Further Losses For Dutch Stocks As US Trade War Escalates

Table of Contents

Impact on Specific Dutch Sectors

The escalating US trade war has had a demonstrably negative effect on several key sectors of the Dutch economy. Increased tariffs and supply chain disruptions are significantly impacting profitability and growth projections.

Technology Sector

The Dutch technology sector, a key contributor to the nation's GDP, is feeling the pinch of the trade war. Increased tariffs on imported components and finished goods are raising production costs, impacting profitability, and hindering export opportunities.

- Affected Companies: Examples include [Insert names of specific Dutch tech companies and their stock performance].

- Percentage Losses: [Insert data on percentage losses experienced by specific companies or indices].

- Long-term Effects: Reduced competitiveness in global markets, potential job losses, and decreased innovation are all potential long-term consequences. The "trade war impact on technology" in the Netherlands is a growing concern for analysts.

Agricultural Sector

The Netherlands, a global leader in agricultural exports, is facing significant challenges due to trade disputes and retaliatory tariffs. Key export markets are being affected, leading to decreased demand and lower prices for Dutch agricultural products.

- Key Agricultural Products Affected: Dairy products, flowers, and horticultural products are particularly vulnerable.

- Export Volume Changes: [Insert data on changes in export volumes for specific agricultural products].

- Government Support Measures: The Dutch government has implemented [mention specific support measures, if any], but the long-term effects of the "trade war impact on farming" remain uncertain. Concerns regarding "agricultural exports" from the Netherlands are mounting.

Other Affected Industries

Beyond the technology and agricultural sectors, other Dutch industries are experiencing losses due to the trade war.

- Dutch Manufacturing: Disruptions in global supply chains and reduced demand are affecting manufacturing output and profitability.

- Dutch Tourism: Uncertainty in the global economy and potential travel restrictions are impacting the tourism sector.

- Reasons for Impact: These industries are heavily reliant on international trade and are therefore vulnerable to trade disputes and protectionist measures. Understanding the "trade war consequences" for these sectors is crucial for effective policymaking.

Investor Sentiment and Market Volatility

The escalating US trade war is significantly impacting investor sentiment and causing increased volatility in the Dutch stock market.

Decreasing Investor Confidence

The ongoing uncertainty surrounding the trade war is eroding investor confidence in the Dutch stock market.

- Decreasing Investments: Foreign investment in Dutch companies is declining as investors adopt a more cautious approach.

- Stock Market Index Performance: [Insert data on the performance of major Dutch stock market indices].

- Investor Reactions: Investors are reacting to the increased uncertainty by reducing their exposure to riskier assets. The "Dutch stock market volatility" is a clear indication of this.

Flight to Safety

As investors seek safer assets, there's a significant "flight to safety," impacting investment flows into the Netherlands.

- Examples of Safe Haven Assets: Government bonds and gold are seen as safe havens during times of economic uncertainty.

- Impact on Bond Yields: Demand for safe haven assets is driving down bond yields.

- Implications for Dutch Markets: This shift is diverting investment away from the Dutch stock market and impacting the country's economic outlook. The term "risk aversion" is now a dominant factor in investment decisions.

Government Response and Potential Solutions

The Dutch government is actively responding to the economic fallout from the US trade war, but the effectiveness of its measures remains to be seen.

Government Intervention

The Dutch government is attempting to mitigate the negative effects of the trade war through various policy interventions.

- Government Aid Packages: [Mention specific aid packages or support programs for affected businesses].

- Economic Stimulus Plans: [Detail any stimulus plans implemented to boost economic activity].

- Policy Changes: [Discuss any policy changes aimed at improving the competitiveness of Dutch industries]. The effectiveness of the "Dutch government response" will be crucial in navigating this economic challenge.

Long-Term Economic Outlook

The long-term economic consequences of the US trade war for the Netherlands are still uncertain.

- Potential Economic Growth Forecasts: [Cite forecasts from reputable economic institutions].

- Predictions for Specific Sectors: [Provide insights into the predicted recovery timelines for various sectors].

- Strategies for Diversification: The Netherlands needs to focus on diversifying its export markets and strengthening its domestic economy to mitigate future risks. Achieving "economic recovery" will require a multi-pronged approach. Developing strategies for "Dutch economic growth" that are less reliant on exports to the US is crucial.

Conclusion

The escalating US trade war is causing significant losses for Dutch stocks, impacting crucial sectors like technology and agriculture. Decreased investor confidence and a "flight to safety" are further exacerbating the situation. The Dutch government's response, while important, faces the challenge of mitigating the effects of a global economic disruption. The long-term "economic recovery" and future "Dutch economic growth" will depend on effective policy measures, diversification, and a proactive approach to navigating global trade uncertainties. Stay updated on further developments affecting Dutch stocks and the escalating US trade war by following our regular market analysis and insights. Understanding the impact of the US trade war on Dutch stocks is crucial for investors. Learn more about mitigating risks and adapting your investment strategy.

Featured Posts

-

Dazi Stati Uniti Influenza Sui Prezzi Dell Abbigliamento Di Lusso

May 25, 2025

Dazi Stati Uniti Influenza Sui Prezzi Dell Abbigliamento Di Lusso

May 25, 2025 -

Desperate Fathers Rowing Feat To Fund Sons 2 2 Million Treatment

May 25, 2025

Desperate Fathers Rowing Feat To Fund Sons 2 2 Million Treatment

May 25, 2025 -

Kering Sales Dip Demnas Gucci Debut In September

May 25, 2025

Kering Sales Dip Demnas Gucci Debut In September

May 25, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025 -

Kering Reports Sales Decline Demnas First Gucci Collection Unveiled In September

May 25, 2025

Kering Reports Sales Decline Demnas First Gucci Collection Unveiled In September

May 25, 2025

Latest Posts

-

Pennsylvania Flash Flood Warning Heavy Rain Until Thursday

May 25, 2025

Pennsylvania Flash Flood Warning Heavy Rain Until Thursday

May 25, 2025 -

Texas Weather Alert Flash Flood Warning Issued Seek Higher Ground Immediately

May 25, 2025

Texas Weather Alert Flash Flood Warning Issued Seek Higher Ground Immediately

May 25, 2025 -

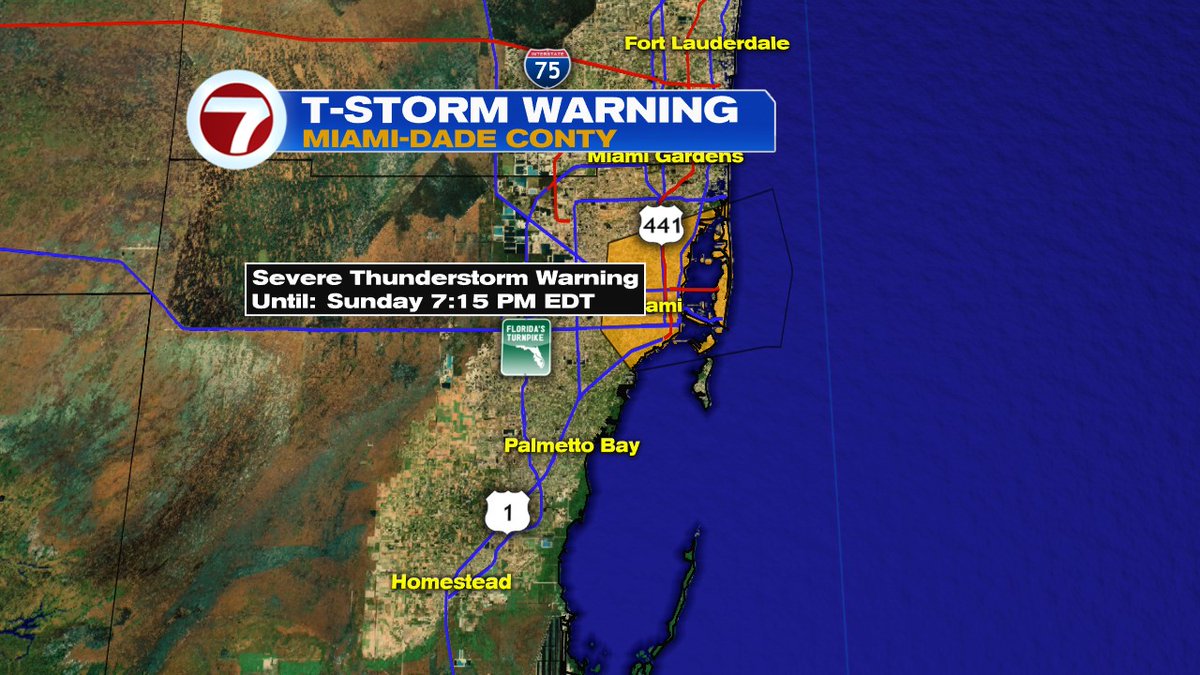

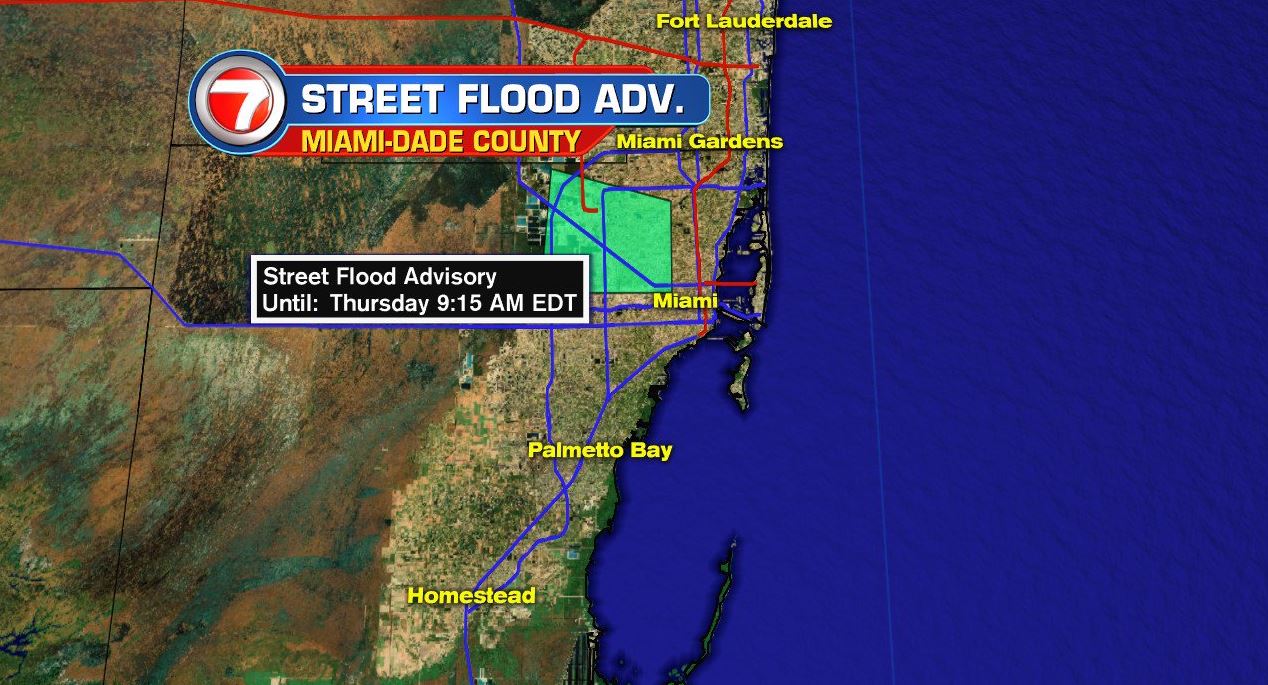

Miami Valley Flood Risk Severe Weather And Current Advisories

May 25, 2025

Miami Valley Flood Risk Severe Weather And Current Advisories

May 25, 2025 -

Flood Advisory Update Miami Valley Facing Severe Storm Impacts

May 25, 2025

Flood Advisory Update Miami Valley Facing Severe Storm Impacts

May 25, 2025 -

Texas Flash Flood Warning Severe Storms And Heavy Rain Impacting North Central Region

May 25, 2025

Texas Flash Flood Warning Severe Storms And Heavy Rain Impacting North Central Region

May 25, 2025