High Stock Market Valuations: A BofA Analyst's Take

Table of Contents

Assessing Current Market Valuations: Are Stocks Overvalued?

Determining whether the stock market is overvalued requires a careful examination of various valuation metrics. These metrics offer different perspectives, and a holistic view is crucial. Key indicators include:

-

Price-to-Earnings Ratio (P/E Ratio): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation.

-

Shiller PE Ratio (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable valuation measure. A high Shiller PE often suggests overvaluation.

-

Price-to-Sales Ratio (P/S Ratio): This compares a company's market capitalization to its revenue. It's useful for valuing companies with negative earnings.

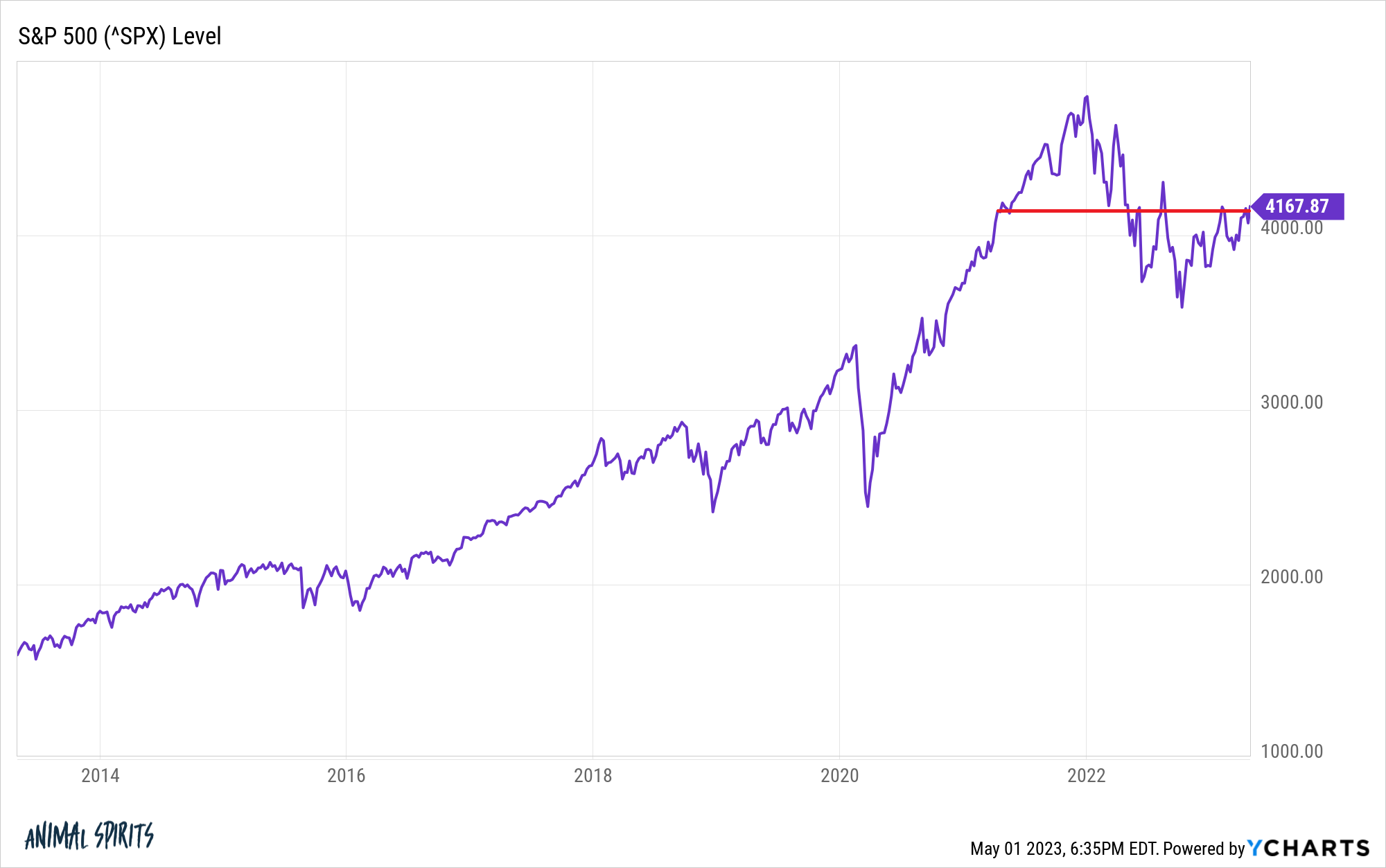

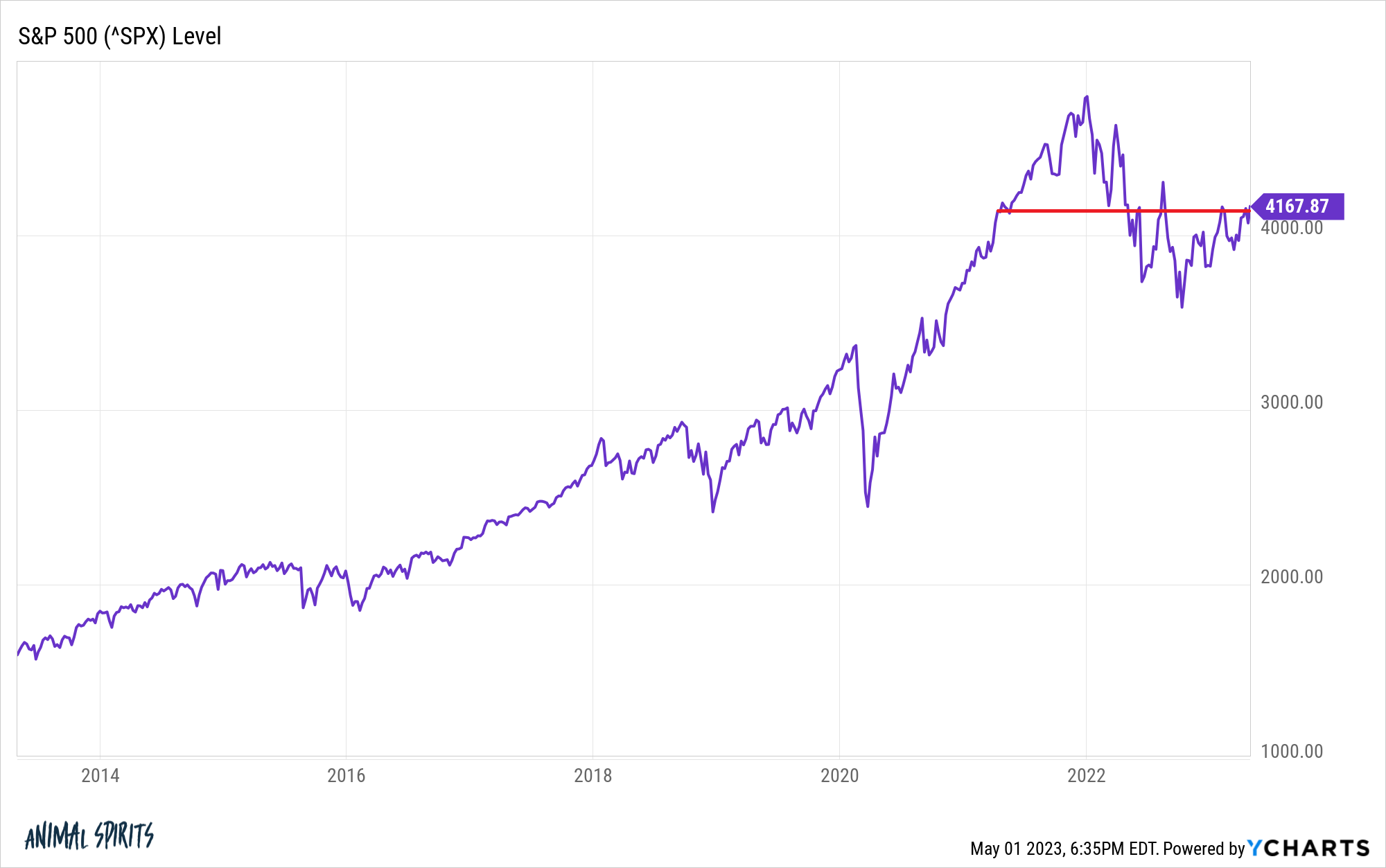

BofA's research indicates that several key indices show valuations significantly above their long-term averages. For instance:

- BofA's research suggests the S&P 500's P/E ratio is significantly above its long-term average, exceeding the historical mean by a considerable margin. This suggests a potential overvaluation.

- The current Shiller PE ratio indicates a potential overvaluation compared to historical norms, further supporting concerns about high valuations. This metric considers long-term earnings, reducing the impact of short-term market fluctuations.

- Specific sector valuations are highlighted, showing disparities across different market segments. While some sectors might appear reasonably valued, others exhibit significant overvaluation.

Identifying Potential Risks Associated with High Stock Market Valuations

Investing in a market characterized by high valuations presents inherent risks. These include:

-

Increased Volatility: Overvalued markets are more susceptible to sharp corrections. Even small negative news can trigger significant price drops.

-

Potential for Market Corrections: High valuations rarely sustain themselves indefinitely. Market corrections, or even crashes, are a possibility.

-

Impact of Rising Interest Rates: Higher interest rates increase borrowing costs for companies, reducing profitability and impacting valuations. BofA's analysis shows a strong correlation between interest rate hikes and market corrections in periods of high valuations.

-

Macroeconomic Factors: Global economic slowdowns, geopolitical instability, and inflation all significantly influence stock prices. These factors can exacerbate the risks associated with already high valuations.

-

Increased risk of market corrections due to elevated valuations. The higher the valuation, the greater the potential for a sharp decline.

-

Impact of rising interest rates on company earnings and valuations. Higher interest rates increase borrowing costs and can lead to lower profit margins.

-

Geopolitical risks and their potential effect on stock market performance. Uncertainties in the global landscape can trigger market volatility.

Opportunities Amidst High Valuations: Finding Undervalued Gems

Even in a market with high stock market valuations, opportunities exist for discerning investors. Focusing on fundamental analysis is key:

-

Value Investing: Identify companies trading below their intrinsic value, based on their financial health and future prospects.

-

Growth at a Reasonable Price (GARP): Find companies exhibiting strong growth potential but trading at reasonable valuations compared to their growth rates.

-

Sector-Specific Analysis: Some sectors might be undervalued relative to others. Thorough research is vital to uncover these opportunities.

-

Focus on companies with strong fundamentals and sustainable growth potential. Look beyond market sentiment and focus on the underlying business.

-

Sector-specific opportunities: identifying undervalued sectors within the overall market. Careful sector analysis is crucial for finding hidden gems.

-

Utilizing value investing principles to find undervalued companies. This involves rigorous fundamental analysis and a long-term perspective.

BofA Analyst's Outlook and Investment Recommendations

BofA's analysts currently foresee a period of moderate growth, tempered by the risks posed by high valuations and rising interest rates. Their outlook suggests a cautious approach, emphasizing diversification and risk management.

- BofA's prediction for market performance in the next 12 months involves a cautious outlook, emphasizing potential volatility and the need for strategic diversification.

- Recommended asset allocation strategies based on current market conditions include a balanced approach, with a focus on diversification across different asset classes.

- Specific sector recommendations and rationale may include a focus on sectors less sensitive to interest rate changes and possessing strong fundamentals.

Disclaimer: This article does not constitute investment advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Conclusion: Making Informed Decisions in a Market with High Stock Market Valuations

High stock market valuations present both risks and opportunities. Understanding the various valuation metrics, recognizing potential risks, and employing effective investment strategies are crucial for navigating this complex market environment. BofA's outlook suggests a balanced, cautious approach, emphasizing diversification and fundamental analysis. Understand the implications of high stock market valuations, learn more about managing your portfolio in a market with high stock market valuations, and navigate the complexities of high stock market valuations by conducting thorough research and seeking professional financial advice. Remember to consult with a financial advisor before making any investment decisions. For more information, refer to BofA's research reports and other reputable financial analysis resources.

Featured Posts

-

F1 Fashion The Drivers Guide To Effortless Style

May 26, 2025

F1 Fashion The Drivers Guide To Effortless Style

May 26, 2025 -

Live Streaming Moto Gp Inggris 2025 Sprint Race Tayangan Langsung Pukul 20 00 Wib

May 26, 2025

Live Streaming Moto Gp Inggris 2025 Sprint Race Tayangan Langsung Pukul 20 00 Wib

May 26, 2025 -

Canada Posts Decline A Boon For Competing Delivery Companies

May 26, 2025

Canada Posts Decline A Boon For Competing Delivery Companies

May 26, 2025 -

Nepo Baby Actress Poses With Gerard Butler Emmy Winning Moms Influence

May 26, 2025

Nepo Baby Actress Poses With Gerard Butler Emmy Winning Moms Influence

May 26, 2025 -

Naomi Kempbell Noviy Obraz U Biliy Tunitsi Na Zakhodi V Londoni

May 26, 2025

Naomi Kempbell Noviy Obraz U Biliy Tunitsi Na Zakhodi V Londoni

May 26, 2025