FTC Vs. Meta: The Antitrust Implications Of The WhatsApp And Instagram Acquisitions

Table of Contents

The FTC's Case Against Meta: Stifling Innovation and Competition

The FTC argued that Meta's acquisitions of WhatsApp and Instagram constituted anti-competitive behavior, aiming to eliminate potential rivals and solidify its monopolistic grip on the social media and messaging markets.

The Argument of Monopolization

The core of the FTC's argument rested on the assertion that Meta used its pre-existing dominance to strategically acquire and neutralize emerging competitors.

- Acquisition of WhatsApp: The FTC contended that the WhatsApp acquisition prevented the emergence of a strong, independent messaging platform capable of challenging Meta's dominance. WhatsApp, with its massive user base, represented a significant threat that was effectively eliminated.

- Instagram Acquisition: Similarly, the Instagram acquisition was presented as a move to neutralize a major competitor in the photo-sharing and social networking space. Instagram's rapid growth posed a direct threat to Facebook's core user base and market share.

- Integration and Barriers to Entry: The FTC emphasized that Meta leveraged its market power to tightly integrate WhatsApp and Instagram into its existing ecosystem, creating substantial barriers to entry for new competitors. This integration made it nearly impossible for smaller companies to compete effectively.

Harm to Consumers

Beyond the competitive landscape, the FTC alleged that these acquisitions directly harmed consumers by:

- Reduced Innovation: Less competition, the FTC argued, leads to a stagnation in innovation. Without the pressure of rivals, Meta had less incentive to develop new features and improve existing services.

- Limited Consumer Choice: The acquisitions reduced the diversity of choices available to consumers in social media and messaging platforms. This lack of choice can lead to decreased user satisfaction and less control over personal data.

- Potential Price Increases: While Meta's services remained free, the FTC warned that the lack of competition could pave the way for future price increases or the introduction of intrusive monetization strategies.

Evidence Presented by the FTC

The FTC's case was supported by substantial evidence, including:

- Internal Meta Documents: Emails and internal memos revealed Meta's strategic intent to eliminate or neutralize potential competitors through acquisitions. These documents provided crucial insight into Meta's motivations.

- Market Share Data: The FTC presented market share data demonstrating Meta's overwhelming dominance in social media and messaging, highlighting the significant impact of the acquisitions on the competitive landscape.

- Expert Testimony: The FTC relied on expert testimony from economists and industry analysts to support its claims of monopolistic behavior and harm to consumers. This expert analysis provided crucial context and interpretation of the presented data.

Meta's Defense: Synergies, Innovation, and Consumer Benefits

Meta countered the FTC's accusations by emphasizing the synergies, innovation, and consumer benefits stemming from the acquisitions.

Integration and Synergies

Meta argued that integrating WhatsApp and Instagram created significant efficiencies and enhanced the user experience.

- Cross-Platform Messaging: The integration allowed users to seamlessly connect across multiple platforms, improving communication and convenience.

- Streamlined Functionality: Meta highlighted the improved user experience resulting from streamlined functionalities and integrated features.

- Targeted Advertising: The combined user base allowed for more effective and targeted advertising, benefiting both businesses and consumers through relevant ads.

Increased Innovation

Meta maintained that the acquisitions spurred innovation by combining resources, talent, and user bases.

- New Features and Functionalities: Meta pointed to the development of new features and improvements across its platforms as a direct result of the combined resources.

- R&D Investment: The larger user base and combined resources enabled increased investment in research and development, furthering innovation.

- Market Expansion: Meta claimed the acquisitions facilitated expansion into new markets and demographics.

Consumer Benefits

Meta emphasized the tangible benefits to consumers, highlighting:

- Broader Range of Services: Users gained access to a wider range of interconnected services and functionalities.

- Free Services: Meta emphasized the continued provision of free services to its vast user base.

- Improved User Experience: The integration, claimed Meta, led to an overall improved user experience and increased engagement.

Legal Outcomes and Implications for Future Acquisitions

The FTC vs. Meta case concluded with a significant settlement. While not an outright victory for the FTC, the settlement imposed some restrictions on Meta's behavior and data sharing practices. The case's resolution and ongoing legal battles surrounding similar acquisitions are vital for understanding the complexities of antitrust law in the digital economy.

Court Decisions and Settlements

[Insert details of court decisions and settlements reached. Include specific dates, outcomes, and any imposed restrictions.]

Impact on Future M&A Activity

The outcome of this case has set a significant precedent, influencing future merger and acquisition activity in the tech industry. Companies are now more cautious about acquisitions that could trigger antitrust scrutiny. The increased regulatory scrutiny necessitates more thorough due diligence and potentially limits the scope of future mergers.

The Shifting Landscape of Antitrust Regulation

The FTC vs. Meta case highlights the ongoing debate about the application of traditional antitrust laws to the dynamic digital economy. The case underscores the need for a more nuanced approach to antitrust enforcement, one that accounts for the unique characteristics and rapid innovation cycles within the technology sector. The future likely requires a reevaluation of antitrust regulations and the criteria used to assess the competitive impact of mergers and acquisitions in the digital age.

Conclusion

The FTC vs. Meta antitrust case surrounding the WhatsApp and Instagram acquisitions serves as a crucial landmark case, illustrating the complexities of applying antitrust laws in the digital realm. The FTC’s concerns regarding monopolization and the stifling of competition were countered by Meta’s arguments emphasizing synergies, innovation, and consumer benefits. The outcome significantly impacts future mergers and acquisitions in the tech industry, highlighting the urgent need for a refined and adaptable approach to antitrust enforcement in the digital age. Understanding the intricacies of the FTC vs. Meta Antitrust case is essential for navigating the evolving landscape of tech industry regulation. Stay informed about the implications of this landmark case for future FTC vs. Meta Antitrust related legal battles and the ongoing evolution of antitrust law in the tech industry.

Featured Posts

-

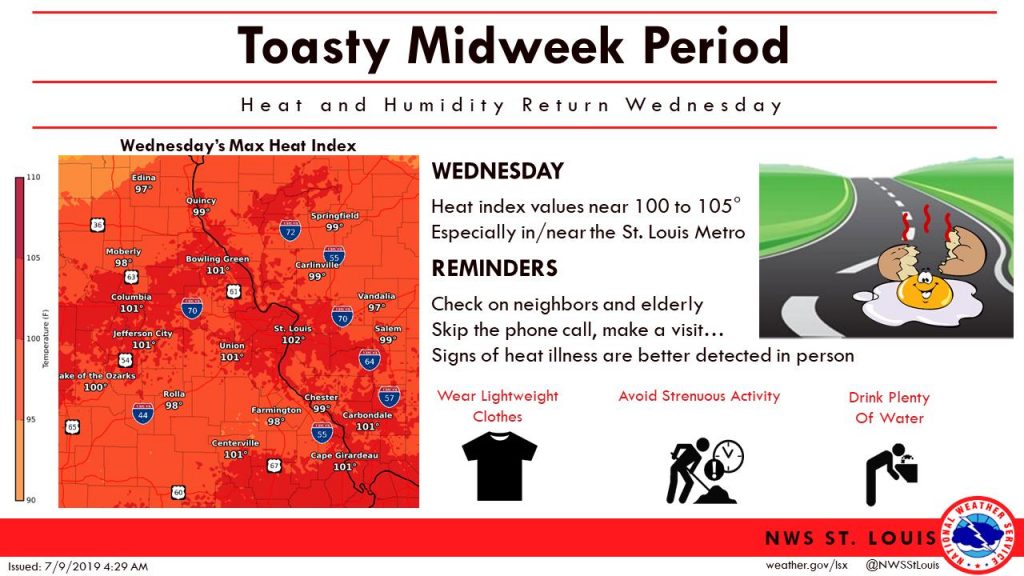

Delhi Governments Heatwave Warning Advisory Issued Amid Soaring Temperatures

May 13, 2025

Delhi Governments Heatwave Warning Advisory Issued Amid Soaring Temperatures

May 13, 2025 -

Epic City Development Halted Abbotts Warning And Developer Response

May 13, 2025

Epic City Development Halted Abbotts Warning And Developer Response

May 13, 2025 -

Epic Muslim Mega City Proposal Faces Doj Inquiry

May 13, 2025

Epic Muslim Mega City Proposal Faces Doj Inquiry

May 13, 2025 -

Atalanta Lecce Sigue La Fecha 34 De La Serie A En Vivo Online

May 13, 2025

Atalanta Lecce Sigue La Fecha 34 De La Serie A En Vivo Online

May 13, 2025 -

Kostyuk I Kasatkina Sportivnoe Rukopozhatie Na Fone Politicheskikh Sobytiy

May 13, 2025

Kostyuk I Kasatkina Sportivnoe Rukopozhatie Na Fone Politicheskikh Sobytiy

May 13, 2025