FTC Appeals Activision Blizzard Deal: A Deep Dive Into The Legal Battle

Table of Contents

The FTC's Case Against the Merger

The FTC's core argument centers on the assertion that the Microsoft-Activision Blizzard merger would create an anti-competitive environment, harming consumers and stifling innovation.

Concerns Regarding Anti-Competitive Practices

The FTC worries that the merger would grant Microsoft an unfair advantage, particularly concerning the immensely popular Call of Duty franchise. Their concerns are multifaceted:

- Loss of competition in the console gaming market: Microsoft acquiring Activision Blizzard would significantly increase its market share, potentially reducing competition with Sony's PlayStation.

- Potential for Call of Duty exclusivity: The FTC fears Microsoft could make Call of Duty exclusive to Xbox, significantly harming PlayStation players and reducing consumer choice. This would leverage Activision Blizzard's key IP to gain an unfair advantage.

- Impact on subscription services like Game Pass: Integrating Activision Blizzard's titles into Xbox Game Pass could give Microsoft an insurmountable advantage over competing subscription services.

- Increased prices for gamers: Reduced competition could lead to higher prices for games and subscription services, ultimately harming consumers.

The Role of Cloud Gaming

The FTC also emphasizes the potential for Microsoft to exploit its control over Activision Blizzard's intellectual property to dominate the burgeoning cloud gaming market.

- Microsoft's existing strength in cloud infrastructure (Azure): Microsoft's considerable cloud infrastructure (Azure) already gives them a significant head start. Combining this with Activision Blizzard's game catalog could create an insurmountable barrier to entry for competitors.

- Potential for anti-competitive practices in cloud gaming subscriptions: Microsoft could leverage its position to exclude competitors from cloud gaming services or offer less competitive terms.

- Long-term implications for innovation in the cloud gaming space: The FTC argues that the merger could stifle innovation by reducing competition and limiting consumer choice in this rapidly evolving market sector.

Microsoft's Defense and Arguments

Microsoft counters the FTC's claims by emphasizing its commitment to fair competition and the benefits the merger would bring to gamers and the industry as a whole.

Commitment to Fair Competition

Microsoft refutes the FTC's accusations of anti-competitive behavior, asserting its intention to maintain Call of Duty availability across multiple platforms.

- Proposed agreements to keep Call of Duty on Playstation: Microsoft has proposed ten-year agreements to keep Call of Duty on Playstation, aiming to alleviate the FTC's concerns about exclusivity.

- Arguments about the competitive landscape of the gaming industry: Microsoft argues the gaming industry is highly competitive, with numerous established players and new entrants.

- Emphasis on the benefits of the merger for game developers and consumers: Microsoft highlights the potential for increased investment in game development, leading to higher quality games and a richer gaming experience for consumers.

Benefits of the Merger for Gamers and Innovation

Microsoft paints a picture of a merger that will ultimately boost innovation and benefit gamers:

- Increased investment in game development: The merger could lead to increased investment in game development, potentially resulting in more innovative and higher-quality games.

- Expansion of Game Pass offerings: The addition of Activision Blizzard's extensive game catalog would significantly enhance the value proposition of Xbox Game Pass.

- Potential for cross-platform gaming experiences: The merger could facilitate the development of cross-platform gaming experiences, allowing players on different platforms to interact more easily.

The Judge's Initial Decision and the FTC's Appeal

The Initial Ruling

Initially, a judge ruled in favor of allowing the merger, finding the FTC's arguments insufficient to block the deal. The ruling included stipulations, but ultimately deemed the merger unlikely to substantially lessen competition.

- Summary of the judge's arguments: The judge's decision emphasized the competitive nature of the gaming market and Microsoft's concessions regarding Call of Duty availability.

- Key aspects of the decision that the FTC disagreed with: The FTC disagreed with the judge's assessment of the competitive landscape and the sufficiency of Microsoft's proposed remedies.

The Grounds for Appeal

The FTC appealed the decision, arguing the judge's assessment was flawed and the merger would have significant negative consequences.

- Specific points of disagreement: The FTC reiterated their concerns about Call of Duty exclusivity, cloud gaming dominance, and the overall impact on competition.

- Legal precedents cited by the FTC: The FTC cited various legal precedents supporting their position.

- Potential impact on future merger approvals: The FTC's appeal signals a broader concern about potential anti-competitive behavior in the tech sector and its potential to set a precedent for future mergers.

Potential Outcomes and Implications

Scenarios and their Impact

The appeal's outcome could significantly alter the gaming landscape. A blocked merger would limit Microsoft's expansion, while approval solidifies their position.

- Impact on Microsoft's market share: A blocked merger would prevent Microsoft from acquiring a significant market share boost.

- Effect on the gaming industry's competitive landscape: The outcome will define the industry's competitive dynamics for years to come.

- Implications for future mergers and acquisitions in the tech sector: This case will set a precedent for future antitrust considerations.

Wider Implications for Antitrust Law

This case holds significant weight for antitrust law and regulation, particularly regarding tech mergers.

- Setting precedents for future antitrust cases: The decision will influence future antitrust litigation involving tech giants.

- The role of regulatory bodies in controlling monopolies: This case tests regulatory power in curbing potential monopolies.

- Impact on the future of mergers and acquisitions: The ruling will affect how future mergers and acquisitions in the tech sector are evaluated.

Conclusion

The FTC Activision Blizzard deal is a pivotal case with far-reaching consequences. The FTC's appeal challenges the initial ruling and highlights the complexities of regulating mergers in the dynamic tech industry. The outcome will significantly impact the gaming industry's competitive landscape and shape future antitrust enforcement. Staying informed on the latest developments in the FTC Activision Blizzard deal is critical to understanding its lasting impact on the gaming world. Keep following the FTC Activision Blizzard deal to see how this pivotal legal battle unfolds.

Featured Posts

-

Man Utd Striker Transfer Talks Agents Arrival Signals Acceleration

May 20, 2025

Man Utd Striker Transfer Talks Agents Arrival Signals Acceleration

May 20, 2025 -

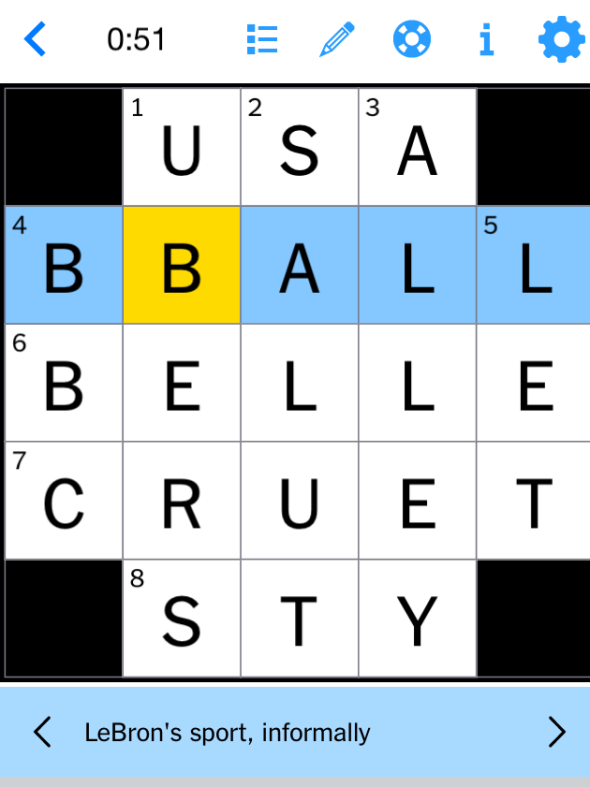

Nyt Mini Crossword Answers For April 25 Complete Solutions

May 20, 2025

Nyt Mini Crossword Answers For April 25 Complete Solutions

May 20, 2025 -

Agatha Christie A New Bbc Resurrection

May 20, 2025

Agatha Christie A New Bbc Resurrection

May 20, 2025 -

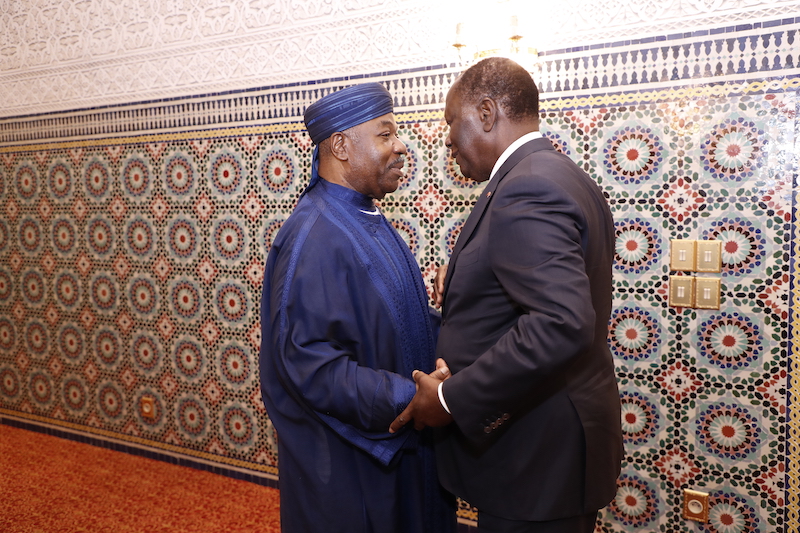

Visite D Amitie Et De Travail Du President Ghaneen Mahama A Abidjan Renforcement Des Liens Diplomatiques

May 20, 2025

Visite D Amitie Et De Travail Du President Ghaneen Mahama A Abidjan Renforcement Des Liens Diplomatiques

May 20, 2025 -

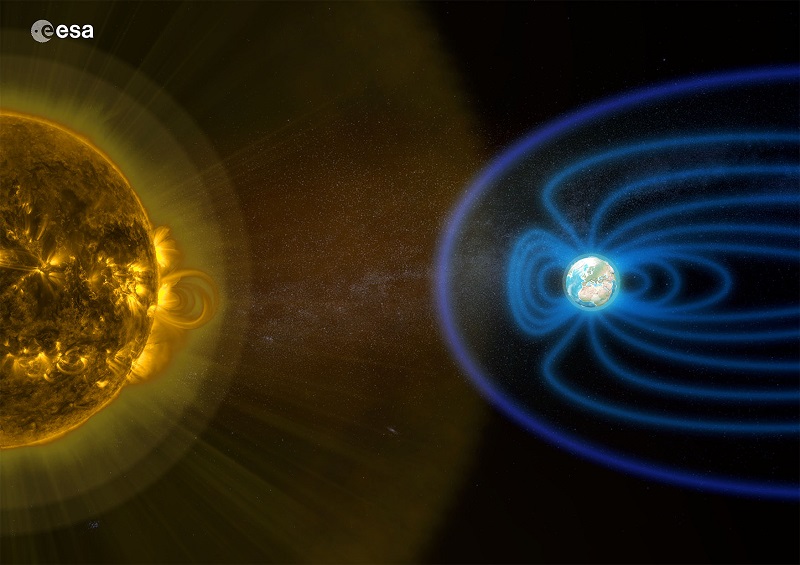

Damaging Winds How Fast Moving Storms Impact Watches And Warnings

May 20, 2025

Damaging Winds How Fast Moving Storms Impact Watches And Warnings

May 20, 2025