High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA's analysis of stock market valuation relies on several key metrics to gauge the overall health and potential risks within the market. These metrics provide a comprehensive picture beyond simple price movements, offering deeper insights into whether the market is overvalued, undervalued, or fairly priced. The most commonly used metrics include the price-to-earnings ratio (P/E), the price-to-sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (CAPE), also known as the Shiller P/E.

-

BofA's overall assessment: (Note: This section needs to be updated with the most recent BofA report data. Replace the bracketed information with actual data from a recent BofA report). [Insert BofA's current overall assessment of market valuation here – e.g., "BofA currently assesses the market as slightly overvalued, citing concerns about..."].

-

Specific data points: [Insert specific data points from a recent BofA report, such as: "The S&P 500 P/E ratio stands at [insert number], compared to its historical average of [insert number]. The CAPE ratio is currently at [insert number], exceeding its long-term average of [insert number]."]

-

Comparison to historical valuations: [Include a comparison of current valuations to historical averages and significant market events. For example: "This P/E ratio is higher than the levels seen before the dot-com bubble of 2000 and the financial crisis of 2008, suggesting a higher degree of risk."]

-

Sector-specific analysis: [Mention any sectors BofA highlights as particularly overvalued or undervalued. For instance: "BofA's analysis suggests that the technology sector is currently overvalued, while the energy sector might present better value opportunities."]

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these elements is critical for assessing the sustainability of the current market conditions and identifying potential risks.

-

Low interest rate environment: The prolonged period of low interest rates, often a result of central bank policies like quantitative easing, has pushed investors into riskier assets like stocks in search of higher returns. This increased demand directly inflates stock prices.

-

Quantitative easing (QE): QE programs inject liquidity into the market, increasing the availability of capital for investment. This added liquidity can fuel further stock price increases, even if underlying economic fundamentals don't fully support them.

-

Strong corporate earnings (or weak, depending on BofA's assessment): [Depending on the BofA report, discuss whether strong or weak corporate earnings are contributing to current valuations. For example, "BofA's report suggests that strong corporate earnings, particularly in the [sector] sector, have supported higher stock prices. However, concerns remain about the sustainability of these earnings."]

-

Investor sentiment and market speculation: Positive investor sentiment and market speculation can create a self-fulfilling prophecy, pushing prices higher regardless of fundamental valuations. This speculative element adds significant volatility and risk.

-

Potential risks: Rising inflation, unexpected interest rate hikes, or geopolitical instability can significantly impact market sentiment and trigger corrections, potentially leading to a substantial decline in stock prices.

Investment Strategies in a High-Valuation Environment

Given BofA's analysis of high stock market valuations, investors need to adopt strategic approaches to manage risk and potentially capitalize on opportunities.

-

Risk management: In a high-valuation environment, risk management becomes paramount. Investors should carefully evaluate their risk tolerance and diversify their portfolios to mitigate potential losses.

-

Portfolio diversification: Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to reduce the impact of any single investment's underperformance.

-

Value investing vs. growth investing: [Discuss the current suitability of value versus growth investing strategies based on BofA's analysis. For example, "BofA's assessment suggests that value investing might be a more prudent approach in the current market, as growth stocks appear to be more susceptible to corrections."]

-

Sector rotation strategies: BofA's sector-specific analysis can inform sector rotation strategies. By shifting investments toward undervalued sectors and away from overvalued ones, investors can potentially improve their returns.

-

Long-term vs. short-term investing: Long-term investors may be better positioned to weather short-term market fluctuations, while short-term investors need to be more agile and responsive to market changes.

BofA's Market Outlook and Predictions

[This section requires the latest data from BofA's reports. Replace bracketed information with BofA's actual predictions.]

-

Short-term and long-term predictions: [Insert BofA's predictions for short-term and long-term market performance. For example: "BofA predicts a [percentage]% increase in the S&P 500 over the next year, but cautions about potential corrections of [percentage]% due to [reason]."]

-

Influencing factors: [Identify the key factors driving BofA's predictions, such as inflation rates, interest rate changes, and economic growth projections.]

-

Potential risks and opportunities: [Highlight the potential risks and opportunities identified by BofA in their outlook, such as specific sectors to watch or potential market events.]

-

Sector-specific outlook: [Summarize BofA's outlook on specific sectors, noting which ones they are bullish or bearish on.]

Conclusion

Understanding high stock market valuations is crucial for making sound investment decisions. BofA's analysis provides valuable insights into current market conditions, highlighting both potential risks and opportunities. By incorporating BofA's findings into your investment strategy, along with your own due diligence, and employing appropriate risk management and diversification techniques, you can navigate this environment more effectively. Utilize BofA's analysis, along with your own research, to create a robust investment plan that aligns with your risk tolerance and financial goals. Remember to regularly review and adjust your strategy based on evolving market conditions and new information.

Featured Posts

-

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Deadly Barrage

Apr 22, 2025

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Deadly Barrage

Apr 22, 2025 -

500 Million Bread Price Fixing Settlement Key Hearing Scheduled For May

Apr 22, 2025

500 Million Bread Price Fixing Settlement Key Hearing Scheduled For May

Apr 22, 2025 -

Ukraine Under Fire Russia Launches Devastating Air Strikes As Us Seeks Peace

Apr 22, 2025

Ukraine Under Fire Russia Launches Devastating Air Strikes As Us Seeks Peace

Apr 22, 2025 -

1 Billion Funding Cut Planned For Harvard Trump Administrations Anger

Apr 22, 2025

1 Billion Funding Cut Planned For Harvard Trump Administrations Anger

Apr 22, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 22, 2025

Latest Posts

-

Edmonton School Projects 14 Initiatives To Proceed Rapidly

May 10, 2025

Edmonton School Projects 14 Initiatives To Proceed Rapidly

May 10, 2025 -

Understanding The Impact Of Federal Riding Changes In Greater Edmonton

May 10, 2025

Understanding The Impact Of Federal Riding Changes In Greater Edmonton

May 10, 2025 -

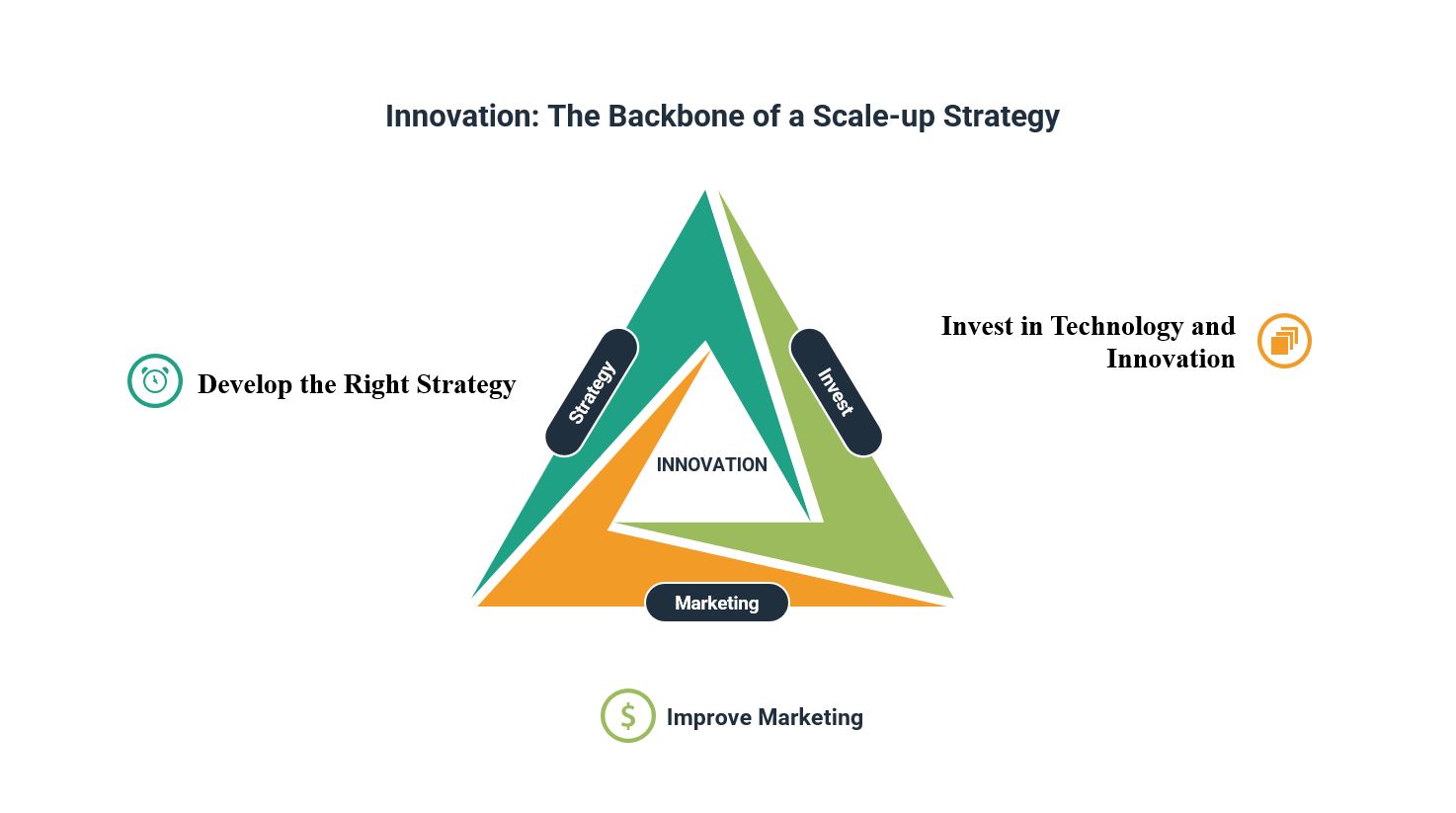

Edmonton Unlimiteds Global Impact Strategy Scaling Tech And Innovation

May 10, 2025

Edmonton Unlimiteds Global Impact Strategy Scaling Tech And Innovation

May 10, 2025 -

Federal Riding Boundary Changes Their Effect On Edmonton Area Voters

May 10, 2025

Federal Riding Boundary Changes Their Effect On Edmonton Area Voters

May 10, 2025 -

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025