Hedge Fund Investment In Norwegian Cruise Line (NCLH): An In-Depth Analysis

Table of Contents

Hedge Fund Interest in NCLH: A Historical Perspective

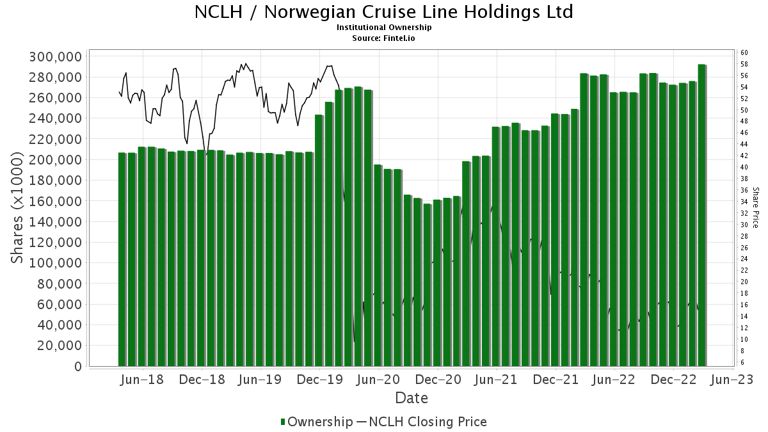

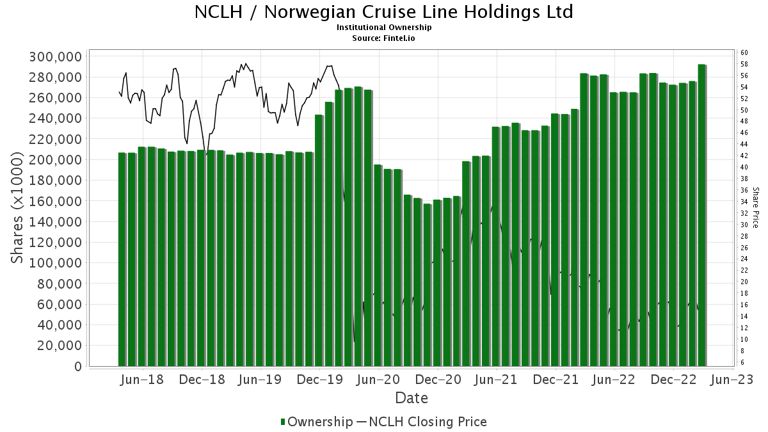

Analyzing the history of hedge fund involvement in NCLH reveals a complex interplay of investment and divestment, strongly correlated with the company's performance and broader market conditions. Identifying key players helps us understand the underlying motivations and strategies. While specific fund names and precise holdings are often confidential, examining publicly available data like 13F filings (SEC filings disclosing large institutional holdings) provides valuable insights.

-

Timeline of major hedge fund activity in NCLH: Tracking significant changes in hedge fund ownership over time reveals patterns of investment during periods of perceived undervaluation and divestment during times of uncertainty or negative market sentiment. For example, a surge in hedge fund buying might coincide with positive news regarding NCLH's financial performance or industry trends. Conversely, a wave of selling could signal concerns about the company's future prospects.

-

Significant changes in hedge fund holdings and their correlation with NCLH stock price movements: A rigorous analysis comparing hedge fund activity with NCLH's share price fluctuations can reveal strong correlations, indicating the significant influence these investors have on the stock's market value. This correlation might not be linear, but identifying trends and patterns is critical for understanding the relationship.

-

Analysis of reported 13F filings: Scrutinizing these filings allows us to identify prominent hedge funds with substantial positions in NCLH. While it doesn't reveal the entire picture (as some funds don't disclose their holdings), it provides a crucial window into institutional ownership and investment trends. This data can reveal whether hedge funds are accumulating shares or reducing their positions, suggesting potential shifts in market sentiment.

Analyzing Hedge Fund Investment Strategies in NCLH

Understanding the strategies employed by hedge funds in NCLH is crucial to predicting future price movements. Are these funds long-term investors, betting on the cruise line's recovery and long-term growth, or are they engaged in short-term trading, attempting to capitalize on market volatility? The motivations behind their involvement are equally important.

-

Betting on recovery post-pandemic: The pandemic significantly impacted the cruise industry, and many hedge funds may be taking a long-term view, anticipating a strong recovery in the sector. Their investments reflect a belief in NCLH's ability to overcome the challenges and regain its market position.

-

Exploiting market volatility: Some hedge funds might employ short-term strategies, taking advantage of the inherent volatility in the NCLH stock price. They might engage in short-selling, betting against the stock's rise, or employing other sophisticated strategies to profit from price fluctuations.

-

Seeking undervalued assets: Hedge funds are often on the lookout for undervalued assets. They might view NCLH as an undervalued company with significant growth potential, leading them to accumulate shares in anticipation of future price appreciation.

-

Long/Short Strategies: Hedge funds might employ both long and short positions simultaneously in NCLH, hedging their bets and aiming to profit regardless of the stock's direction.

-

Potential Arbitrage Opportunities: Opportunities for arbitrage, exploiting price discrepancies between different markets or instruments related to NCLH, might attract some hedge funds.

-

Macroeconomic Factors: Global economic conditions, fuel prices, and tourism trends are all macroeconomic factors that heavily influence hedge fund investment decisions in NCLH.

The Impact of Hedge Fund Activity on NCLH Stock Price

The correlation between hedge fund activity and NCLH's stock price volatility is undeniable. Large buy or sell orders from these funds can significantly impact market sentiment, creating ripple effects throughout the market.

-

Statistical Analysis: While a precise statistical analysis requires substantial data, a qualitative assessment can reveal a clear link between hedge fund trades and NCLH's share price fluctuations.

-

Specific Events: Examining specific instances where major hedge fund activity coincided with significant price swings in NCLH provides anecdotal evidence of this influence.

-

Short-Selling and Volatility: Short-selling by hedge funds can exacerbate volatility, as these trades create downward pressure on the stock price. Increased short interest can reflect negative sentiment about NCLH's future.

-

Market Manipulation Concerns: While not necessarily implied, it's important to acknowledge the potential for market manipulation concerns in instances of extreme hedge fund activity. Regulatory oversight is crucial in ensuring fair market practices.

Future Outlook for Hedge Fund Investment in NCLH

Predicting future hedge fund activity in NCLH requires considering various factors. The current market conditions, NCLH's financial performance, and industry-specific trends all play a significant role.

-

Prediction of future activity: Based on current trends, we can speculate on whether hedge funds will increase or decrease their holdings in NCLH. A strong recovery in the cruise industry might attract more investment, while persistent economic headwinds could lead to divestment.

-

Risks and Opportunities: Investors need to consider the inherent risks associated with NCLH, including the cyclical nature of the cruise industry, fuel price fluctuations, and geopolitical uncertainties. However, opportunities for significant returns remain, particularly for long-term investors.

-

Long-Term Prospects: NCLH's long-term prospects will significantly influence future hedge fund interest. Factors like innovation, market share growth, and successful management will determine its attractiveness to investors.

Conclusion: Key Takeaways and Call to Action

This analysis highlights the significant role hedge funds play in shaping the investment landscape of Norwegian Cruise Line Holdings Ltd. (NCLH). Understanding their investment strategies, holdings, and the impact of their actions on the stock price is crucial for informed decision-making. Hedge fund activity, while complex, provides valuable insights into market sentiment and future price movements. Remember, Hedge fund investment in Norwegian Cruise Line (NCLH) is only one piece of the puzzle. Conduct thorough due diligence, considering all relevant factors before making any investment decisions. Stay informed about Hedge fund investment in Norwegian Cruise Line (NCLH) to make well-informed investment decisions.

Featured Posts

-

Seating Plan For A Papal Funeral A Complex Undertaking

Apr 30, 2025

Seating Plan For A Papal Funeral A Complex Undertaking

Apr 30, 2025 -

Super Bowl 2025 Blue Ivy And Rumi Carters Striking Similarity

Apr 30, 2025

Super Bowl 2025 Blue Ivy And Rumi Carters Striking Similarity

Apr 30, 2025 -

Eurovision 2025 United Kingdom Selects Remember Monday

Apr 30, 2025

Eurovision 2025 United Kingdom Selects Remember Monday

Apr 30, 2025 -

Manchester Eurovision A Comprehensive Guide For Fans

Apr 30, 2025

Manchester Eurovision A Comprehensive Guide For Fans

Apr 30, 2025 -

Google Slides Download Free Android I Os Web App

Apr 30, 2025

Google Slides Download Free Android I Os Web App

Apr 30, 2025