Gibraltar Industries (NASDAQ: ROCK) Earnings Preview: Potential Impacts And Investment Strategies

Table of Contents

Analyzing Gibraltar Industries' Recent Performance and Key Metrics

Gibraltar Industries, a leading manufacturer of building products and infrastructure components, has seen fluctuating performance in recent quarters. A thorough analysis of key metrics is crucial to predicting future performance and informing investment decisions regarding Gibraltar Industries stock.

Revenue Growth and Trends

Recent revenue growth for Gibraltar Industries has been influenced by several factors, including the strength of the housing market and demand for its various product lines. Analyzing these trends provides valuable insights into the company's overall health.

- Q[Insert Quarter]: Revenue of $[Insert Revenue Figure] representing a [Insert Percentage]% increase/decrease compared to the same quarter last year. [Insert Reason for increase/decrease].

- Key Growth Drivers: Strong performance in the [Insert Product Line] segment, driven by increased demand in the [Insert Market Segment] sector. Conversely, [Insert Product Line] experienced a slowdown due to [Insert Reason].

- Market Share: Gibraltar Industries maintains a [Insert Percentage]% market share in the [Insert Market] market, indicating [Insert Analysis - strong/weak position etc.].

Profitability and Margins

Profitability is a critical indicator of Gibraltar Industries' financial health. Analyzing gross profit margins, operating margins, and net income reveals important information about the company's ability to manage costs and generate profits.

- Gross Profit Margin: [Insert Percentage]% for Q[Insert Quarter], reflecting [Insert Analysis - e.g., increase due to improved pricing, decrease due to higher raw material costs].

- Operating Margin: [Insert Percentage]% for Q[Insert Quarter], indicating [Insert Analysis - e.g., efficiency gains, increased operating expenses].

- Net Income: [Insert Net Income Figure] for Q[Insert Quarter], representing a [Insert Percentage]% increase/decrease compared to the same quarter last year. [Insert Reason for change].

- Cost of Goods Sold: Fluctuations in the cost of goods sold significantly impact Gibraltar Industries' profitability, largely dependent on raw material prices and manufacturing efficiency.

Debt Levels and Financial Health

A robust assessment of Gibraltar Industries' financial health requires examining its balance sheet, specifically debt levels and liquidity. This provides a clear picture of the company's financial risk profile.

- Debt-to-Equity Ratio: [Insert Ratio], indicating [Insert Analysis - e.g., healthy/high leverage]. A comparison to industry benchmarks will provide additional context.

- Current Ratio: [Insert Ratio], reflecting the company's ability to meet its short-term obligations. A higher ratio suggests stronger liquidity.

- Debt Management Strategies: Gibraltar Industries' [Insert Analysis - e.g., proactive debt reduction strategy, reliance on debt financing].

Factors Potentially Impacting Gibraltar Industries' Earnings

Several factors beyond the company's control could significantly impact Gibraltar Industries' upcoming earnings report. Understanding these external forces is crucial for accurate forecasting and investment decisions.

Macroeconomic Conditions

The broader macroeconomic environment plays a substantial role in Gibraltar Industries' performance. Factors such as inflation, interest rates, and overall economic growth directly impact consumer spending and business investment.

- Inflation: High inflation leads to increased raw material costs and potentially reduced consumer demand, impacting both revenue and profitability.

- Interest Rates: Rising interest rates can increase borrowing costs, affecting capital expenditures and potentially slowing down investment in the housing and construction sectors.

- Recessionary Fears: Concerns about a potential recession significantly impact consumer and business confidence, potentially leading to reduced demand for Gibraltar Industries' products.

Industry Trends and Competition

The building products industry is dynamic and competitive. Technological advancements, regulatory changes, and the actions of competitors all influence Gibraltar Industries' market position and profitability.

- Technological Advancements: The adoption of new technologies in building materials and construction methods could impact Gibraltar Industries' product demand and competitive advantage.

- Regulatory Changes: New environmental regulations or building codes can influence production costs and product design.

- Competition: Gibraltar Industries faces competition from [List Key Competitors], requiring continuous innovation and efficient operations to maintain its market share.

Supply Chain and Logistics

Supply chain disruptions and logistics challenges continue to impact many industries, including the building products sector. These challenges can lead to increased costs, production delays, and reduced profitability.

- Raw Material Availability: Potential shortages or price increases in raw materials pose a significant risk to Gibraltar Industries' profitability.

- Transportation Costs: Increased fuel prices and transportation bottlenecks impact the cost of distributing products.

- Mitigation Strategies: Gibraltar Industries may employ various mitigation strategies, such as diversifying suppliers, optimizing logistics, or implementing inventory management techniques.

Investment Strategies Based on Earnings Expectations

Based on the analysis of Gibraltar Industries' performance and the factors influencing its earnings, different investment strategies are recommended depending on the earnings outcome.

Potential Scenarios and their Implications

- Exceeding Expectations: If Gibraltar Industries exceeds earnings expectations, the stock price is likely to rise, presenting a potential opportunity for investors holding the stock or considering buying.

- Meeting Expectations: Meeting expectations may result in a relatively stable stock price, with limited movement in either direction.

- Missing Expectations: If the company misses earnings expectations, the stock price could decline significantly, possibly creating a buying opportunity for long-term investors.

Risk Assessment and Mitigation

Investing in Gibraltar Industries (NASDAQ: ROCK) involves inherent risks. Thorough risk assessment and mitigation strategies are vital.

- Macroeconomic Uncertainty: The impact of inflation, interest rate hikes, and potential recessions significantly influences the stock's performance.

- Industry Competition: Intense competition in the building products industry requires continuous innovation and efficient cost management to maintain a competitive edge.

- Financial Risk: Gibraltar Industries' debt levels and financial health should be carefully assessed to understand its financial risk profile. Portfolio diversification is crucial to mitigate these risks.

Conclusion: Investing Wisely with the Gibraltar Industries (NASDAQ: ROCK) Earnings Preview

The Gibraltar Industries (NASDAQ: ROCK) earnings preview highlights a complex interplay of internal and external factors influencing the company's performance. Analyzing revenue growth, profitability, financial health, and macroeconomic conditions is crucial for informed investment decisions. Potential scenarios and associated investment strategies, along with a robust risk assessment, are essential elements for navigating this period effectively. Stay informed on Gibraltar Industries' performance and make strategic investment decisions based on your own thorough research and risk tolerance. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

Ac Milan Vs Atalanta Cuando Y Donde Ver El Partido De Gimenez

May 13, 2025

Ac Milan Vs Atalanta Cuando Y Donde Ver El Partido De Gimenez

May 13, 2025 -

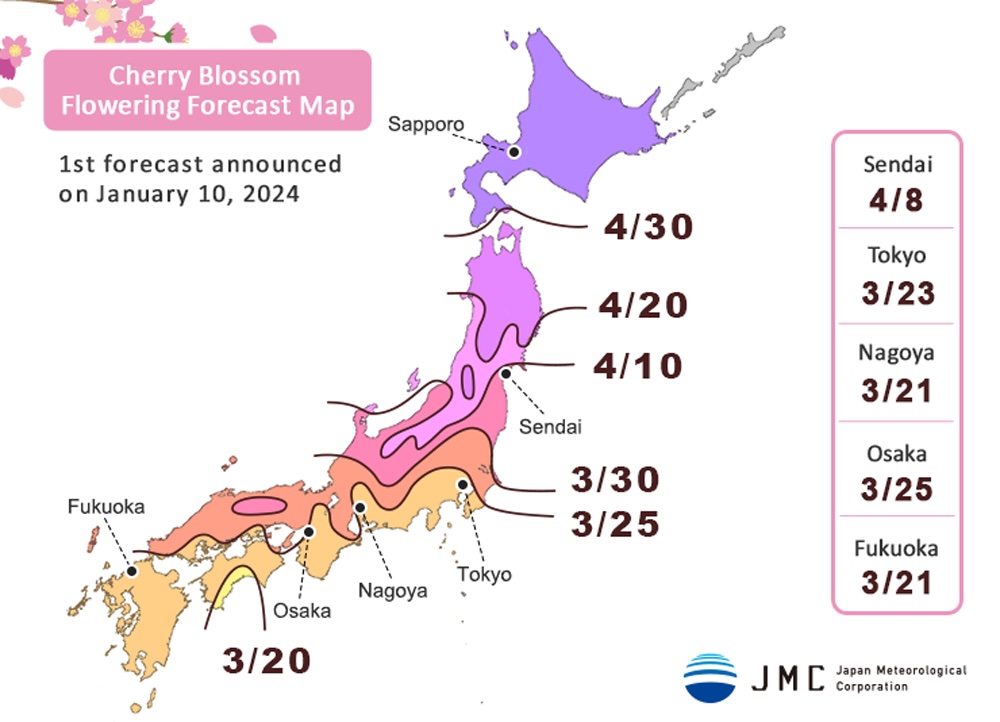

Planning Your Springwatch Cherry Blossom Forecasts And Locations In Japan

May 13, 2025

Planning Your Springwatch Cherry Blossom Forecasts And Locations In Japan

May 13, 2025 -

Braunschweiger Schule Evakuierung Nach Alarmmeldung

May 13, 2025

Braunschweiger Schule Evakuierung Nach Alarmmeldung

May 13, 2025 -

Dy Kabryw Ykhalf Qanwn Mwaedt Sdyqath Tfasyl Alelaqt Aljdydt

May 13, 2025

Dy Kabryw Ykhalf Qanwn Mwaedt Sdyqath Tfasyl Alelaqt Aljdydt

May 13, 2025 -

Fan Reaction To Kyle Tuckers Chicago Cubs Comments

May 13, 2025

Fan Reaction To Kyle Tuckers Chicago Cubs Comments

May 13, 2025