Gas Prices Dip Below $3: Economic Factors Play A Key Role

Table of Contents

Decreased Global Oil Demand

The weakening global economy is a primary driver of the recent decline in oil demand and subsequently, gas prices. Slower economic growth in major economies like China and Europe has directly translated to reduced industrial activity. This means less energy is needed to power factories, transportation, and other industrial processes, thus lowering the overall demand for oil.

- Weakening global economy leading to lower energy consumption: A global recession, or even the fear of one, significantly reduces energy consumption across various sectors.

- Reduced industrial production impacting fuel demand: Factories operating at lower capacity require less energy, translating to lower oil demand.

- Shift in consumer behavior towards less fuel-intensive activities: Economic uncertainty often leads consumers to curtail non-essential activities, such as driving long distances, reducing their gasoline consumption.

- Impact of alternative energy sources: The gradual but consistent growth of renewable energy sources, such as solar and wind power, is also contributing to a lower reliance on fossil fuels.

Increased Oil Supply

The increase in global oil supply is another critical factor contributing to lower gas prices. OPEC+, the group of oil-producing countries, has made adjustments to its production levels, increasing the amount of oil available in the market. Furthermore, the release of strategic petroleum reserves by various countries, including the United States, has added to the overall supply.

- OPEC+ production adjustments: Decisions by OPEC+ to increase oil production quotas have directly increased the supply, thus putting downward pressure on prices.

- Increased US shale oil production: The United States has also seen increased production from its shale oil reserves, adding to the global supply.

- Release of strategic petroleum reserves: Governments releasing oil from their strategic reserves aims to stabilize prices and counter supply disruptions.

- Impact of new oil discoveries: While less immediate, new oil discoveries can eventually lead to increased supply and lower prices in the long term.

Strengthening US Dollar

The US dollar's recent strength has also played a role in the decrease of oil prices. Since oil is primarily traded in US dollars, a stronger dollar makes oil more expensive for buyers using other currencies. This reduces the global demand for oil, leading to lower prices.

- Impact of a strong dollar on international commodity prices: A strong dollar generally makes commodities priced in dollars more expensive for international buyers.

- Effects on oil-importing countries: Oil-importing countries with weaker currencies face higher costs for their oil imports when the dollar strengthens.

- Relationship between currency exchange rates and oil prices: There is a strong inverse correlation between the US dollar's value and oil prices.

Impact on Inflation and Consumer Spending

The drop in gas prices is a welcome relief for consumers and has a positive effect on inflation. Lower fuel costs reduce transportation costs for businesses, leading to lower prices for goods and services. The savings on fuel also increases consumers' disposable income, potentially boosting spending and overall economic growth.

- Easing of inflationary pressures: Lower gas prices directly alleviate inflationary pressures, contributing to overall price stability.

- Increased disposable income for consumers: Consumers have more money to spend on other goods and services, potentially stimulating economic activity.

- Potential boost to consumer confidence and spending: Lower gas prices can improve consumer sentiment, leading to increased spending and economic growth.

- Impact on overall economic growth: The combined effect of reduced inflation and increased consumer spending can contribute positively to overall economic growth.

Potential for Future Price Volatility

While the current decline in gas prices is positive, it's crucial to acknowledge the potential for future price fluctuations. Geopolitical instability, unexpected supply disruptions (like hurricanes or other natural disasters impacting oil production), and shifts in global demand could all contribute to price volatility.

- Geopolitical instability and its impact on oil supply: Conflicts or political tensions in oil-producing regions can significantly disrupt supply and impact prices.

- Uncertainties related to future energy demand: The unpredictable nature of global economic growth and energy consumption makes forecasting future oil demand challenging.

- Potential for unexpected supply shocks: Unforeseen events, such as natural disasters or major pipeline disruptions, can cause sudden supply shortages.

- Speculation in the oil market: Speculation and trading activity in the oil futures market can influence price movements, regardless of actual supply and demand dynamics.

Conclusion:

The decrease in gas prices below $3 is a multifaceted event influenced by decreased global oil demand, increased oil supply, and the strengthening US dollar. These interconnected economic factors have contributed to easing inflationary pressures and boosting consumer spending. However, the potential for future price volatility remains, emphasizing the need to stay informed about global events and energy market trends. Stay updated on gas prices and monitor the impact of $3 gas on the economy by regularly checking reliable news sources and economic indicators. Learn more about the factors influencing fuel prices to better understand their impact on your finances and the overall economy.

Featured Posts

-

Naslidki Obmanu Putin Ta Tramp Geopolitichna Gra

May 22, 2025

Naslidki Obmanu Putin Ta Tramp Geopolitichna Gra

May 22, 2025 -

The Allure Of Cassis Blackcurrant Liqueur

May 22, 2025

The Allure Of Cassis Blackcurrant Liqueur

May 22, 2025 -

Saskatchewans Costco Campaign A Political Panel Analysis

May 22, 2025

Saskatchewans Costco Campaign A Political Panel Analysis

May 22, 2025 -

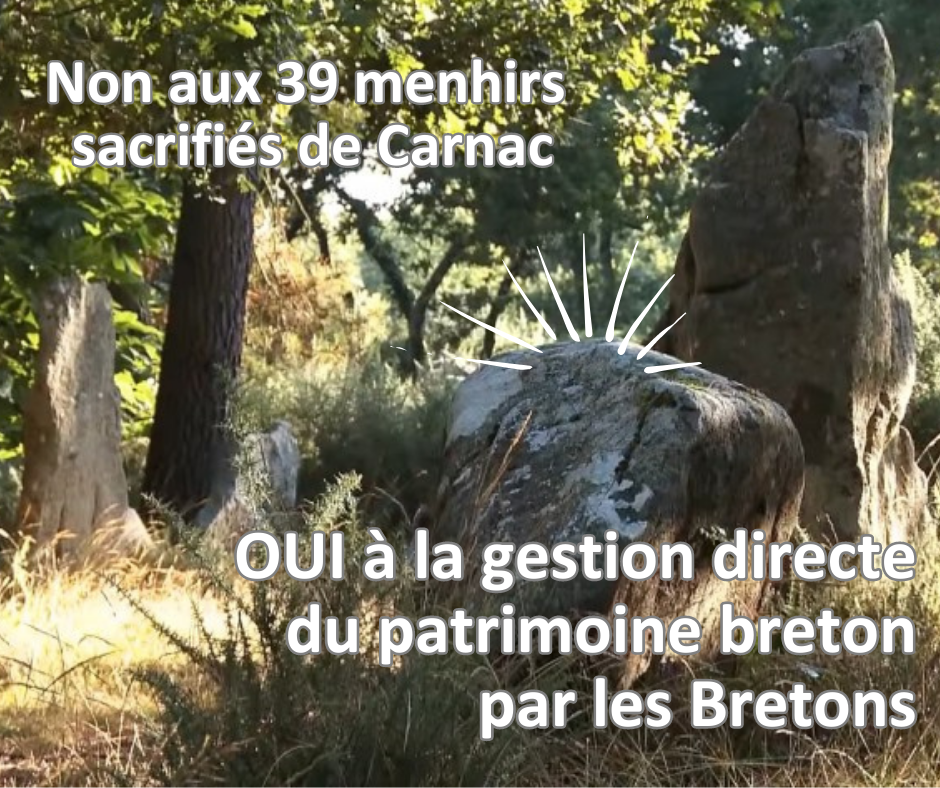

Mission Patrimoine 2025 Plouzane Et Clisson Patrimoine Breton Sauve

May 22, 2025

Mission Patrimoine 2025 Plouzane Et Clisson Patrimoine Breton Sauve

May 22, 2025 -

Unfiltered Pub Landlords Angry Tirade At Employee Who Handed In Notice

May 22, 2025

Unfiltered Pub Landlords Angry Tirade At Employee Who Handed In Notice

May 22, 2025

Latest Posts

-

Who Drummer Speaks Out After Royal Albert Hall Dismissal

May 23, 2025

Who Drummer Speaks Out After Royal Albert Hall Dismissal

May 23, 2025 -

From Mod Icons To Rock Legends The Story Behind The Whos Name

May 23, 2025

From Mod Icons To Rock Legends The Story Behind The Whos Name

May 23, 2025 -

Pete Townshend On Zak Starkey The Who Drummer Is Back

May 23, 2025

Pete Townshend On Zak Starkey The Who Drummer Is Back

May 23, 2025 -

Official Zak Starkey Back As The Who Drummer Says Pete Townshend

May 23, 2025

Official Zak Starkey Back As The Who Drummer Says Pete Townshend

May 23, 2025 -

Unveiling The Mystery How The Who Chose Their Band Name

May 23, 2025

Unveiling The Mystery How The Who Chose Their Band Name

May 23, 2025