Global Bond Market Instability: A Posthaste Warning

Table of Contents

Rising Interest Rates and Their Impact

Central bank actions are a primary driver of global bond market instability. Understanding the mechanics of interest rate hikes is crucial to grasping the current volatility.

The Mechanics of Interest Rate Hikes

Interest rate hikes directly influence bond prices, creating interest rate risk. When central banks raise interest rates, the yield on newly issued bonds increases, making existing bonds with lower yields less attractive. This leads to a decrease in the price of those existing bonds. The impact varies across the yield curve, affecting short-term and long-term bonds differently. Inflation expectations play a crucial role; higher expected inflation generally leads to higher interest rates.

- Increased interest rates lead to decreased bond prices.

- Short-term bonds are generally more sensitive to interest rate changes than long-term bonds.

- The Federal Reserve's recent rate hikes exemplify the impact of central bank policy on bond yields and market sentiment. The anticipation of further hikes contributes to ongoing uncertainty.

- Inflation expectations significantly influence central bank decisions and subsequent impacts on bond prices.

Rising rates directly affect investors' decisions. Many investors, anticipating higher yields on new bonds, sell their existing holdings, further depressing prices and increasing market volatility. This creates a feedback loop, exacerbating the instability.

Geopolitical Uncertainty and Its Ripple Effects

Geopolitical events significantly contribute to global bond market instability. The resulting uncertainty impacts investor confidence and capital flows, creating ripples throughout the market.

The Influence of Global Conflicts

Ongoing conflicts and geopolitical tensions are major sources of geopolitical risk. These events often trigger a "flight to safety," where investors move their capital from riskier assets into safer havens, such as government bonds of stable economies. However, even these safe havens can experience increased volatility during periods of heightened geopolitical risk.

- The war in Ukraine has significantly impacted global bond markets, causing increased volatility and uncertainty.

- Escalating tensions in the Taiwan Strait have led to capital flight into perceived safer assets.

- Sanctions imposed on various countries have created market uncertainty and further contributed to instability.

This capital flight can create imbalances and distort market pricing, leading to further volatility. The uncertainty associated with these events makes it difficult for investors to make informed decisions, exacerbating the instability in the global bond market.

Inflationary Pressures and Their Consequences

High inflation is another significant factor fueling global bond market instability. The inverse relationship between inflation and bond prices is a fundamental concept to understand.

The Bond Market's Sensitivity to Inflation

Inflation erodes the purchasing power of fixed-income investments, creating inflation risk. When inflation rises, the real yield (the return adjusted for inflation) of a bond falls, making it less attractive to investors. This impacts bond prices, creating volatility.

- High inflation erodes the value of fixed-income investments, reducing their real return.

- Inflation expectations significantly influence bond yields; higher expectations lead to higher yields demanded by investors.

- Central bank actions to combat inflation, such as raising interest rates, further impact bond markets, creating a complex interplay of factors.

Investors actively try to mitigate inflation risk through various strategies, such as investing in inflation-linked bonds or adjusting their portfolio allocations. However, the unpredictable nature of inflation makes effective mitigation challenging, contributing to market instability.

Potential Future Scenarios and Mitigation Strategies

Predicting the future of the global bond market is inherently challenging, but examining potential scenarios and mitigation strategies is crucial for investors.

Forecasting Future Instability

Future global bond market instability will likely depend on several interconnected factors: economic growth rates, inflation trends, and geopolitical developments.

- Interest rates could continue to rise, depending on inflation and economic growth.

- Inflation may persist at elevated levels, further pressuring bond prices.

- Unforeseen geopolitical events could trigger significant market disruptions.

Investors can utilize various risk management strategies to navigate this uncertainty. Portfolio diversification across different asset classes is a fundamental approach. Careful consideration of interest rate risk, inflation risk, and geopolitical risk is crucial for informed investment decisions. Hedging strategies, such as using derivatives, may also be considered.

Conclusion

Global bond market instability is driven by a complex interplay of rising interest rates, geopolitical uncertainty, and inflationary pressures. Understanding these factors is crucial for making informed investment decisions. The potential consequences of this instability are significant, highlighting the need for vigilance and proactive risk management. Managing global bond market risks requires a nuanced understanding of market dynamics and a proactive approach to portfolio construction. To effectively navigate this challenging environment, consult with a financial advisor to develop a robust strategy for understanding global bond market instability and mitigating its impact on your investments.

Featured Posts

-

300 Million Hit Marks And Spencer Details Cyberattack Impact

May 24, 2025

300 Million Hit Marks And Spencer Details Cyberattack Impact

May 24, 2025 -

Goroskopy I Predskazaniya Sovety Na Kazhdiy Den

May 24, 2025

Goroskopy I Predskazaniya Sovety Na Kazhdiy Den

May 24, 2025 -

Glastonbury 2024 Unannounced Us Band Teases Festival Appearance

May 24, 2025

Glastonbury 2024 Unannounced Us Band Teases Festival Appearance

May 24, 2025 -

Jonathan Groffs Just In Time A Stellar 1965 Style Performance

May 24, 2025

Jonathan Groffs Just In Time A Stellar 1965 Style Performance

May 24, 2025 -

Nisan Ayinda Mali Sansin Artacagi Burclar Detayli Burc Yorumlari

May 24, 2025

Nisan Ayinda Mali Sansin Artacagi Burclar Detayli Burc Yorumlari

May 24, 2025

Latest Posts

-

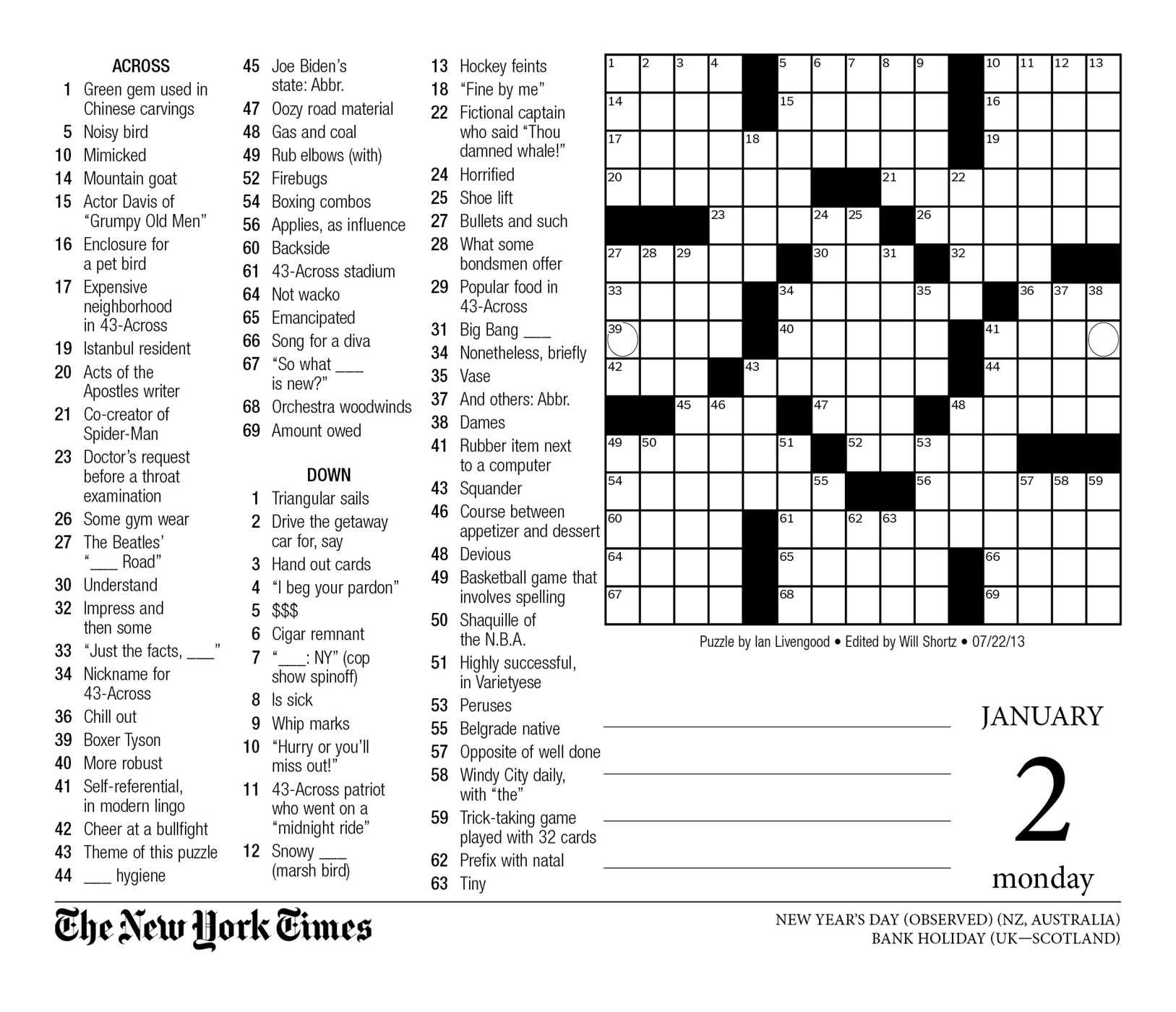

Nyt Mini Crossword Answers And Clues Sunday May 11

May 24, 2025

Nyt Mini Crossword Answers And Clues Sunday May 11

May 24, 2025 -

Solve The Nyt Mini Crossword April 6 2025 Complete Guide

May 24, 2025

Solve The Nyt Mini Crossword April 6 2025 Complete Guide

May 24, 2025 -

Nyt Mini Crossword Solutions For March 12 2025

May 24, 2025

Nyt Mini Crossword Solutions For March 12 2025

May 24, 2025 -

April 8 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025

April 8 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025 -

Understanding The Marvel The Avengers Crossword Clue Nyt Mini May 1

May 24, 2025

Understanding The Marvel The Avengers Crossword Clue Nyt Mini May 1

May 24, 2025