Goldman Sachs Deciphers Trump's Preferred Oil Price Range Through Social Media

Table of Contents

Goldman Sachs's Methodology: Analyzing Trump's Tweets and Public Statements

Goldman Sachs employed a sophisticated methodology to gauge Trump's stance on oil prices. Their analysis leveraged the power of natural language processing (NLP) and sentiment analysis techniques to systematically examine Trump's public statements, primarily from his Twitter account. While the exact timeframe isn't publicly available, the analysis likely covered a significant period encompassing his presidency. The firm's algorithms scanned for specific keywords related to energy and oil prices, including terms like "energy independence," "oil prices," "OPEC," and "fuel costs."

- Keywords Used: "energy," "oil," "price," "OPEC," "shale," "gas," "drill," "energy independence," "American energy."

- Examples of Analyzed Statements: Direct quotes from Trump's tweets and public speeches regarding energy policy, responses to oil price fluctuations, and comments on the performance of the oil and gas sector.

- Challenges: Interpreting social media data presents unique difficulties. The inherent ambiguity of language, the potential for sarcasm, and the changing context of online communication all posed challenges for accurate sentiment analysis.

The Identified Oil Price Range: Trump's Sweet Spot

Goldman Sachs's analysis reportedly identified a specific oil price range that appeared most favorable to Trump's policies and rhetoric. While the exact figures remain confidential, understanding the underlying rationale is crucial. A price range considered favorable could be interpreted as one that would promote economic growth without causing significant inflationary pressures or negatively impacting voter sentiment. This range likely reflected a balance between supporting domestic energy production and maintaining affordable energy prices for consumers.

- Preferred Price Range: (Hypothetical example: $50-$70 per barrel). The precise range is not publicly disclosed by Goldman Sachs but would be a key element of their report.

- Economic Indicators: This price band likely correlated with favorable GDP growth, low inflation, and a strong US dollar – economic conditions that generally benefit a sitting president's re-election chances.

- Political Implications: Maintaining oil prices within this "sweet spot" could translate to positive public perception, potentially boosting Trump's popularity and improving his re-election prospects.

Implications for the Oil Market and Investors

The implications of Goldman Sachs's analysis are significant for the oil market and investors. The identification of a preferred oil price range suggests that market volatility could be heightened around this range. Price movements outside this band might spark policy responses, impacting supply and demand dynamics.

- Market Reactions: A substantial and sustained move above or below the identified range could trigger unpredictable market reactions, depending on how Trump or other policy makers react.

- Investment Opportunities: Investors could potentially use this information to inform trading strategies, focusing on hedging against price volatility or identifying opportunities within the oil and gas sector based on predicted price movements.

- Geopolitical Considerations: Investors need to assess geopolitical risks carefully, particularly potential policy changes that could alter energy markets.

Criticisms and Limitations of the Study

It's crucial to acknowledge potential criticisms and limitations of Goldman Sachs's methodology. Reliance on social media data alone presents inherent limitations. Social media posts often lack the context and nuance of formal policy statements.

- Accuracy and Reliability: The accuracy of sentiment analysis using social media data is debated. The algorithm's interpretation of Trump's statements might not always accurately reflect his true intentions or policies.

- Misinterpretation: The inherent ambiguity of language and the potential for sarcasm or irony in Trump's tweets could lead to misinterpretations by the algorithm.

- Other Factors: Oil prices are influenced by numerous factors beyond Trump's preferences, including global supply and demand, geopolitical events, and technological advancements.

Conclusion: Understanding Trump's Influence on Oil Prices Through Social Media Analysis

Goldman Sachs's innovative analysis offers a unique perspective on the intersection of politics and oil markets. By using social media analysis to decipher Trump's preferred oil price range, the firm highlights the importance of considering political factors in investment strategies. While the study has its limitations, it demonstrates the potential of unconventional data sources in market analysis. To fully understand the intricacies of this analysis and its implications for the future of the oil market, further research into Goldman Sachs's report is recommended. Explore related articles on Goldman Sachs's oil price predictions and the growing field of social media analysis techniques to gain a comprehensive understanding of this evolving area of market forecasting.

Featured Posts

-

De Npo En Grensoverschrijdend Gedrag Preventie Aanpak En Verbetering

May 15, 2025

De Npo En Grensoverschrijdend Gedrag Preventie Aanpak En Verbetering

May 15, 2025 -

Podarok Ot Kinopoiska Soski S Ovechkinym Dlya Malyshey V Chest Rekorda N Kh L

May 15, 2025

Podarok Ot Kinopoiska Soski S Ovechkinym Dlya Malyshey V Chest Rekorda N Kh L

May 15, 2025 -

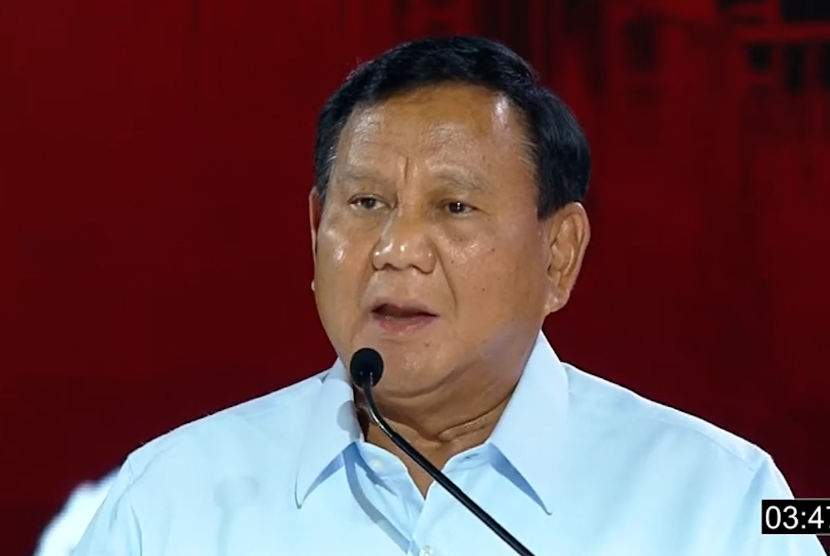

Dukungan Dpr Untuk Proyek Giant Sea Wall Presiden Prabowo

May 15, 2025

Dukungan Dpr Untuk Proyek Giant Sea Wall Presiden Prabowo

May 15, 2025 -

Ovechkin Na 12 Y Pozitsii V Spiske Luchshikh Snayperov Pley Off N Kh L

May 15, 2025

Ovechkin Na 12 Y Pozitsii V Spiske Luchshikh Snayperov Pley Off N Kh L

May 15, 2025 -

New York City Vs Toronto Detailed Player Performance Ratings

May 15, 2025

New York City Vs Toronto Detailed Player Performance Ratings

May 15, 2025