Grayscale's XRP ETF Filing: Impact On XRP Price And Dominance Over Bitcoin

Table of Contents

Potential Impact on XRP Price

An approved Grayscale XRP ETF would likely have a profound effect on XRP's price trajectory. Several factors point towards significant price increases, but also highlight the inherent uncertainties.

Increased Demand and Liquidity

- Institutional Investment Floodgates: An approved XRP ETF would open the doors for institutional investors, who currently have limited regulated avenues to access XRP. This influx of capital would dramatically increase demand.

- Boosted Trading Volume: The increased trading volume on regulated exchanges, facilitated by the ETF, would significantly improve liquidity, making it easier to buy and sell XRP.

- Price Surge Potential: The combined effect of increased demand and liquidity could lead to a considerable surge in XRP's price. Historical examples of other asset price increases following ETF approvals provide a strong precedent. For instance, the approval of gold ETFs significantly increased the liquidity and investment in the gold market, driving up its price.

Reduced Volatility (Potentially)

While a price surge is likely, increased institutional investment could lead to reduced volatility in the long term. Large institutional players tend to be less susceptible to short-term market swings, creating a stabilizing effect.

- Long-Term Investment Strategies: Institutions often employ longer-term investment strategies, less prone to emotional reactions to market fluctuations.

- Initial Volatility Expected: However, it's crucial to acknowledge that initial price volatility is highly probable as the market adjusts to the new reality of a regulated XRP ETF.

- Market Sentiment and Regulation: The overall market sentiment and the prevailing regulatory environment will significantly influence the extent of volatility reduction.

Price Prediction Challenges

Accurately predicting the price impact of a Grayscale XRP ETF is extremely challenging. Numerous variables come into play:

- Regulatory Hurdles: The SEC's approval process is unpredictable, creating uncertainty.

- Market Sentiment: Broader market conditions, including the overall crypto market sentiment and the performance of other cryptocurrencies, will play a substantial role.

- Competing Cryptocurrencies: The success of the XRP ETF will depend on its competitive advantages compared to other investment vehicles in the crypto space.

Challenges Facing Grayscale's XRP ETF Application

Grayscale faces significant hurdles in its quest for SEC approval of an XRP ETF.

SEC Scrutiny and Regulatory Uncertainty

- Stringent Regulatory Standards: The SEC has historically been cautious about approving crypto ETFs, setting a high bar for applicants.

- Ripple Lawsuit Aftermath: The legal battle between Ripple and the SEC casts a long shadow. While the outcome was partially favorable to Ripple, regulatory uncertainty surrounding XRP remains.

- Past ETF Rejections: Previous rejections of Bitcoin ETF applications demonstrate the challenges Grayscale will face in meeting the SEC’s rigorous requirements.

Market Manipulation Concerns

The SEC is acutely aware of the potential for market manipulation within the cryptocurrency market. Grayscale must address these concerns convincingly.

- Robust Risk Mitigation Measures: Grayscale will need to demonstrate robust mechanisms to prevent and detect market manipulation.

- Transparency and Surveillance: Transparency in the ETF's operations and robust market surveillance are crucial for gaining SEC approval.

Competition from Other XRP Investment Vehicles

Grayscale isn't alone in the XRP investment landscape. Existing investment products pose a competitive threat.

- Competitive Pricing and Accessibility: Grayscale's ETF must offer competitive pricing and accessibility to attract investors.

XRP's Potential to Challenge Bitcoin's Dominance

A successful Grayscale XRP ETF could significantly alter the cryptocurrency landscape, potentially challenging Bitcoin's long-held dominance.

Increased Market Capitalization

A substantial increase in XRP's market capitalization, driven by the ETF, could significantly narrow the gap with Bitcoin.

Wider Adoption and Utility

Increased institutional adoption could boost XRP's usage in payments and other applications, accelerating its adoption.

Narrative Shift in the Crypto Market

A successful XRP ETF could shift the market narrative, highlighting the potential of altcoins beyond Bitcoin.

The Long Road Ahead

While an XRP ETF could provide a significant boost, achieving dominance over Bitcoin is a long-term goal requiring sustained growth and widespread acceptance.

Conclusion

Grayscale's XRP ETF filing is a pivotal moment. While SEC approval is not guaranteed, a successful filing could dramatically impact XRP's price and potentially challenge Bitcoin's dominance. However, significant regulatory hurdles and market uncertainties remain. Further research into the Grayscale XRP ETF and its implications is crucial for investors. Stay informed about developments to navigate this evolving landscape. Understanding the potential of the XRP ETF is key to making informed investment decisions in this dynamic market.

Featured Posts

-

Watykan Konklawe I Tajemnice Kardynalow Raport Eksperta

May 07, 2025

Watykan Konklawe I Tajemnice Kardynalow Raport Eksperta

May 07, 2025 -

Nba Playoffs Cavaliers Clinch 1 Seed In East

May 07, 2025

Nba Playoffs Cavaliers Clinch 1 Seed In East

May 07, 2025 -

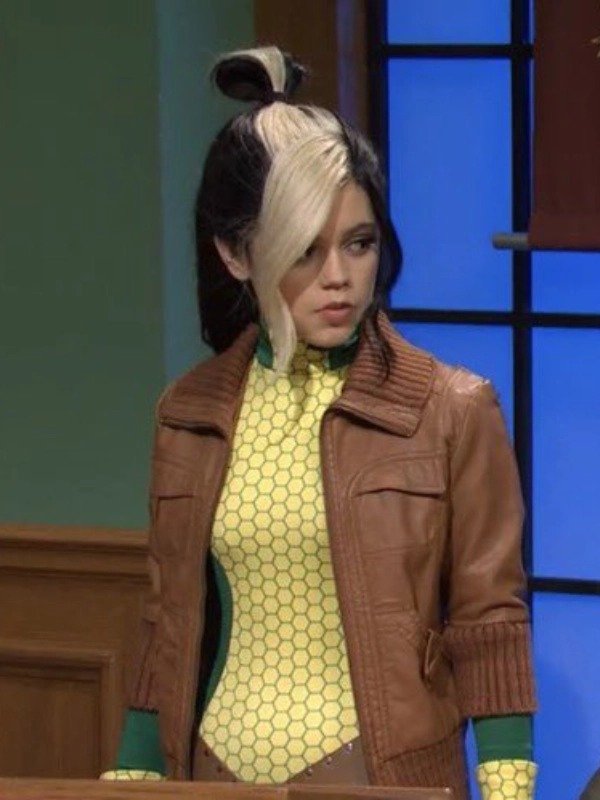

Snl 50 Jenna Ortegas Impressive Performance And Sabrina Carpenters Shout Out Gain Viral Attention

May 07, 2025

Snl 50 Jenna Ortegas Impressive Performance And Sabrina Carpenters Shout Out Gain Viral Attention

May 07, 2025 -

Last Chance To Buy A Ps 5 At Current Prices Top Retailers

May 07, 2025

Last Chance To Buy A Ps 5 At Current Prices Top Retailers

May 07, 2025 -

Xrps Big Moment The Sec Etfs And What It Means For Investors

May 07, 2025

Xrps Big Moment The Sec Etfs And What It Means For Investors

May 07, 2025