Gold Declines On US-China Trade Optimism; Investors Secure Gains

Table of Contents

US-China Trade Deal Fuels Gold Price Decline

Easing trade tensions between the US and China have significantly impacted investor sentiment towards safe-haven assets like gold. The perception of reduced risk has led to a shift in investment strategies.

Easing Trade Tensions

- Positive Developments: Recent announcements of phased trade agreements, de-escalation of tariff threats, and increased dialogue between the two economic giants have contributed to a more optimistic outlook. The signing of the Phase One trade deal in 2020, for instance, marked a significant turning point.

- Investor Risk Appetite: Reduced trade war anxieties have encouraged investors to move away from traditionally safer assets like gold, opting instead for riskier, higher-return investments. This is reflected in the increased capital flows into equity markets and other asset classes.

- Gold Price Fluctuations: Data indicates a clear correlation between positive US-China trade news and a subsequent decline in gold prices. For example, (insert specific example of price drop correlated to positive trade news, citing a reliable source like a financial news website).

Shift in Market Sentiment

The market has demonstrably moved from a risk-averse to a risk-on environment. This shift has profoundly impacted the demand for gold.

- Investment Flows: Capital is flowing out of gold and into higher-yielding assets like stocks and corporate bonds. Investors are seeking greater returns in a perceived low-risk environment.

- Expert Opinions: Many financial analysts have commented on this shift, predicting continued pressure on gold prices as long as trade optimism prevails. (Cite specific analysts and their reports if possible, linking to reputable financial sources).

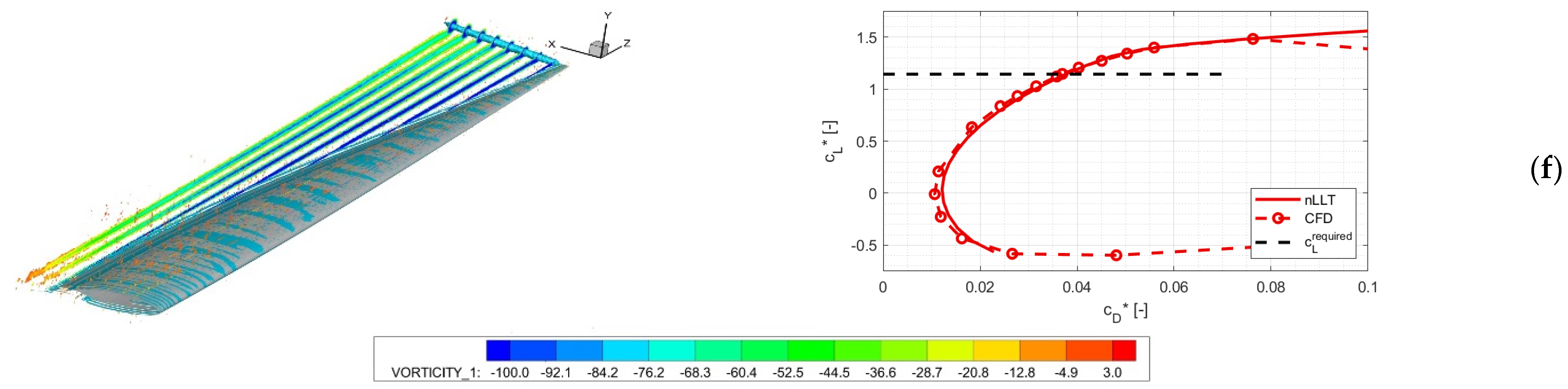

- (Insert chart or graph here illustrating the inverse relationship between investor confidence indices and gold prices during periods of positive trade news.)

Investors Capitalize on Gold Price Volatility

The recent gold price decline has presented lucrative opportunities for astute investors. However, it’s important to understand both short-term and long-term strategies.

Profit-Taking Opportunities

- Short-Selling: Investors adept at short-selling have capitalized on the price drop, profiting from the downward trajectory of the gold market.

- Timing the Market: Successful investors understand the importance of precise market timing and recognizing price fluctuations as opportunities for profit. This requires careful analysis and awareness of market trends.

- Successful Strategies: (Include a brief, hypothetical example of a successful trading strategy using short-selling or other relevant tactics during the recent price drop, emphasizing the importance of risk management).

Long-Term Gold Investment Strategies

Despite the recent dip, many long-term investors view this as a buying opportunity.

- Buy the Dip: The "buy the dip" strategy, a classic investment tactic, encourages investors to purchase gold when its price is low, anticipating future price appreciation.

- Long-Term Outlook: While current trade relations positively influence the price, long-term gold investment considers various factors like inflation, currency fluctuations, and geopolitical instability, suggesting enduring value.

- Expert Quotes: "(Quote a respected financial expert on the long-term value proposition of gold investment, citing the source)."

Factors Beyond US-China Trade Affecting Gold Prices

While US-China trade relations play a significant role, other factors influence gold prices.

Influence of the US Dollar

Gold and the US dollar share an inverse relationship.

- US Dollar Strength: A strong US dollar typically reduces the attractiveness of gold as an alternative investment, leading to lower gold prices. This is because gold is priced in US dollars.

- Interest Rates and Monetary Policy: The Federal Reserve's monetary policy and interest rate decisions directly impact the dollar's value and, consequently, gold prices.

Geopolitical Risks and Global Uncertainty

Geopolitical uncertainties can swiftly reverse the current trend.

- Global Events: Unforeseen global events, such as political instability in key regions or escalating international conflicts, can trigger increased demand for gold as a safe haven, causing prices to rise.

- Future Price Increases: The potential for future gold price increases remains substantial, given the ongoing uncertainties in the global political and economic landscape.

Conclusion

The recent decline in the gold price is primarily linked to investor confidence boosted by improving US-China trade relations. This has created profit-taking opportunities for some investors, while others see it as a chance to "buy the dip" within their long-term gold investment strategies. However, it's crucial to remember that gold prices are influenced by numerous factors beyond trade negotiations, including the strength of the US dollar and global geopolitical risks. The gold market remains dynamic and unpredictable.

Call to Action: Stay updated on gold price fluctuations and monitor the US-China trade relations for their impact on gold. Learn more about effective gold investment strategies to navigate this volatile market and protect your portfolio. [Link to relevant resources/market analysis reports].

Featured Posts

-

Kanye Wests New Song Diddy North West Collaboration Despite Kim Kardashians Efforts

May 18, 2025

Kanye Wests New Song Diddy North West Collaboration Despite Kim Kardashians Efforts

May 18, 2025 -

Bowen Yang Addresses Ego Nwodims Controversial Snl Weekend Update Performance

May 18, 2025

Bowen Yang Addresses Ego Nwodims Controversial Snl Weekend Update Performance

May 18, 2025 -

Prodazhi Vinilu Teylor Svift Absolyutniy Rekord Za Desyatilittya

May 18, 2025

Prodazhi Vinilu Teylor Svift Absolyutniy Rekord Za Desyatilittya

May 18, 2025 -

Trumps Aerospace Legacy Assessing The Impact Of Ambitious Deals

May 18, 2025

Trumps Aerospace Legacy Assessing The Impact Of Ambitious Deals

May 18, 2025 -

Mlb Dfs Strategy May 8th Sleeper Picks And Hitter Projections

May 18, 2025

Mlb Dfs Strategy May 8th Sleeper Picks And Hitter Projections

May 18, 2025

Latest Posts

-

The Stephen Miller Nsa Connection A Deep Dive

May 18, 2025

The Stephen Miller Nsa Connection A Deep Dive

May 18, 2025 -

Jersey Mikes Subs Expands To Galesburg Details On The New Restaurant

May 18, 2025

Jersey Mikes Subs Expands To Galesburg Details On The New Restaurant

May 18, 2025 -

Could Stephen Miller Head The Nsa Exploring The Possibility

May 18, 2025

Could Stephen Miller Head The Nsa Exploring The Possibility

May 18, 2025 -

Analyzing Stephen Millers Potential Appointment As Nsa Director

May 18, 2025

Analyzing Stephen Millers Potential Appointment As Nsa Director

May 18, 2025 -

Great Wolf Lodge Rescue Suffolk Boy Hailed A Hero

May 18, 2025

Great Wolf Lodge Rescue Suffolk Boy Hailed A Hero

May 18, 2025