Goldman Sachs: Trump's Stance On $40-$50 Oil Based On Social Media

Table of Contents

Goldman Sachs' Methodology: Analyzing Trump's Tweets and Social Media Activity

Goldman Sachs, renowned for its sophisticated market analysis, likely employs a multi-faceted approach to understand Trump's stance on oil prices through his social media footprint. Their analysis probably involves a combination of techniques designed to extract meaningful insights from the vast amount of data available.

-

Data Sources: The primary source would be Trump's Twitter feed, given its historical significance in disseminating his opinions. Other platforms like Facebook or Truth Social (if relevant posts existed) may also have been included in their analysis.

-

Methods: Goldman Sachs' analysts likely utilized advanced tools and techniques including:

- Sentiment analysis: Algorithms assess the emotional tone of Trump's posts related to oil prices. Was his language positive, negative, or neutral towards the $40-$50 range?

- Keyword frequency analysis: Tracking the frequency of specific keywords like "oil," "price," "energy," "$40 oil," and "$50 oil" helps determine the relative importance of the topic in his communications.

- Network analysis: Examining connections between Trump's social media activity and other key figures in the oil industry or energy policy could reveal additional context and influence.

-

Data Limitations: It's crucial to acknowledge limitations. Social media data is inherently noisy. Sarcasm, irony, and ambiguous statements can lead to misinterpretations. Furthermore, Trump’s tweets often lack the nuance and detail of formal policy statements.

Trump's Public Statements on Oil Prices: A Social Media Deep Dive

Analyzing Trump's social media activity for clues about his oil price preferences requires a careful examination of his pronouncements. While direct statements specifying a preferred price range of $40-$50 might be scarce, indirect cues and contextual clues can be revealing. For example:

-

Examples of tweets or posts: [Insert examples of relevant tweets or social media posts here, including direct quotes and links if available. Analyze the tone (positive, negative, neutral) and context of each post. If specific tweets supporting or opposing a $40-$50 price range can be cited, include them here with appropriate attribution.]

-

Interpretation of the language used: [Explain the interpretation of the identified tweets and posts. For instance, did Trump express concern about high oil prices affecting consumers? Did he celebrate lower prices as beneficial to the economy? Did he ever mention specific price points, directly or indirectly?]

-

Timeline of relevant social media activity: [Creating a timeline of relevant posts could show trends and shifts in Trump's stance over time. This could provide further insights into his thinking.]

Goldman Sachs' Interpretation and Market Impact

Based on their social media analysis, Goldman Sachs likely formed an interpretation of Trump's stance on the $40-$50 oil price range. This interpretation, however speculative, could have had significant market implications:

-

Goldman Sachs' reported conclusions: [Summarize any publicly available reports or statements from Goldman Sachs detailing their conclusions on Trump's oil price preferences and how they reached those conclusions. Note that if no such reports are publicly available, this section should speculate based on likely interpretations.]

-

Impact on oil futures prices: Goldman Sachs' analysis, even if not explicitly stated, could have influenced investor sentiment and trading strategies. The anticipation of a particular oil price policy under a Trump administration might have impacted futures contracts.

-

Effects on oil-producing companies and countries: Oil-producing nations and companies could adjust their production levels or investment strategies based on perceived support or opposition from Trump.

-

Wider economic consequences: Oil price fluctuations have ripple effects across the global economy, impacting inflation, transportation costs, and numerous other sectors. Goldman Sachs' assessment of Trump's social media activity contributes to a larger picture of potential economic outcomes.

Alternative Perspectives and Criticisms

While Goldman Sachs' social media analysis provides valuable insights, it's crucial to consider alternative perspectives and criticisms:

-

Alternative explanations for oil price fluctuations: Oil prices are driven by multiple factors, including global supply and demand, geopolitical events, technological advancements, and OPEC policies. Attributing price changes solely to Trump's social media activity would be an oversimplification.

-

Criticisms of Goldman Sachs' methodology or conclusions: The accuracy and reliability of sentiment analysis and other quantitative methods depend on various factors, including the quality of the data and the sophistication of the algorithms used. Any limitations or potential biases in Goldman Sachs' methodology should be acknowledged.

-

Other significant factors impacting the oil market: Geopolitical instability in oil-producing regions, changes in global energy demand, and technological innovations all play a significant role in determining oil prices and should not be overlooked.

Conclusion: Understanding the Complex Relationship Between Social Media, Trump, and Oil Prices

Goldman Sachs' social media analysis of Donald Trump's views on oil prices, particularly concerning a $40-$50 price range, offers a unique perspective on the interplay between political rhetoric and market dynamics. However, it's essential to remember that social media is just one piece of a complex puzzle. Relying solely on social media data for economic forecasting is inherently limited. Further research is needed to fully understand the intricate relationship between social media sentiment, political statements, and the actual fluctuations of oil prices.

To stay informed about this dynamic interplay, continue following updates on Goldman Sachs' analyses of Trump’s stance on oil prices and related social media activity. Understanding the impact of social media on market sentiment is increasingly crucial in today's interconnected world.

Featured Posts

-

Ufc Paddy Pimbletts Unexpected 35 Second Loss By Submission

May 15, 2025

Ufc Paddy Pimbletts Unexpected 35 Second Loss By Submission

May 15, 2025 -

Discussie Leeflang Noodzaak Voor Overleg Tussen Bruins En Npo Toezichthouder

May 15, 2025

Discussie Leeflang Noodzaak Voor Overleg Tussen Bruins En Npo Toezichthouder

May 15, 2025 -

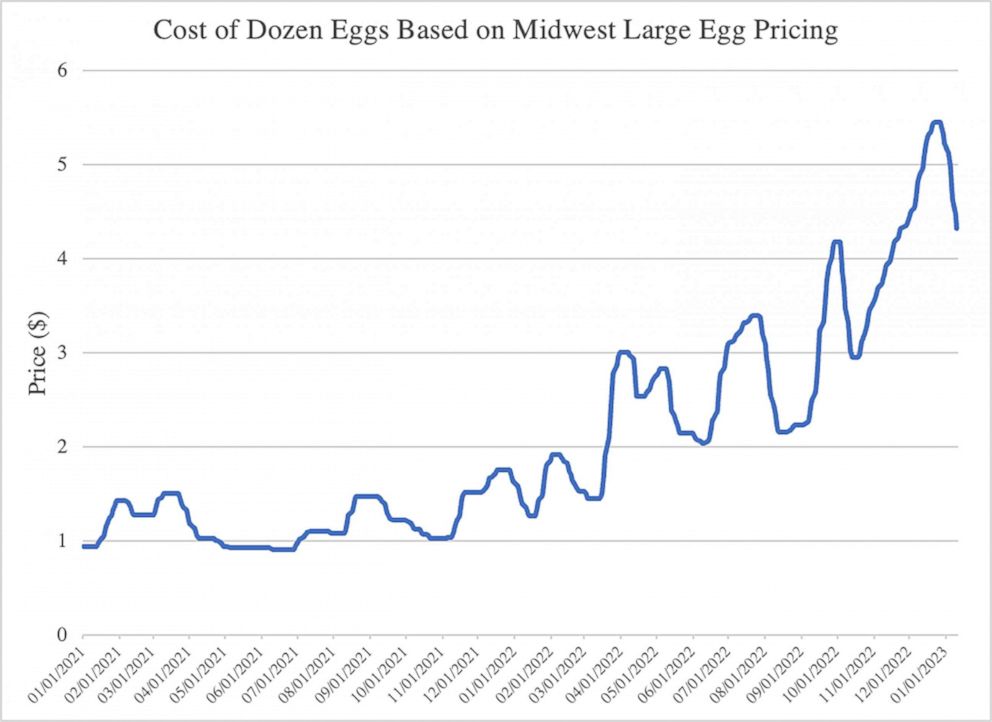

Us Egg Prices From Record Highs To 5 A Dozen

May 15, 2025

Us Egg Prices From Record Highs To 5 A Dozen

May 15, 2025 -

De Zaak Leeflang Waarom Bruins Met De Npo Toezichthouder Moet Praten

May 15, 2025

De Zaak Leeflang Waarom Bruins Met De Npo Toezichthouder Moet Praten

May 15, 2025 -

San Diego Padres Pregame Report Lineup Includes Arraez And Heyward

May 15, 2025

San Diego Padres Pregame Report Lineup Includes Arraez And Heyward

May 15, 2025

Latest Posts

-

Vont Weekend 2025 A Look Back At April 4th 6th 107 1 Kiss Fm

May 15, 2025

Vont Weekend 2025 A Look Back At April 4th 6th 107 1 Kiss Fm

May 15, 2025 -

1 Kiss Fms Vont Weekend A Photo Journal April 4 6 2025

May 15, 2025

1 Kiss Fms Vont Weekend A Photo Journal April 4 6 2025

May 15, 2025 -

Vont Weekend Photos April 4 6 2025 107 1 Kiss Fm

May 15, 2025

Vont Weekend Photos April 4 6 2025 107 1 Kiss Fm

May 15, 2025 -

Vont Weekend Recap April 4th 6th 2025 107 1 Kiss Fm

May 15, 2025

Vont Weekend Recap April 4th 6th 2025 107 1 Kiss Fm

May 15, 2025 -

Vont Weekend 2025 104 5 The Cats Top Five Photos

May 15, 2025

Vont Weekend 2025 104 5 The Cats Top Five Photos

May 15, 2025