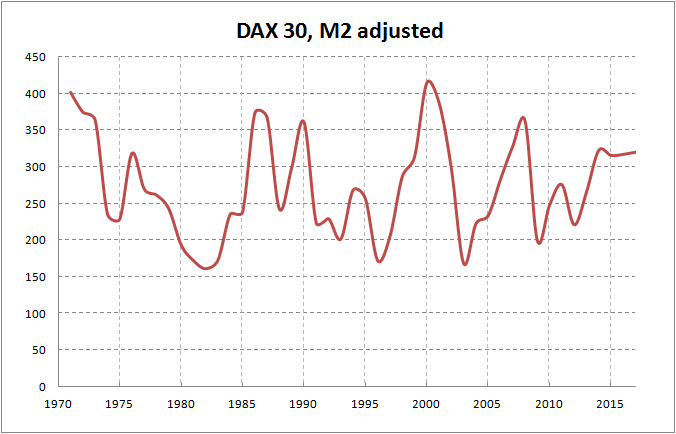

German Stock Market Losses: DAX Under 24,000 At Close

Table of Contents

Factors Contributing to DAX Decline

Several interconnected factors have contributed to the recent decline in the DAX, impacting investor confidence and the overall performance of the Frankfurt Stock Exchange.

Global Economic Uncertainty

Rising inflation and interest rates worldwide are significantly impacting investor sentiment. The global economy faces headwinds from several directions, creating uncertainty and prompting investors to seek safer havens. Geopolitical tensions, particularly the ongoing war in Ukraine, and the resulting energy crisis further exacerbate market volatility.

- Weakening global growth forecasts: International organizations are revising down their growth predictions, signaling a potential slowdown or even recession in many major economies.

- Supply chain disruptions: Persistent supply chain bottlenecks continue to inflate prices and constrain economic activity.

- The war in Ukraine: The conflict's impact on energy prices and global trade continues to destabilize markets and fuels uncertainty.

Weakness in the German Economy

The German economy, a major engine of the European Union, is facing its own set of challenges that are contributing to the DAX decline. High energy costs, a direct consequence of the war in Ukraine and global energy market fluctuations, are significantly impacting German businesses and dampening consumer spending. This has led to concerns regarding the industrial sector's performance and a potential export slowdown.

- Decreased manufacturing output: Higher energy prices and supply chain issues have led to reduced industrial production, weakening overall economic growth.

- Weakening consumer confidence: Rising inflation and economic uncertainty are eroding consumer confidence, leading to reduced spending and impacting retail sales.

- Rising unemployment concerns: As businesses struggle with higher costs and reduced demand, there are growing concerns about potential job losses.

Sector-Specific Performance

The DAX decline isn't uniform across all sectors. Some sectors are experiencing steeper losses than others.

- Automotive sector struggles: The automotive industry, a cornerstone of the German economy, faces challenges from supply chain disruptions, the global chip shortage, and the transition to electric vehicles.

- Energy sector volatility: The energy sector remains highly volatile, influenced by geopolitical events and fluctuating energy prices. This volatility significantly impacts investor sentiment.

- Technology sector downturn: The technology sector, after a period of rapid growth, is currently experiencing a downturn, reflecting broader global economic uncertainties and investor risk aversion.

Implications of the DAX Decline

The DAX decline has far-reaching implications for investors and the German economy.

Investor Sentiment and Market Volatility

The recent drop in the DAX has negatively impacted investor confidence, leading to increased market volatility. This uncertainty may cause further declines in the short term as investors reassess their portfolios and adjust their strategies.

- Increased market uncertainty: The current climate breeds uncertainty, making it challenging for investors to predict future market movements.

- Potential for further declines: The risk of further declines in the DAX remains, depending on the evolution of the global and German economies.

- Impact on retirement savings: The decline in the DAX directly affects the value of retirement savings invested in the German stock market.

Impact on the German Economy

A sustained decline in the DAX can have a broader impact on the German economy. Reduced investor confidence may lead to decreased business investment, further slowing economic growth.

- Reduced business investment: Uncertainty can discourage companies from investing in expansion and innovation, hindering long-term growth.

- Decreased consumer spending: Economic uncertainty and potential job losses can further reduce consumer spending, creating a negative feedback loop.

- Potential government intervention: The German government may need to implement fiscal or monetary policies to stimulate economic activity and mitigate the negative consequences of the DAX decline.

Strategies for Investors

Navigating the current market requires careful planning and a strategic approach.

Risk Management and Diversification

Effective risk management is critical during market downturns. Diversification across different asset classes (stocks, bonds, real estate, etc.) and geographies helps to reduce overall portfolio risk.

- Re-evaluating investment portfolios: Investors should review their portfolios to ensure they align with their risk tolerance and long-term financial goals.

- Considering defensive assets: During periods of uncertainty, investors may consider shifting some of their assets into more defensive investments, such as government bonds.

- Long-term investment strategies: Maintaining a long-term investment horizon is crucial, as short-term market fluctuations should not dictate long-term investment decisions.

Monitoring Market Trends

Staying informed about economic indicators and market news is essential for making informed investment decisions.

- Following financial news: Regularly monitoring reputable financial news sources provides valuable insights into market trends and economic developments.

- Consulting with financial advisors: Seeking advice from a qualified financial advisor can help investors develop a personalized investment strategy.

- Understanding market analysis: Familiarizing oneself with market analysis techniques helps in interpreting economic data and predicting potential market movements.

Conclusion

The DAX closing below 24,000 marks a significant decline in the German stock market, driven by a confluence of global economic uncertainty and specific challenges facing the German economy. This downturn has significant implications for investors and the broader German economy. Understanding the factors contributing to these German stock market losses and the implications of the DAX being under 24,000 is crucial for navigating the current market climate. Stay informed about the latest developments and consider adjusting your investment strategies accordingly to mitigate risks and potentially capitalize on future opportunities within the German stock market. Monitor the DAX closely and make informed decisions regarding your portfolio based on updated market analysis.

Featured Posts

-

Get Bbc Radio 1 Big Weekend 2025 Tickets Official Ticketing Information And Tips

May 25, 2025

Get Bbc Radio 1 Big Weekend 2025 Tickets Official Ticketing Information And Tips

May 25, 2025 -

Escape To The Country Affordable Dream Homes Found Below 1m Budget

May 25, 2025

Escape To The Country Affordable Dream Homes Found Below 1m Budget

May 25, 2025 -

Yevrobachennya Kudi Podilisya Peremozhtsi Ostannikh 10 Rokiv

May 25, 2025

Yevrobachennya Kudi Podilisya Peremozhtsi Ostannikh 10 Rokiv

May 25, 2025 -

Actress Mia Farrows Dire Warning Is American Democracy Facing Collapse

May 25, 2025

Actress Mia Farrows Dire Warning Is American Democracy Facing Collapse

May 25, 2025 -

Artfae Qyasy Daks 30 Ytjawz Dhrwt Mars

May 25, 2025

Artfae Qyasy Daks 30 Ytjawz Dhrwt Mars

May 25, 2025

Latest Posts

-

Ev Mandate Faces Strong Opposition From Car Dealerships

May 25, 2025

Ev Mandate Faces Strong Opposition From Car Dealerships

May 25, 2025 -

Toxic Chemical Residue From Ohio Train Derailment Building Contamination

May 25, 2025

Toxic Chemical Residue From Ohio Train Derailment Building Contamination

May 25, 2025 -

Fbi Investigation Reveals Multi Million Dollar Office365 Data Breach

May 25, 2025

Fbi Investigation Reveals Multi Million Dollar Office365 Data Breach

May 25, 2025 -

Millions Lost Inside The Office365 Hack Targeting Executives

May 25, 2025

Millions Lost Inside The Office365 Hack Targeting Executives

May 25, 2025 -

Cybercriminals Office365 Hack Millions In Losses Reported

May 25, 2025

Cybercriminals Office365 Hack Millions In Losses Reported

May 25, 2025