Future Of Microsoft-Activision Deal Uncertain After FTC Appeal

Table of Contents

The FTC's Antitrust Concerns and Legal Arguments

The Federal Trade Commission (FTC) has voiced strong opposition to the Microsoft-Activision merger, primarily focusing on the potential for anti-competitive practices concerning Activision Blizzard's flagship franchise, Call of Duty. The FTC argues that Microsoft acquiring Activision Blizzard, a major competitor in the video game market, would stifle competition, ultimately harming consumers. Their arguments center around several key points:

- Reduced competition in the console gaming market: The FTC contends that Microsoft's acquisition would give it an unfair advantage over competitors like Sony, potentially leading to higher prices and reduced innovation.

- Potential for anti-competitive practices like exclusive content: A key concern revolves around the possibility of Microsoft making Call of Duty and other Activision Blizzard titles exclusive to its Xbox ecosystem, limiting consumer choice and harming rival platforms. This impacts the very core of the Microsoft-Activision deal debate.

- Impact on game subscription services: The FTC also worries about the merger's impact on subscription services like Xbox Game Pass, arguing that it could lead to anti-competitive practices and stifle competition in this rapidly growing market segment.

- Argument against Microsoft's proposed remedies: Microsoft has offered various concessions, such as licensing agreements to keep Call of Duty on PlayStation, but the FTC has argued these remedies are insufficient to address the underlying antitrust concerns. This highlights the complexity of the Microsoft-Activision deal's legal battle.

The FTC’s legal challenge invokes sections of antitrust law designed to prevent mergers that substantially lessen competition. The outcome will significantly influence future mergers and acquisitions in the gaming industry and set precedents for how regulators approach similar deals.

Microsoft's Defense and Proposed Solutions

Microsoft has vigorously defended the merger, arguing that it will actually increase competition and innovation in the gaming industry. They counter the FTC’s claims with several arguments and proposed solutions:

- Agreements to keep Call of Duty on PlayStation: A significant part of Microsoft's defense rests on its commitment to keeping Call of Duty available on PlayStation, ensuring continued access for Sony's vast user base. This attempts to directly address the FTC's core concerns about exclusivity in the Microsoft-Activision deal.

- Investment in cloud gaming infrastructure: Microsoft has highlighted its investment in cloud gaming technology, arguing that this will benefit gamers by improving access to games across multiple platforms. This is a key aspect of their argument for increased competition and accessibility resulting from the Microsoft-Activision deal.

- Arguments for increased competition and innovation: Microsoft claims the merger will foster greater competition and innovation, leading to better games and more choices for consumers.

- Economic benefits of the merger: Microsoft also points to the economic benefits of the deal, including job creation and investment in the gaming industry.

These counterarguments, along with the proposed solutions, form the bedrock of Microsoft's defense against the FTC's challenge to the Microsoft-Activision deal.

International Regulatory Responses and Their Implications

The regulatory landscape surrounding the Microsoft-Activision deal is complex and multifaceted, with varying approaches from different jurisdictions.

- EU's approval (or disapproval) of the deal: The European Union's regulatory body has made its own assessment of the deal, with approval (or rejection) having significant global implications.

- UK's CMA decision and its impact: The UK's Competition and Markets Authority (CMA) has also played a crucial role, its decision impacting the deal's prospects in other regions. Their findings and rationale offer insights into the international regulatory approach to the Microsoft-Activision deal.

- Regulatory differences and their global implications: The divergence in regulatory opinions across different countries highlights the complexities of international antitrust law and its application to a global tech giant like Microsoft.

Potential Outcomes and Their Impact on the Gaming Industry

Several potential outcomes for the Microsoft-Activision deal exist:

- Deal Completion: If the FTC appeal is unsuccessful and regulatory hurdles are cleared, the merger will proceed, potentially shaping the gaming landscape significantly.

- Deal Rejection: A complete rejection by the courts could leave Activision Blizzard independent, impacting its future strategy and partnerships. This would also establish a significant precedent for future mergers in the gaming sector.

- Significant alterations to the deal: The courts might require Microsoft to make substantial concessions to satisfy antitrust concerns, altering the deal's structure and impact.

Each outcome would have profound implications:

- Impact on game prices: The deal's outcome could directly impact game pricing, potentially leading to either increases or decreases depending on the level of competition.

- Changes in game subscription models: The future of game subscription models could significantly change based on whether the merger proceeds as planned or is altered.

- Future of exclusive content and platform loyalty: The level of exclusive content and platform loyalty could be fundamentally altered based on the final outcome of the Microsoft-Activision deal.

- Long-term effects on gaming competition: The long-term implications for gaming competition will depend significantly on the final resolution of the FTC’s appeal.

The Uncertain Future of the Microsoft-Activision Deal

The legal battle surrounding the Microsoft-Activision deal remains fiercely contested, with compelling arguments presented by both the FTC and Microsoft. The FTC's appeal introduces significant uncertainty, potentially delaying or even derailing the acquisition. The various possible outcomes—deal completion, rejection, or substantial modification—will have a ripple effect across the gaming industry, influencing game pricing, subscription models, exclusive content, and the overall competitive landscape. The implications extend beyond just the merging companies; developers, publishers, and ultimately, millions of gamers worldwide are watching closely. Stay informed about this ongoing legal battle by following reputable news sources and industry publications for the latest updates on the Microsoft-Activision deal and its impact on the future of gaming.

Featured Posts

-

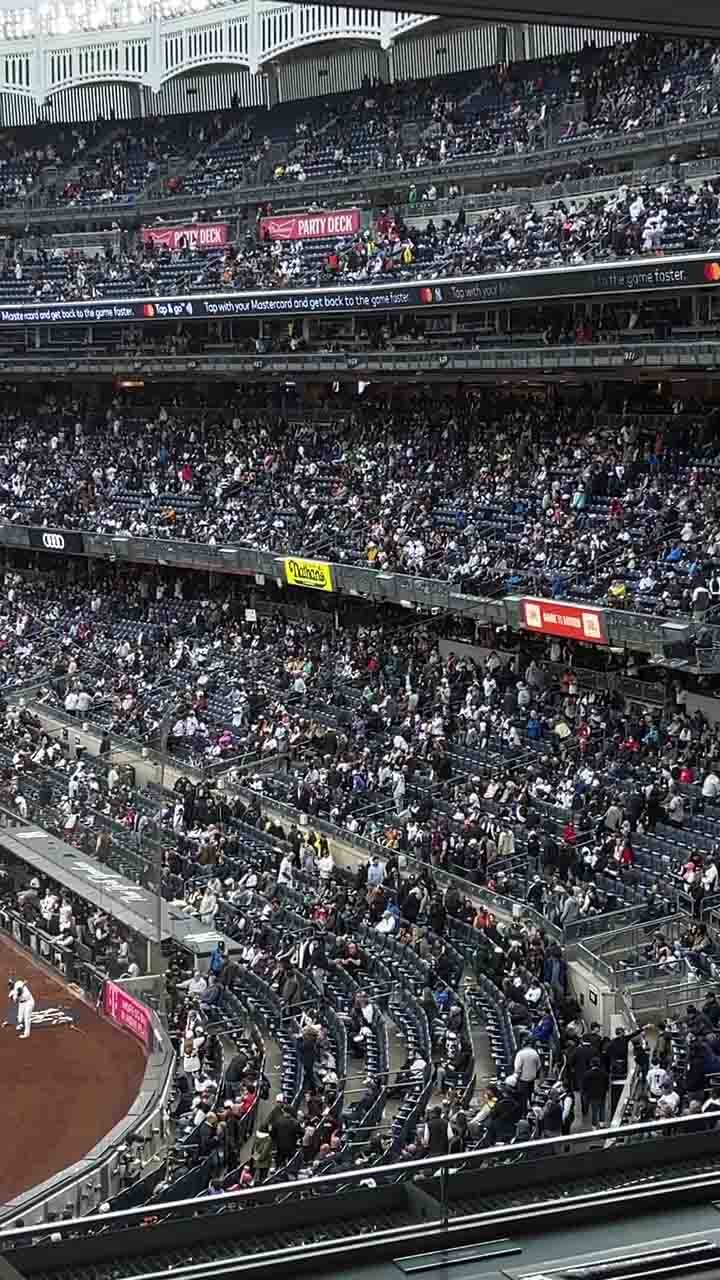

Analysis Mets Rivals Top Pitchers Rise To Prominence

Apr 28, 2025

Analysis Mets Rivals Top Pitchers Rise To Prominence

Apr 28, 2025 -

Mhrjan Abwzby 2024 Asatyr Almwsyqa Alealmyt Tltqy

Apr 28, 2025

Mhrjan Abwzby 2024 Asatyr Almwsyqa Alealmyt Tltqy

Apr 28, 2025 -

Key Offensive Performances How Judge And Goldschmidt Saved The Series

Apr 28, 2025

Key Offensive Performances How Judge And Goldschmidt Saved The Series

Apr 28, 2025 -

Abu Dhabis 2024 Successes Key Projects Real Estate Growth And Technological Innovations

Apr 28, 2025

Abu Dhabis 2024 Successes Key Projects Real Estate Growth And Technological Innovations

Apr 28, 2025 -

Aaron Judge Equals Babe Ruths Legendary Yankees Mark

Apr 28, 2025

Aaron Judge Equals Babe Ruths Legendary Yankees Mark

Apr 28, 2025

Latest Posts

-

Yankees Diamondbacks Series Whos Injured April 1 3

May 11, 2025

Yankees Diamondbacks Series Whos Injured April 1 3

May 11, 2025 -

Predicting Aaron Judges 2025 Impact Key Analytics For Yankees Fans

May 11, 2025

Predicting Aaron Judges 2025 Impact Key Analytics For Yankees Fans

May 11, 2025 -

Analyzing Aaron Judges Performance What It Means For The Yankees In 2025

May 11, 2025

Analyzing Aaron Judges Performance What It Means For The Yankees In 2025

May 11, 2025 -

Aaron Judges Key Stats A 2025 Yankees Prediction

May 11, 2025

Aaron Judges Key Stats A 2025 Yankees Prediction

May 11, 2025 -

New York Yankees Vs Arizona Diamondbacks Injury News April 1 3

May 11, 2025

New York Yankees Vs Arizona Diamondbacks Injury News April 1 3

May 11, 2025