FTC Challenges Microsoft's Activision Blizzard Buyout: What's Next?

Table of Contents

The FTC's Case Against the Microsoft Activision Blizzard Buyout

The FTC's key argument centers on the assertion that the merger would stifle competition, particularly within the burgeoning cloud gaming market, granting Microsoft an unfair competitive advantage. Their concern isn't just about the size of the deal—it's about the potential for Microsoft to leverage its ownership of immensely popular Activision Blizzard franchises like Call of Duty, Candy Crush, and World of Warcraft to effectively lock out competitors.

Evidence Presented: The FTC likely presented evidence demonstrating Microsoft's ability to make these popular titles exclusive to its Xbox Cloud Gaming service and Xbox Game Pass, hindering the ability of rivals like Google Stadia, GeForce Now, and Amazon Luna to compete effectively. This could lead to reduced innovation and higher prices for consumers.

- Concerns about anti-competitive practices: The FTC worries that Microsoft could use its market power to leverage Activision Blizzard's titles to create insurmountable barriers to entry for smaller cloud gaming providers.

- Potential for higher prices for gamers: By controlling access to key franchises, Microsoft could potentially raise prices for games or subscriptions, harming consumers.

- Reduced choice and innovation in the gaming market: A lack of competition could lead to less innovation and fewer choices for gamers in terms of games, platforms, and subscription services.

- Impact on smaller gaming companies: Smaller gaming companies could be significantly disadvantaged by the merger, potentially hindering the growth of independent developers and publishers.

Microsoft's Defense of the Microsoft Activision Blizzard Buyout

Microsoft vehemently denies the FTC's claims, arguing that the acquisition will actually benefit gamers by expanding access to popular titles through Game Pass and bringing them to a wider range of platforms. Their core argument is that the deal won't harm competition, but instead foster it.

Evidence Presented: Microsoft likely emphasized its commitment to keeping Activision Blizzard games available on multiple platforms, including PlayStation and Nintendo Switch, directly countering the FTC's concerns about exclusivity. They have also highlighted the expansion of Game Pass, presenting it as a positive development for consumers by offering greater value and choice.

- Claims of increased competition and innovation: Microsoft argues the combined resources will fuel innovation and lead to the creation of new and exciting gaming experiences.

- Promises to keep games on rival platforms: A key component of Microsoft's defense is its repeated commitment to continue offering Activision Blizzard games on competing platforms like PlayStation.

- Focus on expanding Game Pass subscription service: Microsoft is heavily promoting Game Pass as a consumer-friendly service that will gain even more value with the addition of Activision Blizzard titles.

- Highlighting benefits to game developers and creators: Microsoft aims to show that the acquisition will benefit developers by providing them with more resources and opportunities.

Potential Outcomes and Next Steps in the Microsoft Activision Blizzard Buyout Case

Several potential outcomes exist for this landmark case:

- The FTC blocking the merger completely: This would be a significant victory for the FTC and a major setback for Microsoft.

- A negotiated settlement with conditions imposed on Microsoft: This could involve concessions from Microsoft, such as agreements to keep Activision Blizzard games on competing platforms.

- Microsoft winning the case and the acquisition proceeding as planned: This would be a major win for Microsoft, but potentially raise concerns about the future regulation of large tech mergers.

Next Steps: The legal battle is far from over. Further hearings, evidence submissions, and potentially appeals are expected, making the timeline uncertain. The outcome will undeniably set a crucial precedent for future mergers and acquisitions within the tech industry.

- Timeline for court proceedings and decisions: The legal process could take months, even years, to complete.

- Impact on the gaming industry's landscape: The decision will significantly shape the competitive landscape of the gaming industry.

- Regulatory implications for future mergers: The outcome will influence future regulatory decisions regarding mergers and acquisitions in the tech sector.

- Analysis of similar past antitrust cases: Legal experts will be analyzing past antitrust cases to predict the likely outcome and its implications.

The Role of Cloud Gaming in the Microsoft Activision Blizzard Buyout Debate

The FTC's focus on cloud gaming is critical. They argue that Microsoft's potential dominance in this space, amplified by the acquisition of Activision Blizzard, could stifle innovation and competition. The concern centers on the potential for Microsoft to leverage its vast resources and popular franchises to make cloud gaming a walled garden, excluding competitors and limiting consumer choice. Microsoft counters that the cloud gaming market is still highly competitive and that their acquisition will only accelerate innovation and benefit consumers. This aspect will be intensely scrutinized throughout the legal process.

Conclusion

The FTC's challenge to the Microsoft Activision Blizzard buyout is a landmark case with far-reaching implications for the gaming industry and antitrust law. The outcome will significantly shape the future of mergers and acquisitions in the tech sector, especially concerning cloud gaming. The arguments presented by both sides highlight the complexities of balancing innovation and competition in a rapidly evolving market. Keeping a close eye on the developments in this Microsoft Activision Blizzard Buyout case is crucial for anyone interested in the future of gaming and tech. Stay informed and follow the unfolding legal battle to understand the implications for the gaming industry and beyond. Understanding the intricacies of this Microsoft Activision Blizzard merger is essential for anyone following the future of gaming.

Featured Posts

-

Jenson Fw 22 Extended Design Inspiration And Craftsmanship

May 25, 2025

Jenson Fw 22 Extended Design Inspiration And Craftsmanship

May 25, 2025 -

Past Florida Film Festivals Notable Celebrity Appearances Mia Farrow Christina Ricci

May 25, 2025

Past Florida Film Festivals Notable Celebrity Appearances Mia Farrow Christina Ricci

May 25, 2025 -

Melanie Thierry Et Raphael Parentalite Et Difference D Age Entre Leurs Enfants

May 25, 2025

Melanie Thierry Et Raphael Parentalite Et Difference D Age Entre Leurs Enfants

May 25, 2025 -

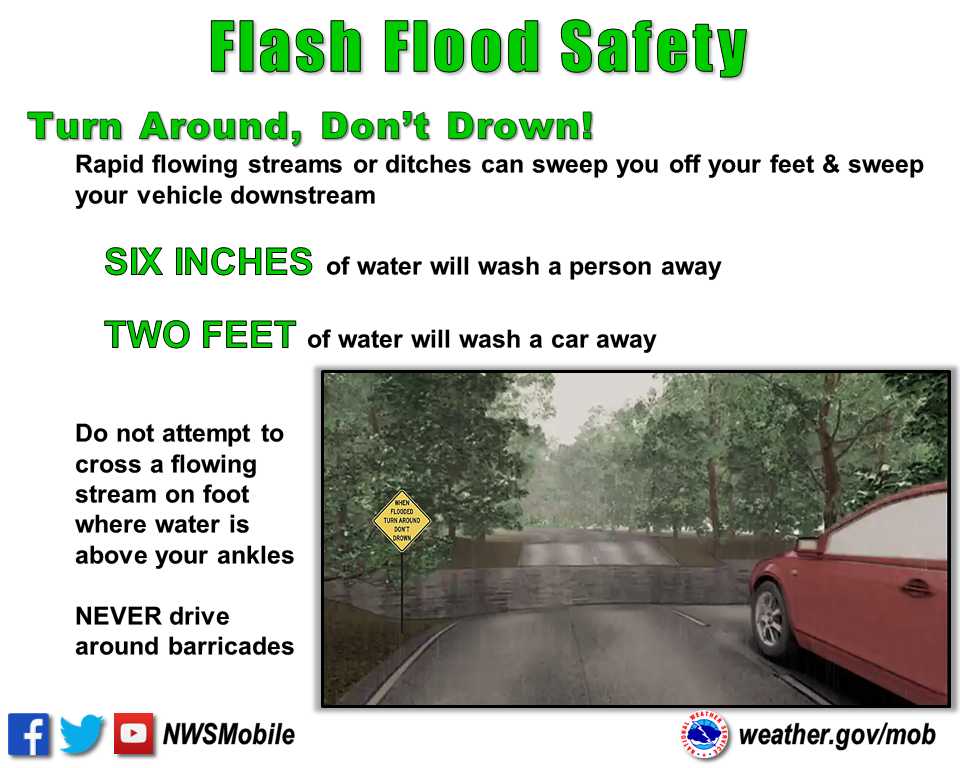

Severe Weather Awareness Week Day 5 Flood Safety Tips And Preparedness

May 25, 2025

Severe Weather Awareness Week Day 5 Flood Safety Tips And Preparedness

May 25, 2025 -

M56 Traffic Delays Current Updates Following Crash

May 25, 2025

M56 Traffic Delays Current Updates Following Crash

May 25, 2025