Funding Support For Sustainable Small And Medium-Sized Enterprises (SMEs)

Table of Contents

Government Grants and Subsidies for Sustainable SMEs

Many governments recognize the importance of supporting environmentally conscious businesses. Accessing these funds can significantly boost your sustainable SME's growth and impact.

Identifying Relevant Government Programs

Finding the right government program requires diligent research. Numerous national, regional, and local initiatives offer financial assistance for sustainable businesses.

- Research your eligibility: Carefully review program guidelines to ensure your SME meets all requirements regarding location, industry sector (e.g., renewable energy, green tech, sustainable agriculture), and the type of sustainability initiatives undertaken.

- Utilize online resources: Government websites, business support agencies, and dedicated sustainability portals often list available grants and subsidies. Keywords like "green business grants," "sustainable SME funding," and "[your country/region] eco-friendly business support" are helpful in your searches.

- Network effectively: Connect with other sustainable businesses and industry associations. Sharing information and experiences can lead to valuable insights on successful grant applications and available funding opportunities.

The Application Process for Government Funding

Securing government funding requires a meticulous and well-structured application.

- Demonstrate clear sustainability goals: Quantify your environmental impact using measurable Key Performance Indicators (KPIs). For example, demonstrate reductions in carbon emissions, water usage, or waste generation.

- Provide detailed financial projections: Include a comprehensive budget outlining how the funding will be used and demonstrating the financial viability of your project. Show a clear return on investment (ROI) for the grant, highlighting both financial and environmental benefits.

- Craft a compelling narrative: Highlight the social and environmental benefits of your initiative. Explain how your project contributes to a more sustainable future and aligns with government sustainability policies. A strong story increases your chances of securing the funding.

Green Loans and Financing Options for Sustainable Businesses

Beyond grants, various financial institutions offer tailored solutions for sustainable SMEs.

Accessing Green Loans from Banks and Financial Institutions

Many banks and credit unions now offer specialized green loans with attractive interest rates and favorable repayment terms designed specifically for eco-friendly projects.

- Explore funding options: Green loans can finance energy-efficient upgrades (e.g., installing solar panels, improving insulation), renewable energy installations (e.g., wind turbines, geothermal systems), and waste reduction initiatives (e.g., implementing recycling programs, adopting circular economy models).

- Highlight positive environmental impact: Clearly articulate the environmental benefits of your project and how the loan will contribute to achieving your sustainability goals. This strengthens your application and showcases your commitment to environmentally responsible practices.

- Compare loan offers: Shop around and compare terms and interest rates from multiple lenders before making a decision. Consider factors such as repayment schedules, fees, and any associated conditions.

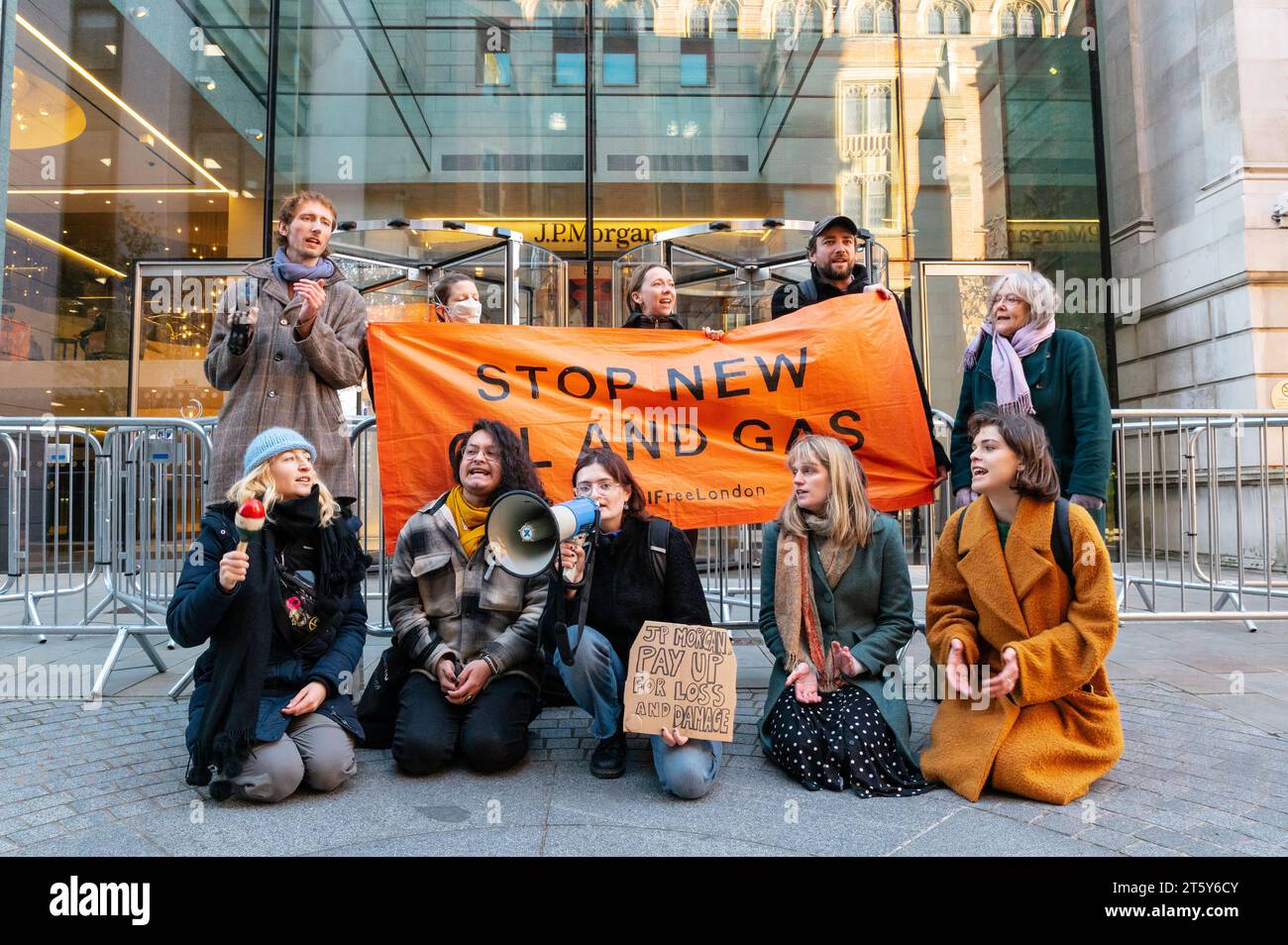

Impact Investing and Sustainable Venture Capital

Impact investors and sustainable venture capitalists prioritize environmentally and socially responsible investments. They seek businesses demonstrating strong environmental and social returns, in addition to financial profitability.

- Develop a strong investment proposal: This should clearly outline your business model, financial projections, environmental impact, and social benefits. Emphasize the long-term sustainability of your business and its potential for positive change.

- Network strategically: Attend industry events, conferences, and workshops to connect with impact investors and sustainable venture capitalists. Online platforms and databases dedicated to impact investing can also facilitate these connections.

- Demonstrate a strong team: Highlight the experience and expertise of your management team, emphasizing their commitment to sustainability and their ability to execute your business plan effectively.

Crowdfunding and Community Funding for Sustainable SMEs

Crowdfunding and local community initiatives present alternative avenues for securing funding.

Leveraging Crowdfunding Platforms for Sustainable Projects

Crowdfunding platforms allow you to directly engage with potential investors and build a community around your sustainable project.

- Create a compelling campaign: Develop a clear and concise campaign outlining your project, its environmental benefits, and the rewards offered to investors (e.g., early access to your product, exclusive merchandise, naming rights).

- Incentivize investment: Offer attractive rewards to incentivize investment and encourage participation. Make it clear how your project will make a difference and benefit the investors and the community.

- Engage with your audience: Actively interact with potential investors, responding to their questions and concerns. Building a strong online community around your project can significantly boost your fundraising success.

Exploring Local Community Funding Initiatives

Local community foundations and organizations often offer grants and funding opportunities to support local businesses with a strong commitment to sustainability.

- Build community relationships: Engage with your local community, highlighting your business's commitment to sustainability and its positive impact on the local environment and economy.

- Showcase local impact: Emphasize how your business benefits the community and promotes sustainable practices within your area. This fosters a strong sense of local support and increases your chances of securing funding.

- Attend local networking events: Networking events are invaluable for connecting with potential funders and learning about local funding opportunities. Active participation can significantly increase your chances of securing support.

Conclusion

Securing funding for sustainable SMEs requires a multifaceted approach. By exploring government grants, green loans, impact investing, and crowdfunding, sustainable businesses can access the necessary capital to implement innovative solutions and contribute to a more environmentally responsible future. Don't hesitate to explore the diverse avenues of funding support available for your sustainable SME; begin your search for funding for sustainable SMEs today and unlock your business’s green potential. Remember to thoroughly research available options and tailor your applications to showcase your commitment to sustainability and its positive impact.

Featured Posts

-

Mairon Santos Claims Ufc 313 Victory Over Francis Marshall A Controversial Decision Revisited

May 19, 2025

Mairon Santos Claims Ufc 313 Victory Over Francis Marshall A Controversial Decision Revisited

May 19, 2025 -

Chateau Diy Projects Step By Step Guides For Beginners And Experts

May 19, 2025

Chateau Diy Projects Step By Step Guides For Beginners And Experts

May 19, 2025 -

31 000 Raised To Fight Environmental Concerns Threatening Major Uk Festival

May 19, 2025

31 000 Raised To Fight Environmental Concerns Threatening Major Uk Festival

May 19, 2025 -

Espionage Probe Youtuber Jyoti Malhotra Puris Srimandir Visit Under Scrutiny

May 19, 2025

Espionage Probe Youtuber Jyoti Malhotra Puris Srimandir Visit Under Scrutiny

May 19, 2025 -

Are You Ready For The 1 70 First Class Stamp

May 19, 2025

Are You Ready For The 1 70 First Class Stamp

May 19, 2025