoft to abandon its pursuit.

- Stricter Conditions: Even if the merger isn't blocked entirely, the FTC could impose stricter conditions, potentially limiting Microsoft's control over Activision Blizzard's assets or requiring divestitures.

- Financial and Reputational Impact: A loss for Microsoft would have significant financial implications and could damage the company's reputation.

Microsoft Victory

If the court upholds the original ruling, the acquisition will proceed. This would allow Microsoft to integrate Activision Blizzard's assets.

- Acquisition Completion: Microsoft would proceed with the acquisition, integrating Activision Blizzard's studios and IP into its existing gaming ecosystem.

- Integration of Assets: The successful integration of Activision Blizzard's assets into Microsoft's existing gaming infrastructure would be critical for the long-term success of the acquisition.

- Strategic Goals: Microsoft would likely pursue its stated goals regarding Game Pass expansion, multi-platform releases, and potentially other initiatives.

Settlement or Compromise

A settlement or compromise between the FTC and Microsoft remains a possibility. This could involve concessions from Microsoft to address the FTC's concerns.

- Divestiture: Microsoft might agree to divest certain Activision Blizzard assets to alleviate concerns about market dominance. This would reduce the company's overall market share.

- Behavioral Remedies: The settlement could involve commitments from Microsoft regarding future conduct, such as promises not to engage in anti-competitive practices. This could include restrictions on pricing and platform exclusivity.

- Conditional Approval: The FTC might approve the merger, but with conditions that must be met by Microsoft. These might include regular reporting or compliance with specific regulations.

Conclusion

The FTC's appeal of the Microsoft-Activision Blizzard merger represents a pivotal moment for the gaming industry and regulatory oversight of tech giants. The outcome will significantly influence future mergers and acquisitions in the sector, setting precedents for competitive practices and regulatory approaches. The implications extend far beyond gaming, impacting the broader tech landscape and setting a precedent for how antitrust regulators will approach large-scale mergers in the future.

Call to Action: Stay informed about the latest developments in the FTC's appeal against the Microsoft Activision Blizzard acquisition. Follow [your website/news source] for ongoing updates and analysis on the future of gaming and tech mergers.

Featured Posts

-

Fortnites Cowboy Bebop Collaboration Pricing For Faye Valentine And Spike Spiegel Skins

May 17, 2025

Fortnites Cowboy Bebop Collaboration Pricing For Faye Valentine And Spike Spiegel Skins

May 17, 2025 -

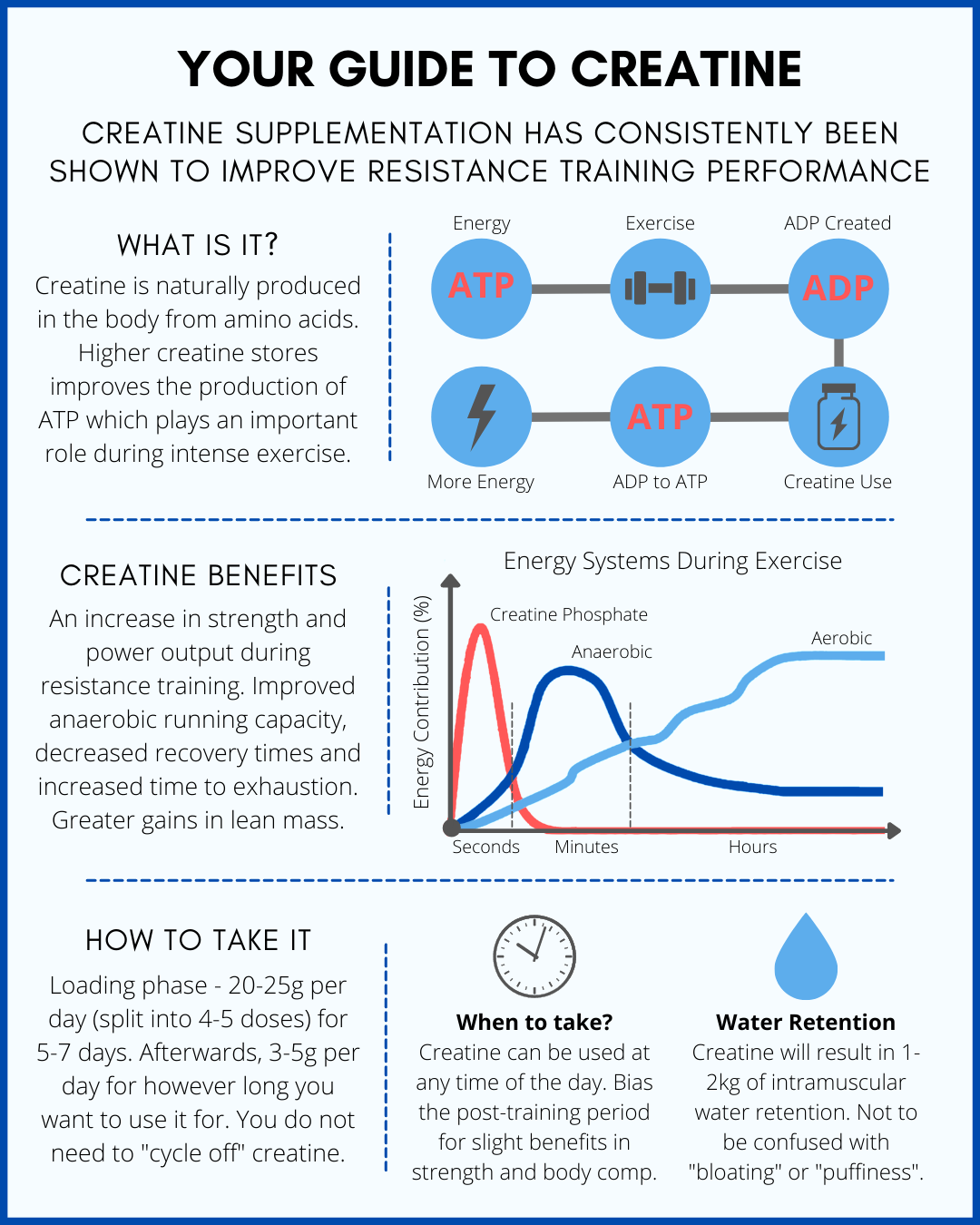

Creatine For Muscle Growth Benefits And Considerations

May 17, 2025

Creatine For Muscle Growth Benefits And Considerations

May 17, 2025 -

Analyzing The Influence Of Multiple Affairs And Accusations On Donald Trumps Presidency

May 17, 2025

Analyzing The Influence Of Multiple Affairs And Accusations On Donald Trumps Presidency

May 17, 2025 -

Why Did Uber Stock Rally Over 10 In April

May 17, 2025

Why Did Uber Stock Rally Over 10 In April

May 17, 2025 -

March 27 30 Mariners Vs Athletics Whos On The Injured List

May 17, 2025

March 27 30 Mariners Vs Athletics Whos On The Injured List

May 17, 2025