High Stock Market Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Key Arguments for Maintaining a Calm Approach

BofA's overall stance is one of cautious optimism. They acknowledge the elevated valuation multiples but argue that several factors counterbalance the perceived risk. Their reasoning emphasizes the importance of considering broader economic trends and future growth potential rather than focusing solely on current valuation metrics. This balanced perspective suggests that while vigilance is necessary, panic selling might be premature.

-

Strong Corporate Earnings Growth Potential: BofA forecasts robust corporate earnings growth in the coming years, driven by factors such as technological innovation and sustained consumer demand. This projected growth helps justify, to some extent, the current elevated price-to-earnings ratios. Strong earnings growth can support higher stock prices even if valuations appear initially stretched.

-

Low Interest Rates Providing a Supportive Environment: The prevailing low-interest-rate environment significantly impacts stock valuations. Low borrowing costs make it cheaper for companies to invest and expand, fueling economic growth and supporting higher stock prices. Low interest rates also make bonds less attractive, pushing investors towards equities.

-

Technological Innovation Driving Future Growth: BofA highlights the transformative power of technological advancements, particularly in sectors such as artificial intelligence, cloud computing, and biotechnology. These innovations are expected to drive significant economic growth and corporate profitability in the long term, justifying premium valuations for companies at the forefront of these trends.

-

Positive Long-Term Economic Outlook: BofA cites several factors contributing to a positive long-term economic outlook, including sustained global growth (albeit uneven across regions), ongoing government infrastructure investments in many developed economies, and continued resilience in the consumer sector. This positive outlook supports the belief that current valuations are sustainable, at least for the foreseeable future.

Analyzing the Metrics: Are Valuations Really That High?

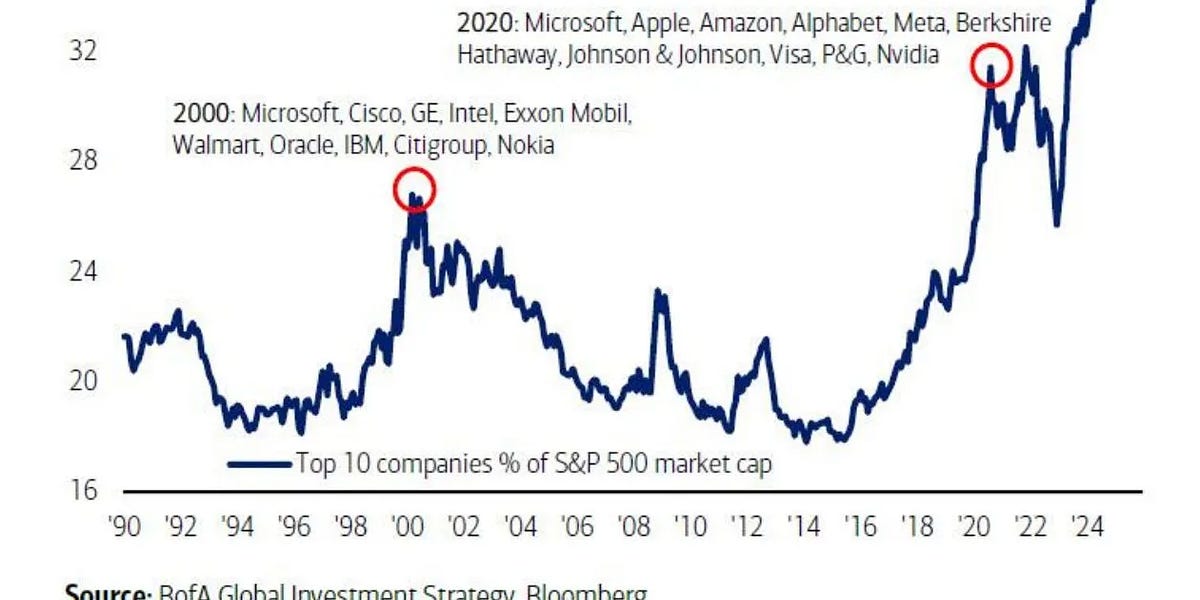

Assessing whether valuations are truly "high" requires examining various metrics and considering the context. Common valuation metrics include the price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and others. While some metrics suggest elevated valuations compared to historical averages, BofA emphasizes the importance of nuance.

-

Comparison of Current Valuations to Historical Data: While current P/E ratios might be above historical averages, BofA points out that these averages don't always account for factors like low interest rates or periods of exceptionally strong earnings growth. A historical comparison requires careful consideration of the economic conditions prevailing during different periods. (Charts and graphs comparing current valuations to historical data would be beneficial here.)

-

Factors Influencing Current Valuation Multiples: BofA emphasizes that the current elevated valuations are partially justified by the aforementioned strong earnings growth, low interest rates, and technological innovation. These factors aren't fully reflected in historical averages, making a direct comparison potentially misleading.

-

Sector-Specific Valuations: BofA acknowledges that some sectors might indeed be overvalued, while others possess justifiable valuations given their growth potential. Identifying these sector-specific differences is crucial for a well-informed investment strategy. For example, tech companies benefiting from AI advancements may justify higher valuations than cyclical industries more sensitive to economic downturns.

The Role of Interest Rates in Stock Market Valuations

Interest rates play a crucial role in determining stock market valuations. There's an inverse relationship: lower interest rates generally lead to higher stock valuations. This is because lower interest rates reduce the discount rate used in discounted cash flow (DCF) models, a common valuation technique. A lower discount rate increases the present value of future earnings, leading to higher valuations.

-

Discounted Cash Flow Models and Interest Rates: DCF models are used extensively to value companies based on their projected future cash flows. Lower interest rates directly translate to a higher present value of those future cash flows, leading to a higher valuation for the company.

-

Impact of Quantitative Easing (QE) and Monetary Policies: BofA's analysis considers the impact of QE and other monetary policies employed by central banks to stimulate economic growth. These policies contribute to lower interest rates, indirectly boosting stock market valuations.

-

Potential Scenarios for Future Interest Rate Changes: BofA's predictions about future interest rate movements are crucial to their outlook on stock market valuations. While some analysts foresee rising interest rates, BofA might provide a counterpoint, perhaps suggesting that rates will remain low for an extended period. This directly affects their overall assessment of valuation risks.

Addressing Potential Risks and Counterarguments

While BofA's analysis suggests a relatively calm approach, it's crucial to acknowledge potential risks associated with high valuations. Dismissing concerns outright would be irresponsible.

-

Risk of Inflation and its Impact on Valuations: Inflation erodes purchasing power and can impact corporate profitability. BofA likely addresses this risk by assessing the likelihood and potential magnitude of inflation, providing a counter-argument perhaps based on their outlook for future economic growth, wage growth, or commodity price trends.

-

Potential for a Market Correction or Downturn: A market correction or downturn is always a possibility. BofA might address this by highlighting the mitigating factors, such as the robust earnings growth potential they forecast. They might also emphasize the importance of diversification and risk management strategies.

-

Geopolitical Risks and Their Potential Influence: Geopolitical events can significantly impact markets. BofA will likely have assessed these potential risks, detailing their anticipated impact on valuations and suggesting how these risks might be mitigated through a diversified investment strategy.

Navigating High Stock Market Valuations with Confidence

BofA's analysis suggests that while stock market valuations appear elevated, several significant factors mitigate the immediate risks. Their argument rests on robust earnings growth potential, the supportive low-interest-rate environment, the transformative power of technological innovation, and a positive long-term economic outlook. It's essential to remember that relying solely on valuation metrics in isolation can be misleading. The broader economic context and future growth prospects are equally important.

Conduct your own thorough research and consider the information presented here alongside your personal risk tolerance and investment goals. Don't panic based solely on headline-grabbing valuation figures. Remember that a well-diversified investment strategy remains a crucial element of long-term success. Learn more about managing your portfolio in the face of high stock market valuations by [linking to relevant resource, such as a reputable financial website or research report].

Featured Posts

-

Hugh Jackman Deposition Rumors In Blake Lively Legal Case Fan Reactions

May 28, 2025

Hugh Jackman Deposition Rumors In Blake Lively Legal Case Fan Reactions

May 28, 2025 -

Missing Teen Bryan County Sheriffs Office Requests Publics Assistance

May 28, 2025

Missing Teen Bryan County Sheriffs Office Requests Publics Assistance

May 28, 2025 -

Alcaraz Confident Swiatek Struggles French Open Outlook

May 28, 2025

Alcaraz Confident Swiatek Struggles French Open Outlook

May 28, 2025 -

Rome Champ Continued Success No Room For Complacency

May 28, 2025

Rome Champ Continued Success No Room For Complacency

May 28, 2025 -

Koster Desak Bps Singkirkan Canang Dari Daftar Komoditas Inflasi

May 28, 2025

Koster Desak Bps Singkirkan Canang Dari Daftar Komoditas Inflasi

May 28, 2025

Latest Posts

-

Bring Her Back A Scarier Remake Than The Original

May 29, 2025

Bring Her Back A Scarier Remake Than The Original

May 29, 2025 -

A24s New Horror Movie A Connection To Their 92 M Hit Directors Reveal All

May 29, 2025

A24s New Horror Movie A Connection To Their 92 M Hit Directors Reveal All

May 29, 2025 -

The Horror Trend That Could Bring Back Cindy And Brenda For Scary Movie 6

May 29, 2025

The Horror Trend That Could Bring Back Cindy And Brenda For Scary Movie 6

May 29, 2025 -

Scary Movie 6 Rebooting The Franchise With A Familiar Face Cindy And Brenda

May 29, 2025

Scary Movie 6 Rebooting The Franchise With A Familiar Face Cindy And Brenda

May 29, 2025 -

Sally Hawkins Stars In Talk To Me A Terrifying New Trailer For Bring Her Back

May 29, 2025

Sally Hawkins Stars In Talk To Me A Terrifying New Trailer For Bring Her Back

May 29, 2025