Harvard And Yale: House Plan Slams Elite Universities With Higher Endowment Taxes

Table of Contents

The Proposed Legislation: Details of the Higher Endowment Tax

The House plan proposes a significant increase in taxes levied on university endowments exceeding a specific threshold. While the exact details are still being finalized, the core proposal involves a tiered tax system. This means that institutions with larger endowments will face a higher tax rate compared to those with smaller ones. This progressive tax structure aims to target the wealthiest universities while minimizing the impact on smaller institutions.

Key provisions of the plan, as currently understood, include:

- Tax Rate Percentage: A proposed graduated tax rate, potentially starting at a certain percentage for endowments above a specific threshold and increasing incrementally for larger endowments.

- Threshold Amount: The exact endowment size that triggers the increased taxation is subject to ongoing debate and refinement within the legislative process. This figure is a crucial element in determining the overall impact and fairness of the proposed legislation.

- Application to Private vs. Public Universities: The plan's applicability to both private and public universities is under consideration. Current drafts may include stipulations that differentiate taxation based on university type.

- Specific Use of Collected Tax Revenue: The collected revenue generated from higher endowment taxes is earmarked for critical public purposes, such as increased funding for public education, student financial aid programs, or other essential social services.

Impact on Harvard and Yale: Analyzing the Financial Consequences

Harvard and Yale, possessing endowments valued in the tens of billions of dollars, would likely face a substantial tax burden under this proposed legislation. The exact financial consequences depend heavily on the final threshold and tax rates established by the House. However, even a moderate increase could translate into billions of dollars in additional taxes for each university.

Potential responses from these institutions could include:

- Tuition Increases: To offset the lost revenue, both universities might increase tuition fees, potentially making higher education less accessible for students from lower-income backgrounds.

- Reduced Financial Aid: Cuts to financial aid programs could limit access to higher education for many deserving students, potentially exacerbating inequalities.

- Cuts to Research Programs: Reductions in research funding could impact scientific advancements and limit the universities' ability to contribute to critical research areas.

The potential consequences are multifaceted and far-reaching:

- Estimated Tax Revenue Generated from Harvard and Yale Alone: This amount would be substantial and could significantly contribute to the funding of public programs.

- Potential Impact on Student Financial Aid: A reduction in financial aid could disproportionately affect low-income students.

- Potential Effects on Faculty Salaries and Research Opportunities: Cuts in funding could lead to salary freezes or reductions for faculty and limit research opportunities.

- Possible Legal Challenges: Harvard and Yale may initiate legal challenges, arguing that the legislation infringes on their autonomy or violates principles of fairness.

Arguments For and Against Higher Endowment Taxes on Elite Universities

The proposed higher endowment taxes have sparked vigorous debate, with proponents and opponents raising compelling arguments.

Arguments in Favor:

- Increased Equity and Social Justice: Proponents argue that taxing large endowments helps to address wealth disparity and promote greater social equity in higher education.

- Funding for Public Education and Other Essential Services: The revenue generated could significantly improve funding for public schools and other crucial social programs.

- Addressing the Growing Wealth Disparity: Taxing these massive endowments could help to alleviate the growing disparity between the wealthiest universities and the broader population.

Arguments Against:

- Negative Impact on Research and Education: Opponents fear that increased taxes could significantly hinder research initiatives and educational programs, ultimately harming students and society.

- Potential for Unintended Consequences: There are concerns that the tax could discourage private philanthropy and negatively impact the universities' ability to attract and retain top faculty.

- Concerns About Government Overreach: Some argue that increased taxation constitutes excessive government intervention in the affairs of private institutions.

The Broader Context: National Debate on University Funding and Wealth

The debate surrounding higher endowment taxes reflects a larger national discussion about the role of universities in society and the distribution of wealth. Similar proposals have been considered in other jurisdictions, highlighting a growing global concern about the concentration of resources within a limited number of elite institutions. The long-term implications of the House Plan extend far beyond Harvard and Yale, potentially influencing the funding models and operational strategies of universities across the country. Alternative approaches to addressing wealth disparity in higher education, such as increased federal funding for public institutions or improved access to financial aid programs, also merit consideration.

Conclusion: The Future of Higher Endowment Taxes and their Impact on Elite Institutions

The proposed House plan to increase endowment taxes on institutions like Harvard and Yale presents a complex challenge with significant implications. While proponents emphasize the need to address wealth inequality and allocate resources more equitably, opponents highlight the potential negative consequences for research, education, and the overall financial health of these institutions. The ultimate impact of this legislation will depend on the final details, including the tax rates and thresholds that are ultimately adopted. Understanding the arguments for and against higher endowment taxes is essential for informed civic engagement. Stay informed about the evolving debate on higher endowment taxes and their implications for the future of higher education. Learn more about the proposed legislation and share your thoughts with your elected officials.

Featured Posts

-

Court Upholds Ruling Against Trump In Alien Enemies Act Dispute

May 13, 2025

Court Upholds Ruling Against Trump In Alien Enemies Act Dispute

May 13, 2025 -

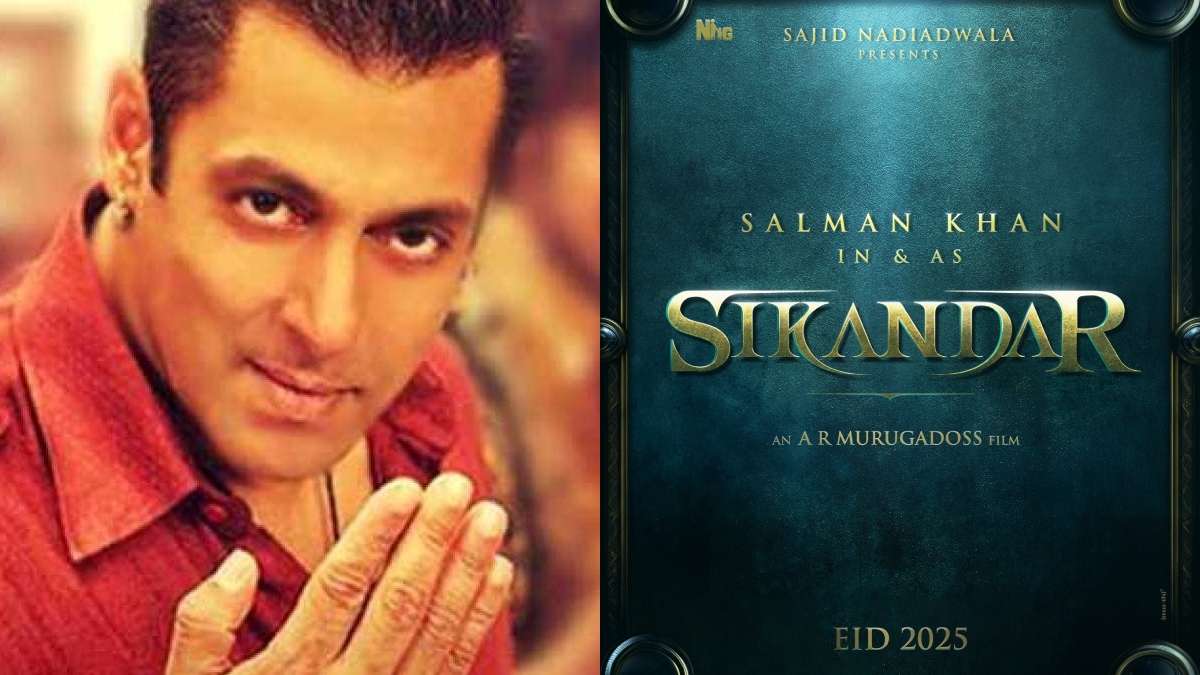

Salman Khans Latest Movie A Critical Box Office Failure

May 13, 2025

Salman Khans Latest Movie A Critical Box Office Failure

May 13, 2025 -

Myanmar Sanctions Examining The Uk And Australias Selective Approach To Accountability

May 13, 2025

Myanmar Sanctions Examining The Uk And Australias Selective Approach To Accountability

May 13, 2025 -

Amsterdam Leads In Soaring Dutch Bicycle Thefts A New Record

May 13, 2025

Amsterdam Leads In Soaring Dutch Bicycle Thefts A New Record

May 13, 2025 -

Gaza Hostage Crisis A Prolonged Nightmare For Families

May 13, 2025

Gaza Hostage Crisis A Prolonged Nightmare For Families

May 13, 2025